-

Market Participants Betting on Nafta Deal between US and Canada

Read MoreThe Canadian Dollar strengthened to a two month high against US Dollar earlier this week. Market participants seem to bet on possible inclusion of Canada in a new Nafta pact. The U.S. has just concluded a successful bilateral talk with Mexico on Monday. Under the new agreement, cars need to have 75% of their content […]

-

AUDUSD Elliott Wave View: Downside Pressure Remains

Read MoreElliott Wave view on AUDUSD suggests that the decline to 0.7199 ended Intermediate wave (W). Intermediate wave (X) rally appears complete at 0.7382. The internal of Intermediate wave (X) unfolded as a zigzag Elliott Wave structure. Minor wave A of (X) ended at 0.7287, Minor wave B of (X) ended at 0.7248. and Minor wave […]

-

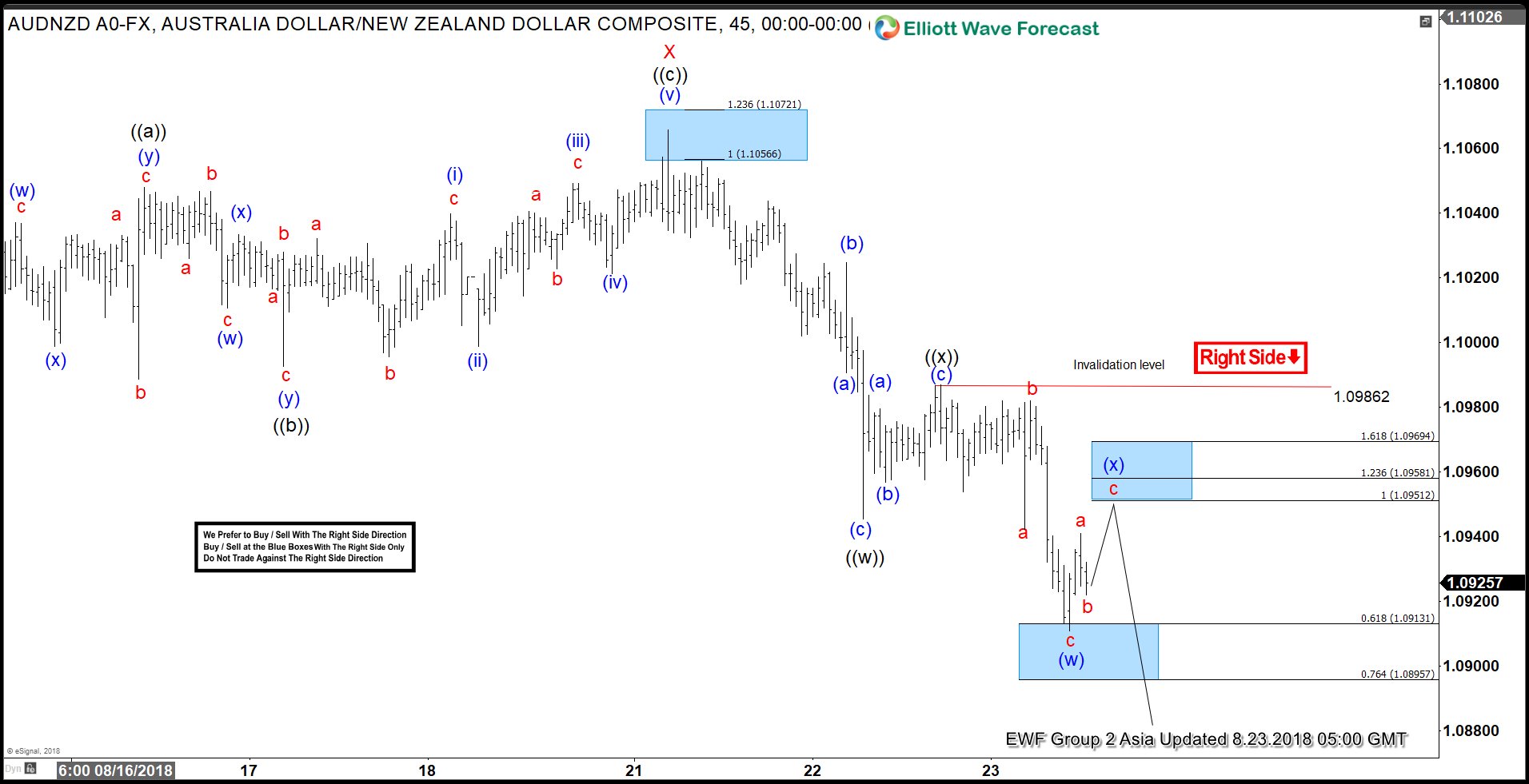

AUDNZD Elliott Wave View: Further Downside Expected

Read MoreAUDNZD Short-term Elliott Wave view suggests that the rally to 1.1066 ended Minor wave X. The internal subdivision of Minor wave X is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 1.1048, Minute wave ((b)) ended at 1.0992, and Minute wave ((c)) of X ended at 1.1066. A zigzag is […]

-

AT&T Elliott Wave View: Rallying as Impulse with Nest

Read MoreAT&T (ticker symbol T) Short-term Elliott Wave view suggests that the pullback to $31.76 ended Minor wave 2. The stock is rallying from there within Minor wave 3 as an impulse Elliott Wave structure with a nest. An impulse structure subdivides in 5 waves and we can see up from $31.76, the rally to $33.58 […]

-

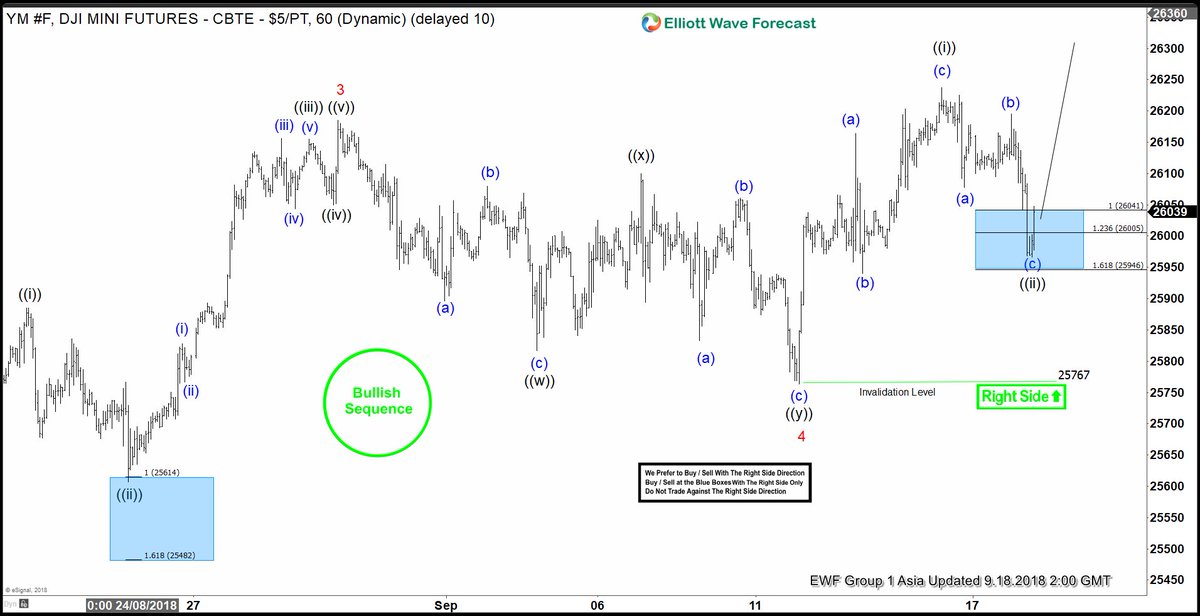

Dow Futures Elliott Wave View: Pullback Should Find Support

Read MoreShort-term Elliott Wave view on YM_F (Dow Futures) suggests that the pullback to 24956 low ended Minor wave 4. Up from there, Index is rallying within Minor wave 5 to end a 5 waves up from 4/2/2018 low. Minute wave ((i)) of 5 is currently in progress with internal subdivision as an impulse Elliott Wave structure. […]

-

Trading Elliott Wave Charts with the Right Side Tag and Blue Boxes

Read MoreSimplifying Elliott Wave Analysis for Traders One of our goals at Elliottwave-Forecast is to figure out the best way to present Elliott Wave charts in such a way that non-technical traders can easily understand our view and know what they need to do. To this end, we implement the Right Side Tag and Blue Boxes […]