-

GBPUSD Trade from 7/20 Live Trading Room

Read MoreGBPUSD Trade Video Clip from July 20th Live Trading Room Below is a video clip of GBPUSD trade that we took from July 20th Live Trading Room Below is the trading journal line for the trade GBPUSD 4 Hour Elliott Wave Chart on July 20th GBPUSD is showing bullish 5 swing Elliott Wave sequence in […]

-

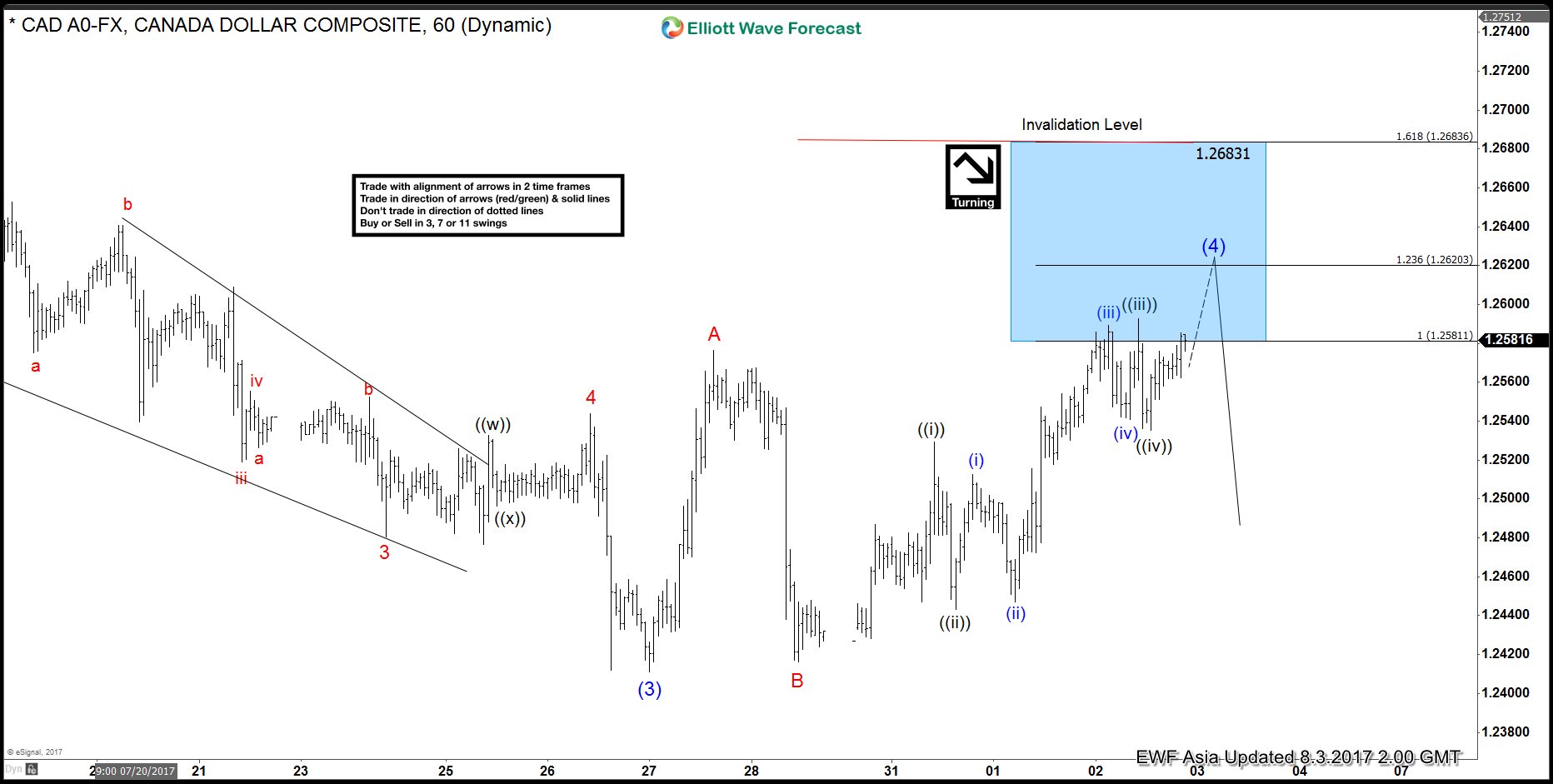

USDCAD Elliott Wave Vision: Flat correction

Read MoreShort term USDCAD Elliott Wave view suggests the decline to 1.2411 ended Intermediate wave (3) of an Elliott Wave impulse structure from 6/2 peak. Intermediate wave (4) bounce is in progress as a flat Elliott wave structure where Minor wave A ended at 1.2576 and Minor wave B ended at 1.2416. Minor wave C is subdivided as an impulse Elliott Wave structure. Up from 1.2416 […]

-

USDCAD Elliott Wave View: Wave (4) in progress

Read MoreShort term USDCAD Elliott Wave view suggests the decline to 1.2411 ended Intermediate wave (3) of an Elliott Wave impulse structure from 6/2 peak. Intermediate wave (4) bounce is in progress as a double three Elliott wave structure where Minor wave W ended at 1.2576 and Minor wave X ended at 1.2416. Minor wave Y is subdivided also […]

-

US Dollar to stay soft in 2017

Read MoreThe USD Index has dipped over 9% this year. The weakness in US Dollar has been broad-based and consistent against all major currencies. The Dollar Index closed fifth straight month in losses , something which hasn’t happened since 2011. The USD weakness started with the Euro early this year then continues to widen to other currencies. […]

-

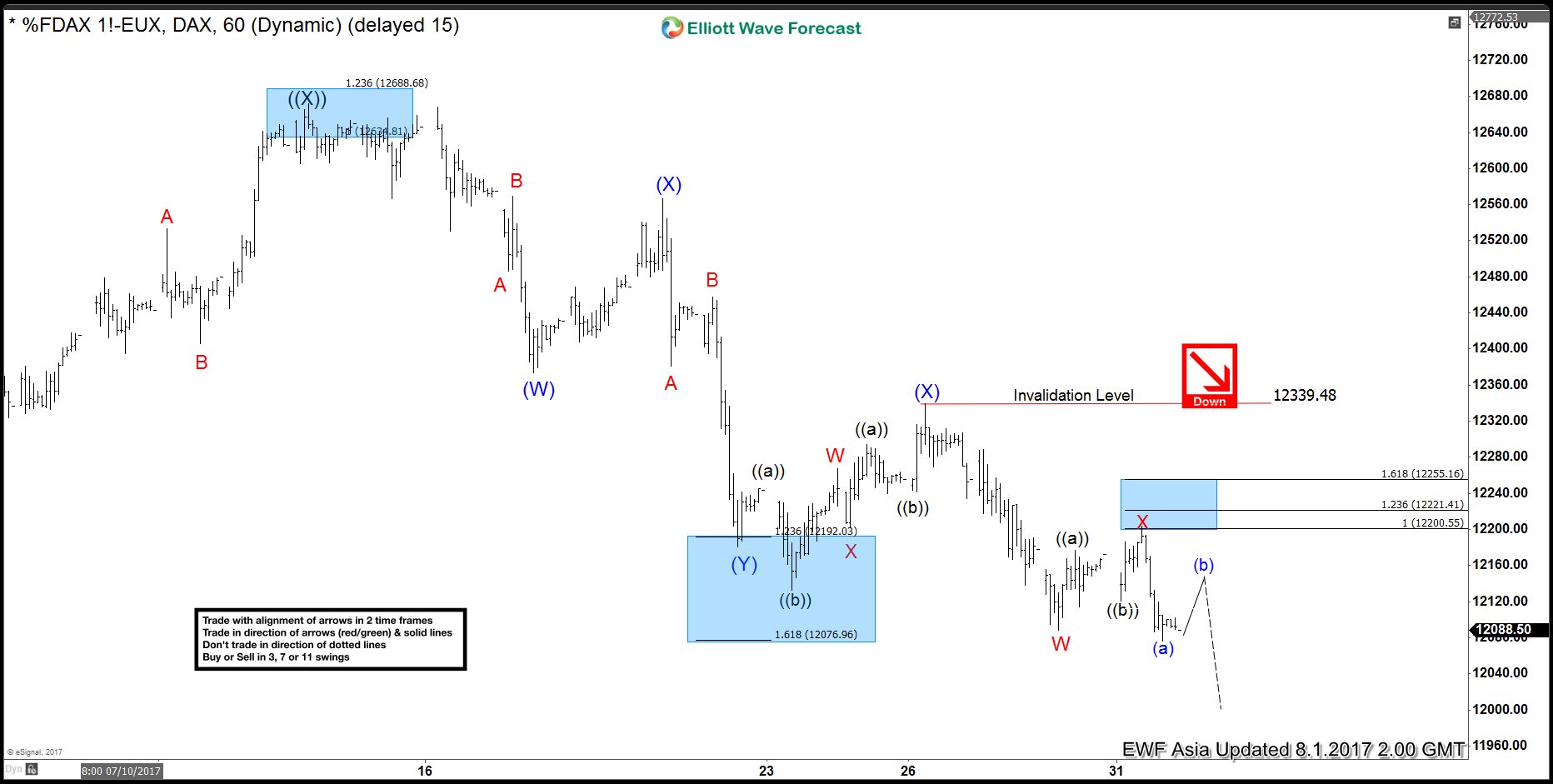

DAX Elliott Wave View: More Downside

Read MoreShort term DAX Elliott Wave view suggests the decline from 5/15 high is unfolding as a double three Elliott wave structure. Down from 5/15 peak, Primary wave ((W)) ended at 12303 as a Flat and Primary wave ((X)) bounce ended at 12672. Primary wave ((Y)) is currently in progress and unfolding as a triple three Elliott wave structure. Down from […]

-

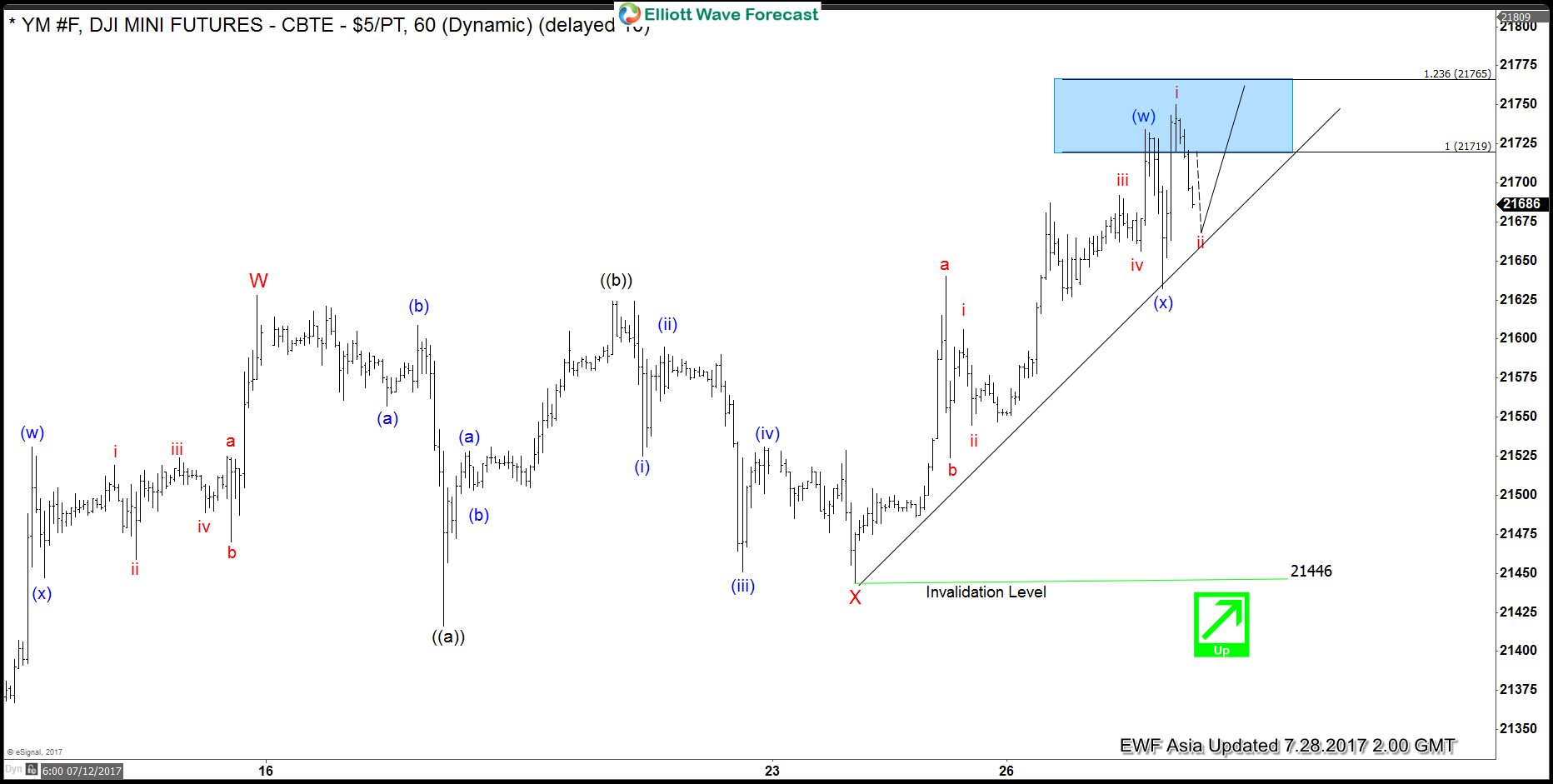

Dow Futures Elliott Wave View: Extending Higher

Read MoreShort term YM_F (Dow E-Mini Future) Elliott Wave view suggests the rally from 6/29 low is unfolding as a double three Elliott wave structure and ended with Minor wave W at 21628. Down from there, Minor wave X pullback unfolded as a running Elliott Wave flat. Minute wave ((a)) ended at 21457, Minute wave ((b)) ended at 21624, […]