-

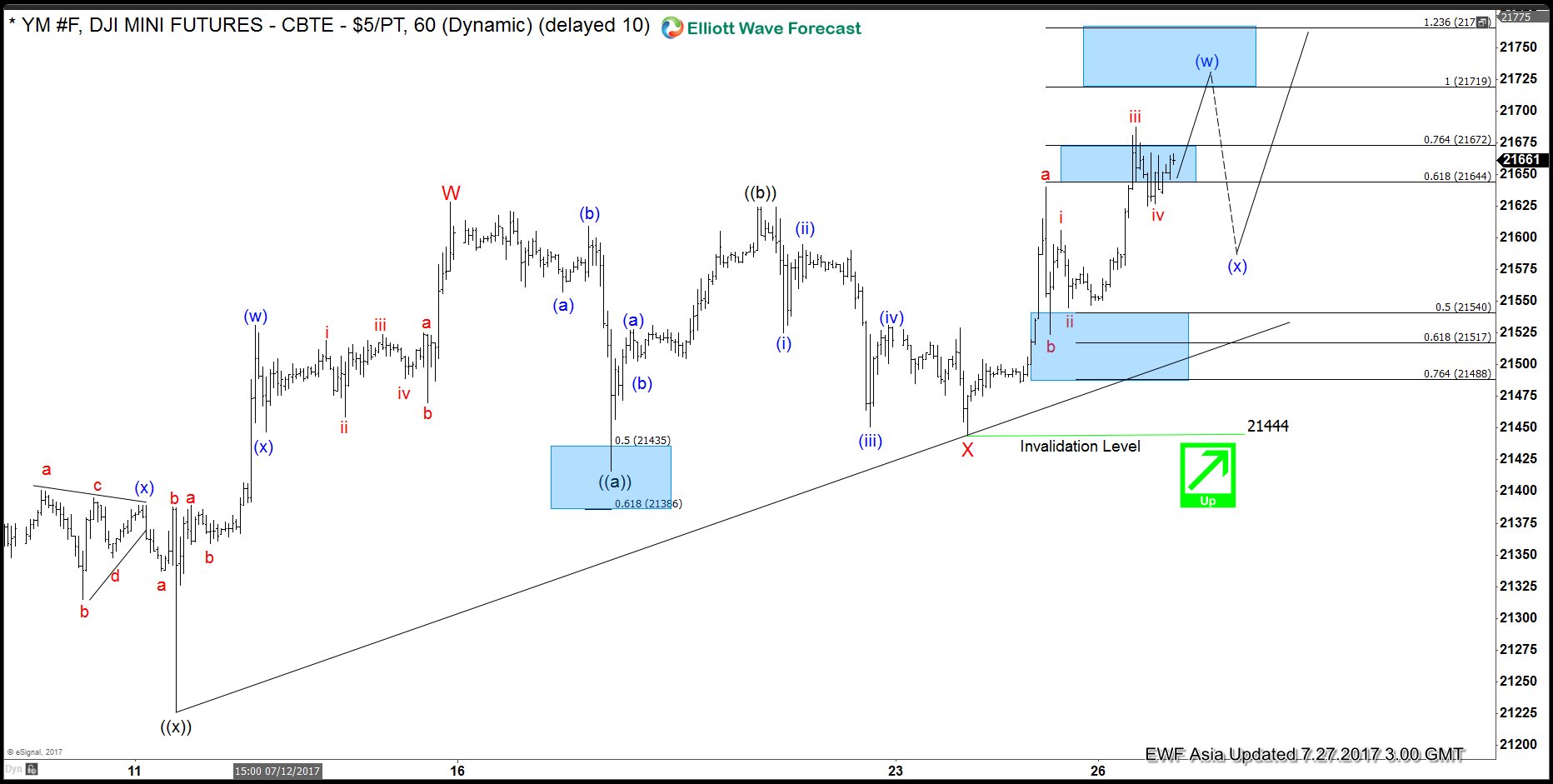

Dow Futures Elliott Wave View 7.27.2017

Read MoreShort term YM_F (Dow E-Mini Future) Elliott Wave view suggests the rally from 6/29 low is unfolding as a double three Elliott wave structure and ended with Minor wave W at 21628. Down from there, Minor wave X pullback unfolded as a running Elliott Wave flat. Minute wave ((a)) ended at 21457, Minute wave ((b)) ended at 21624, […]

-

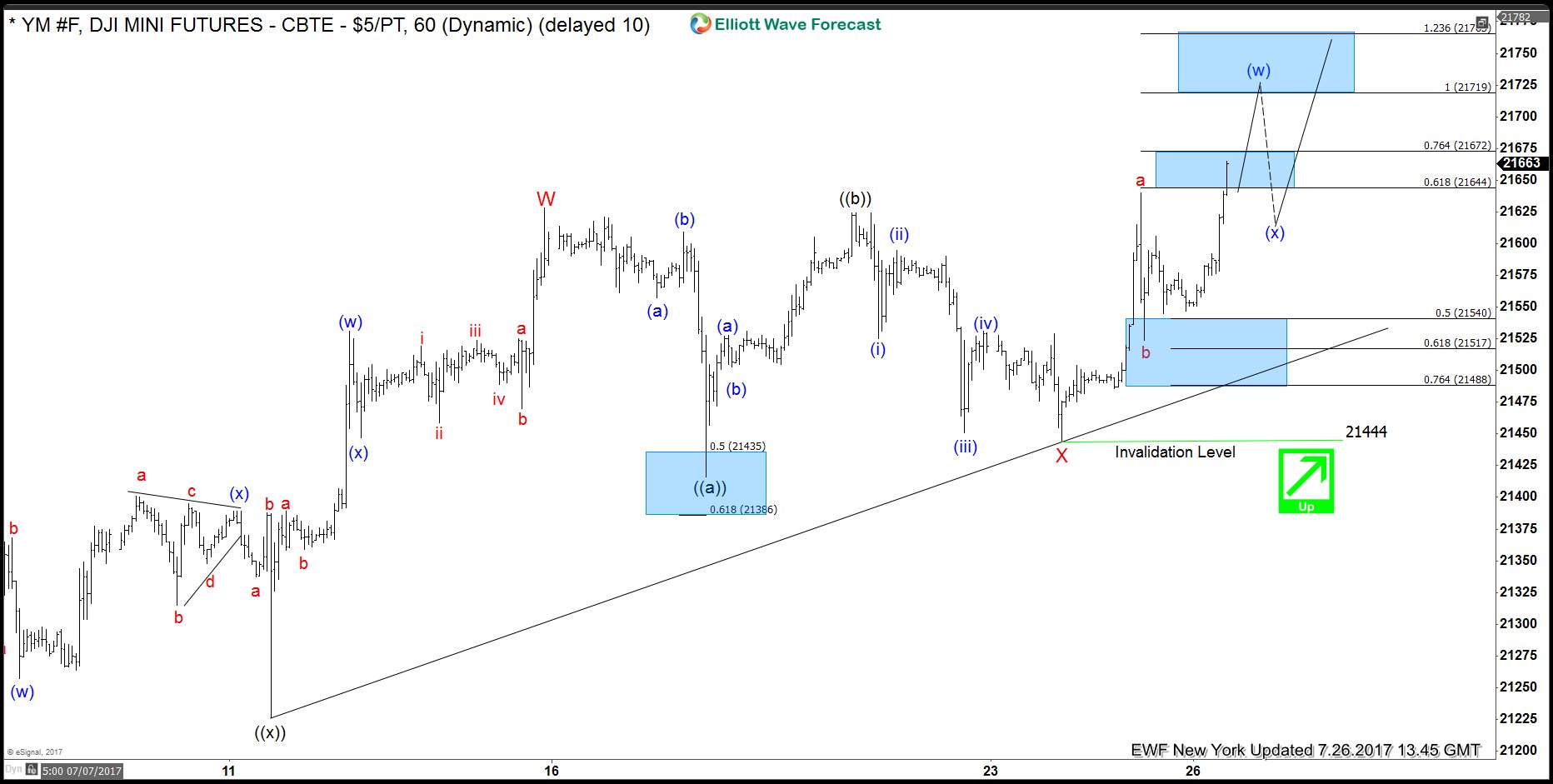

Dow Future Elliott Wave View: Resuming Higher

Read MoreShort term YM_F (Dow E-Mini Future) Elliott Wave view suggests the rally from 6/29 low is unfolding as a double three Elliott wave structure and ended with Minor wave W at 21628. Down from there, Minor wave X pullback unfolded as a running Elliott Wave flat. Minute wave ((a)) ended at 21457, Minute wave ((b)) ended at […]

-

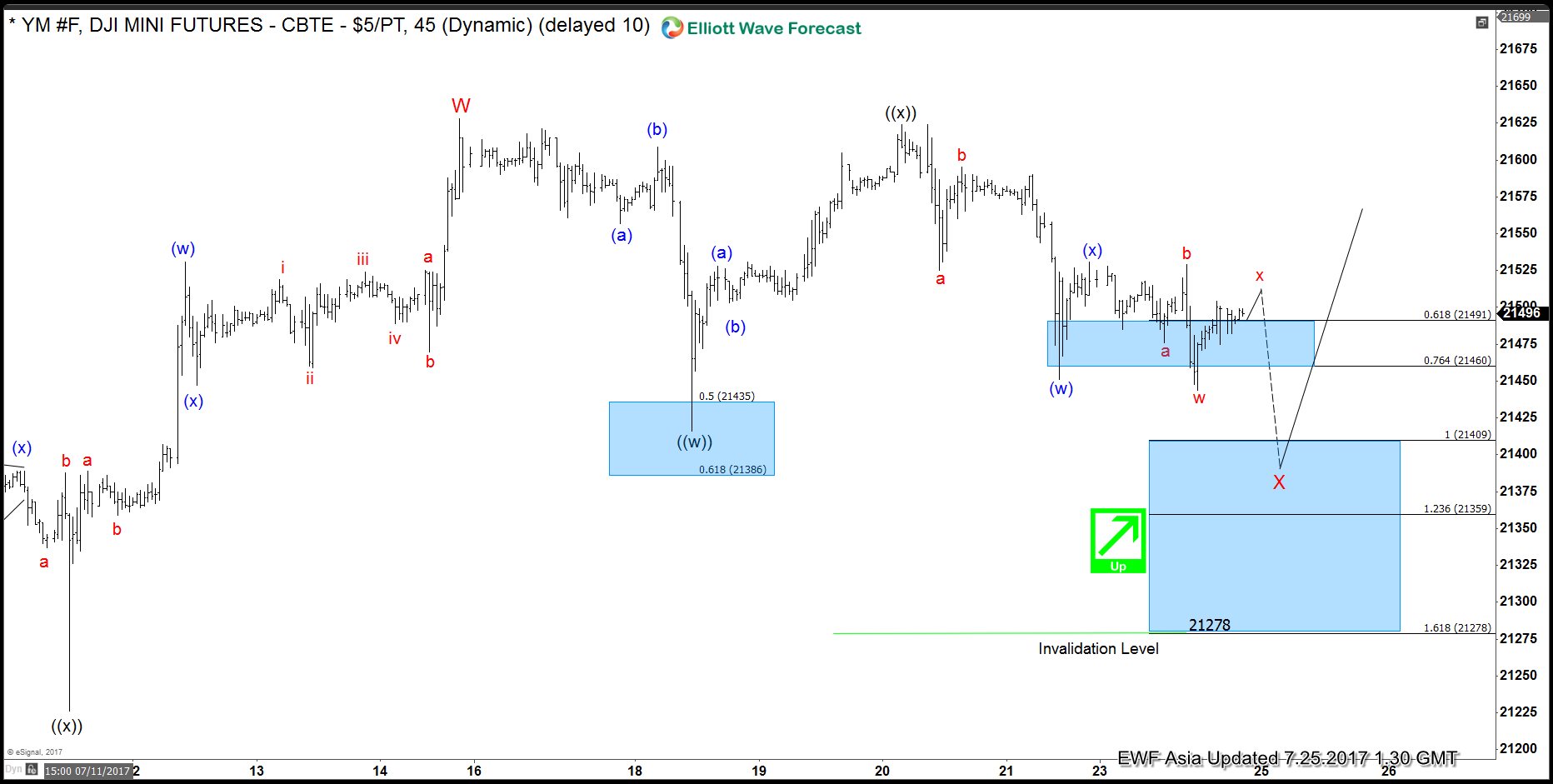

Dow E-mini Future Elliott Wave View: 7.25.2017

Read MoreShort term YM_F (Dow E-Mini Future) Elliott Wave view suggests the rally from 6/29 low is unfolding as a double three Elliott wave structure and ended with Minor wave W at 21628. Index is currently in Minor wave X pullback to correct cycle from 6/29 low in 3, 7, or 11 swing. Structure of Minor wave […]

-

NZDUSD Trade from 7/20 Live Trading Room

Read MoreNZDUSD Trade Video Clip from July 20th Live Trading Room Below is a video clip of NZDUSD Long Trade on July 20th in Live Trading Room. NZDUSD 1 Hour Elliott Wave Chart 1 hour chart below shows a bullish 5 swing sequence from 7/11 low (0.7198), favoring further upside towards 100% area (0.7430). Near term, while the dips […]

-

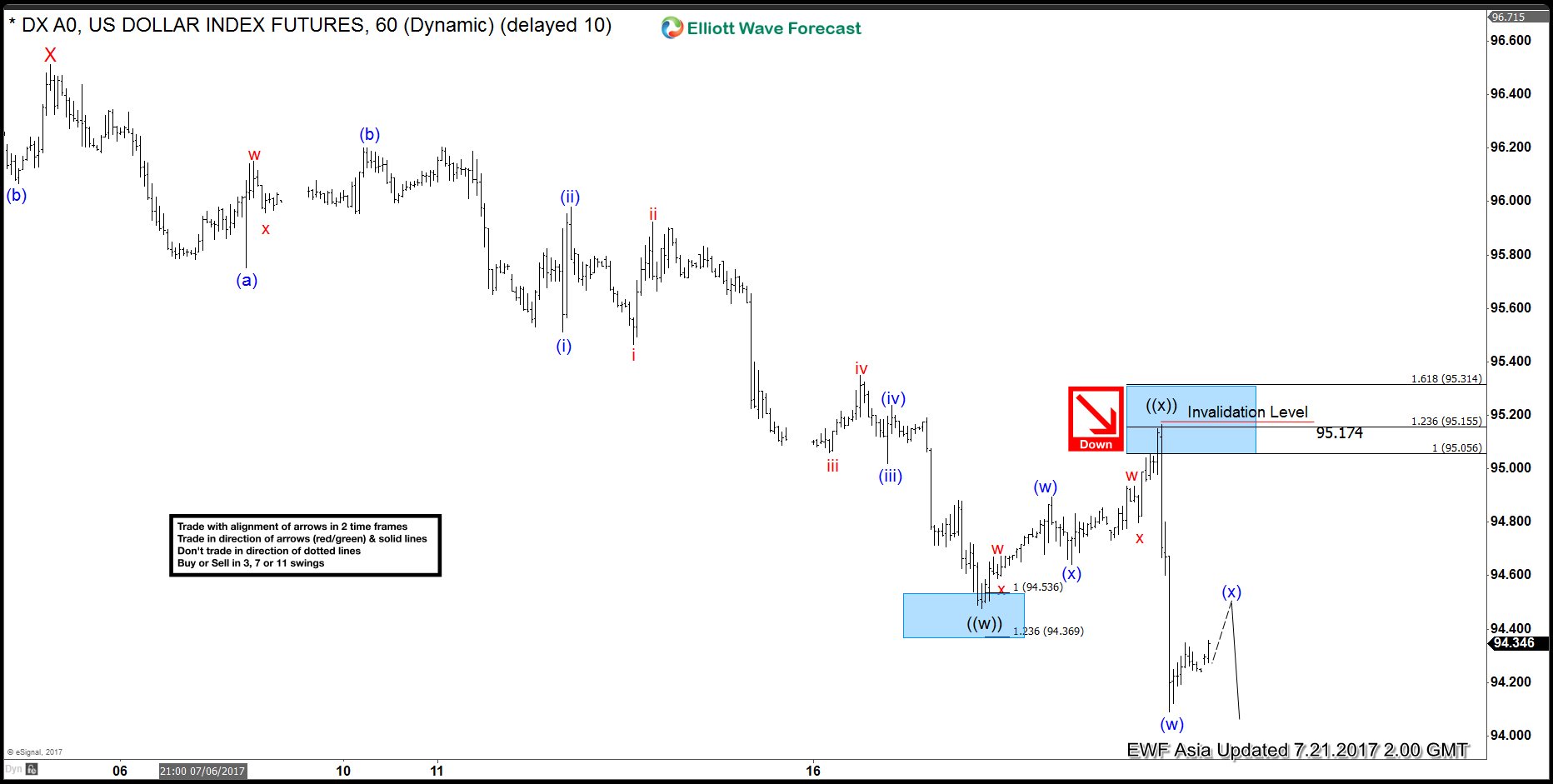

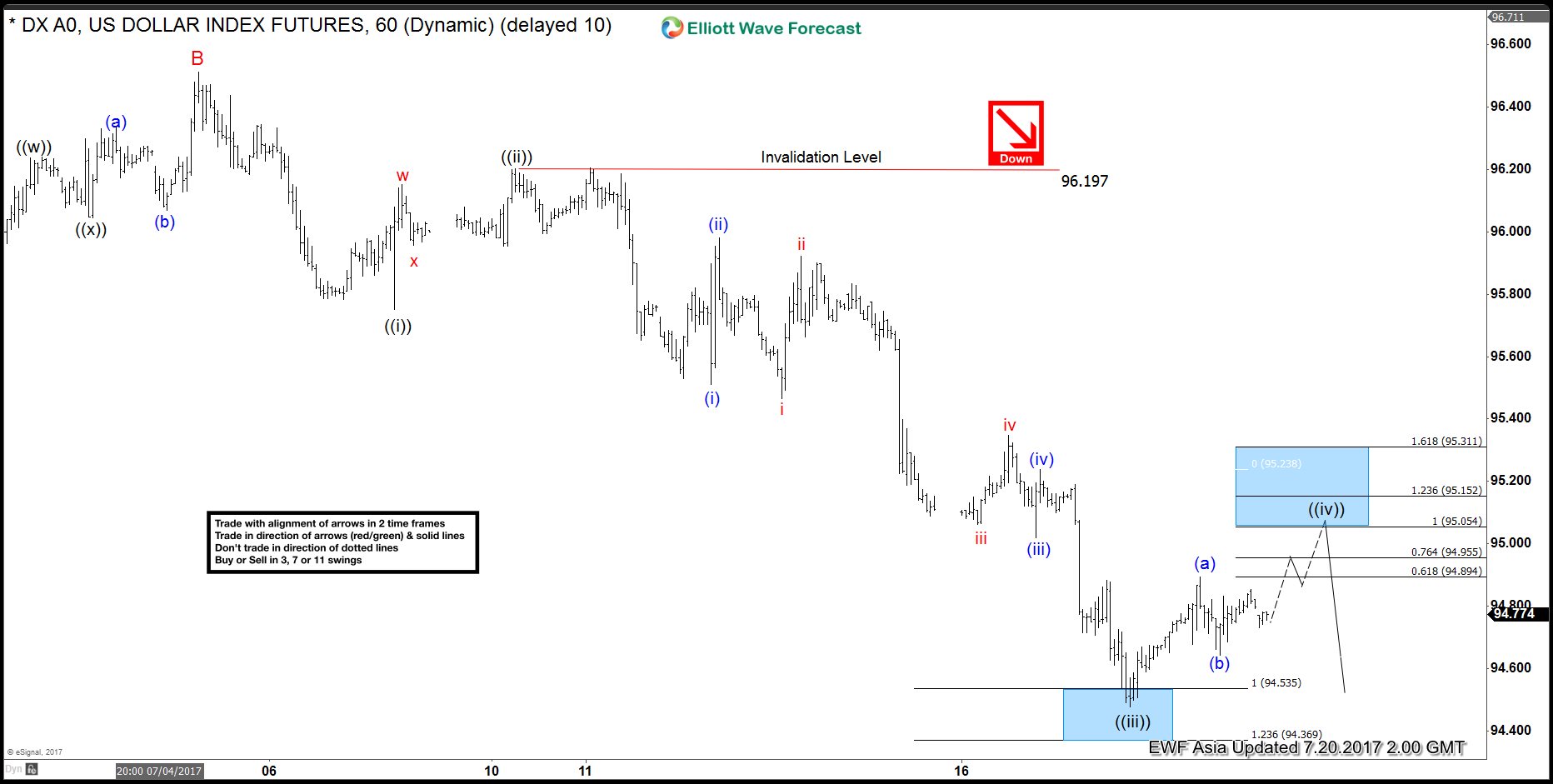

DXY Elliott Wave View: Resuming Downside

Read MoreRevised short term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a double three Elliott wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave W, and bounce to 96.51 high ended Minor wave X. Wave Y is unfolding as another double three Elliott wave structure of a smaller […]

-

DXY Elliott Wave View : Bounce in progress

Read MoreShort term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a Zigzag Elliott Wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave A, and bounce to 96.51 high ended Minor wave B. Wave C is unfolding as an Elliott wave Impulse structure with extension where Minute wave ((i)) ended […]