-

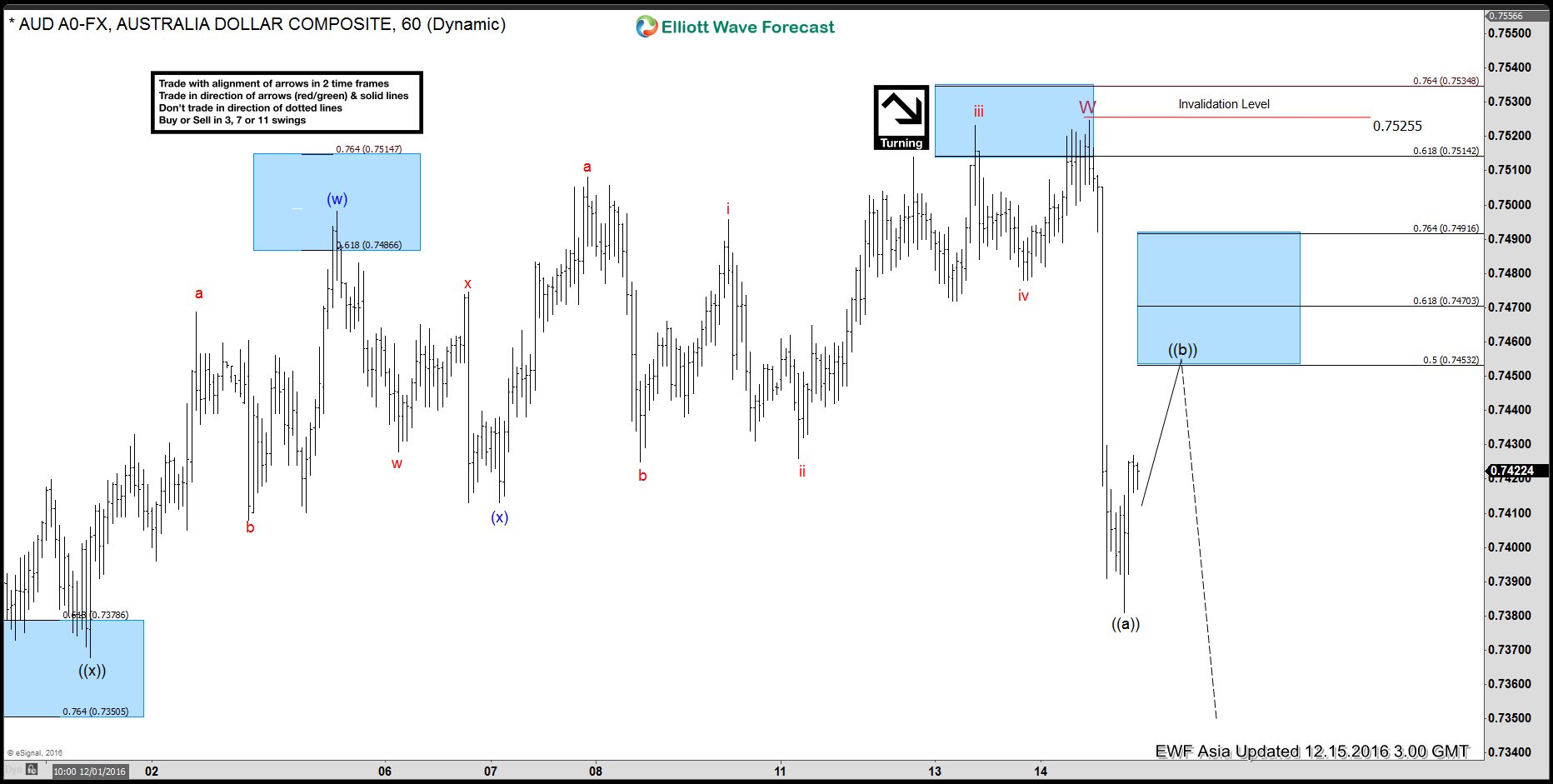

AUDUSD Elliott Wave Forecast 12.15.2016

Read MoreShort Term AUDUSD Elliott wave forecast suggests that the decline to 0.7306 on 11/21 low ended wave (X). Up from there, pair is rallying as a double three structure where wave ((w)) ended at 0.749, wave ((x)) ended at 0.736, and wave ((y)) of W is proposed complete at 0.7525. Pair is currently in wave X […]

-

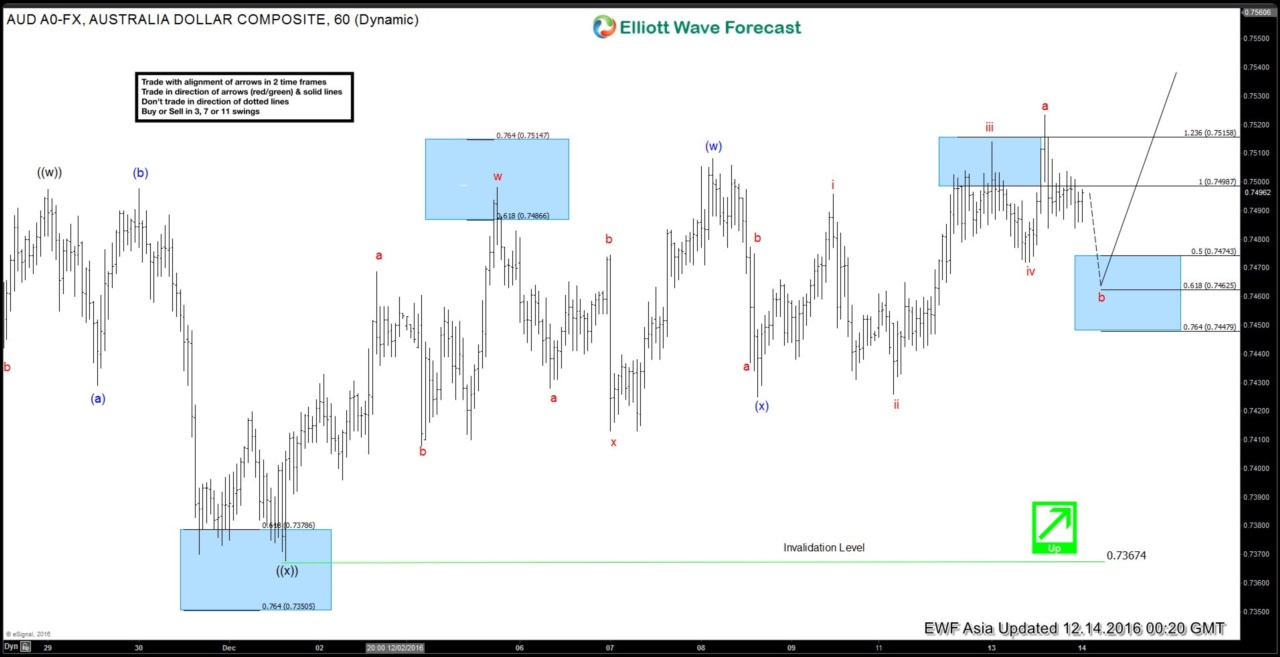

AUDUSD Elliott Wave Forecast 12.14.2016

Read MoreShort Term AUDUSD Elliott wave forecast suggests that the decline to 0.7306 on 11/21 low ended wave (X). Up from there, pair is showing a 5 swing sequence from 11/21 low and suggest more upside. Rally from 11/21 low is unfolding as a double three structure where wave ((w)) ended at 0.749 and wave ((x)) ended […]

-

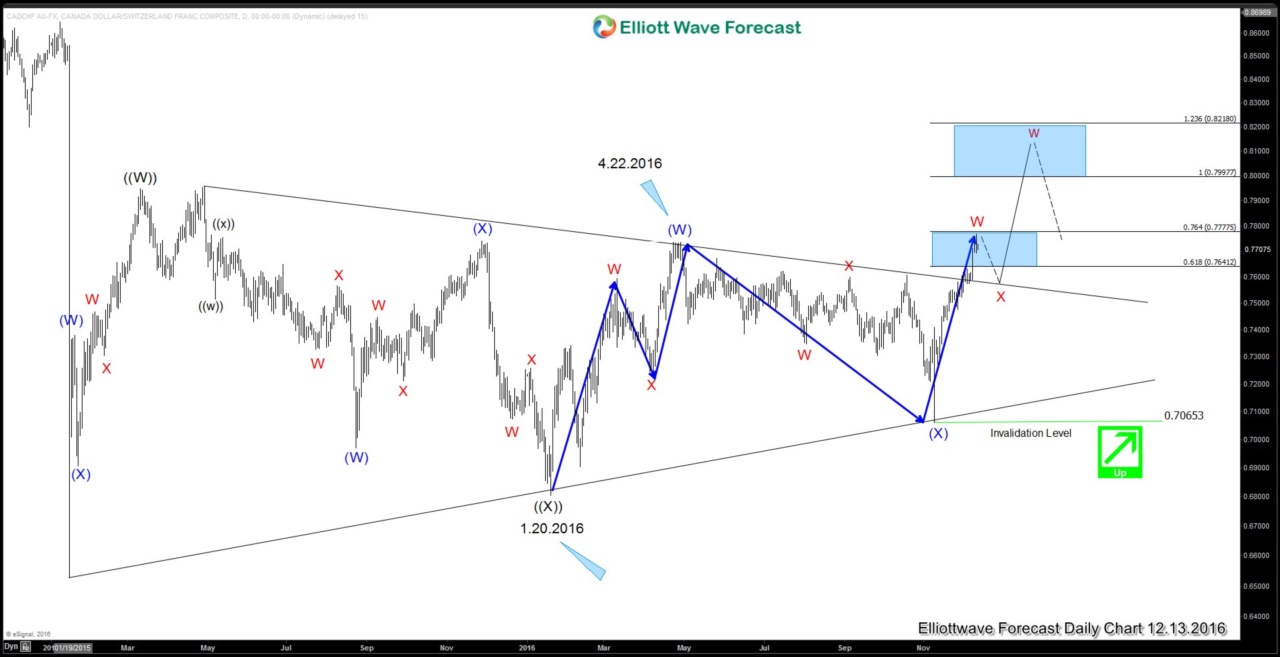

CL_F rally will benefit Canadian Dollar

Read MoreIn November 30, the OPEC members agreed to cut oil production by 1.2 million barrels causing a 9.3% rally in CL_F. Since then, U.S. crude futures continued to rally and took out the previous high of the year made on October 18 at $50.78. We’ve suggested that from technical point of view, CL_F is showing […]

-

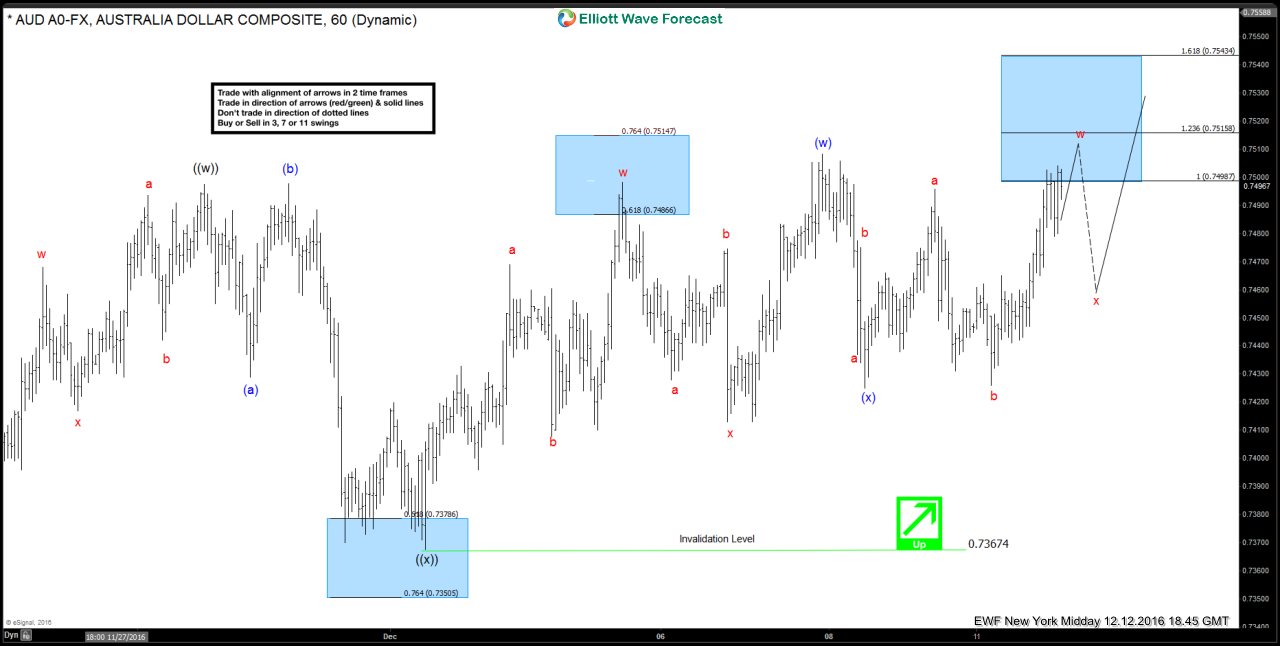

AUDUSD Elliott Wave Forecast 12.13.2016

Read MoreShort Term AUDUSD Elliott wave forecast suggests that the decline to 0.7306 on 11/21 low ended wave (X). Up from there, pair is showing a 5 swing sequence from 11/21 low and suggest more upside. Rally from 11/21 low is unfolding as a double three structure where wave ((w)) ended at 0.749 and wave ((x)) ended […]

-

CL_F Elliott Wave Forecast 12.12.2016

Read MoreShort Term CL_F Elliott wave forecast suggests that the rally from 11/14 (42.21) low is unfolding as a triple three where wave ((w)) ended at $49.2, wave ((x)) ended at $44.82, wave ((y)) ended at $52.43 and 2nd wave ((x)) ended at $49.64. CL_F has gapped up at the opening on Monday Dec 12 and short term while […]

-

CL_F Elliott Wave Forecast 12.8.2016

Read MoreShort Term CL_F Elliott wave forecast suggests that the rally from 11/14 low is unfolding as a double three where wave ((w)) ended at $49.2, wave ((x)) ended at $44.82. and wave ((y)) of W is proposed complete at $52.43. Down from there, wave (w) ended at $50.28, and wave (x) bounce ended at $51.2. While bounces […]