-

Pound Sterling Maintains Strength as Tories Projected to Win

Read MorePound Sterling remains strong as the U.K. will go to poll this coming Thursday December 12. The general election normally should be held every five years. However, this election will be the third time since 2015 as it’s necessary to break the country’s Brexit impasse. It will determine whether the U.K. will quit the European […]

-

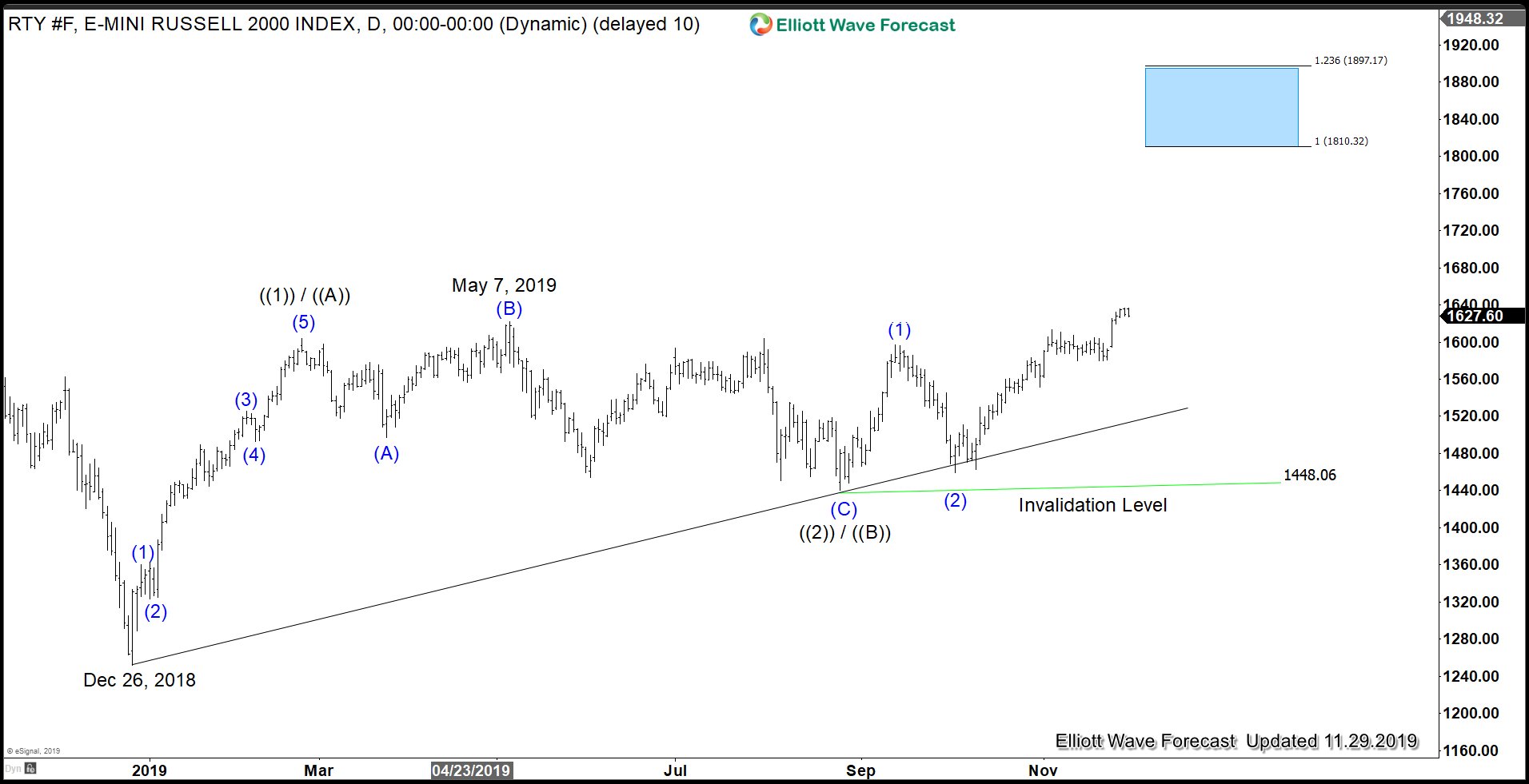

U.S. Stock Market Surged as November Payroll Smashed Expectation

Read MoreU.S. stock market surged as November Nonfarm Payroll came out strong at 266,000. Unemployment rate also fell to 3.5%, which is at 50-year low since 1969. The result smashed the consensus expectation of 185,000. Stocks leaped higher after the blockbuster number as the US economy is firing on all cylinder. There was initially some concern […]

-

Elliott Wave View: GBPUSD Should Remain Supported

Read MoreGBPUSD rally from Nov 23 low is unfolding as an impulse Elliott Wave structure, favoring more upside. This article looks at the Elliottwave path.

-

Elliott Wave View: SPX Correction in Progress

Read MoreSPX has started a wave 4 correction & could see further downside to end a double zigzag Elliott Wave structure. This article look at the Elliottwave path..

-

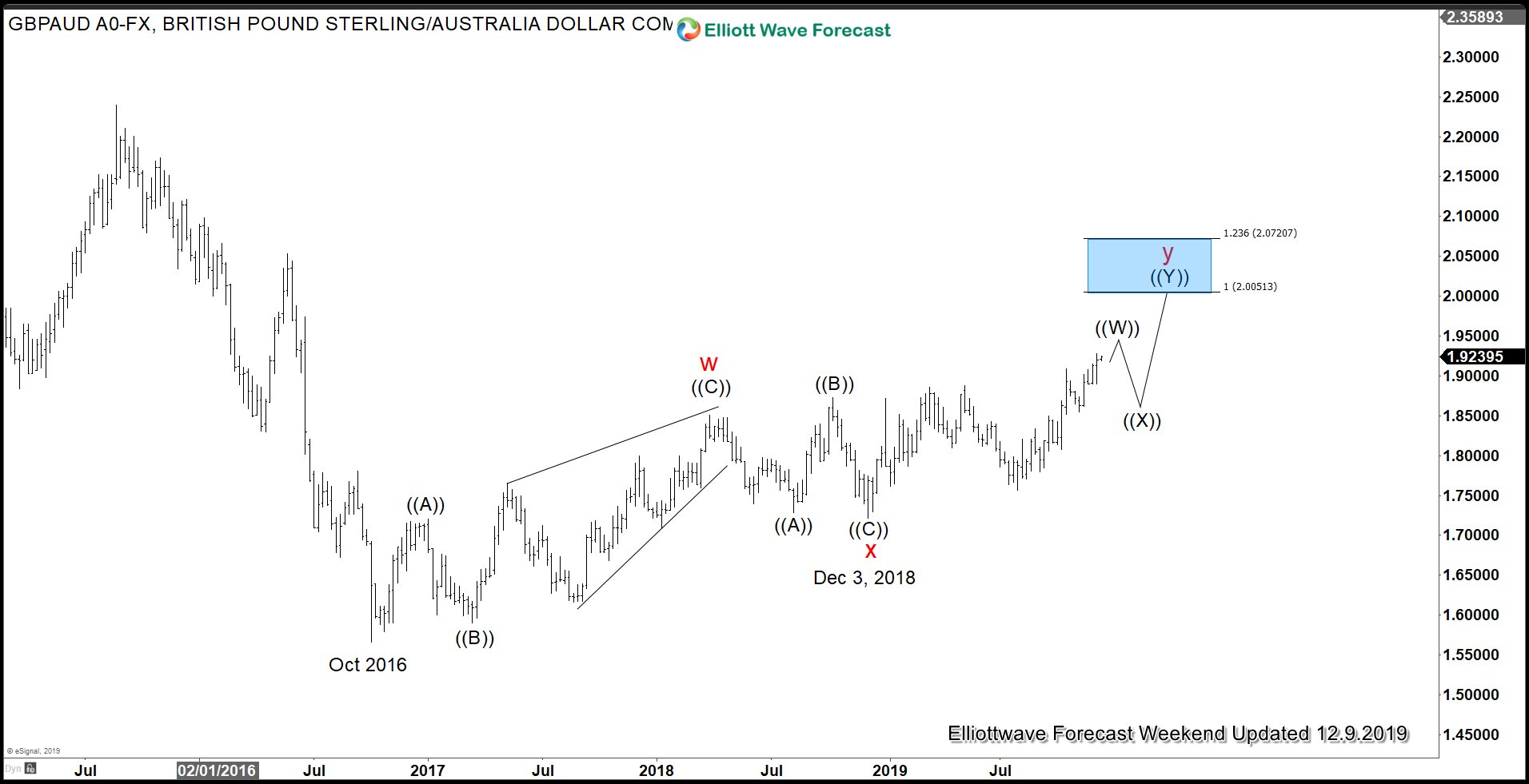

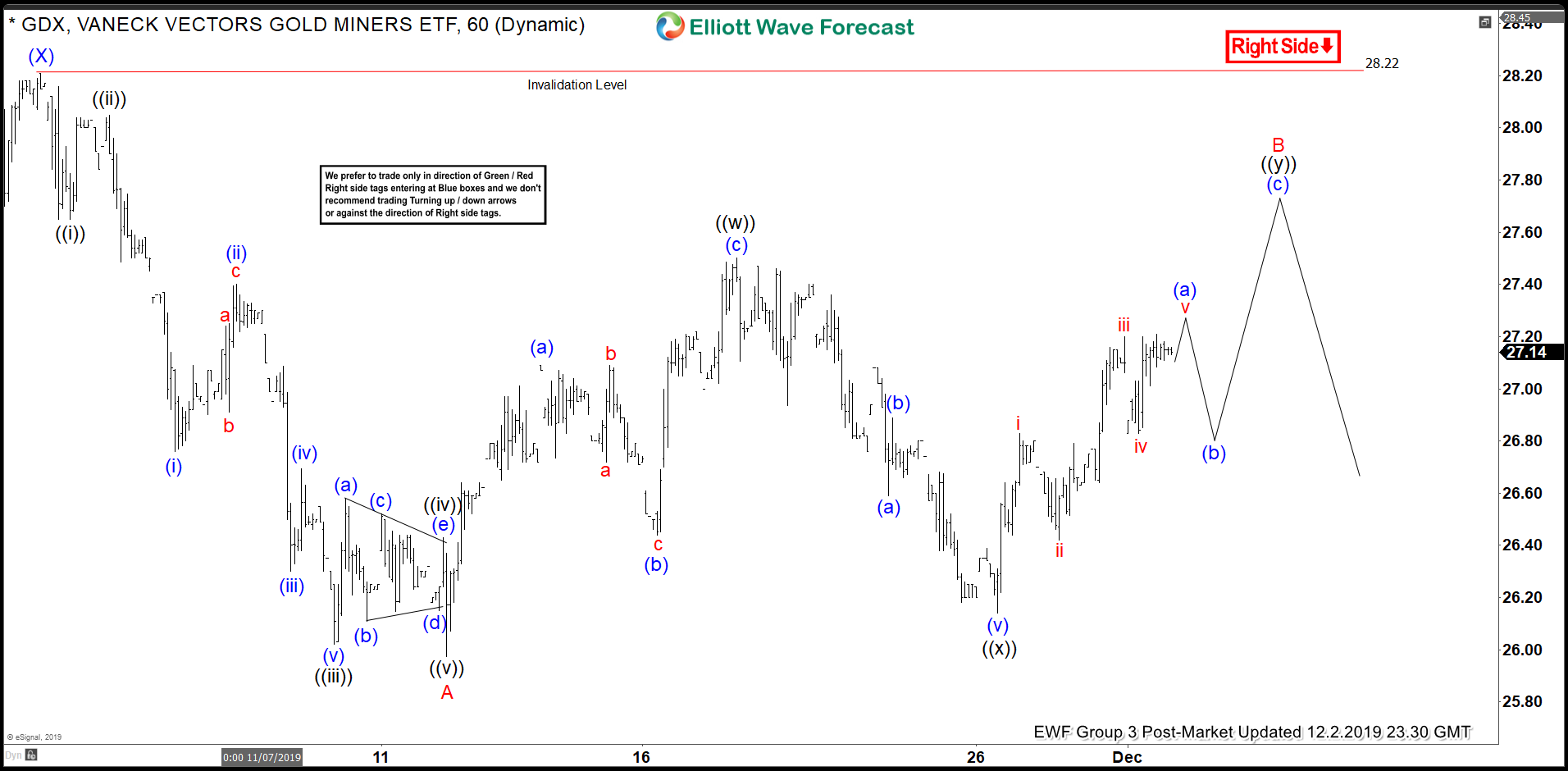

Elliott Wave View: GDX Rally Remains Corrective

Read MoreGDX rally from Nov 12 low is unfolding as a double zigzag Elliott Wave structure & while bounce stays below Nov 1 peak, it can extend lower.

-

Global Indices Should Remain Resilient Despite Geopolitical Threat

Read MoreDespite Beijing’s objection, President Trump has gone ahead and signed two bills backing Hong Kong’s protesters into law. Beijing has continuously voiced strong objection against the legislation as China sees it as meddling in its domestic affairs. Trump signed these bills as US and China still try to reach a phase one trade deal. China […]