-

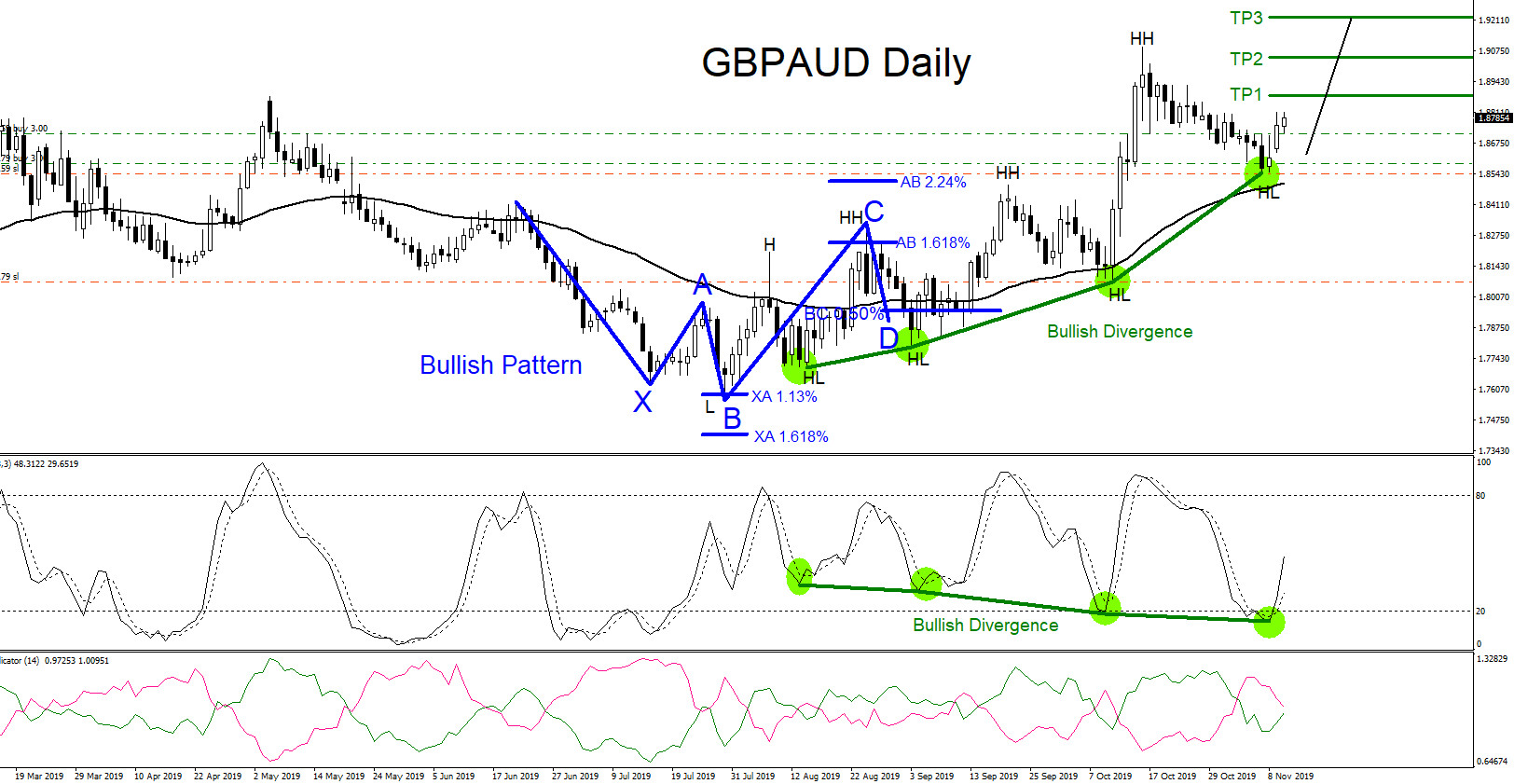

GBPAUD : Calling the 800 Pip Rally Higher

Read MoreGBPAUD Technical Analysis GBPAUD : On July 30/2019 the pair found a bottom and has bounced higher since. GBPAUD, on the daily chart, has been making higher highs and higher lows from the July 30/2019 lows indicating that the pair is trending to the upside. Trading with the trend is always recommended at EWF. After […]

-

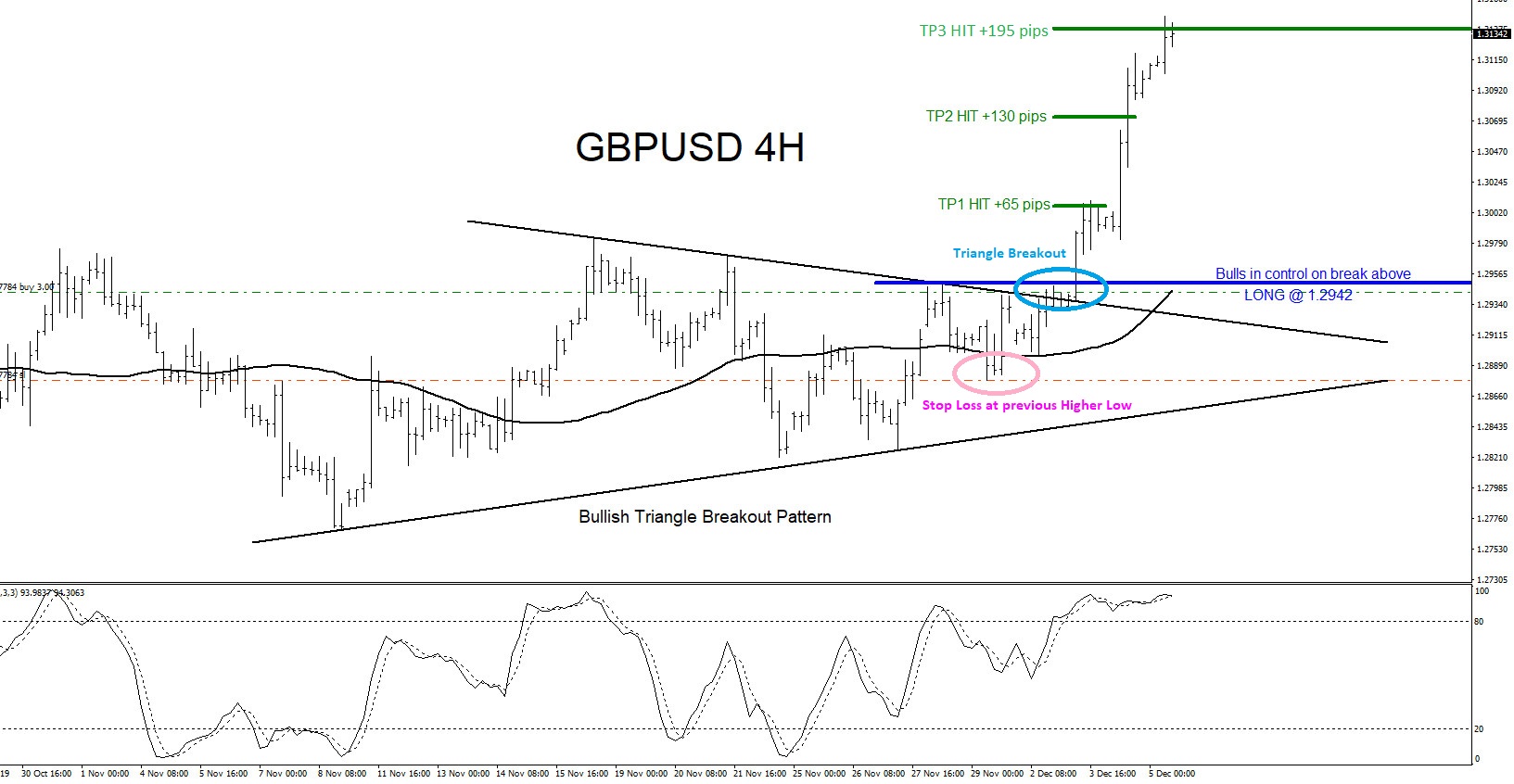

GBPUSD : Triangle Breakout Pattern

Read MoreGBPUSD Technical Analysis GBPUSD : On September 3/2019 the pair found a bottom and has bounced higher since. GBPUSD has been making higher highs and higher lows from the September 3/2019 lows indicating that the pair is trending to the upside. Trading with the trend is always recommended at EWF. Near the start of December […]

-

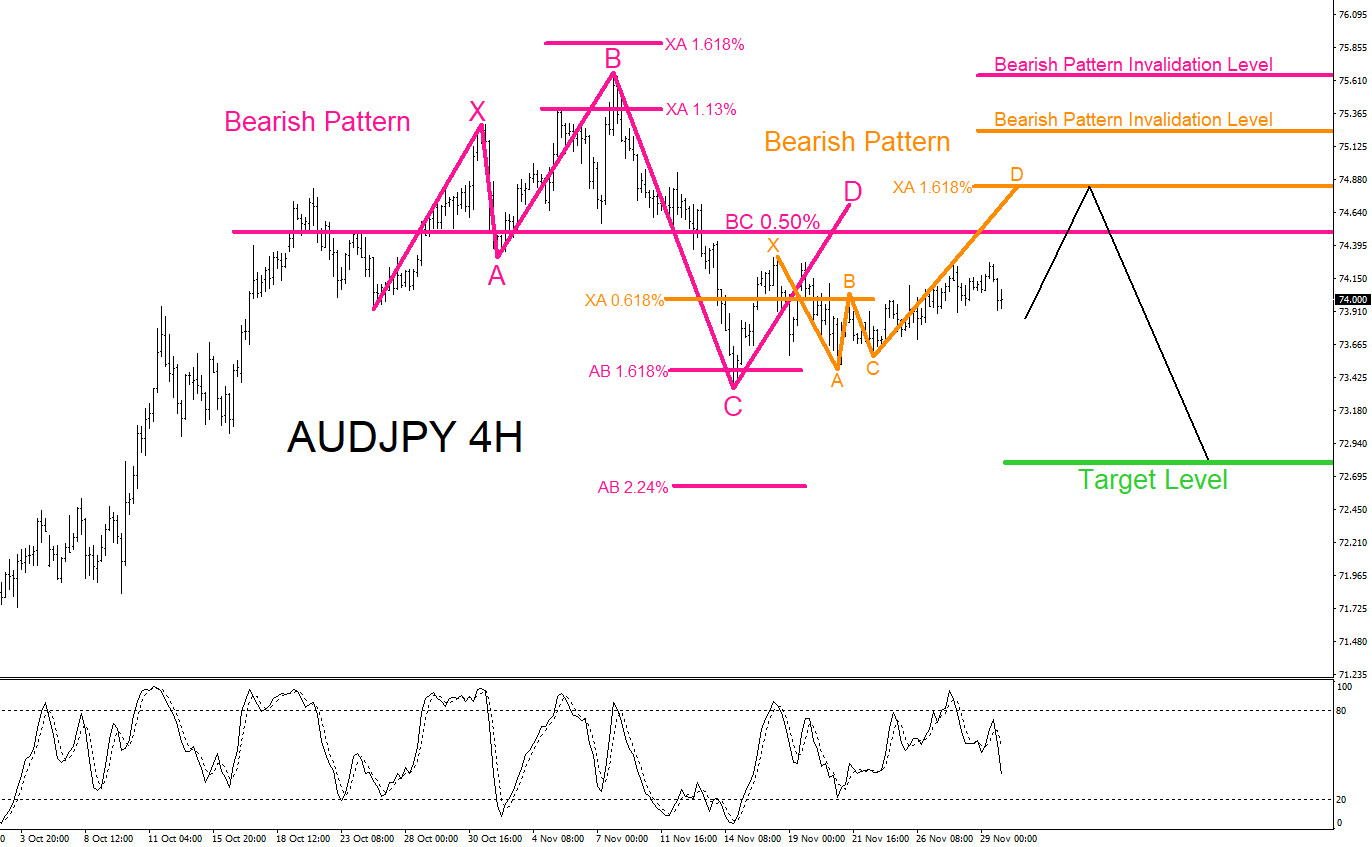

AUDJPY : Possible Move Lower Then A Bounce Higher?

Read MoreAUDJPY Technical Analysis December 1/2019 AUDJPY : A possible bullish pattern is visible on the Daily time frame. The blue bullish pattern still needs to make a push lower to complete point D at the BC 0.50% Fib. retracement level where AUDJPY can possibly bounce higher from. If price extends higher above the AB 2.24% […]

-

AUDJPY : Possible Bearish Pattern?

Read MoreAUDJPY Technical Analysis December 1/2019 AUDJPY : Possible bearish patterns are visible on the 4 hour time frame. The pink bearish pattern still needs to make a push higher to complete point D at the BC 0.50% Fib. retracement level and the orange bearish pattern also needs to make a push higher to complete point […]

-

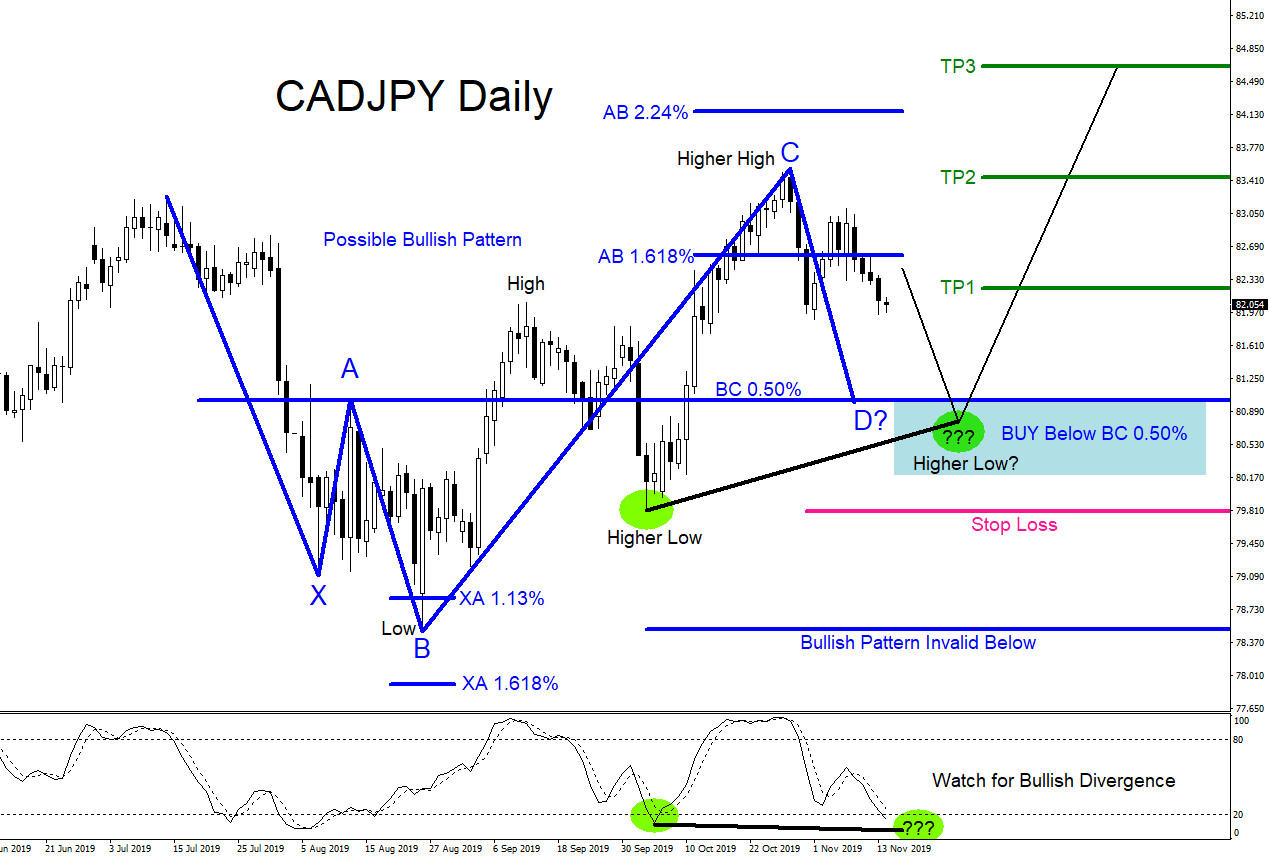

CADJPY : Watch For Possible Buying Opportunities

Read MoreCADJPY Technical Analysis November 14/2019 CADJPY : A possible bullish pattern is visible on the Daily time frame. The blue bullish pattern still needs to make a push lower to complete point D at the BC 0.50% Fib. retracement level where CADJPY can possibly bounce higher from. If price extends higher above the AB 2.24% […]

-

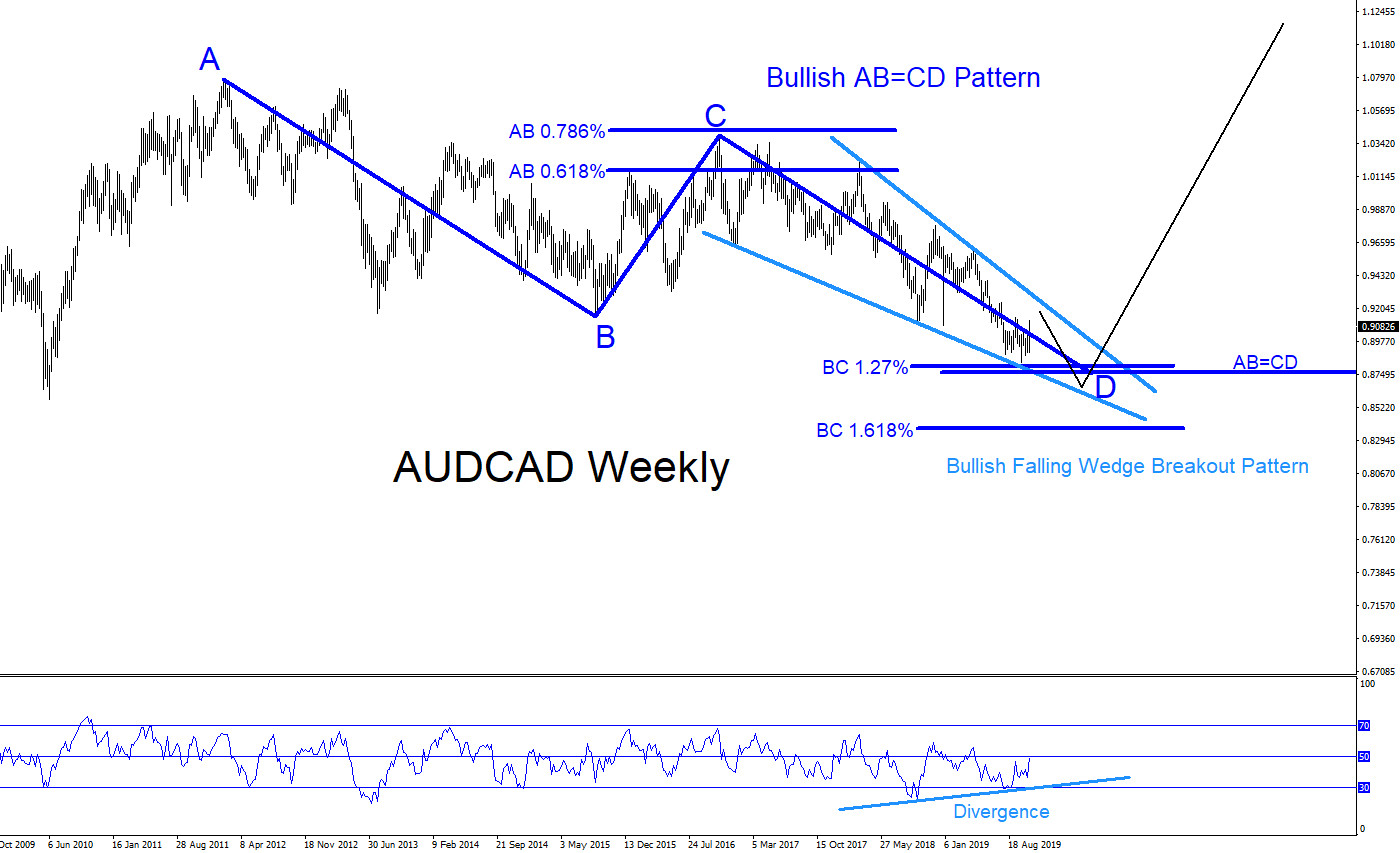

AUDCAD : Will the Pair Bounce Higher in 2020?

Read MoreAUDCAD Technical Analysis November 3/2019 AUDCAD : There are clear visible bullish market patterns on the weekly chart but traders will still need to wait for more confirmation that a bottom will form. AUDCAD still needs to make another move lower to trigger the dark blue bullish AB=CD pattern. Bulls can possibly be waiting below […]