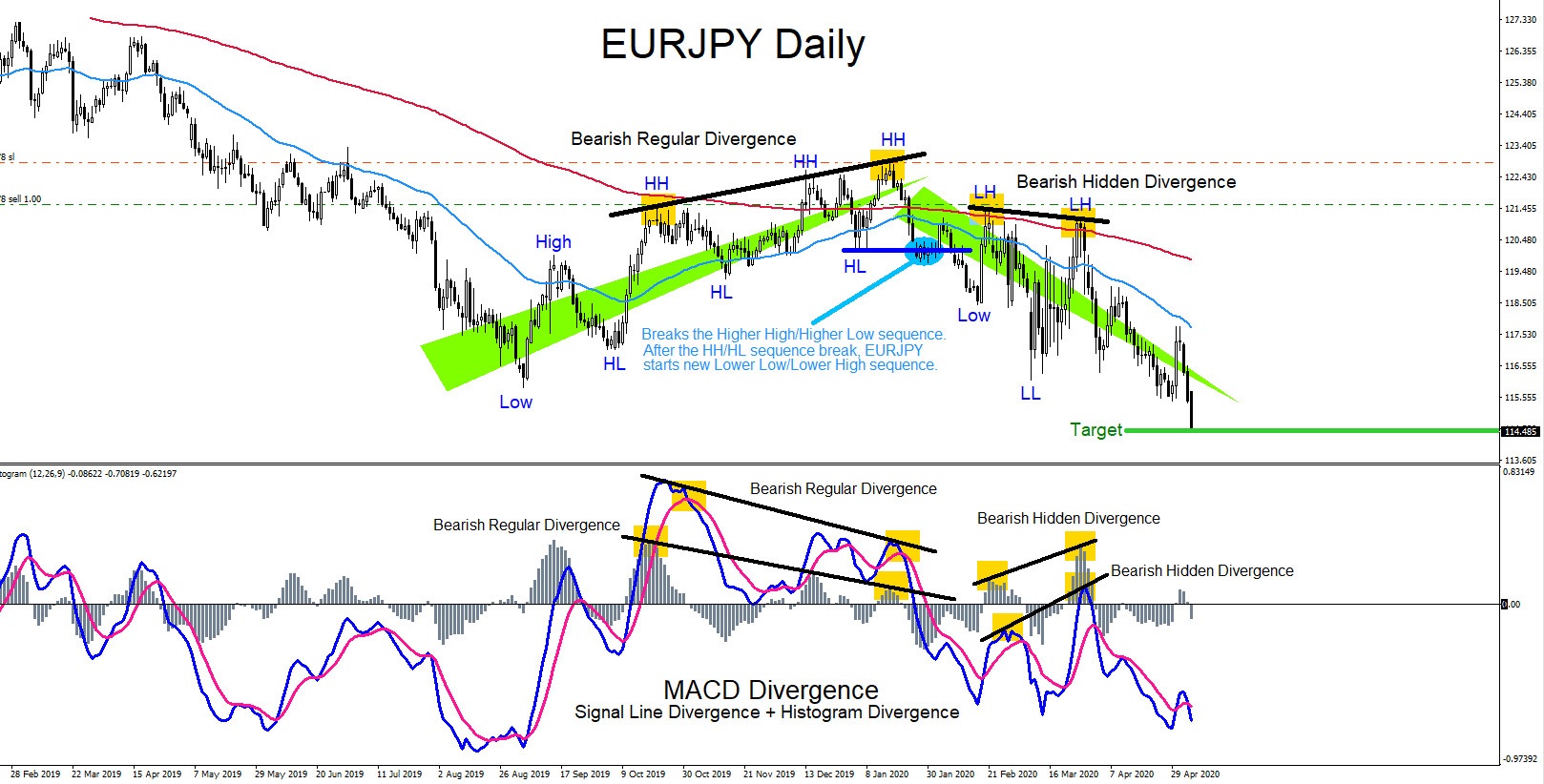

Divergence trading patterns can signal traders of possible trade setups. There are 2 types of divergence patterns, regular divergence and hidden divergence. Both patterns can signal a trader on which side to trade the market. A divergence pattern is when price is moving in one direction but the oscillator indicator is moving in a different direction. […]

-

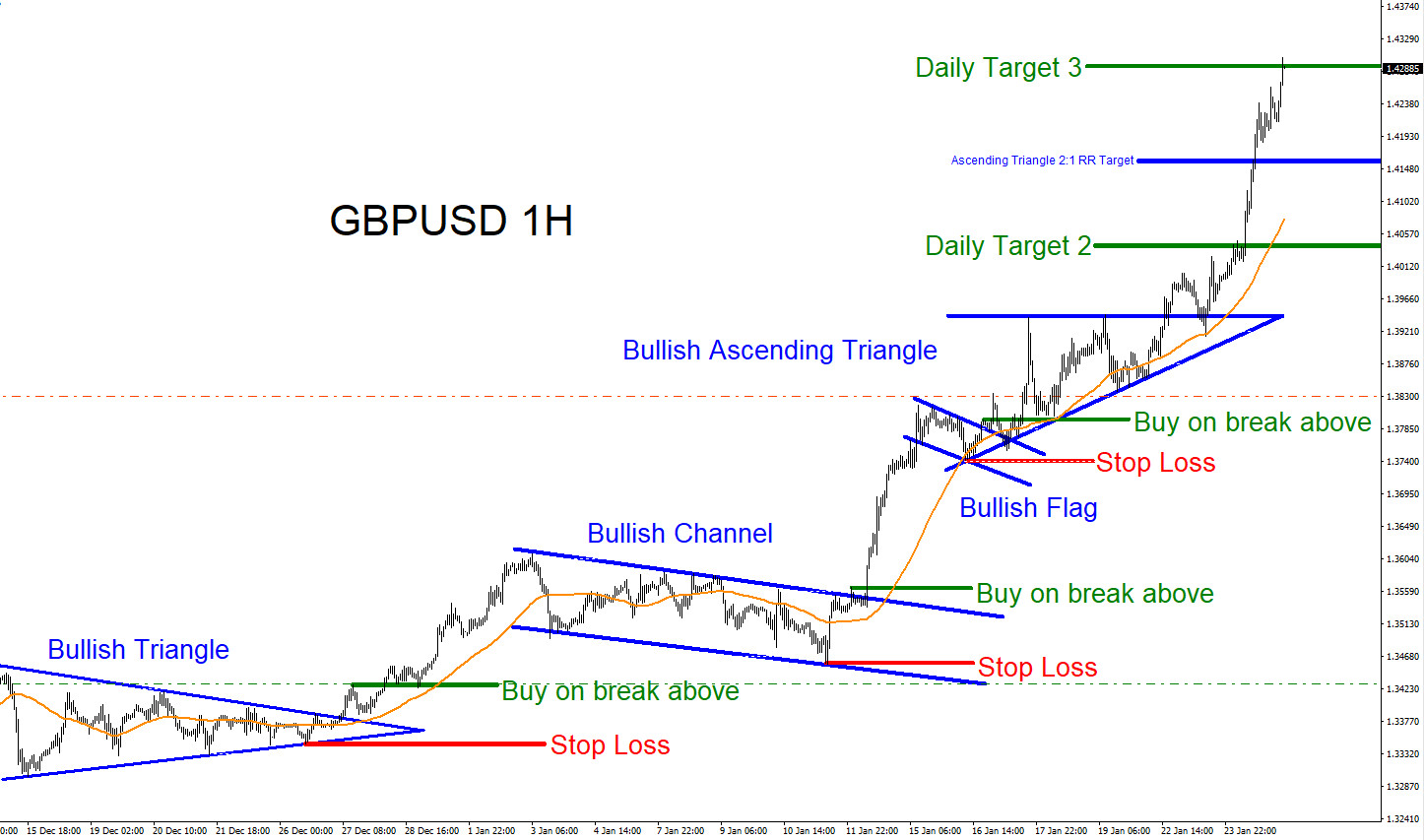

GBPUSD : Trading Market Pattern Breakouts

Read MoreGBPUSD Technical Analysis 1.26.2018 GBPUSD from December 28/2017 till January 25/2018 has produced 4 market pattern breakouts where traders could have entered LONG positions and rode the market rally to the upside. Since December 28/2017 the pair has extended over 900 pips to the upside. The chart below will show how any trader could have […]

-

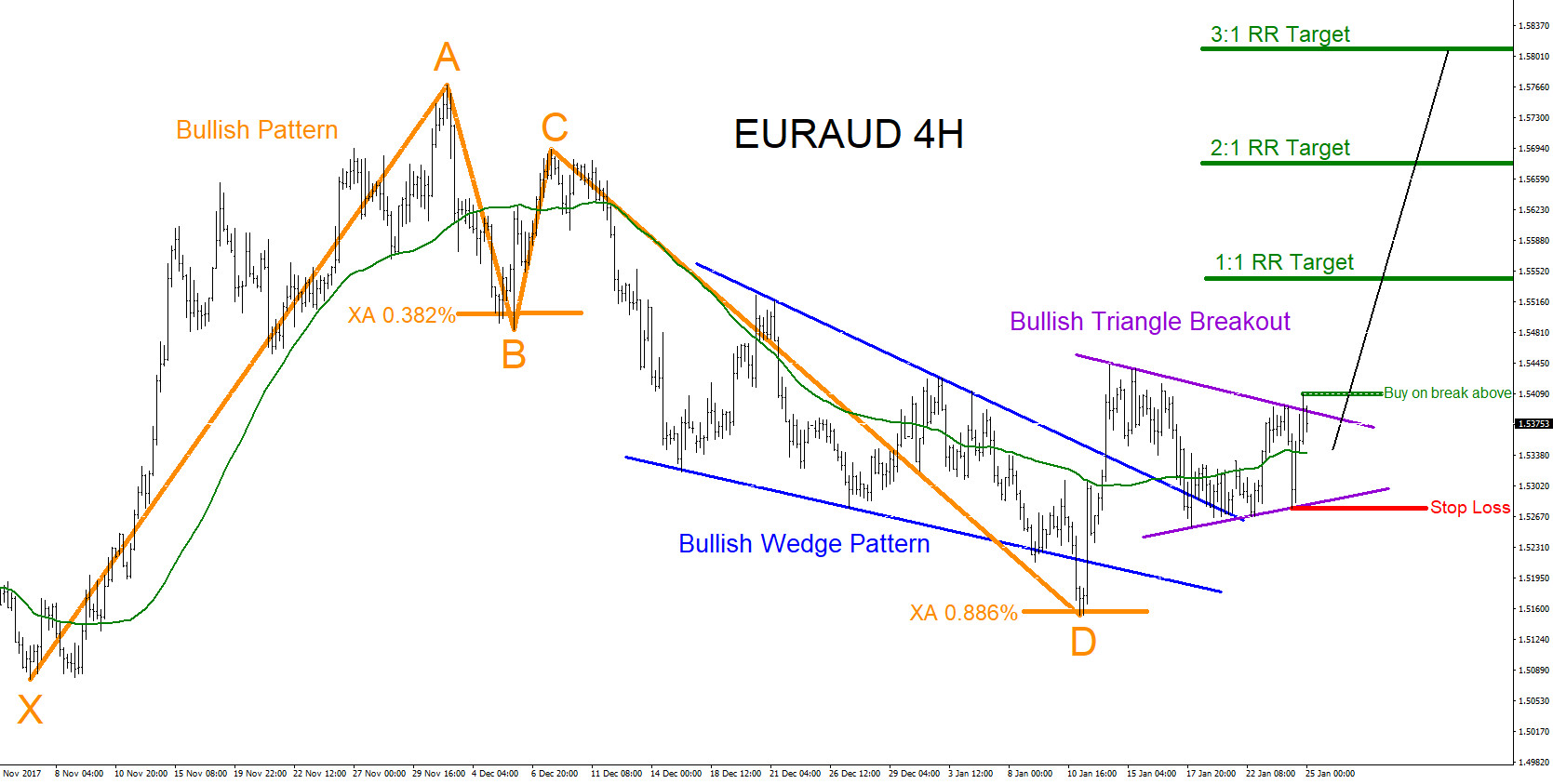

EURAUD : Will Pair Push Higher?

Read MoreEURAUD Technical Analysis 1.25.2018 EURAUD has potential to push higher. Bullish patterns are visible and just waiting for price to start rallying to the upside. On the chart below the orange bullish pattern already triggered buys at the XA 0.886% Fib. retracement level and bounced higher. On the bounce higher the pair broke above the […]

-

USDCHF : Possible Rally Higher?

Read MoreUSDCHF Technical Analysis 12.22.2017 USDCHF is showing two possible bullish patterns. Blue bullish pattern already triggered buys at the blue BC 0.50% Fib. retracement level and price is currently trying to breakout above the purple bullish wedge pattern. More confirmation of a possible rally higher will be if price actually breaks above the top of […]

-

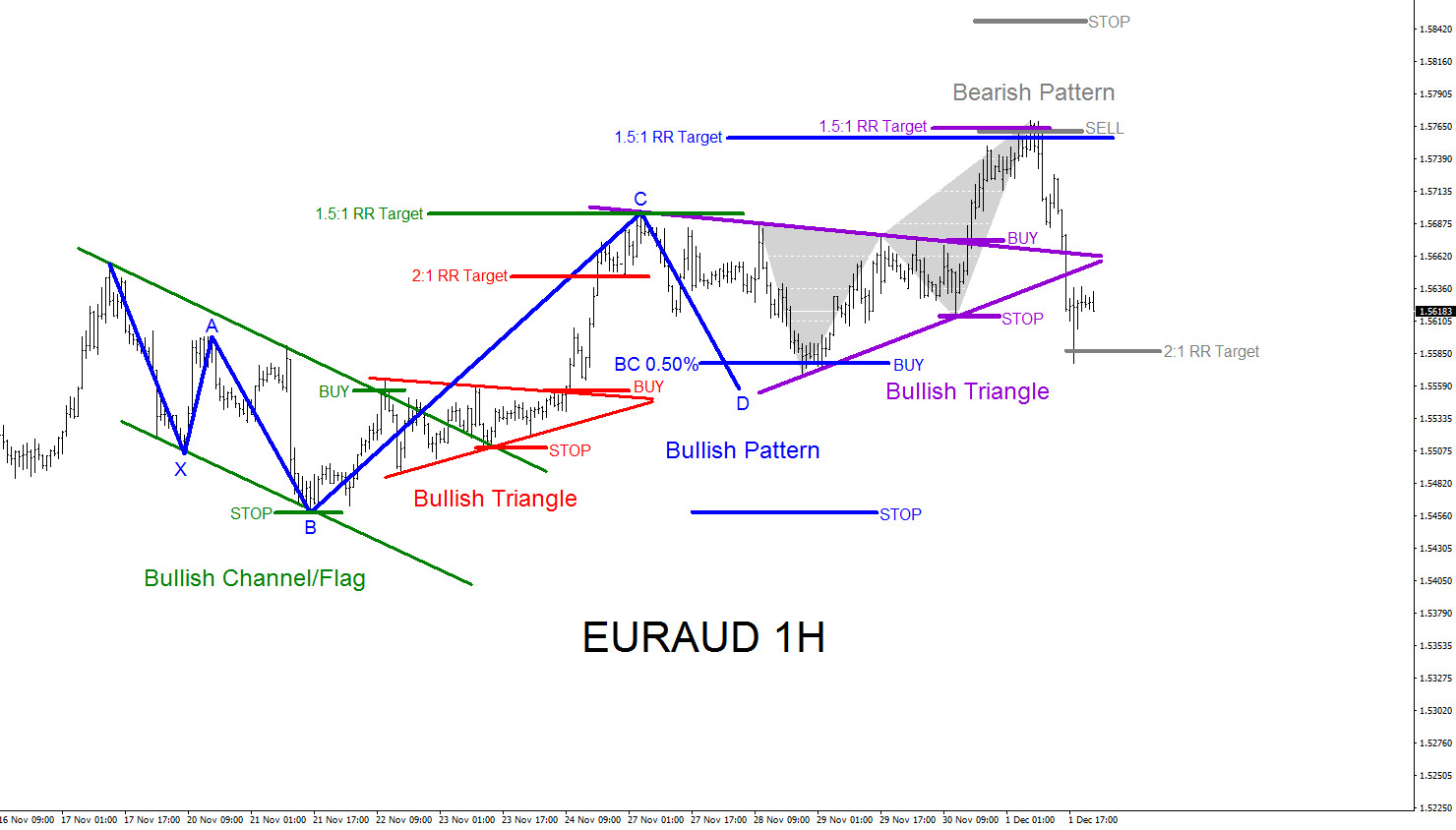

EURAUD : 7 Days, 5 Trades, 675 Pips

Read MoreEURAUD Technical Analysis EURAUD had great structure and market patterns during the week from November 22 2017 to December 1 2017. Allow me to elaborate a little on what I mean by “market patterns”. When you go to the bookstore or read anything online on technical analysis almost every author will write about basic or advanced […]

-

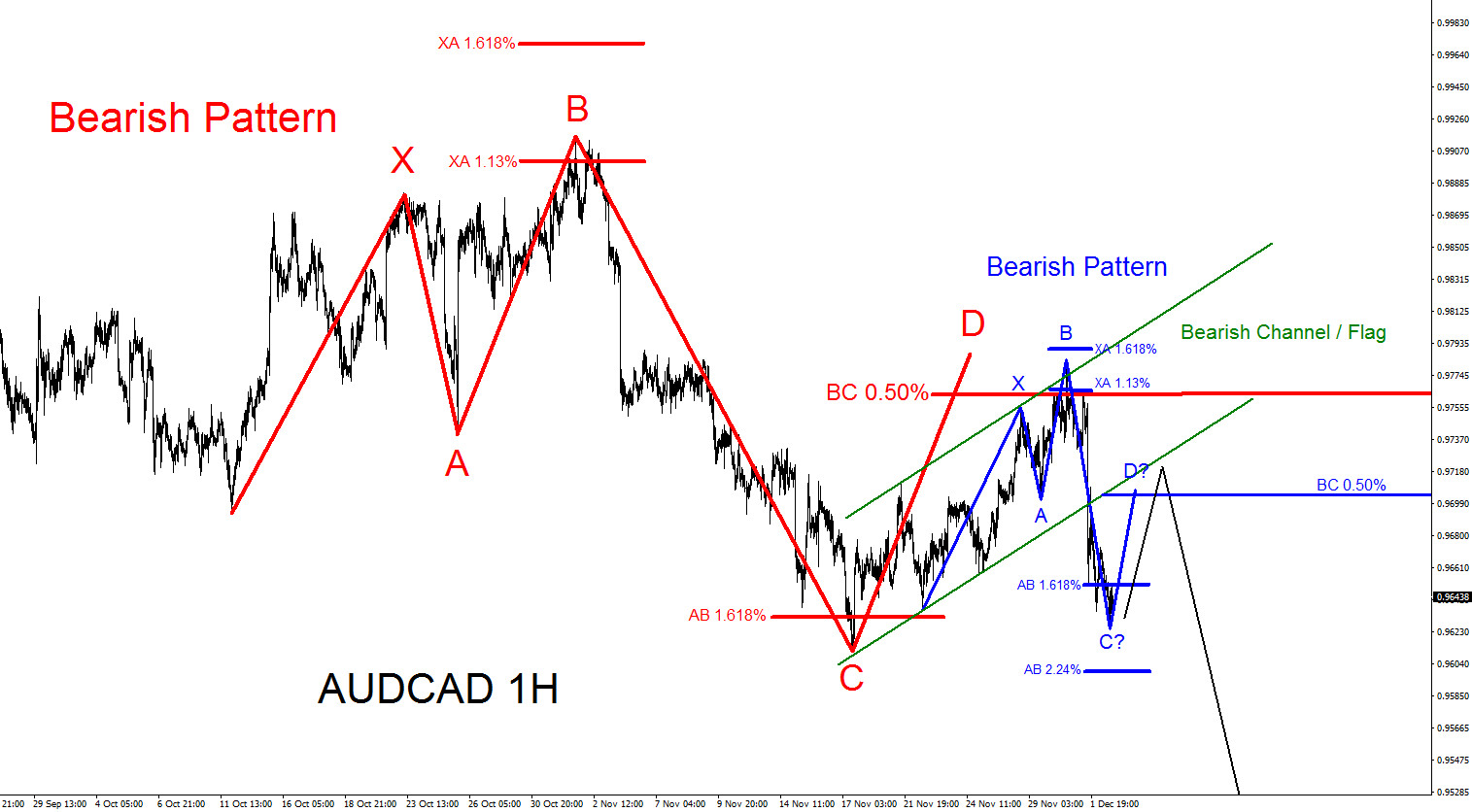

AUDCAD : Selling Opportunity

Read MoreAUDCAD Technical Analysis 12.4.2017 AUDCAD has already pushed lower since it formed a top last week on November 30 2017. The pair is showing bearish patterns which has already sold off from. Red bearish pattern triggered sells at the red BC 0.50% Fib. retracement level where the pair reversed lower from that area. To add […]

-

AUDJPY : Possible Bounce Higher (Part 2)

Read MoreAUDJPY Technical Analysis 11.9.2017 Just to add on to the article published on October 27 2017 “AUDJPY : Possible Bounce Higher” we can now see more bullish patterns that can push AUDJPY higher if it reaches levels lower. In the original article we had and still have a bullish pattern that triggers buys at the purple […]