-

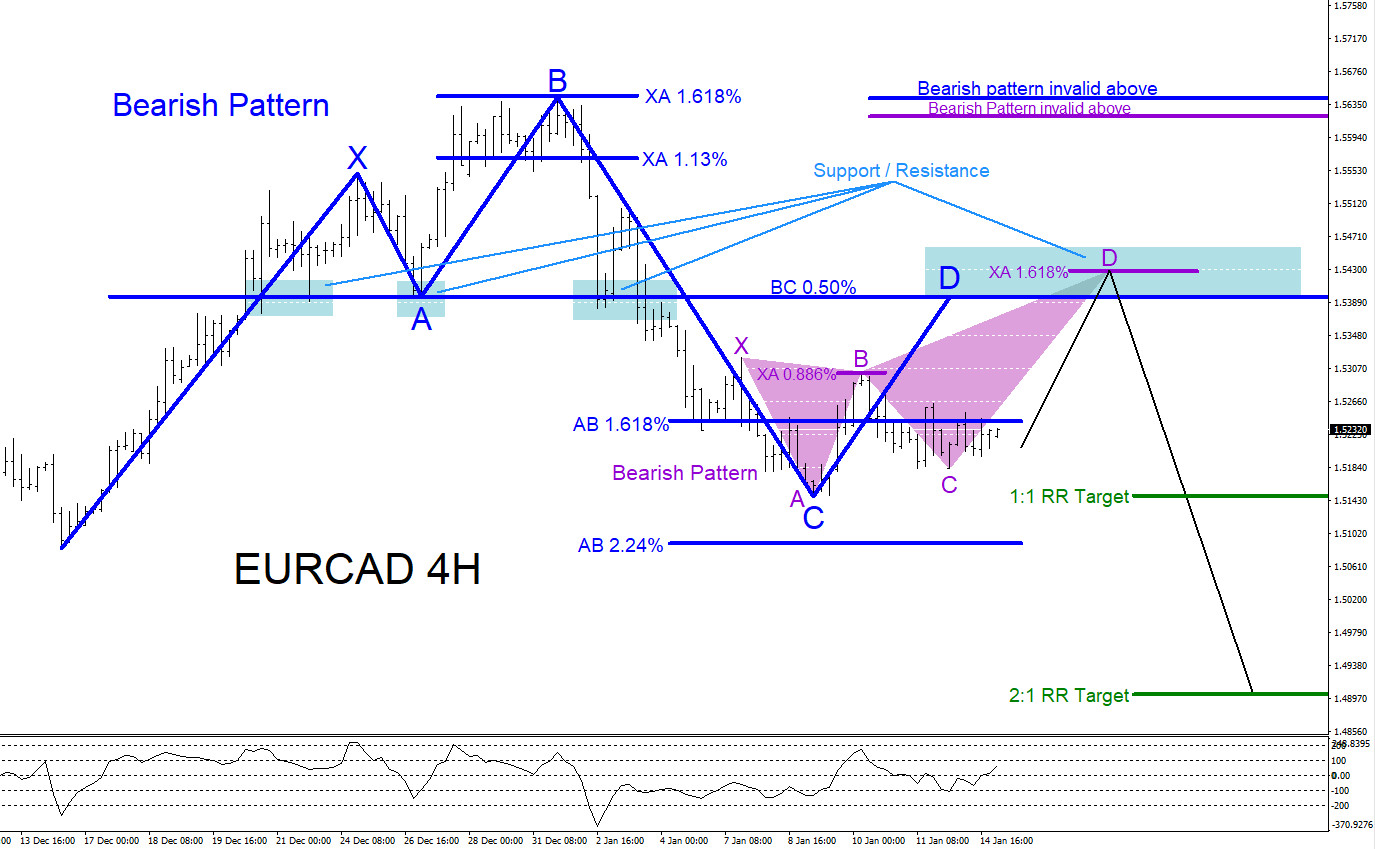

EURCAD : Will Bears Take Control?

Read MoreEURCAD Technical Analysis January 14/2019 Bearish market patterns can be seen on the EURCAD 4 hour chart. In the chart below there are possible bearish patterns that can trigger SELLS if the market makes another move higher. The blue bearish pattern triggers SELLS at the BC 0.50% Fib. retracement level and the purple bearish pattern […]

-

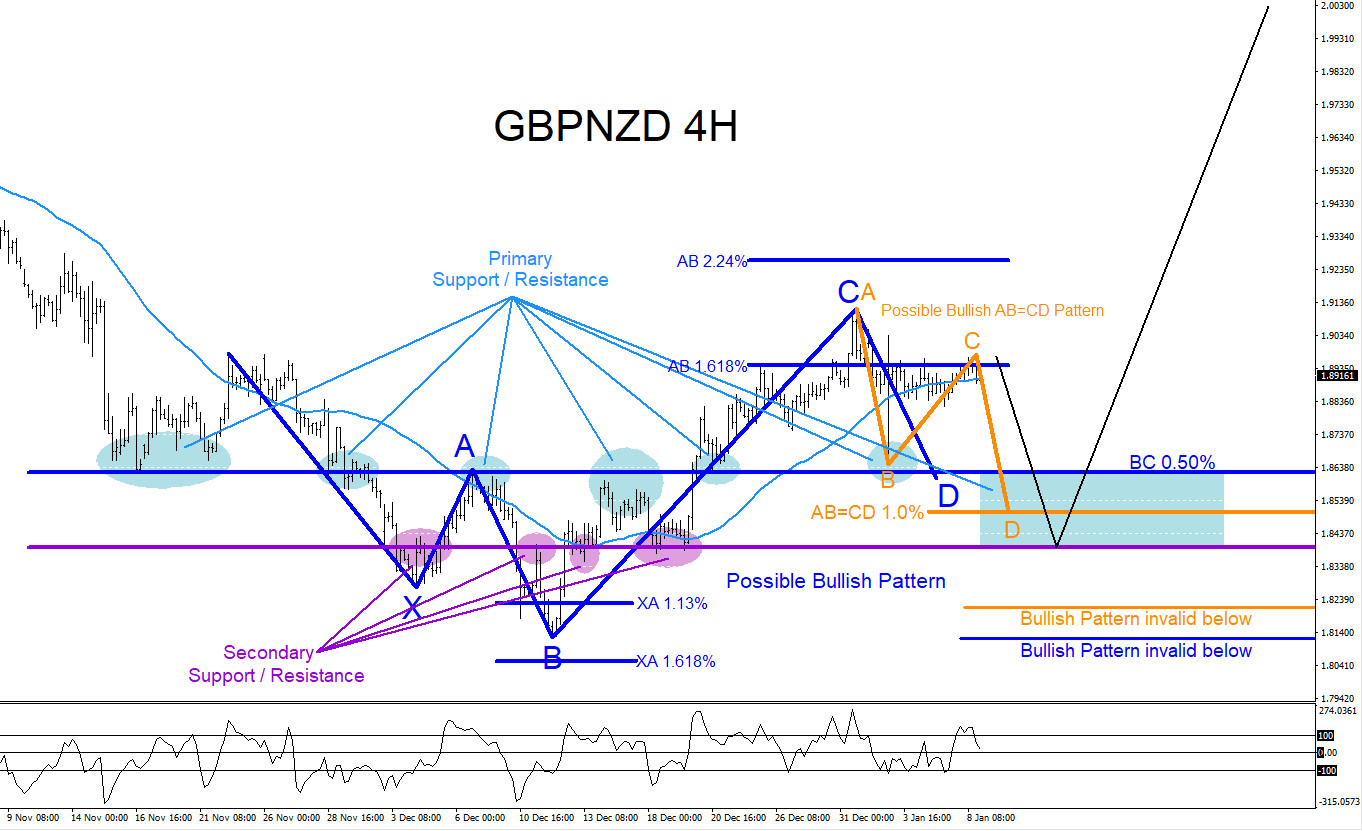

GBPNZD : Buy the Dip Scenario

Read MoreGBPNZD Technical Analysis January 8/2019 Bullish market patterns can be seen on the GBPNZD 4 hour chart. In the chart below there are possible bullish patterns that can trigger BUYS if the market makes another move lower. The orange bullish AB=CD pattern triggers BUYS at the Fib. extension 1.0% level and the blue bullish pattern […]

-

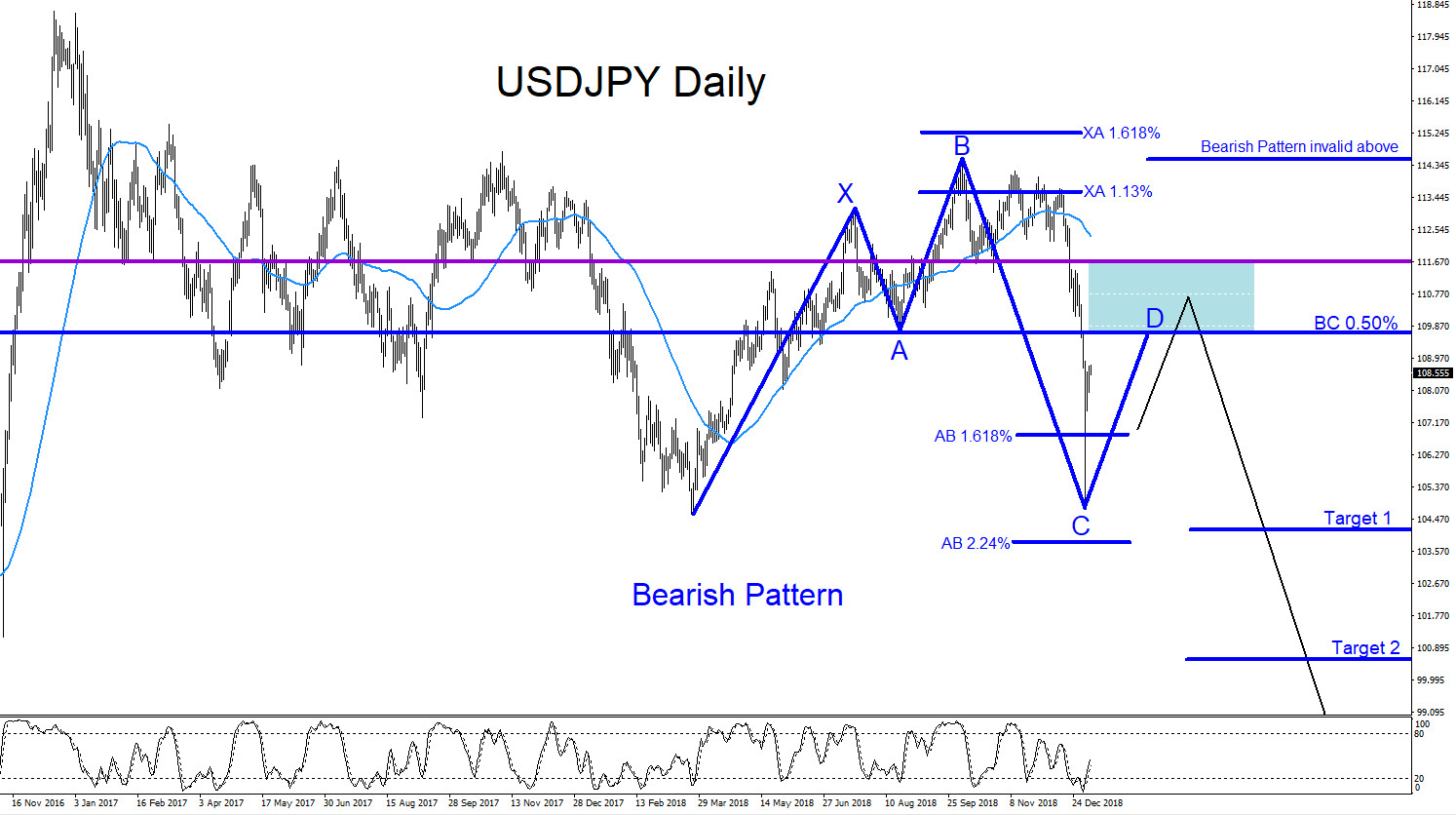

USDJPY : Will Bearish Pattern Trigger More Sells?

Read MoreUSDJPY Technical Analysis January 8/2019 USDJPY remains bearish as long as the October 4/2018 high remains untouched. On the Daily chart there is a clear visible bearish pattern that can be seen. The blue bearish pattern triggers SELLS at the BC 0.50% Fib. retracement level. Price has still not reached this level so traders will […]

-

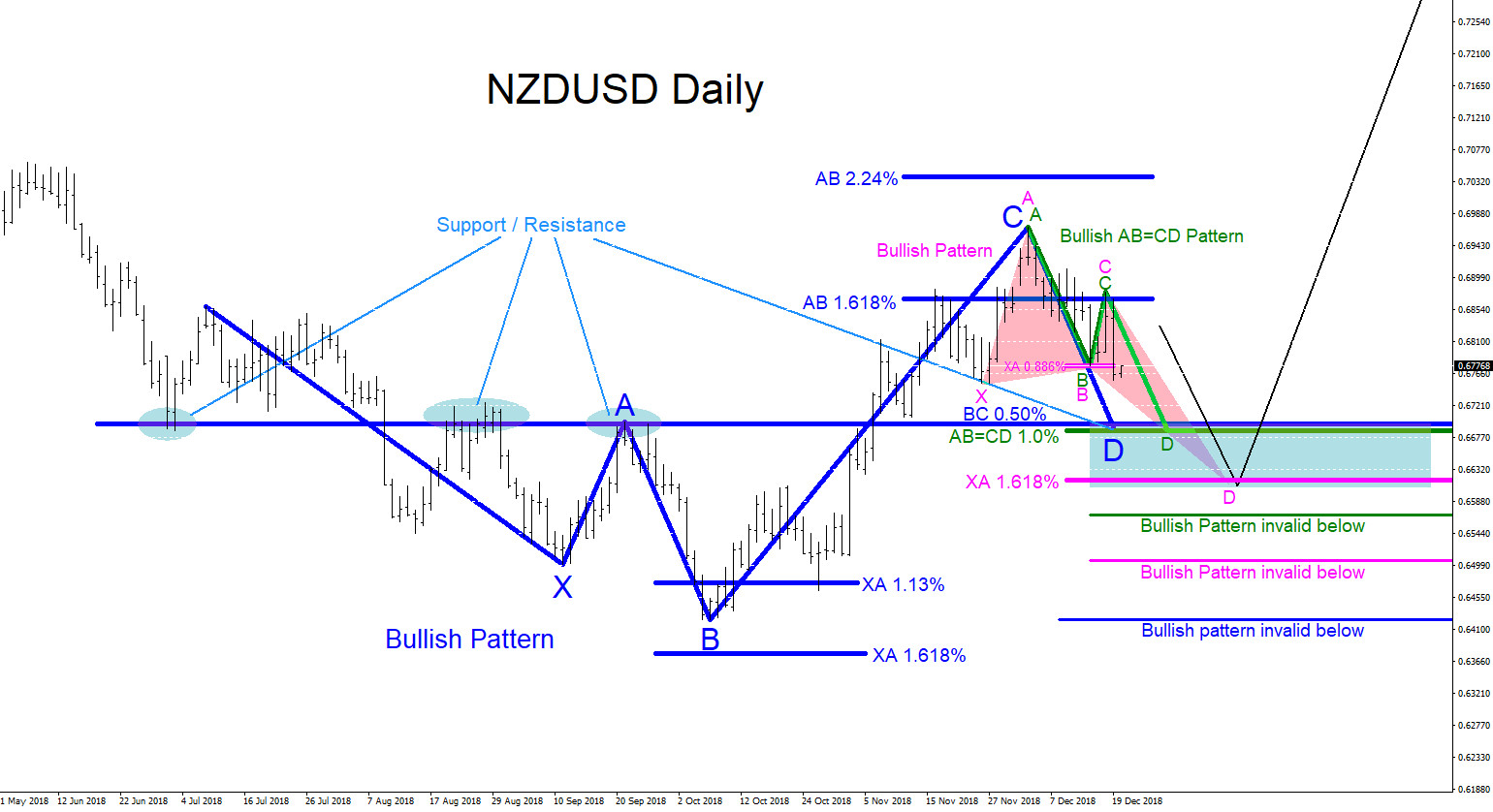

NZDUSD : Possible Bullish Patterns

Read MoreNZDUSD Technical Analysis December 19/2018 NZDUSD remains bullish as long as the October 8/2018 low remains untouched. On the Daily chart there are clear visible bullish patterns that can be seen. In the chart below, market patterns are used to determine where price can possibly pause and bounce higher. The green bullish AB=CD pattern triggers […]

-

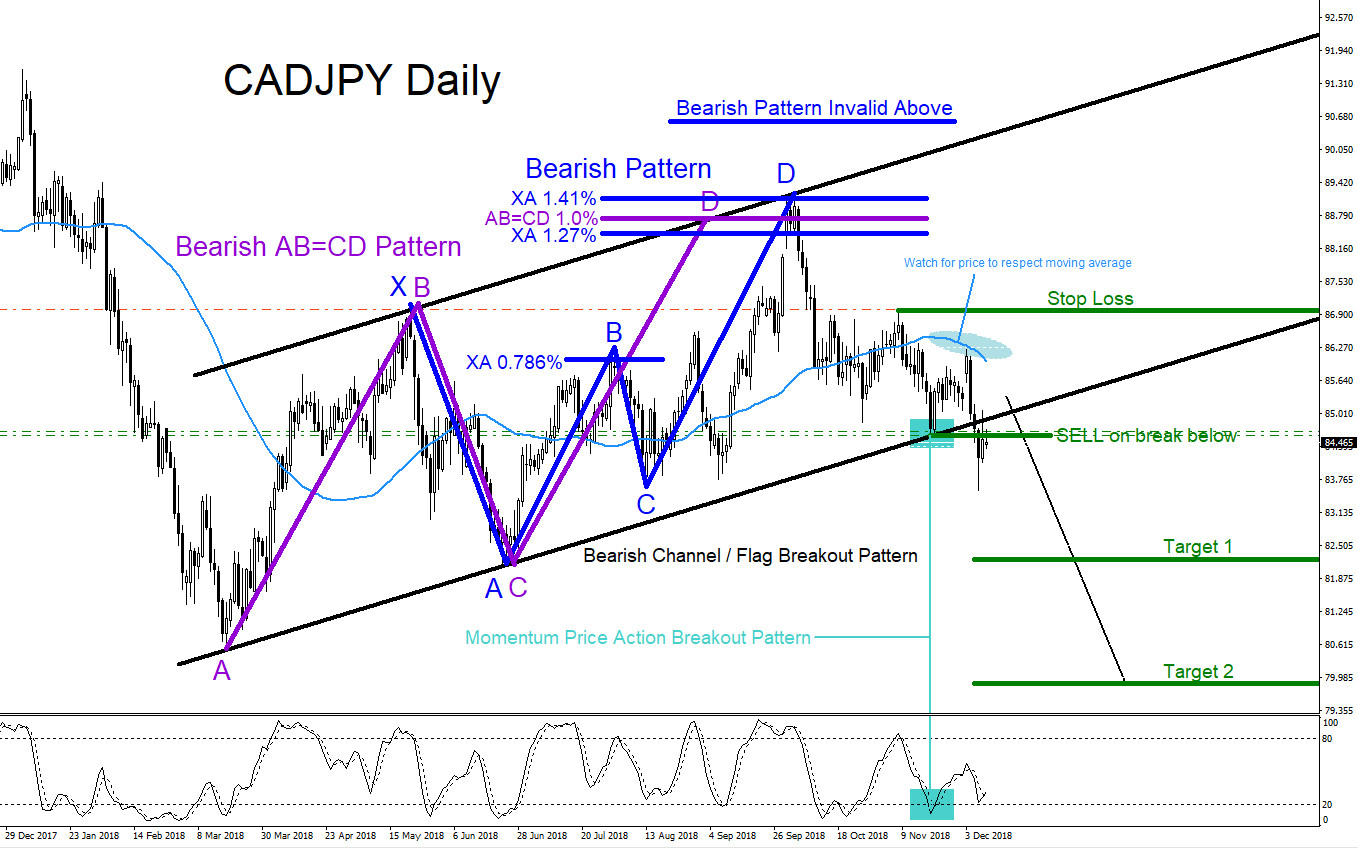

CADJPY : Will Sellers Take Control?

Read MoreCADJPY Technical Analysis December 10/2018 CADJPY looks poised to make another move lower. There are bearish market patterns that are clearly visible. On the Weekly chart below, CADJPY formed a Bearish Pattern (blue) that triggered sellers on September 2017 where price reached the BC 0.50% Fib. retracement level. From this level CADJPY reversed lower signalling […]

-

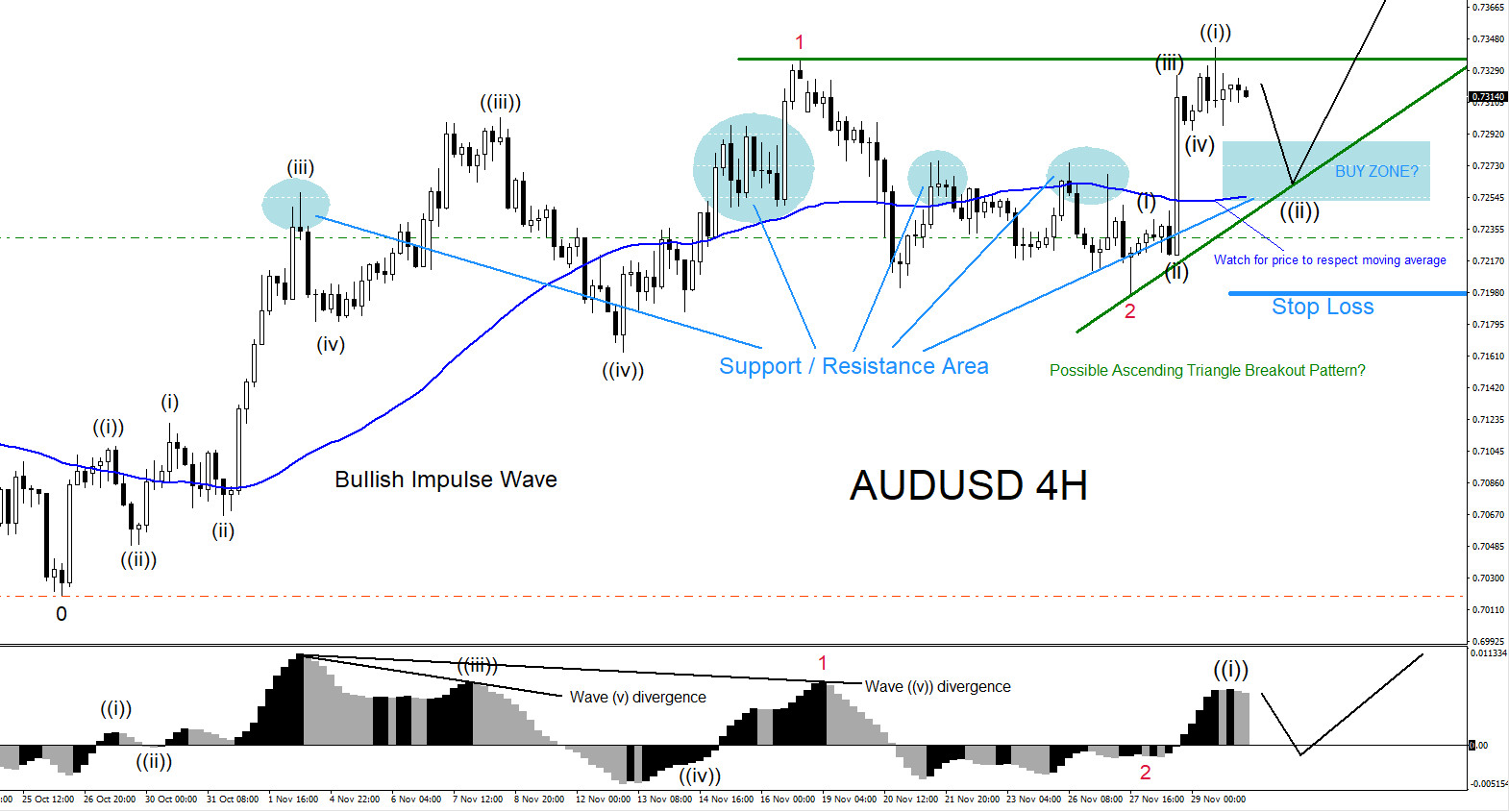

Will AUDUSD Rally Higher?

Read MoreAUDUSD Technical Analysis November 30/2018 AUDUSD BUY/LONG Trade Setup: October 26/2018 AUDUSD found a bottom and bounced higher. The bounce higher has formed a bullish Elliott Wave Impulse Pattern. The current wave count higher can now be seen as a five wave move with red wave 1 terminating at the high of November 16/2018. The […]