What is ETF?

Exchange-Traded Funds or ETFs are a pool of securities traded on the stock exchange like regular stocks.

ETFs track the index it is associated with. Similarly, ETF moves in line with the index. If the index falls, so does the ETF and vice versa. ETFs are traded on the stock exchange and can be created and dissolved daily depending upon the demand.

The two most common method of trading the ETFs are:

Market Orders – The investor places an order in the market to buy or sell ETFs at the best available price. The order will be matched with best available price and will be executed. Sometimes the best available price can be higher and the investor ends up paying more than intended. This is the only downside of this trading method.

Limit Orders – The limit order method allows the investor to buy ETFs at or below a set price. Similarly, it allows the investor to sell at or above a specific price. This way the investor has control over the minimum price he/she is selling at and the maximum price he/she will be purchasing at. The only downside of this method is that it might take longer than usual for the market to reach your desired price.

Types of ETFs

ETFs have a set of types each of which has been created with a different set of investment focus. Here are the most common ETFs:

- Diversified Passive Equity ETFs – This ETF mirrors the performance of widely followed stock market benchmarks such as the S&P 500 and the Dow Jones Industrial Average

- Niche Passive Equity ETFs– This ETF mirrors the performance of the sector subsets of big indexes. This gives the investor a focused exposure on their portfolios

- Active Equity ETFs – This ETF allows the fund managers to select specific stocks from the index instead of mirroring the whole index. This ETF has the potential to outperform the market but is also risky

- Fixed Income ETFs – This ETF focuses on bonds instead of stocks. These types of ETFs have low turnover but stable performance.

How to choose the right ETF?

In selecting the ETF that right for you as an investor, some key factors to look at are:

- Level of Assets – The value of the underlying assets

- Trading Activity – It is very important to check the demand of the ETF you are purchasing

- Underlying Index – The index the ETF follows should match your investment requirement as an investor

In addition to the above factors, as an investor, you should first identify your investment goal and then seek the factors which match your investment required to get the best out of your investment. Investing in best ETFs is one of the most easiest and safe investment option.

What is Index Fund?

Index Fund is a portfolio of stocks compiled together to match or track the components of a financial market index e.g., S&P 500

Index Funds mirror the performance of a large group of assets such as stocks, bonds, currencies, or commodities. The market has indexes for every type of asset e.g., large-cap stocks, small-cap stocks, junk bonds, foreign currencies. The index fund managers set up their asset portfolios in a way that matches the return of the chosen index.

Choosing the weighting strategies in designing the portfolio for the index has a huge impact on the performance of the fund. There are multiple weighting strategies used by index fund managers:

- Price Weighted Index – This method uses the market price of each asset as the major factor in setting up the portfolio. Assets with higher prices have a larger share in the overall fund and assets with lower prices have a smaller share in the fund. An example of Price weighted index is the Dow Jones Industrial Average (DJIA). A price-weighted index fund needs to be updated regularly as market prices change daily

- Market-Cap Weighted Index– This weighting strategy uses the market capitalization of every asset as its major factor is setting up the fund. The share of each company is determined by its market capitalization. An example of a market-cap weighted index is the S&P 500. This index fund does not require to be updated regularly. But often large market cap companies become the driving force of the overall performance of the fund.

- Equal Weight Index – This method gives equal weightage to every asset it tracks. This index fund is a true reflection of the companies it tracks, as no single company can overshadow the overall performance of the fund.

Types of Index Fund

Some of the most common categories of Index Fund are:

- Broad Market Index Funds – This type of index fund duplicates the performance of an entire market e.g., the currency market

- Equity Index Funds – This type of index fund tracks specific stock indexes e.g., the S&P 500

- Bond Index Funds – This type of index fund tracks the performance of specific types of bonds

- Balanced Index Funds – This type of index fund comprises multiple asset classes. E.g. Bonds and Currencies

- Sector Index Funds – This type of index fund includes companies of the specific industrial sector. E.g. renewable energy index would buy companies that belong to the renewable energy market in the S&P 500 index

- Dividend Index Funds – This type of index fund includes stocks of companies that pay high dividends

How to choose the right Index Fund?

The one thing you should keep in mind as an investor is your investment goals. E.g., your investment goal is regular income or long-term growth. Once you have identified your investment goal you can match it with the right type of index fund.

ETF VS INDEX FUND

ETFs and Index Fund both provide a diversified portfolio. For example, an ETF and index fund following the S&P 500 will give you exposure to the whole index.

They both have a lot of differences that make them unique and attractive to investors:

| ETF | Index Fund | |

| 1. | ETF can be purchased at the price of 1 share | Index Fund is a flat dollar amount |

| 2. | ETF can be purchased through a broker | Index funds are bought from the fund manager |

| 3. | ETFs can be traded throughout the day | Index Funds are bought and sold at the end of the trading day |

| 4. | Tax Beneficial | Pay tax without even exchanging |

| 5. | Highly liquid | Less Liquid |

| 6. | Price of securities known at the time of purchase | Price of securities unknown at the time of purchase |

| 7. | Less Costly | Slightly higher price |

Read more:

1. Investment Requirement

ETF– The amount required to buy an ETF is as low as the price of 1 share. ETFs require very low capital to start investing.

Index Fund- Index Funds have a fixed amount which an investor needs to invest and for some stock and forex brokers, the amount is very high. As per the company website of Vanguard, the minimum investment for an index fund is $3000.

2. Trading Method

ETF- ETFs can be traded throughout the day just like stocks. Their trading starts when the market opens and continued till the market closes. ETFs are a great source of investment for day trading.

Index Fund– Index fund is bought and sold at the end of the day at the price set. For long-term investors, this is a great option.

3. Tax Benefit

ETF- Capital gain tax applies whenever you sell an ETF and you have to pay.

Index Fund – In the case of an index fund, capital gain tax applies even when you have not sold your index. When the fund manager sells some securities to redeem cash for some of the fund holder’s capital gain tax applies to it. The capital gain is distributed amongst all the index fund holders and the capital gain tax is also applicable to all.

4. Selling of Funds

ETF – ETFs can be bold and sold easily throughout the day through the broker. Investors can easily trade ETFs.

Index Fund– Index Fund are bought ad sold through the fund manager. It is a comparatively longer process

5. Liquidity

ETF- ETFs are traded just like stocks and they are highly liquid.

Index Funds – Index Fund transactions are carried out in huge denominations after the market closes

6. Price of Securities

ETF– With ETFs investors know the exact share price of the securities they are purchasing

Index Fund – Investors usually purchase a specific dollar amount worth of the fund. The actual price of securities within that fund is unknown at the time of investment. The fundholder can only know the exact price at day end.

7. Expense

ETF- ETFs are less costly than mutual funds. Since ETFs are traded like stocks, as an investor you will pay a commission to buy and sell them.

Index Fund – Index Fund Manager charge a flat amount for their services.

Read more:

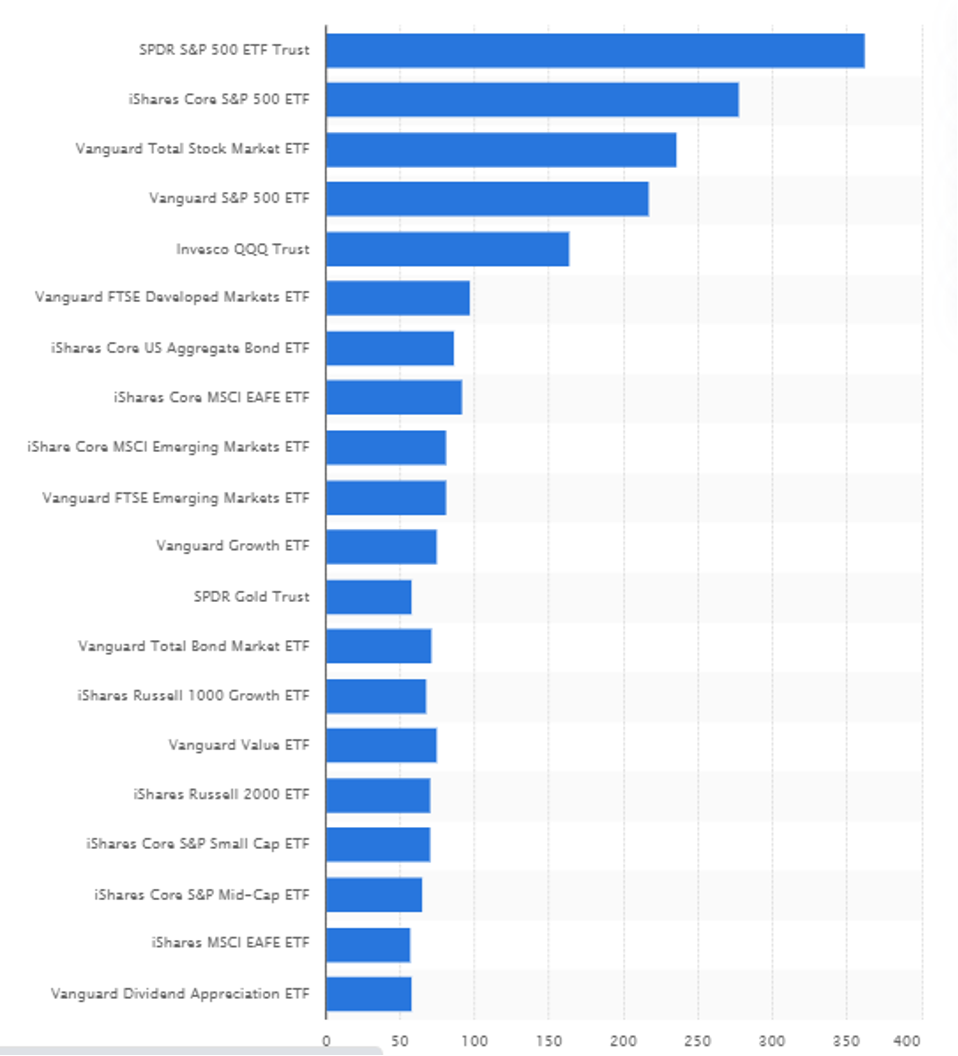

How Big the Market of ETFs and Index Fund is?

ETF

As per statists, ETFs is a huge market with the below statistics:

- Value of Assets managed by ETFs – $7.74 Trillion

- of exchange-traded funds – 7,602

Below is the chart based on the market capitalization of the largest exchange-traded funds (ETFs):

Source: Statista

Source: Statista

Index Fund

According to Statista, Index funds is a huge market with the below statistics:

- Assets managed by investment funds in the US – $32.33 Billion

- Total net assets of open-ended index funds – $63.1 Trillion

ETF or Index Fund- Profitability

As an investor you should keep in mind that there is no way of forecasting how your investments in index funds and ETFs will pay or how much return will you get on your investment. The only thing you can control and know is the underlying securities it mirrors. The best approach is to pick an index fund/ ETF which meets the return potential you want for your portfolio.

Below is the list of the best index funds for the current year. They have the very low expense and offer good return:

- Schwab U.S. Large-Cap ETF

- iShares Core S&P 500 ETF

- Vanguard Total Stock Market ETF

- Invesco S&P 500® Equal Weight ETF

- Vanguard S&P 500 ETF

Index funds tend to have higher returns over longer periods. The reason is index fund tracks a specific set of investments and strives to gain the same returns as them. Index Fund investors require no in-depth analysis and detailed research as the index fund picks the same companies as the index it is following.

Below is the list of best ETFs for the current year. The details of these ETFs can be found here:

- 21shares Ethereum ETP

- 21Shares Bitcoin ETP

- Rize Medical Cannabis and Life Sciences UCITS ETF

- 21Shares Bitcoin Cash ETP

- Invesco Elwood Global Blockchain UCITS ETF A

Returns and profit from investing in ETFs are generated from a combination of capital gains—an increase in the price of the stocks your ETF owns—and yearly and monthly dividends paid out by those same companies.

Conclusion

ETFs and Index Funds are both very viable and good investments. Like every financial instrument, it is very difficult to predict the amount of profit each will generate. Both have their own set of categories which have been crafted keeping investors’ different investment goals in mind. The best approach is to match the type with your investment goal and invest your money.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading: