The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Impulse Decline in Exxon Mobil ($XOM) Suggests Further Downside

Read MoreExxon Mobil (XOM) shows impulsive decline from 4.28.2022 peak suggesting further downside. This article and video look at the Elliott Wave path.

-

$IBM Will Soon See Buyers

Read More$IBM has been trading sideways since it peaked on 02.01.2017. It still has not reached the target at the $82.36 area. This article on 11.2020 shows the target area and and the most likely path at that moment. Since the World Indices bottomed in 2020, the stock has created a five-wave advance. However, the lows back in […]

-

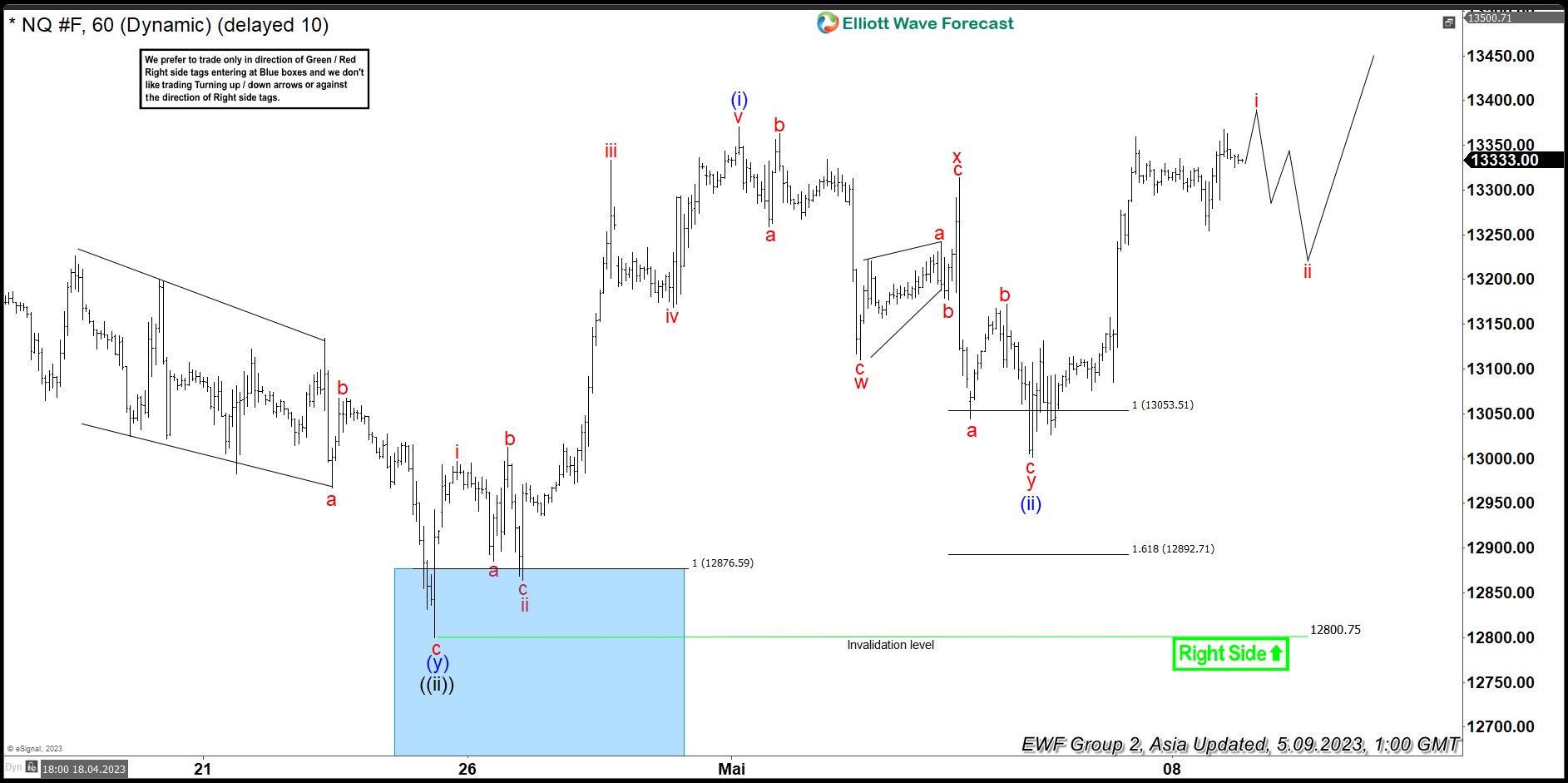

NQ_F: Wave (ii) Found Support From Equal Legs Area

Read MoreHello Traders, in this article we will analyze our forecast of the Nasdaq Futures in the short term cycle. Since the short term peak of NQ_F from 05.01.2023 to end wave (i) we have been expecting a pullback within wave (ii) to take place. Here at Elliott Wave Forecast we have in place a system […]

-

DE (Deere & Company) Favors Weakness In Flat Correction

Read MoreDeere & Company manufactures & distributes various equipment worldwide. The company operates through four segments: Production & Precision Agriculture, small Agriculture & Turf, Construction & Forestry, & Financial services. The company is based in Illinois, US, comes under Industrials sector & trades as “DE” ticker at NYSE. As discussed in previous article, DE showing bullish […]

-

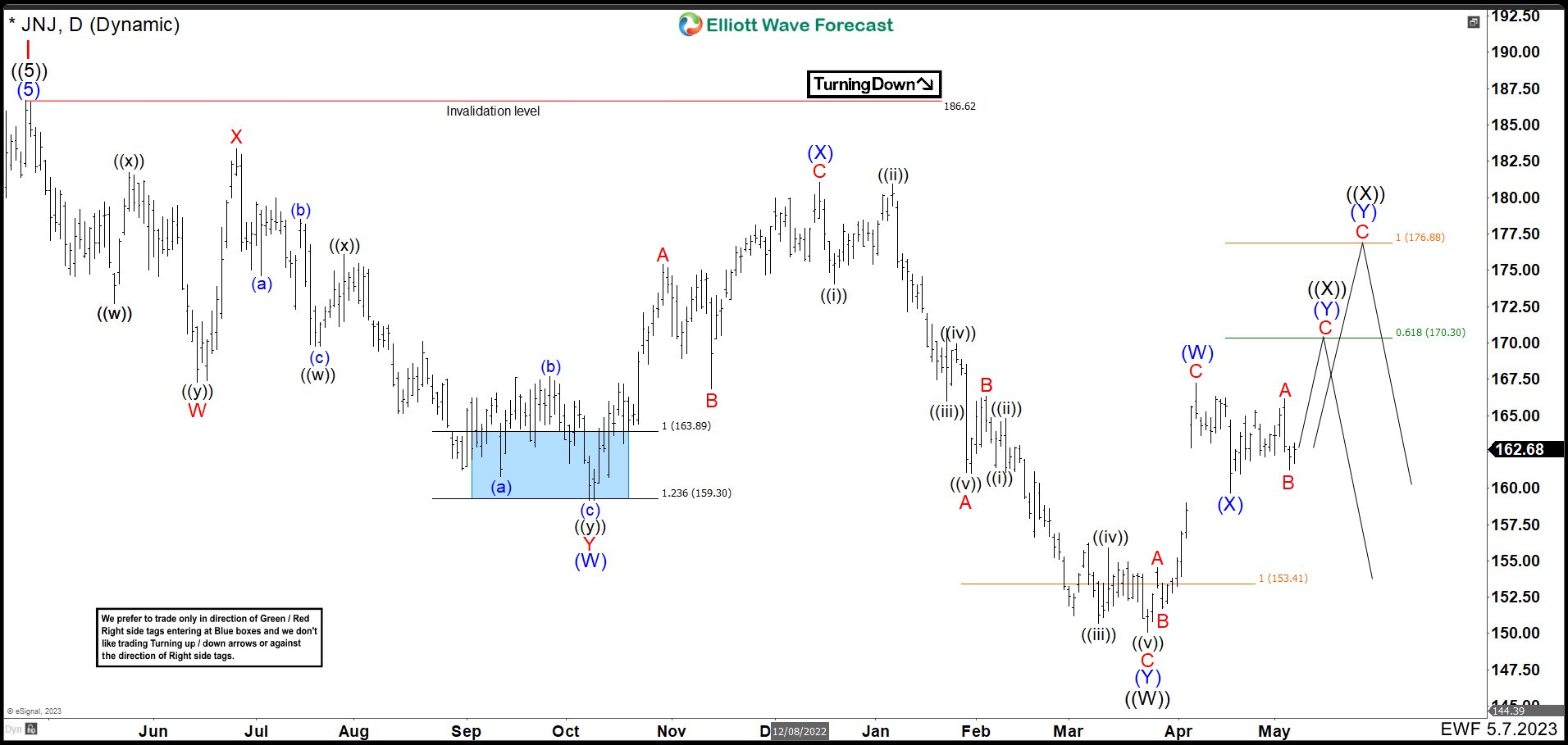

Johnson & Johnson (JNJ) Shares Are Entering In A Bull Trap

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

$KGH: Metals Producer KGHM Reacting Higher from Bluebox Area

Read MoreKGHM Polska Miedź S.A. is a multinational corporation which has its headquarters in Lubin, Poland. Traded under tickers $KGH at WSE and $KGHPF in US in form of ADRs, it is a component of the WIG30 index. KGHM has been a major copper and silver producer for more than 50 years. As a matter of fact, it […]