The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

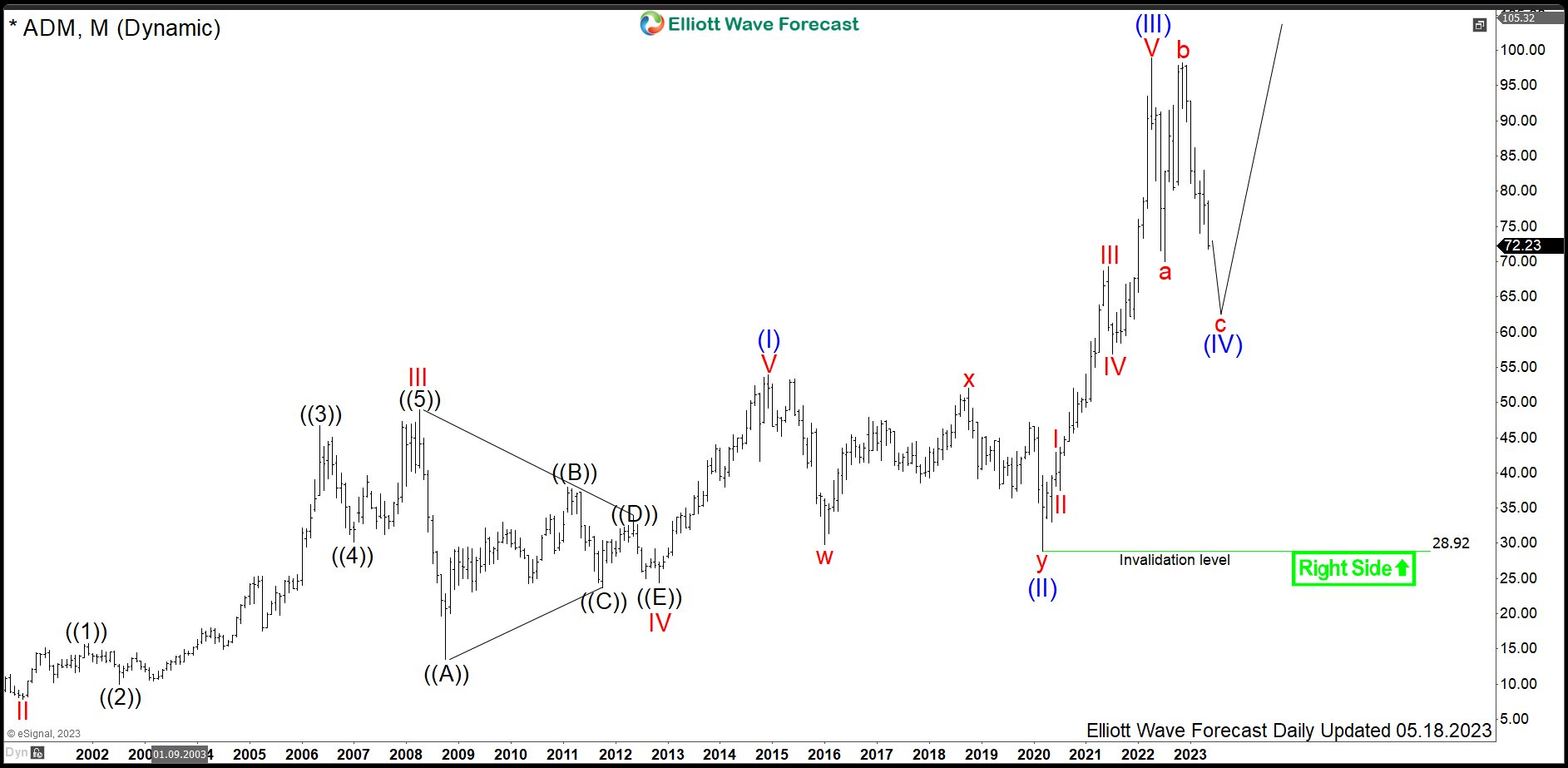

$ADM : Buying Opportunity in Agriculture Stock ADM

Read MoreArcher-Daniels-Midland company, commonly known as ADM, is a multinational food processing and commodities trading corporation. Founded 1902, headquartered in Chicago and traded under the ticker $ADM at NYSE, it is a component of the S&P500 index. First of all, ADM is engaged in corn and oilseeds processing. In general, the products are oils and meals […]

-

Best Non-Cyclical Stocks to Invest in 2024

Read MoreWhat is a Non- Cyclical Stock? Non-cyclical stocks are those whose underlying businesses are not disrupted by economic cycles. These companies offer products and services that meet consumers’ basic needs like food, power, water, and gas. Such non-cyclical stocks are also regarded as defensive stocks because they can help defend portfolios against an economic downturn […]

-

S&P500 (SPX) Elliott Wave: Calling The Rally From The Equal Legs Area

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of SPX published in membership area of the website. As our members know, S&P500 is trading within the cycle from the October 2022 low, which is unfolding as 5 waves structure. We got 3 waves pull back which found […]

-

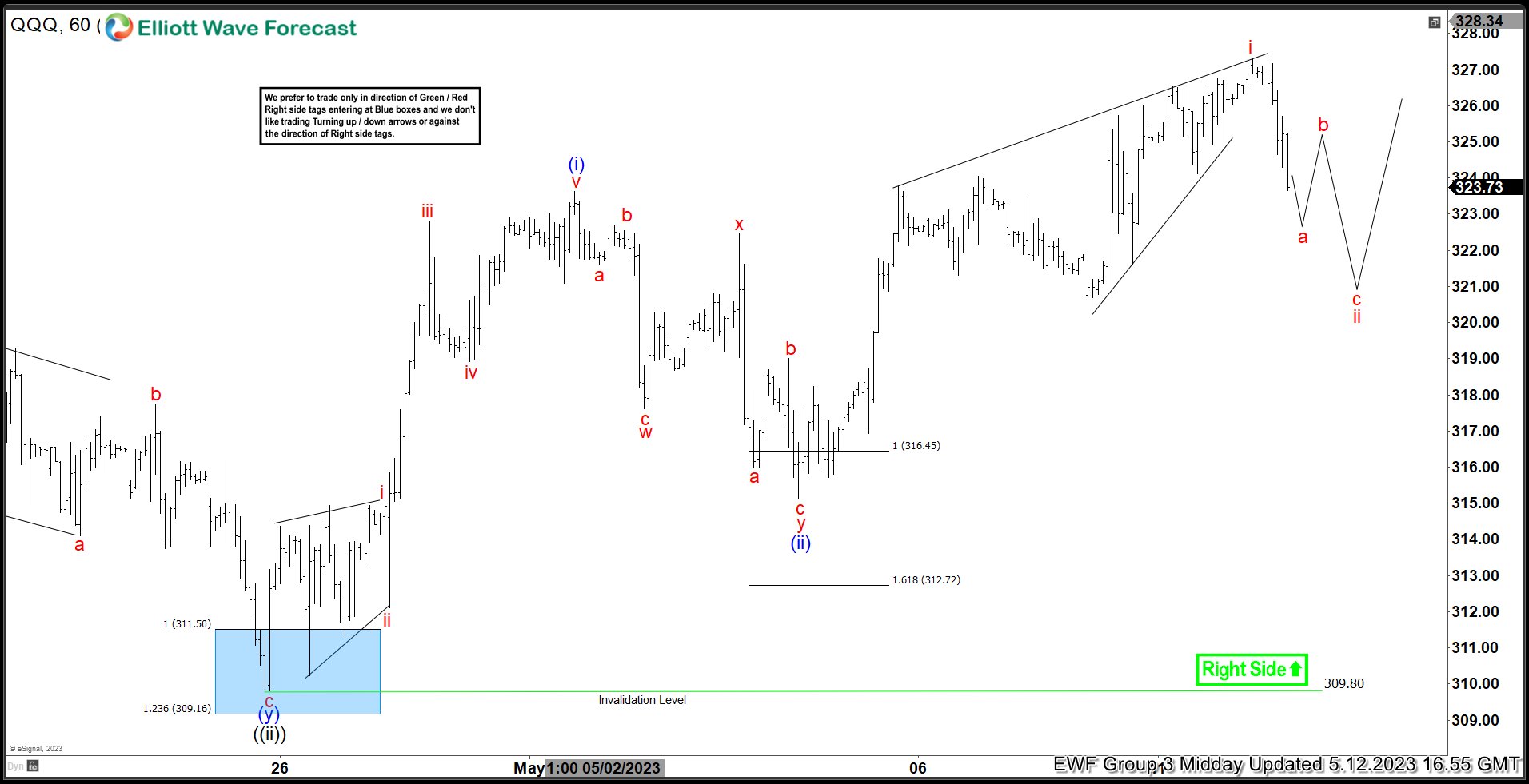

QQQ: Equal Legs Area Found Buyers To Resume The Rally

Read MoreHello Traders, in this article we will analyze our forecast for QQQ ETF in the short term cycle. Since the short term peak of QQQ from 05.01.2023 to end wave (i) we have been expecting a pullback within wave (ii) to take place. Here at Elliott Wave Forecast we have in place a system that […]

-

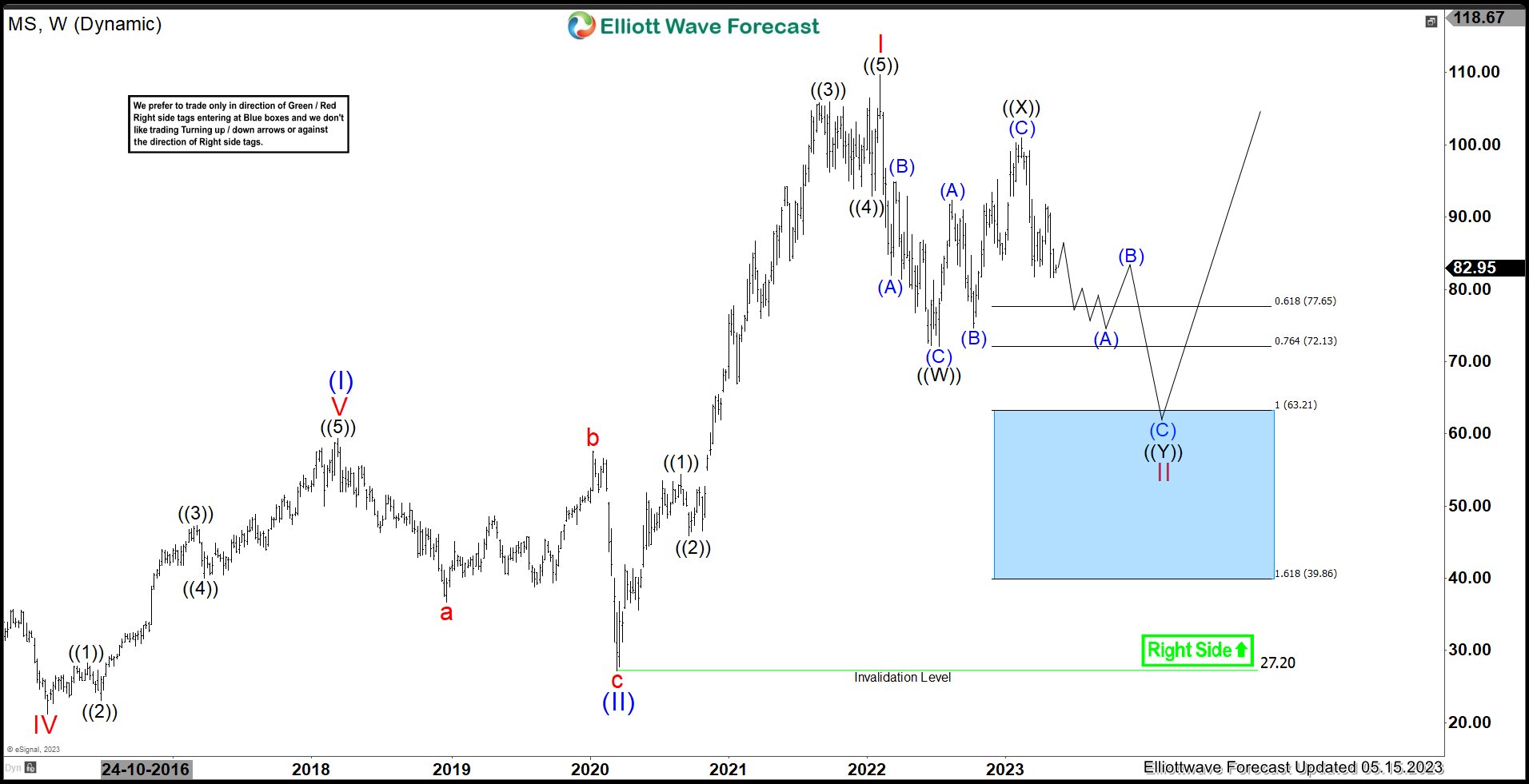

Morgan Stanley (MS) Favors Downside In Double Correction

Read MoreMorgan Stanley (MS), a financial holding company provides various financial products & services to corporations, governments, financial institutions & Individuals in the Americas, Europe, Middle East, Africa & Asia. It operates through Institutional Securities, Wealth Management & Investment management services. It is based in New York, US, comes under Financial services sector & trades as […]

-

Google (GOOGL) Elliott Wave Impulsive Structure Incomplete

Read MoreGoogle (GOOGL) impulse structure from 5.2.2023 low looks incomplete favoring more upside. This article and video look at the Elliott Wave structure.