Bloom Energy Corporation., (BE) designs, manufactures, sells & install solid-oxide fuel cell systems for on-site power generation in the United States & globally. It offers Bloom Energy Server, a power generation platform to convert different fuels like Natural gas, Biogas, Hydrogen or blended fuel into electricity through electrochemical process. It comes under Industrials sector & trades at “BE” ticker at NYSE.

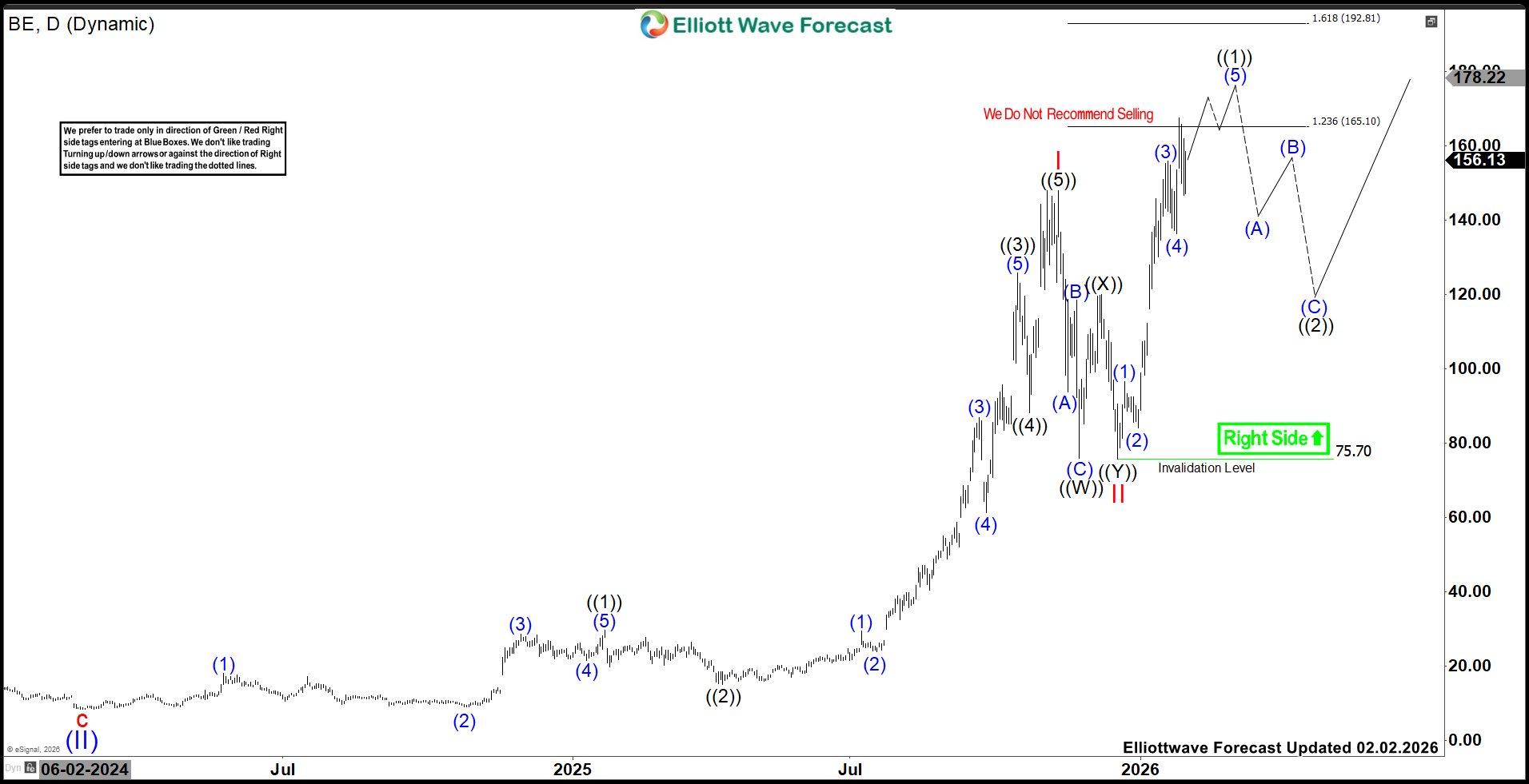

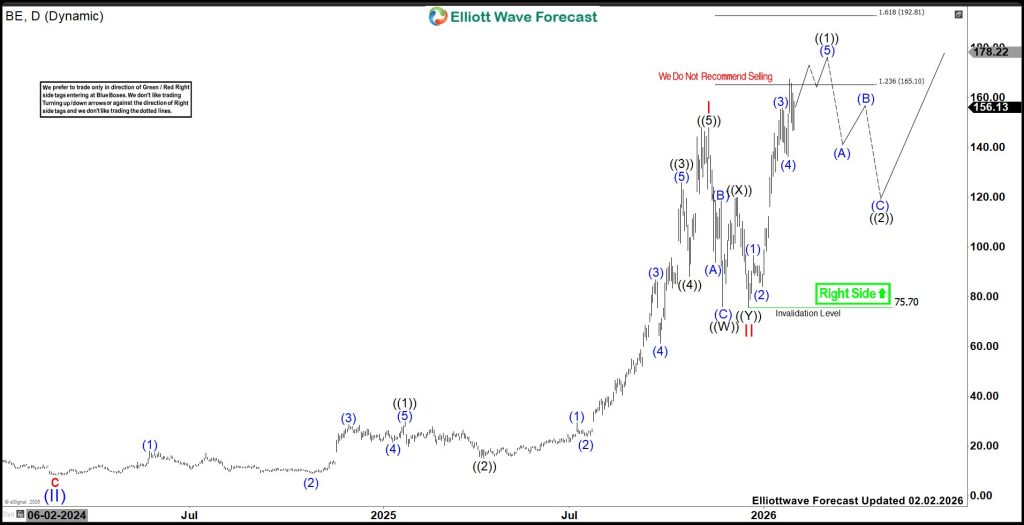

The BE favors impulse rally in ((1)) of III as broke above November-2025 high. It favors rally in (5) towards $165.10 – $192.81 area to end ((1)) started from 12.17.2025 low, while above 1.27.2026 low. The chasing at this level can be risky, so better to wait for pullback in ((2)) as next opportunity.

BE – Elliott Wave Latest Daily View:

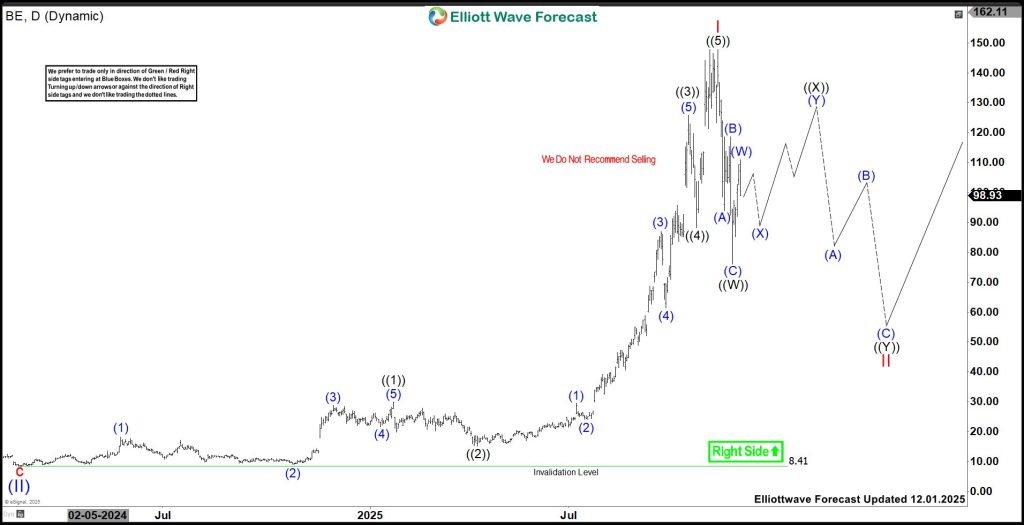

In weekly, it made all time low of $2.44 in October-2019. It placed (I) at $44.95 high of February-2021 & (II) at $8.41 low of February-2024. Above there, it ended I of (III) at $147.86 high on 11.10.2025 high & II at $75.70 low on 12.17.2025. It placed ((1)) of I at $29.82 high, ((2)) at $15.15 low, ((3)) at $125.75 high, ((4)) at $88.23 low & ((5)) at $147.86 high. Within extended ((3)), it ended (1) at $29.44 high, (2) at $24.04 low, (3) at $86.89 high, (4) at $61.37 low & (5) at $125.75 high. Below I high, it placed ((W)) at $76 low, ((X)) at $119.90 high & ((Y)) at $75.70 low as truncated move to end II correction.

BE – Elliott Wave Daily View From 12.01.2025:

Above II low, it favors (5) of ((1)) of III, while dips remain above 1.27.2026 low. It ended (1) at $96.49 high, (2) at $84.14 low, (3) at $155.87 high, (4) at $136.25 low & favors upside in (5). It expects (5) to extend into $165.10 – $192.81 area to end ((1)) before correcting in ((2)). The buyers should not chase longs at current level. Rather than, we like to buy the next pullback in ((2)) in 3, 7 or 11 swings against December-2025 low.

BE is not the part of regular service at EWF. But we provide time to time updates on instruments under blog section. Elliottwave Forecast updates 1-hour charts four times a day & 4-hour charts once a day for all our 78 instruments. We do a daily live session, where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. You can try us for 14 days for only $0.99 (limited time offer). Also, you can check out the Educational section to learn Elliott wave theory & its application through different packages available & 1-1 coaching for doubts.