Small-Cap indicates companies that are small in terms of market capitalization. Usually, a company falls under the small-cap label, if they have a market capitalization between $300 million and $2 billion. Being a small-cap company by no way indicates smaller profits. Some small-cap companies are excellent investments because of their low valuation and they have huge growth potential. One of the biggest examples of small-cap companies turning big is Tesla. In 2010 Tesla has a market capitalization of around $1 billion. Today, it is a mega-cap company with a market cap of around $660 billion. Use the tools and indicators to get educated and to make well-informed decisions for investments.

Stocks that are classified according to market capitalization are divided according to the below table:

| Category | Market Capitalization |

| Micro-cap companies | Less than $300 million |

| Small-cap companies | $300 million to $2 billion |

| Mid-cap companies | $2 billion to $10 billion |

| Large-cap companies | $10 billion to $200 billion |

| Mega-cap companies | More than $200 billion |

Russell 2000 vs S&P 500 Index

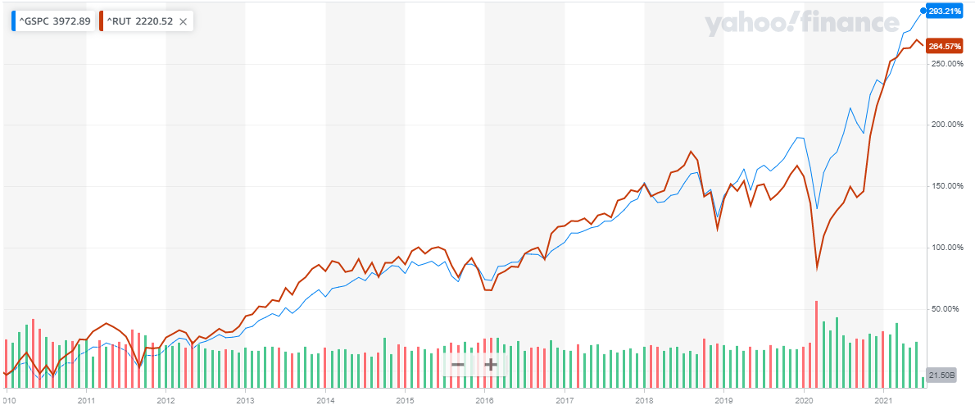

Russell 2000 is a small-cap-focused index. The below chart shows the comparison of Russell 2000 with the S&P 500 (the commonly known large-cap focused index).

As red line represents the Russell 2000 index and the blue line represents S&P 500. As you can see, the Russell 2000 has been outperforming the large-cap index.

As red line represents the Russell 2000 index and the blue line represents S&P 500. As you can see, the Russell 2000 has been outperforming the large-cap index.

List of Best Small-Cap Stocks to Invest

| Sr. | Name | Symbol | Market Capitalization | Share Price ($) as on 13th July, 2021 | Revenue (FY 2020) |

| 1 | Atrion Corporation | ATRI | 1.13 billion | 608.96 | 143 million |

| 2 | Biglari Holdings | BH | 513 million | 165.29 | 392 million |

| 3 | Investors Title Company | ITIC | 323 million | 170.5 | 278.5 million |

| 4 | Winmark Corporation | WINA | 719.2 million | 194.29 | 721 million |

| 5 | Daily Journal Corporation | DJCO | 430 million | 311.5 | 50 million |

| 6 | National Western Life Group Inc | NWLI | 793 million | 218.11 | 868.4 million |

| 7 | ACM Research | ACMR | 1.54 billion | 81.17 | 176 million |

| 8. | Nautilus Inc. | NLS | 459 million | 14.95 | 665 million |

| 9. | Sonic Automotive | SAH | 1.98 billion | 46.84 | 10.25 billion |

| 10. | Core Laboratories | CLB | 1.73 billion | 37.39 | 443 million |

1. Atrion Corporation

Atrion Corporation is a leading manufacturer of medical devices and components. Most of its products are for the cardiovascular, ophthalmic, and fluid delivery markets. Atrion is a relatively small company but its products hold leading market positions in their respective niches, creating a stable and diversified revenue base.

The company’s ability to generate strong cash flows is a key strength that enables the company to deliver consistent growth and profitability. Despite the economic fluctuations, the company has been able to deliver to stockholders via growing earnings. The Company has no outstanding debt as of December 31, 2020. On December 31, 2020, our cash and investments totaled $87.9 million.

Read: Best Gold Trading Signal Providers.

The below chart shows the stock performance of Atrion over the past 5 years:

Currently trading at around $600, Atrion stock touched $900 in April 2019. The stock of Atrion is one of the best small-cap stocks to buy in 2023.

Currently trading at around $600, Atrion stock touched $900 in April 2019. The stock of Atrion is one of the best small-cap stocks to buy in 2023.

2. Biglari Holdings

Biglari Holdings is a multifaceted enterprise, a collection of businesses built through acquisitions. The list of companies Bilgari holdings own is as follows:

- Steak n Shake Inc.

- Western Sizzlin Corporation

- Maxim Inc.

- First Guard Insurance Company

- Southern Oil Company

- Southern Pioneer Property

- Casualty Insurance Company

Biglari’s strength is its cash holdings. Even when the company has been utilizing its cash funds to acquire businesses, its cash holdings have been growing. Below is the detail of cash holdings and investments for the past five years:

| Year | Cash Holdings | Total Investments |

| 2015 | 56.5 | 815 |

| 2016 | 75.8 | 1075 |

| 2017 | 58.6 | 1011 |

| 2018 | 48.6 | 802 |

| 2019 | 67.8 | 778.8 |

| 2020 | 24.5 | 710.3 |

When the COVID-19 pandemic engulfed the global economy, Biglari Holdings’ capital structure proved its soundness. The company stood strong and required no external assistance to maintain the status quo.

The stock performance of Biglari Holdings for the past 5 years, is shown in the below chart:

Biglari Holdings has very solid financial grounds. Its performance during the pandemic has been exceptional. The share of Biglari has increased three times since the pandemic and has been growing until now. Considering the strong financial performance and solid cash and investment holdings, Biglari is one of the best small-cap stocks for 2024 to invest in.

Biglari Holdings has very solid financial grounds. Its performance during the pandemic has been exceptional. The share of Biglari has increased three times since the pandemic and has been growing until now. Considering the strong financial performance and solid cash and investment holdings, Biglari is one of the best small-cap stocks for 2024 to invest in.

Get to know the best vaccine stocks to invest in 2024.

Read more:

3. Investors Title Company

Investors Title Company is a holding company for Investors Title Insurance Company and National Investors Title Insurance Company which write policies to protect mortgage lenders and homeowners from unforeseen claims made against the title to real property.

Investors Title Company has been regularly paying dividends for the past 10 years. As one of the best low market cap divided stock, the company on average have grown by 51% over the years. Also, the company has reported a healthy increase in earnings over the years.

The stock of Investors Title Company is being traded at around $172. The stock performance for the past 5 years is shown in the below chart:

A consistently growing dividend coupled with growing earnings indicates great future potential for the company. As an investor, this company’s stock is a great small-cap stock to buy.

A consistently growing dividend coupled with growing earnings indicates great future potential for the company. As an investor, this company’s stock is a great small-cap stock to buy.

Read more:

4. Winmark Corporation

Winmark Corporation develops, franchises, and operates value-oriented retail concepts for stores that buy, sell, trade, and consign quality used and new merchandise. The company operates through two segments: Franchising and Leasing.

Franchised businesses of the company are:

- Plato’s Closet

- Once Upon A Child

- Play It Again Sports

- Music Go Round

- Style Encore

As of December 26, 2020, Winmark Corporation had 1,264 franchised stores.

Winmark also provides tailored business equipment leasing services to large and medium-sized businesses through its wholly-owned subsidiary, Winmark Capital.

Winmark has a very high price-earnings ratio. Moreover, the company’s stock is on a bullish trend. The stock performance of Winmark Corporation is shown in the below chart:

Winmark reported net income for the first quarter of 2021 $9.3 million, reporting a 27% increase from last year’s first quarter. Also, the company announced a dividend of $0.45per share. The dividend has increased by $0.2 from last year’s first quarter.

Winmark reported net income for the first quarter of 2021 $9.3 million, reporting a 27% increase from last year’s first quarter. Also, the company announced a dividend of $0.45per share. The dividend has increased by $0.2 from last year’s first quarter.

Winmark has been steadily paying dividends to its shareholders and its stock has been on a growing streak. It is a great small-cap stock to buy. Check out the best NFT stocks to buy now.

5. Daily journal corporation

Daily Journal Corporation publishes newspapers and websites covering California and Arizona and produces several specialized information services.

The fiscal year starts in October. The company recently posted results for the six months reporting $24 million in revenues. Overall, the company’s performance has been satisfactory. The stock of the company has been on an upward trend with multiple trenches and peaks. The stock journey for the past 5 years can be seen in the below chart:

Read more:

6. National Western Life Group Inc

National Western Life Group Inc operates as a stock life insurance company. The company provides life insurance products for the savings and protection needs of policyholders; and annuity contracts for the asset accumulation and retirement needs of contract holders.

The Company reported total revenues of $200.9 million for the first quarter of 2021 compared to $155.6 million in 2020. The company’s book value per share as of March 31, 2021, was $673.95.

In the past few years, the stock of National Western Life Group has been struggling to rise. Despite the positive earnings, the stock price has not been rising. On the contrary revenues and earnings have been consistently growing. This indicates that the business is growing strong and the stock has huge potential to grow.

The struggle of the company’s stock can be viewed in the chart below:

7. ACM Research

ACM Research develops, manufactures, and sells semiconductor process equipment and service solutions for single-wafer or batch wet cleaning, electroplating, stress-free polishing, and thermal processes critical to advanced semiconductor device manufacturing and wafer-level packaging.

The company went public in 2017 at $5 per share. Today it is being traded at above $81. The share of ACM Research has risen incredibly in these 4 years. The below chart shows the stock journey of ACM Research:

Since it’s a growing company for many years, ACM Research was unable to generate profits in previous years. It has recently started generating profits:

Since it’s a growing company for many years, ACM Research was unable to generate profits in previous years. It has recently started generating profits:

| Year | Profits |

| 2018 | 6.6 million |

| 2019 | 19.5 million |

| 2020 | 21.7 million |

The business of ACM Research is a high-risk but high-growth industry. Investors get the advantage of benefitting from the high growth industry without the risk of the declining prices of the chips. Moreover, the staggering stock performance is enough to attract investor attention. Within 3 years, the stock has hit $80, if the stock continued growing soon it will surpass the overall industry growth. As an investor, ACM Research is the best small-cap stock to buy now. Checkout the best value stocks to invest in now.

8. Nautilus Inc.

Nautilus designs and sells fitness equipment, including indoor bikes, treadmills, ellipticals, home gyms, and adjustable all-in-one free weights systems. Its portfolio of brands include:

- Bowflex

- Nautilus

- Schwinn

- JRNY

In the recent quarterly report, the fitness equipment manufacturer reported Net sales of $206.1 million, up 119.9% compared to $93.7 million for the same period last year. Net income was $30.4 million, compared to $2.2 million for the same period last year.

The stock performance of Nautilus is shown in the below chart:

The share of Nautilus has shown tremendous growth since last year. With the company’s financial performance going strong, the potential for future growth is high. As an investor, this stock is a must-buy small-cap value stock.

The share of Nautilus has shown tremendous growth since last year. With the company’s financial performance going strong, the potential for future growth is high. As an investor, this stock is a must-buy small-cap value stock.

9. Sonic Automotive

A Fortune 500 company, Sonic Automotive is one of the largest automotive retailers in the United States. Sonic Automotive operates in 14 states with more than 100 dealerships representing 25 different brands of automobiles. Sonic Automotive owns EchoPark Automotive, a used car dealership chain.

The automotive retailer recently issued its first-quarter results which have shown a tremendous improvement from last year. The highlights of the quarterly report are:

- Revenues of $2.8 billion a 20.7% increase for the same period last year

- Earnings from continuing operations of $53.7 million, compared to a loss of $199.1 million for the same period last year

- A 20% increase to the Company’s quarterly cash dividend, to $0.12 per share

The share of Sonic Automotive has been on a bullish trend. There was a sharp decline due to the pandemic but the company recovered soon and has been giving good share price growth to shareholders.

The bullish journey of the company’s stock is shown below:

Being the top retailer in the country, Sonic Automotive has huge growth potential in the future. With the company showing tremendous improvement financially and the stock on a bullish journey, the company will soar in near future. For long-term investors, this is the best small-cap stock to buy now.

Being the top retailer in the country, Sonic Automotive has huge growth potential in the future. With the company showing tremendous improvement financially and the stock on a bullish journey, the company will soar in near future. For long-term investors, this is the best small-cap stock to buy now.

10. Core Laboratories

Core Laboratories is a leading provider of proprietary and patented Reservoir Description and Production Enhancement services. Located in more than 50 countries within major oil-producing provinces, Core Laboratories provides services to the world’s major, national, and independent oil companies.

Last year Core Laboratories grew its earnings per share, moving from a loss to a profit. Core Labs has recently issued the first quarter report of 2021:

- Revenue reported of $4 million, down by 4.7% from last year’s first quarter

- Net Debt reduced by $65 million

- The dividend for the next quarter was approved

The Energy Select Sector SPDR Fund (XLE) has more than doubled in 2021 as investors anticipate a global boom in oil demand. The stock of Core laboratories is also expected to rise further. The below chart shows the stock performance of Core laboratories and the XLE index.

Core Laboratories has started generating profits and its stock is steadily improving. With the demand for oil rising, Core labs stock is expected to soar. Right now is the best time for investors to invest in this small-cap stock to enjoy profits in the future.

Core Laboratories has started generating profits and its stock is steadily improving. With the demand for oil rising, Core labs stock is expected to soar. Right now is the best time for investors to invest in this small-cap stock to enjoy profits in the future.

Conclusion

Small-Cap companies are the best investment for long-term investors. Day traders might not benefit from them as the stock volatility of these stock cap companies is low. But for long-term investors, these companies are a treasure chest. We have compiled the list of best small-cap companies, all of which have huge potential to grow in terms of stock price and company earnings.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Best Penny Stocks to Invest

- Best ETFs to Buy

- Bonds vs Stocks – Where to Invest

- Top Stock Indicators for Stock Trading

- Best Tech Stocks to Buy

- Best trading and forex signal providers

- Best Renewable Energy Stocks to Invest

- Monthly Dividend Stocks to Buy

- Top Most Volatile Stocks