Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

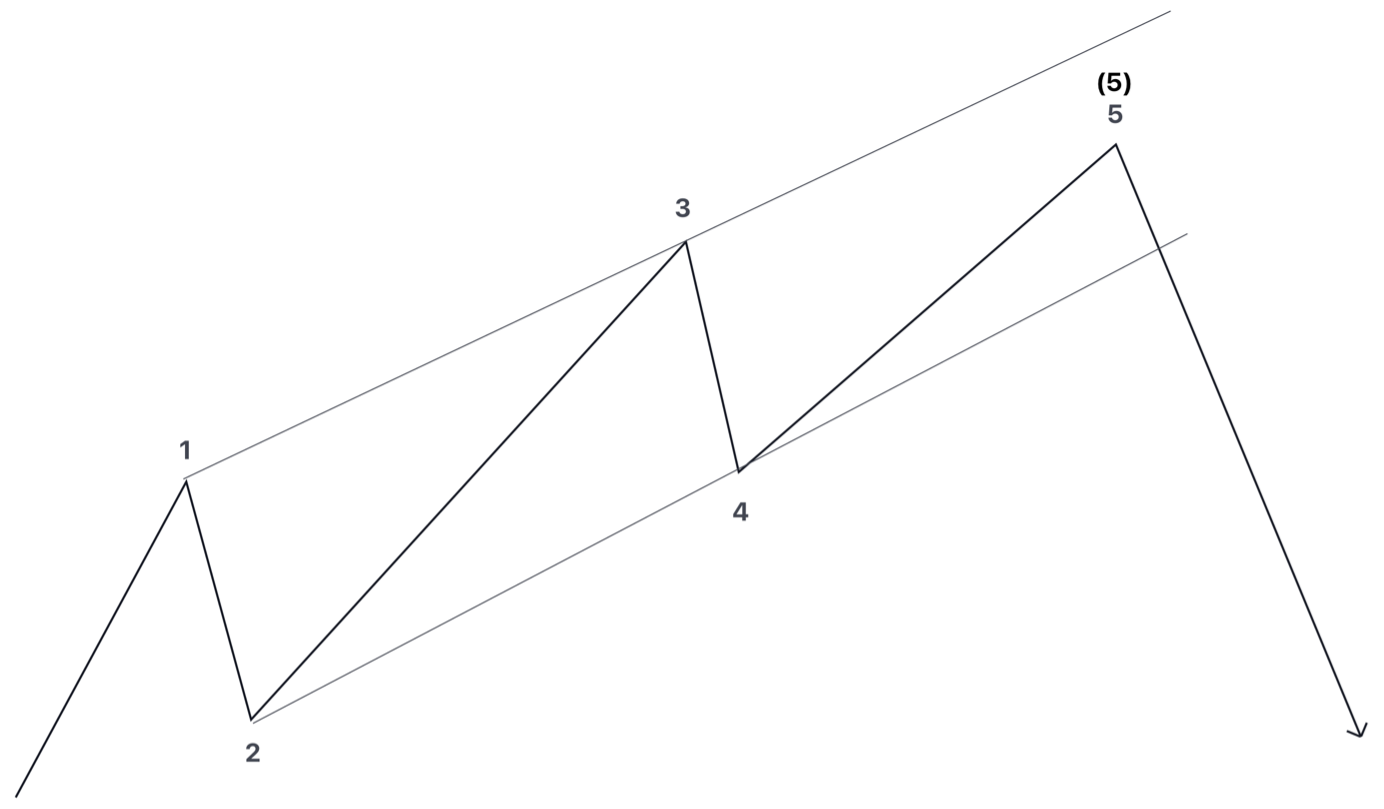

Introduction to Diagonals – Part 1

Read MoreDiagonals are part of the motive waves family alongside Impulse Waves. The difference with them is that they have slightly different characteristics and some rules do not apply. Rules such as 4 wave not going into wave 1’s territory and this is a must in order to quality as a Diagonal. There are two types: […]

-

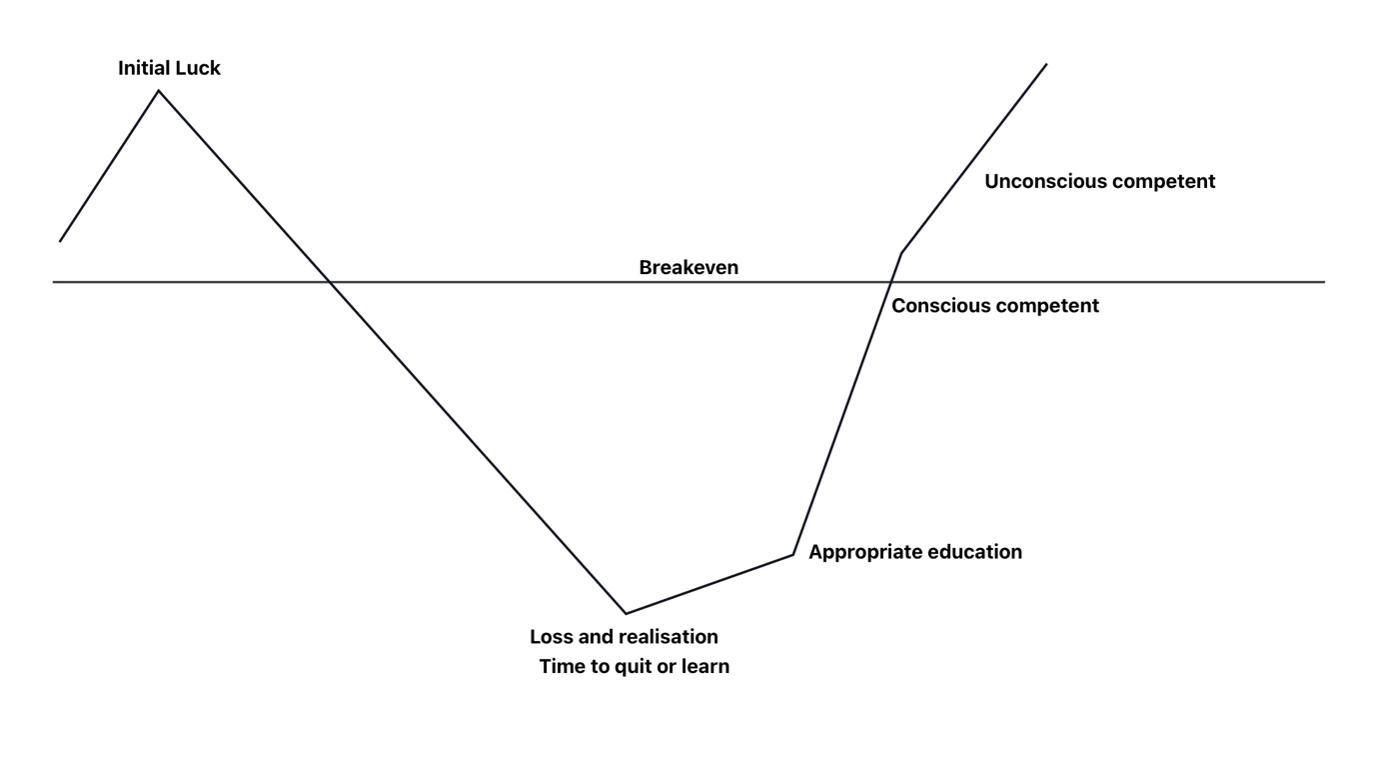

Typical journey of a trader

Read MoreA trader’s journey is typically a long and painful route. Usually, to survive through this process a trader must be very patient with their studying of the market and strategy but simultaneously understand the process and most importantly survive through the journal i.e. not get burnt out, emotionally and monetary. Here is a visual representation […]

-

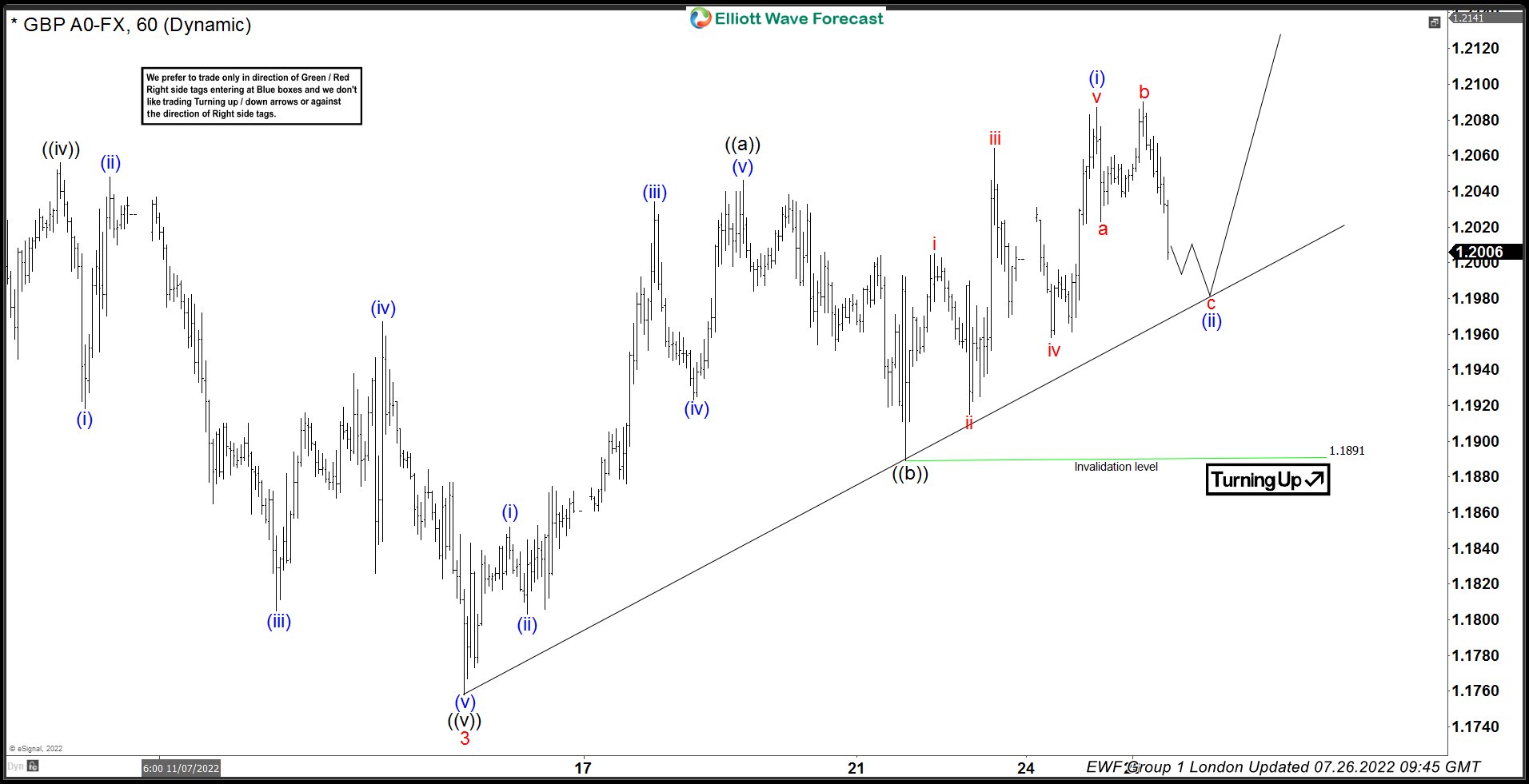

GBPUSD Elliott Wave Zig Zag Pattern Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD . As our members know, GBPUSD is in process of forming Elliott Wave Zig Zag Pattern in the cycle from the 07.14 low. In the further text we are going to explain the Elliott […]

-

Amazon (AMZN) Elliott Wave : Impulsive Sequences Calling The Rally

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Amazon stock. We have been calling for the rally in the stock due to impulsive bullish sequences in the cycles from the June lows. Consequently, we recommended members to avoid selling the stock, while keep […]

-

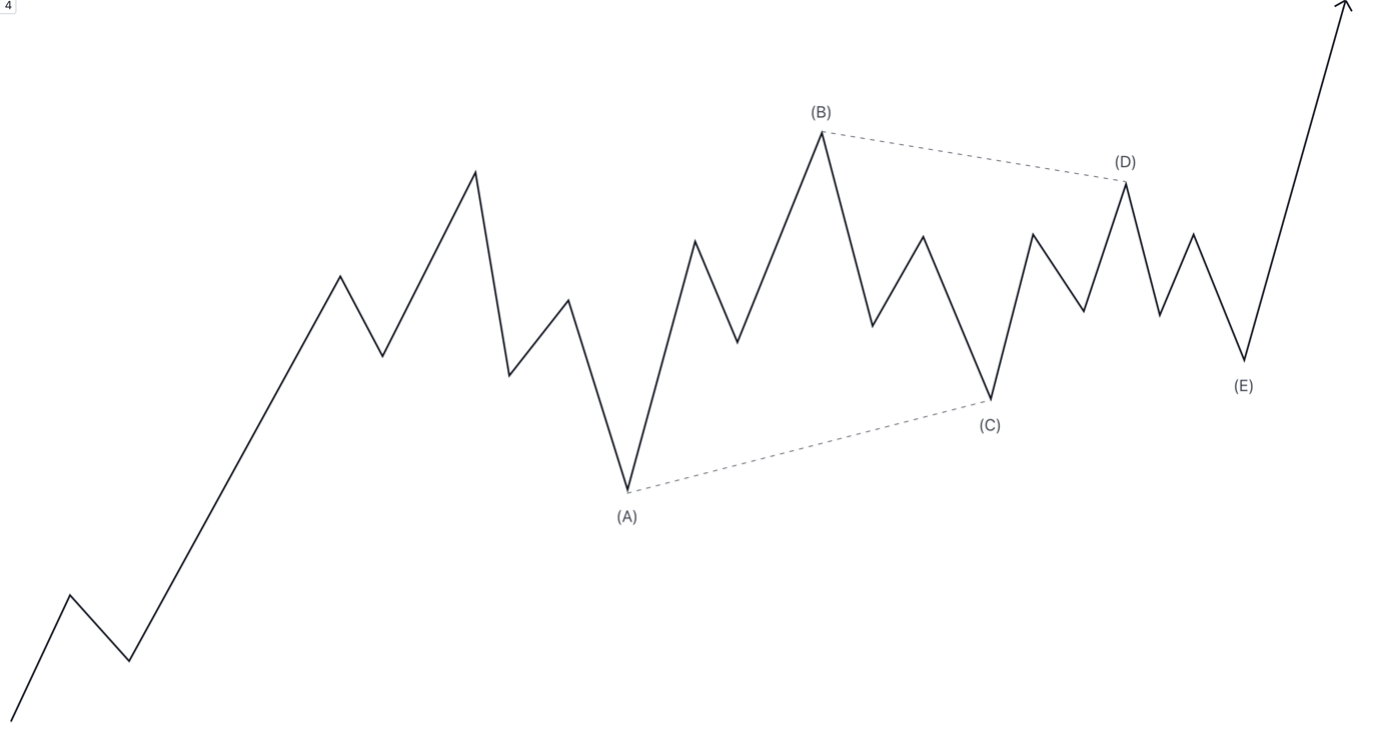

Running Triangle and how they are different to regular Triangles

Read MoreWithin the list Elliott Wave corrective patterns, alongside Zigzags, Flats and Complex Corrections we have triangles. Triangles are a sideways correction that occurs only prior to the final wave in the current trend. Therefore, can only present themselves in wave 4, B or X. The only exception they present themselves in wave 2 is if […]

-

Updated Canopy Growth Corporation ($CGC) 4H Forecast

Read MoreGood day Traders and Investors. In today’s article, we are going to follow up on Canopy Growth Corporation ($CGC) forecast posted back in April 2022 and take a look at the latest 4H count. You can find the article here: https://elliottwave-forecast.com/stock-market/canopy-growth-corporation-cgc-lucrative-investment/ Company Profile: “Canopy is a global, best-in-class cannabis company and CPG organization with the intention […]