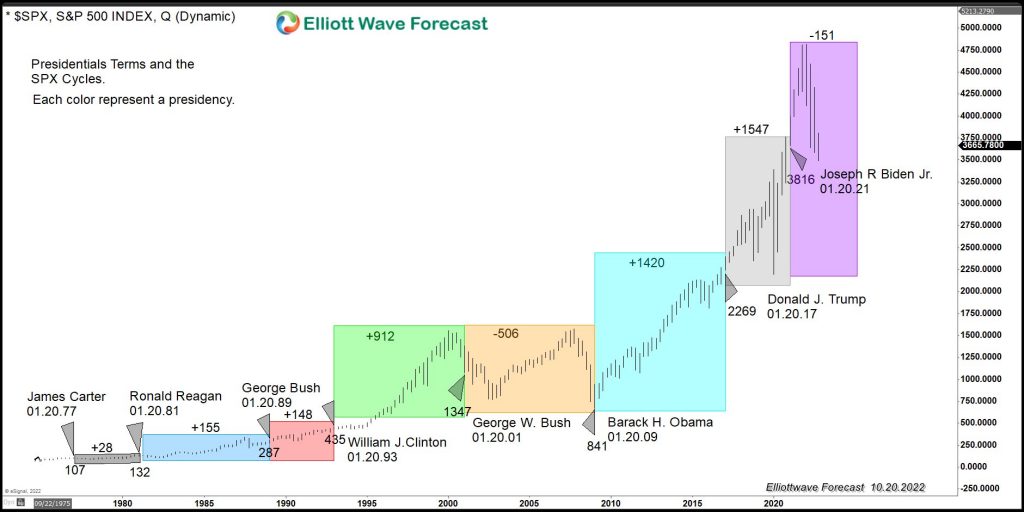

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

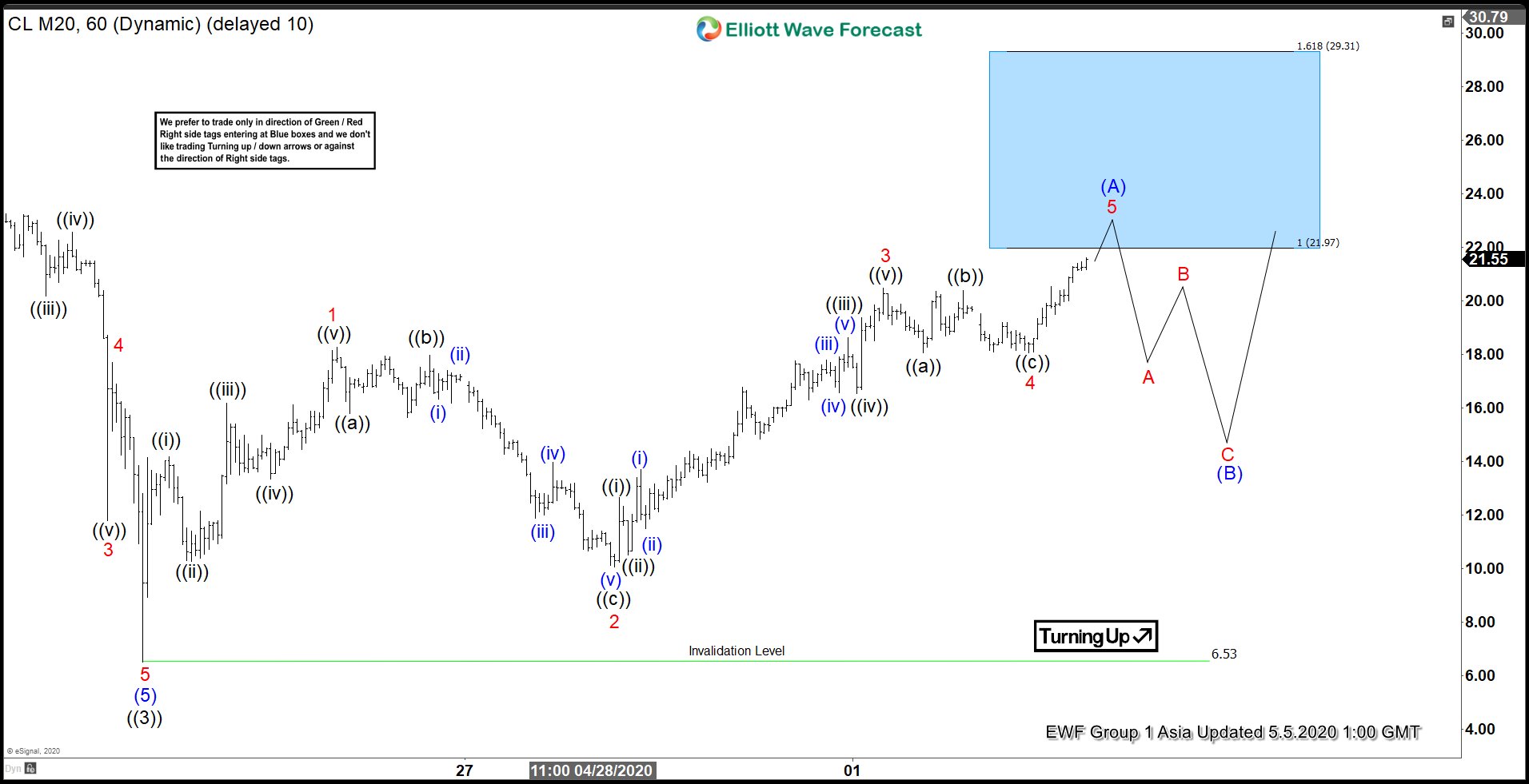

Elliott Wave View: Leading Diagonal in Oil

Read MoreOil shows 5 waves rally from 4.22.2020 low as a leading diagonal, favoring more upside. This article & video looks at the Elliott Wave path.

-

NFLX Ended 5 Waves Up In From The 290.47 Low

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NETFLIX (NFLX) stock, published in members area of the website. As our members know, NETFLIX made New All-time high recently. The price has been showing impulsive structure in the cycle from the 290.47 low. Consequently […]

-

Sona Nanotech (CSE: SONA, OTC: SNANF) Cycle Near Completion

Read MoreThe next entry in the theme of Corona Virus stocks is Sona Nanotech. Normally I would cover a major listed stock on a USA exchange. However, Sona Nanotech has an excellent Elliott Wave structure that is worth reviewing. SONA has exploded since early 2020 from a little known company to one partnered with the likes […]

-

Tesla Elliott Wave View: Buying The Wave Four Pullback

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Tesla In which our members took advantage of the blue box areas.