-

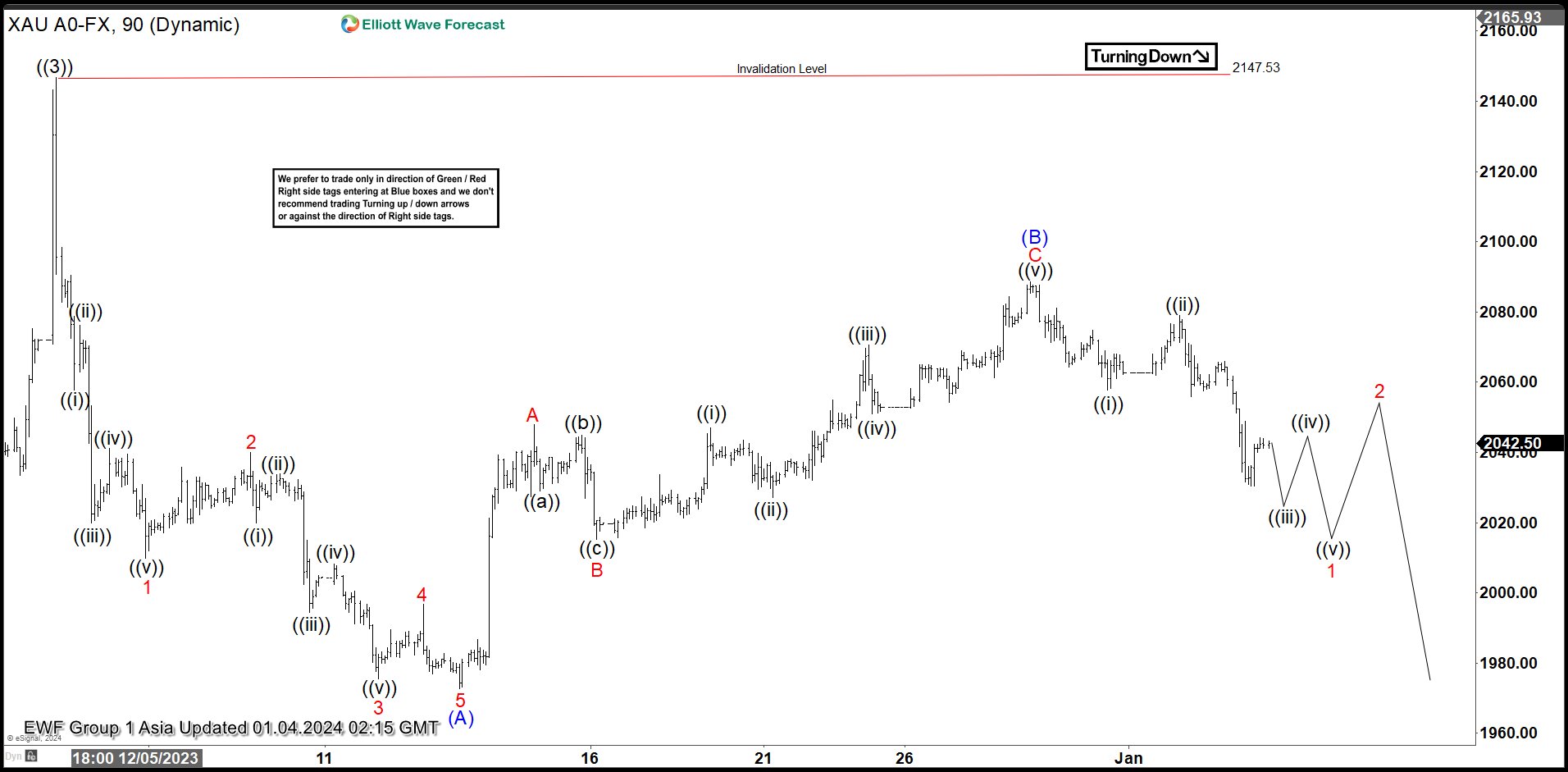

Gold (XAUUSD) Might See Larger Degree Correction

Read MoreGold (XAUUSD) is correcting larger degree cycle from 10.6.2023 low. This article and video look at the Elliott Wave path of the metal.

-

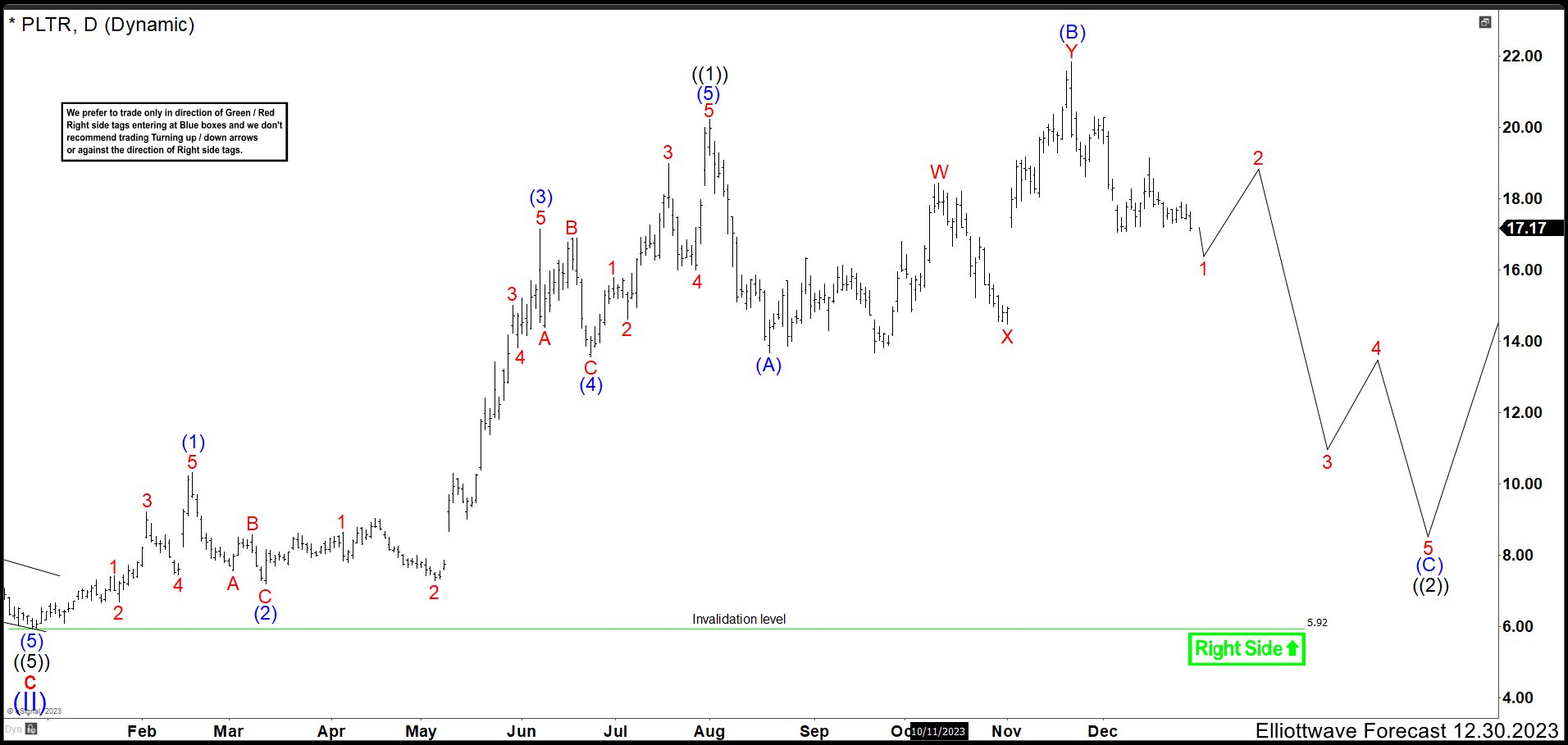

Palantir (PLTR) Rally Is Not Ready To Show Up Again

Read MorePalantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions. PALANTIR (PLTR) Daily Chart Alternative September 2023 Let’s remember Palantir alternative chart, where wave (II) end […]

-

Ford $F Entered in a Double Three Structure to the Downside

Read MoreFord Motor Company is an American multinational automobile manufacturer headquartered in Dearborn, Michigan, United States. It was founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln luxury brand. FORD (F) Daily Chart August 2023 In January 2022 Ford made a high at 25.87 and we called wave I and the […]

-

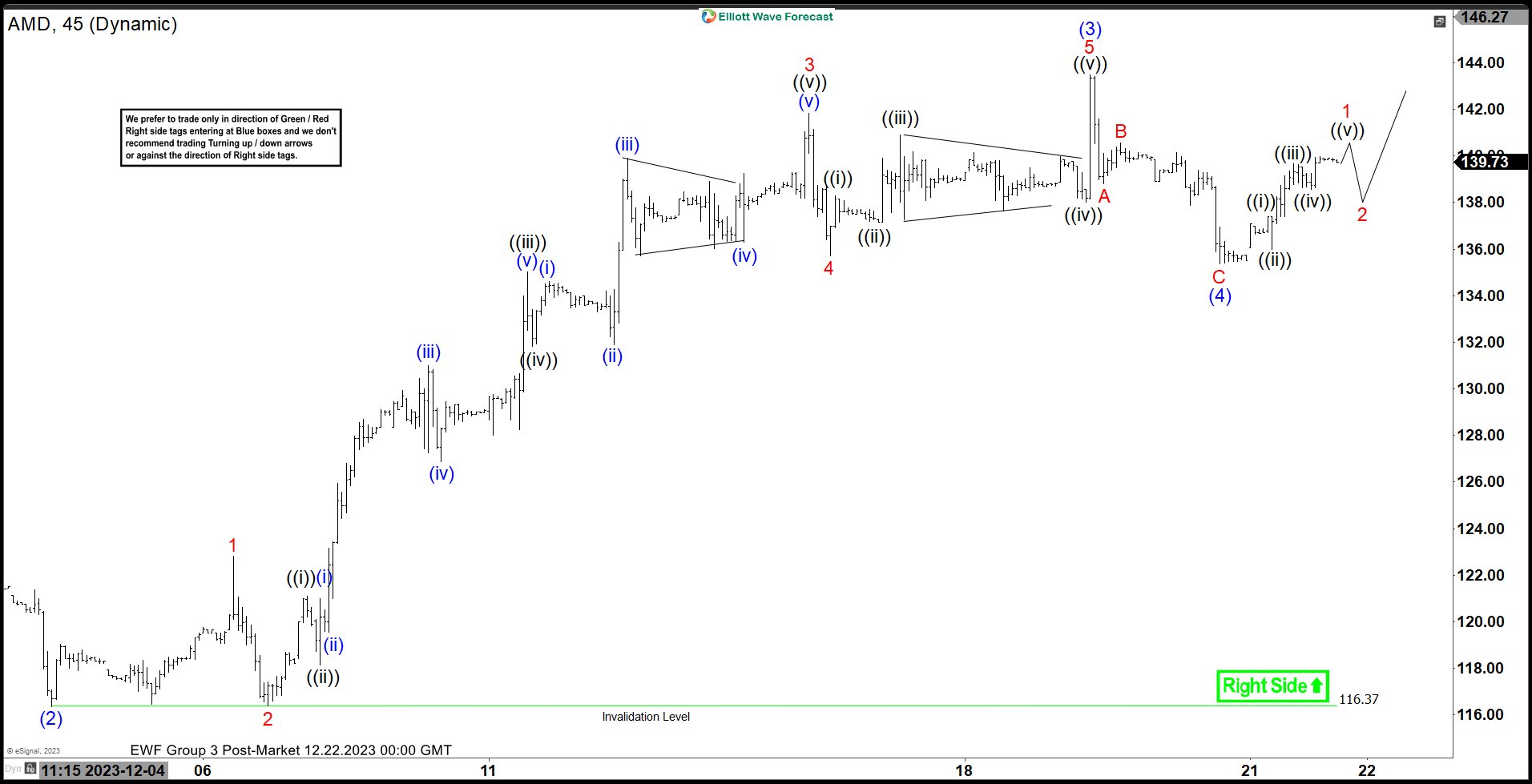

AMD Looking for One More Leg Higher to Complete an Impulse Structure

Read MoreShort Term Elliott Wave View in AMD shows a bullish sequence from 10.26.2023 low favoring further upside. Up from 10.26.2023 low, wave (1) ended at 125.72 and dips in wave (2) ended at 116.37. The impulse is in progress as the 45 minutes chart below shows. Internal subdivision of wave (3) was unfolding as a […]

-

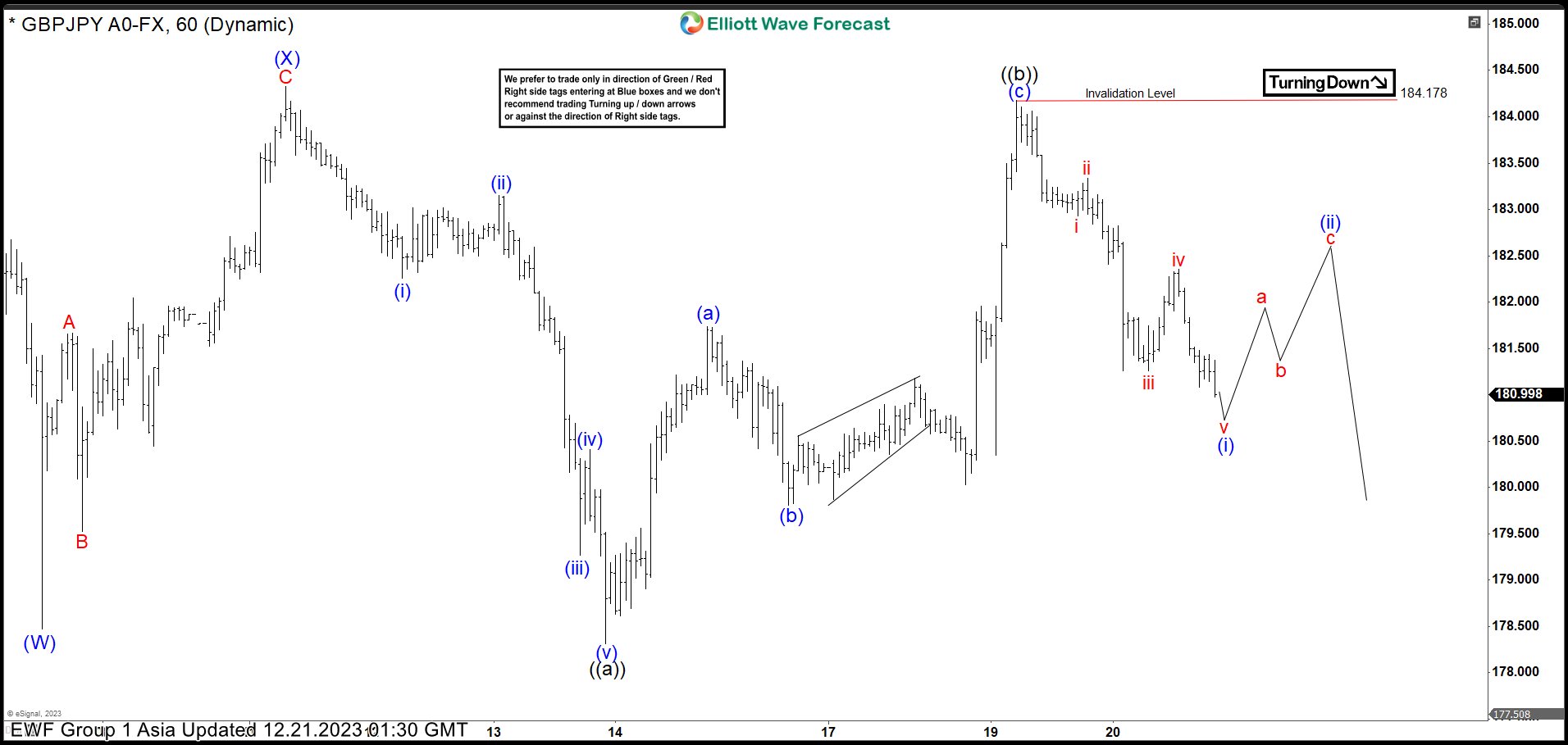

GBPJPY is Showing a Incomplete Bearish Sequence

Read MoreShort Term Elliott Wave View in GBPJPY shows that it has ended wave ((3)) at 188.66. Pullback in wave ((4)) is currently in progress as a double three Elliott Wave structure. Down from wave ((3)), wave A ended at 185.06 and wave B ended at 186.18. Wave C lower made a strong drop ended at […]

-

American Express AXP is Heading to a Potential Selling Area

Read MoreAmerican Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average. AXP Weekly Chart August 2023 We believe that the […]