-

USDJPY Elliott wave View: Mature cycle

Read MoreShort term Elliott Wave view in USDJPY suggests that rally to 115.48 on 3/10 ended Intermediate wave (X). Decline from there is unfolding as a zigzag Elliott wave structure in which the first leg Minor wave A is subdivided in 5 impulsive waves. Down from 3/10 high, Minute wave ((i)) ended at 114.46, Minute wave ((ii)) ended […]

-

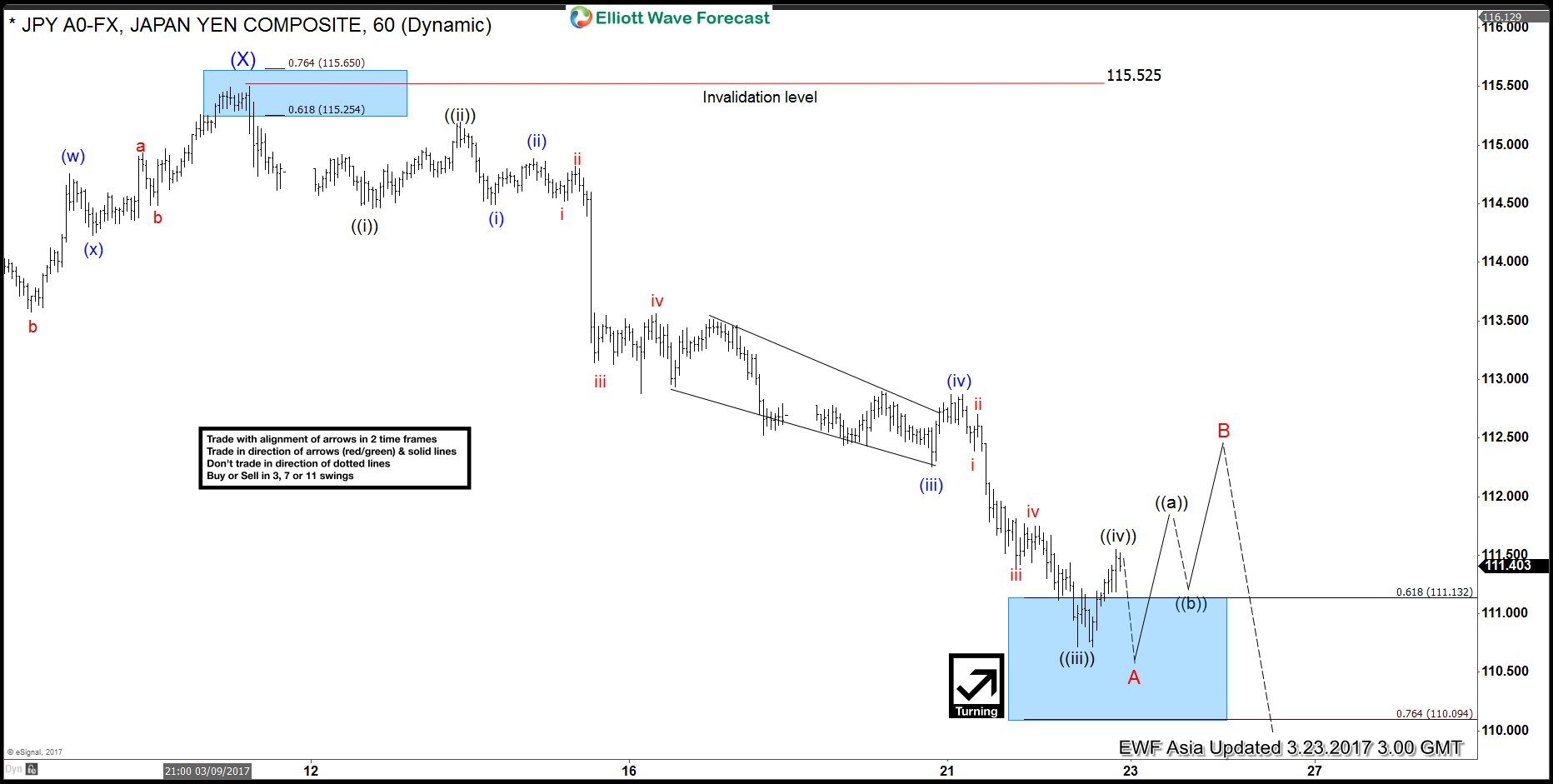

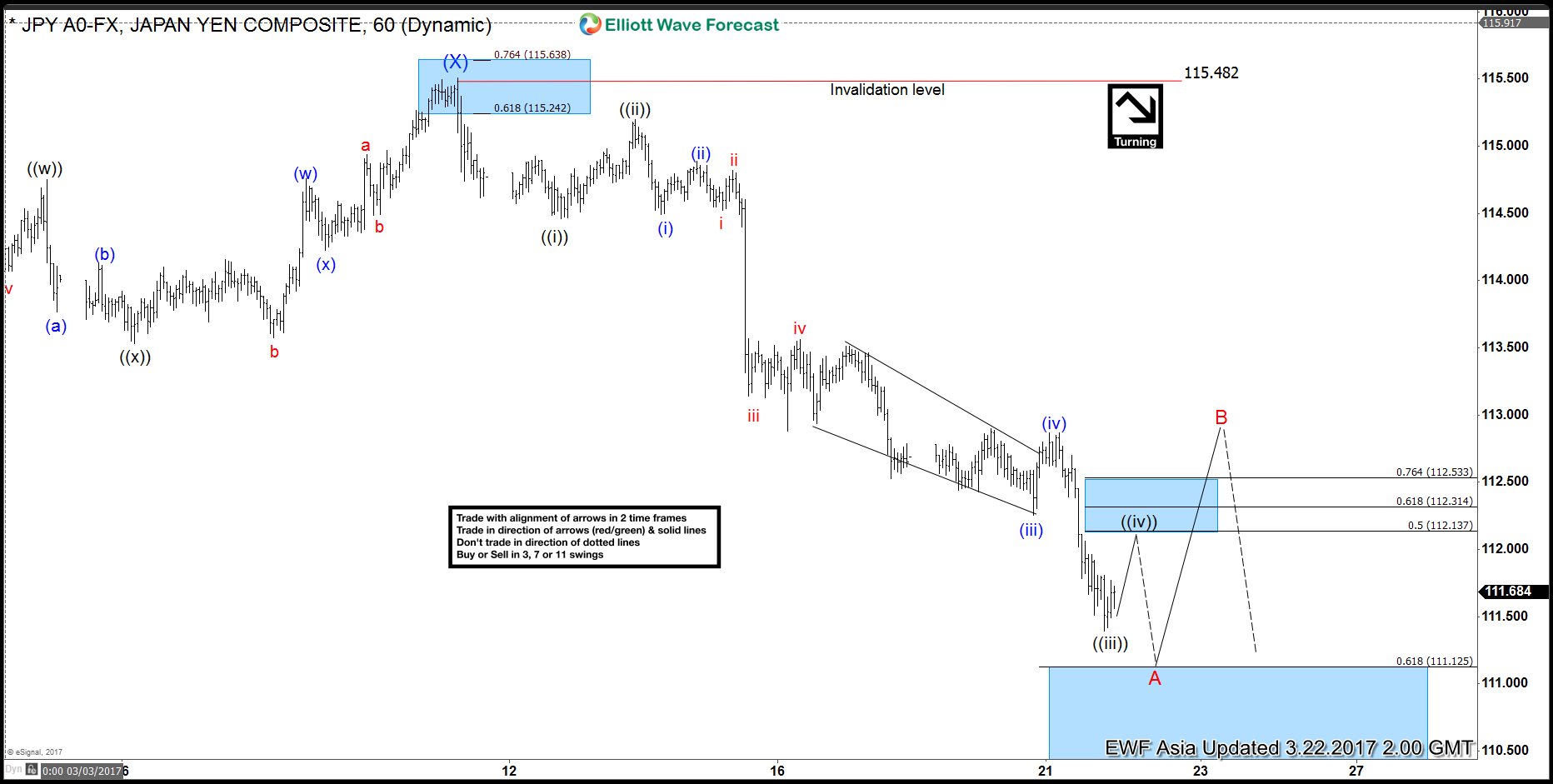

USDJPY Elliott wave View: Near bounce

Read MoreShort term Elliott Wave view in USDJPY suggests that rally to 115.48 on 3/10 ended Intermediate wave (X). Decline from there is unfolding as a zigzag Elliott wave structure in which the first leg Minor wave A is subdivided in 5 impulsive waves. Down from 3/10 high, Minute wave ((i)) ended at 114.46, Minute wave ((ii)) ended […]

-

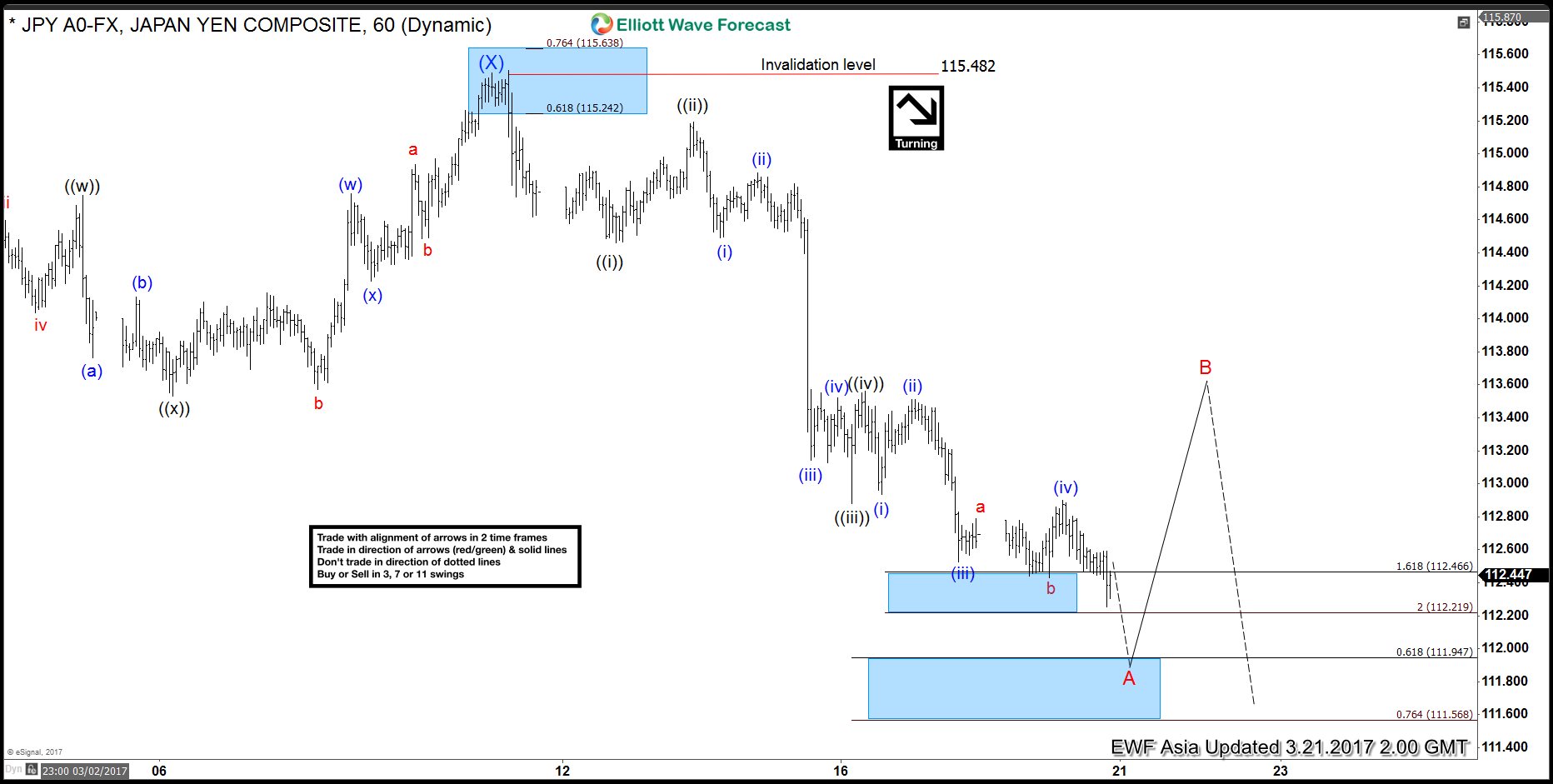

USDJPY Elliott wave View: Ending impulse

Read MoreShort term Elliott Wave view in USDJPY suggests that rally to 115.48 on 3/10 ended Intermediate wave (X). Decline from there is unfolding as a zigzag Elliott wave structure in which the first leg wave A is subdivided in 5 impulsive waves. Down from 3/10 high, Minute wave ((i)) ended at 114.46, Minute wave ((ii)) ended at […]

-

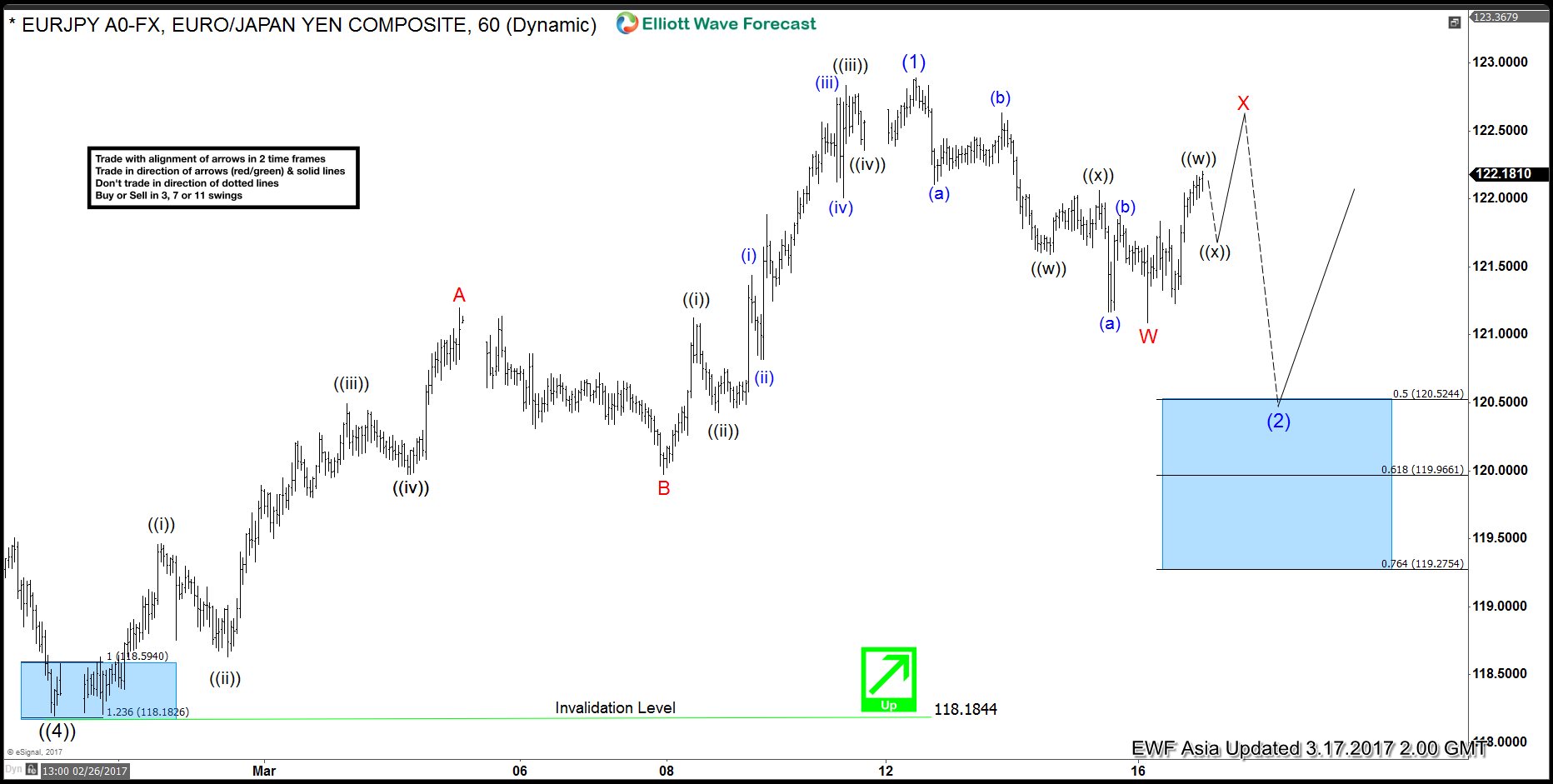

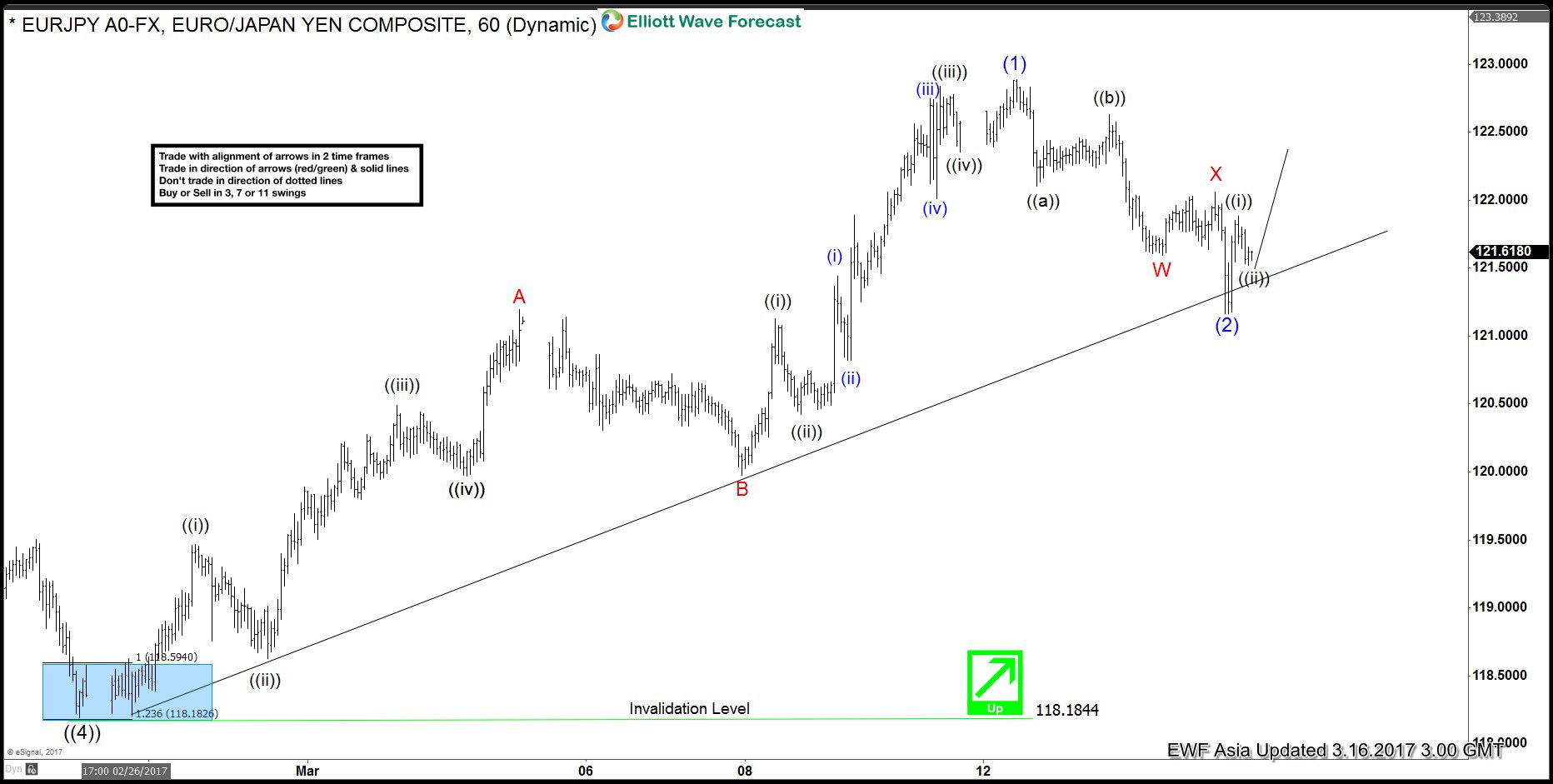

EURJPY Elliott Wave View: Correction in progress

Read MoreShort term Elliott Wave view in EURJPY suggests that the decline to 118.18 on 2/24 ended Primary wave ((4)). Primary wave ((5)) is currently in progress higher and the rally from Primary wave ((4)) low at 118.18 is unfolding as an ending diagonal Elliott wave structure where Intermediate wave (1) ended at 122.88. The subwaves of Intermediate […]

-

EURJPY Elliott Wave View: Pullback ended

Read MoreShort term Elliott Wave view in EURJPY suggests that the decline to 118.18 on 2/24 ended Primary wave ((4)). Primary wave ((5)) is currently in progress higher and the rally from Primary wave ((4)) low at 118.18 is unfolding as an ending diagonal Elliott wave structure where Intermediate wave (1) ended at 122.88. The subwaves of Intermediate […]

-

SPX Index Elliott Wave View: Buying the dips

Read MoreThe video below explains why SPX Index remains a buy in the dips due to incomplete bullish sequence in the Index from 11/4/2016 low and we also explain why we could expect SPX to pullback and show the area where dip buyers are expected to appear. SPX Index Video 4 Hour SPX Index Elliott […]