-

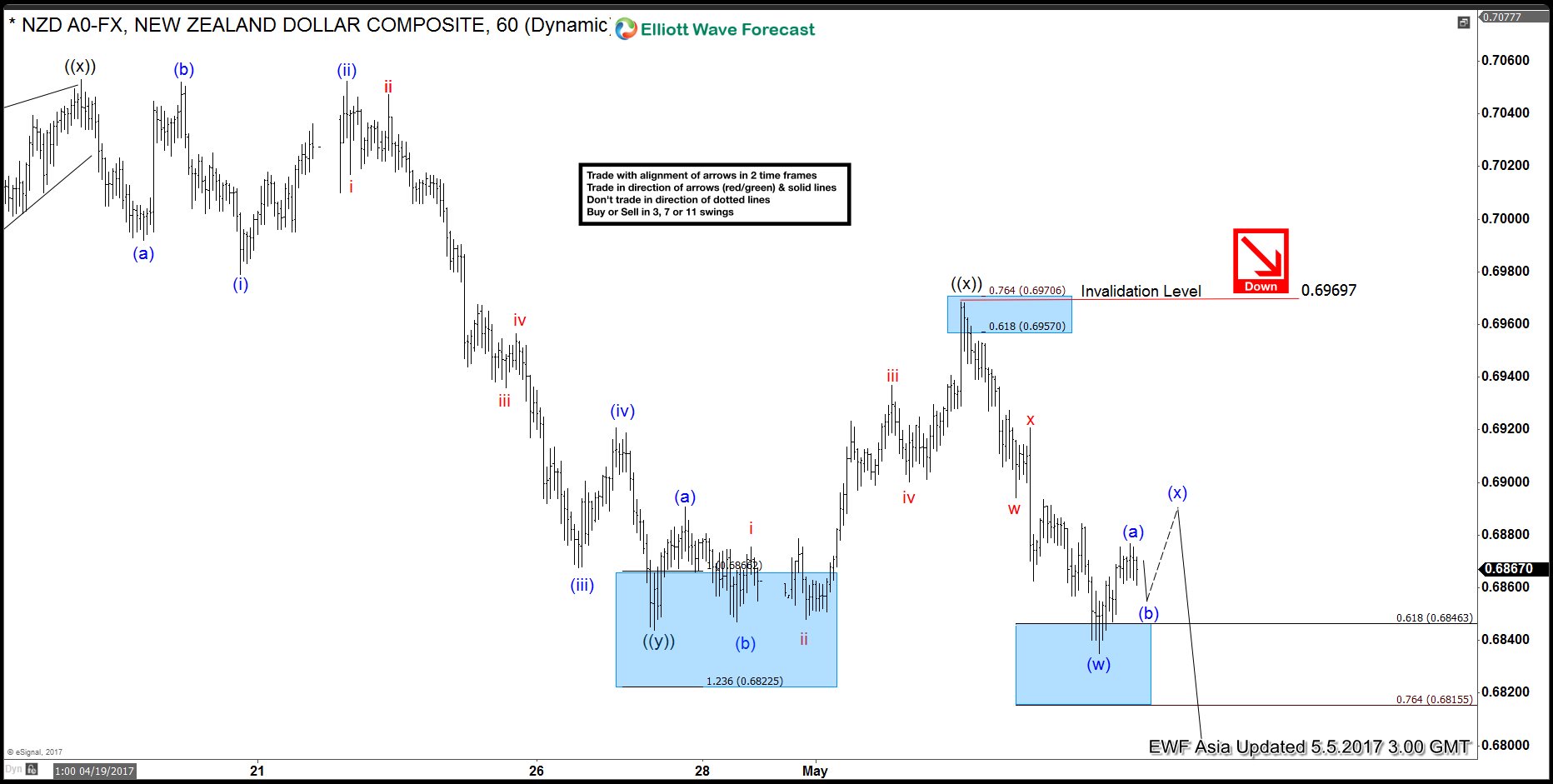

NZDUSD Elliott Wave View: Downside Resumes

Read MoreRevised Elliott Wave view in NZDUSD suggests the decline from 3/21 high (0.709) is unfolding as a triple three Elliott Wave structure where Minute wave ((w)) ended at 0.6905, Minute wave ((x)) ended at 0.7053, Minute wave ((y)) ended at 0.6844 and Minute second wave ((x)) is proposed complete at 0.6968. Minute wave ((z)) is in progress […]

-

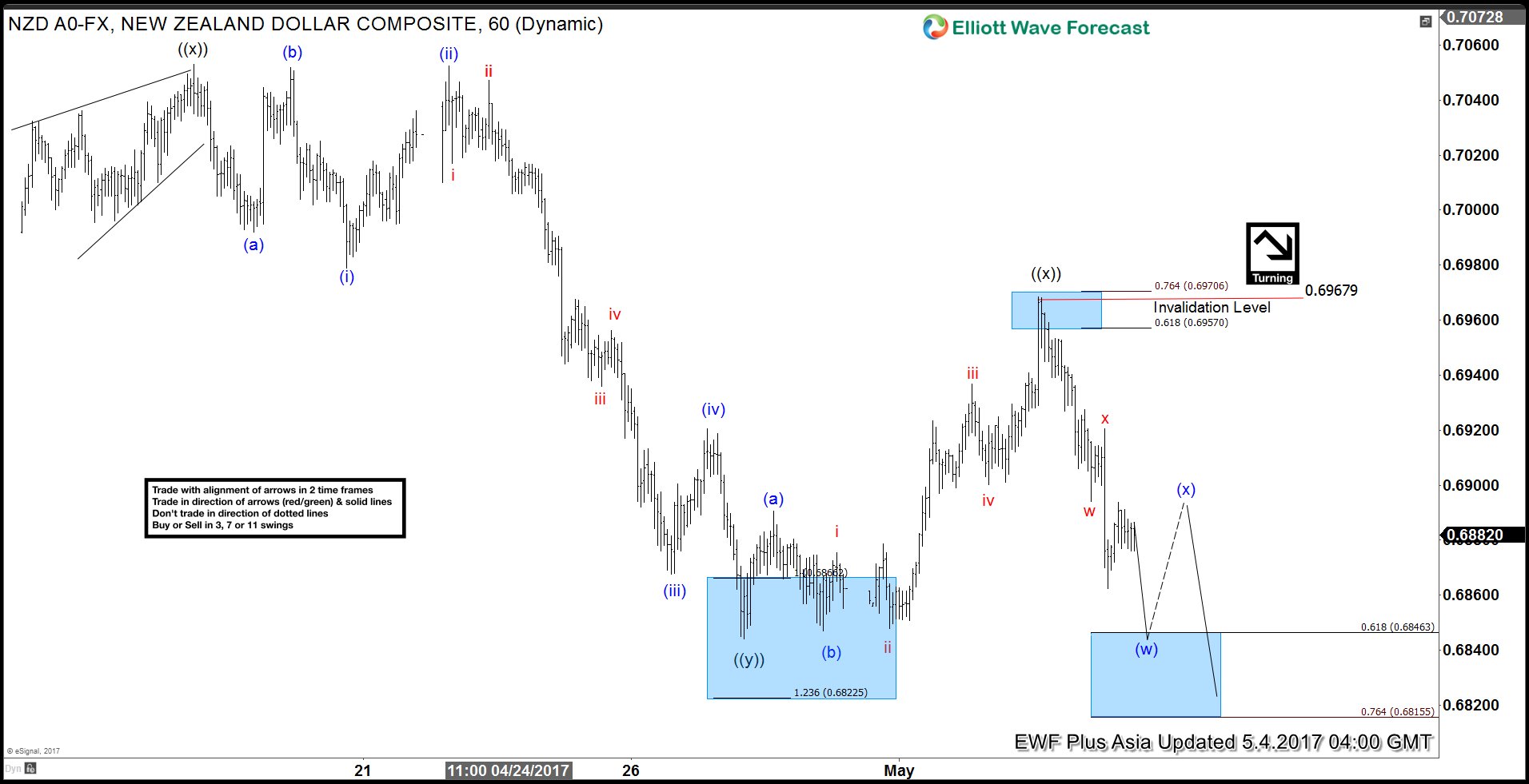

NZDUSD Elliott Wave View: Correction Ended

Read MoreRevised Elliott Wave view in NZDUSD suggests the decline from 3/21 high (0.709) is unfolding as a triple three Elliott Wave structure where Minute wave ((w)) ended at 0.6905, Minute wave ((x)) ended at 0.7053, Minute wave ((y)) ended at 0.6844 and Minute second wave ((x)) is proposed complete at 0.6968. Minute wave ((z)) is in progress […]

-

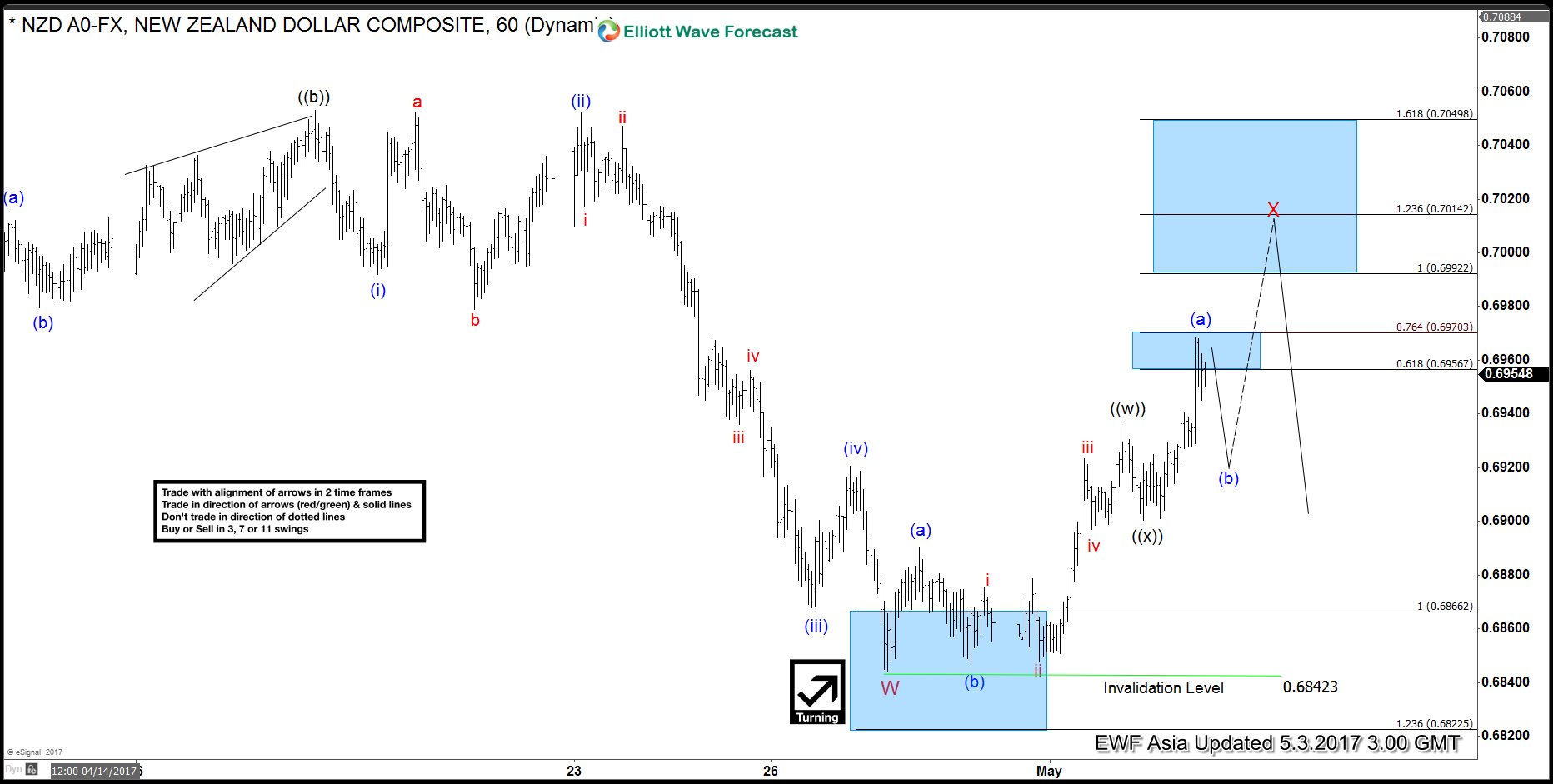

NZDUSD Elliott Wave View: Correction in progress

Read MoreShort term Elliott Wave view in NZDUSD suggests the decline to 0.6844 low ended cycle from 3/21 high in Minor wave W. Pair is currently correcting cycle from 3/21 high in 7 or 11 swing in Minor wave X before the decline resumes. The rally from 4/27 low (0.6844) is unfolding as a double three Elliott Wave structure […]

-

Gold short term weakness likely

Read MoreIn the video below, we provide an update of the Elliott Wave view on Gold-to-Silver ratio and explain why Gold and Silver still may see further weakness in the short term. Gold to Silver Ratio Daily Elliott Wave Chart Daily chart of Gold-to-Silver ratio above suggests that the ratio is correcting cycle from 2/29/2016 […]

-

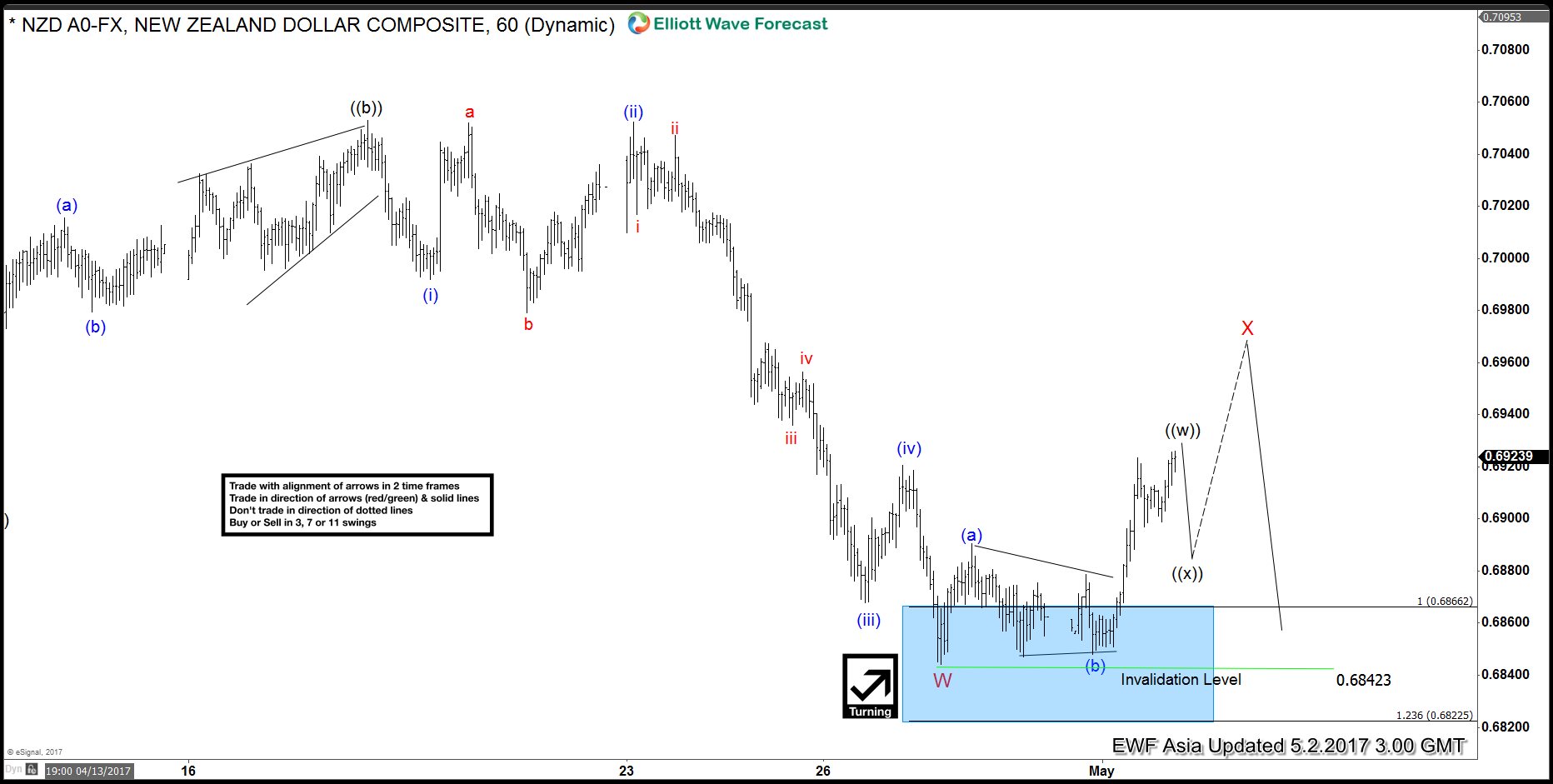

NZDUSD Elliott Wave View: More downside

Read MoreShort term Elliott Wave view in NZDUSD suggests the decline to 0.6844 low ended cycle from 3/21 high in Minor wave W. Pair is currently correcting cycle from 3/21 high in 3, 7, or 11 swing in Minor wave X before the decline resumes. The rally from 4/27 low (0.6844) looks to be unfolding as a double […]

-

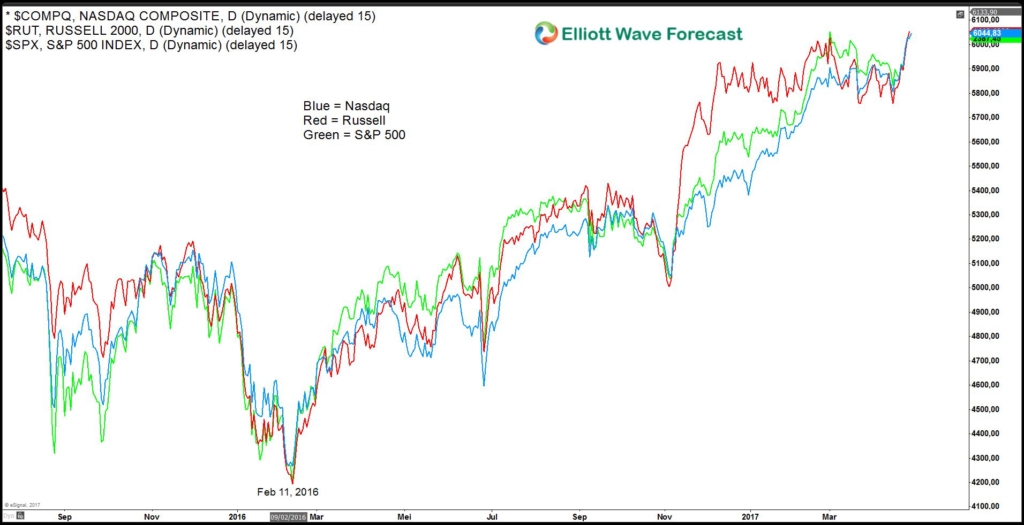

Trump tax cut can create the last rally since 2016

Read MoreAs part of President’s Trump campaign pledge, he wants to sharply reduce the tax rate for all businesses from multinational corporations to mom-and-pop shops to 15%. Treasury Secretary Steven T. Mnuchin said this is the biggest tax cut and the largest tax reform in the U.S history. Currently the U.S. corporate tax rate is 35% […]