-

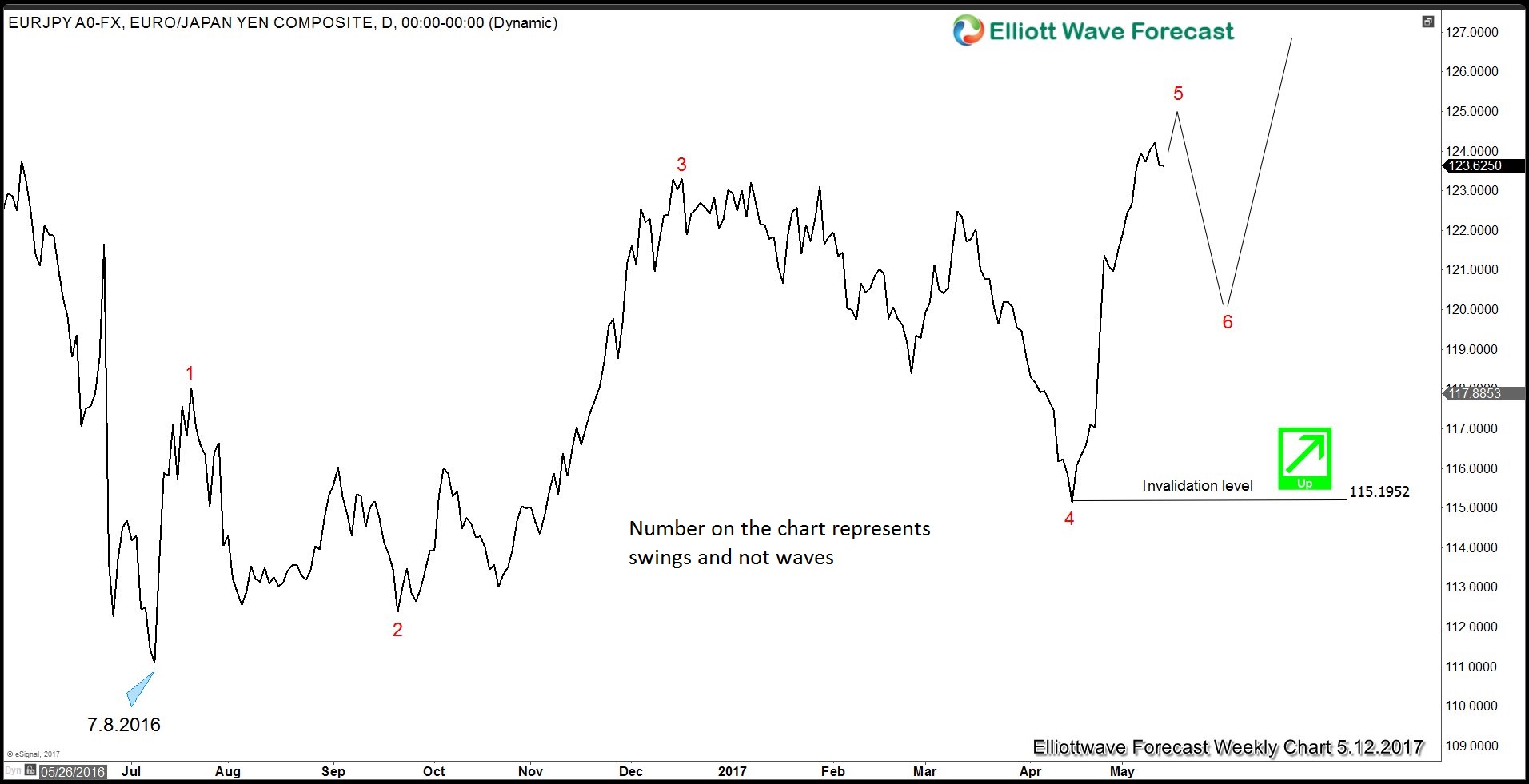

Macron’s Triumph Removes Eurozone Political Risk

Read MoreEmmanuel Macron won the presidential election last Sunday, defeating Marine Le Pen, a far-right nationalist who wanted to take France out of the European Union. Markets had feared that Le Pen’s win could threaten the EU project, but Macron’s win has eliminated uncertainty regarding France’s membership of the Euro and removed the risk of near-term […]

-

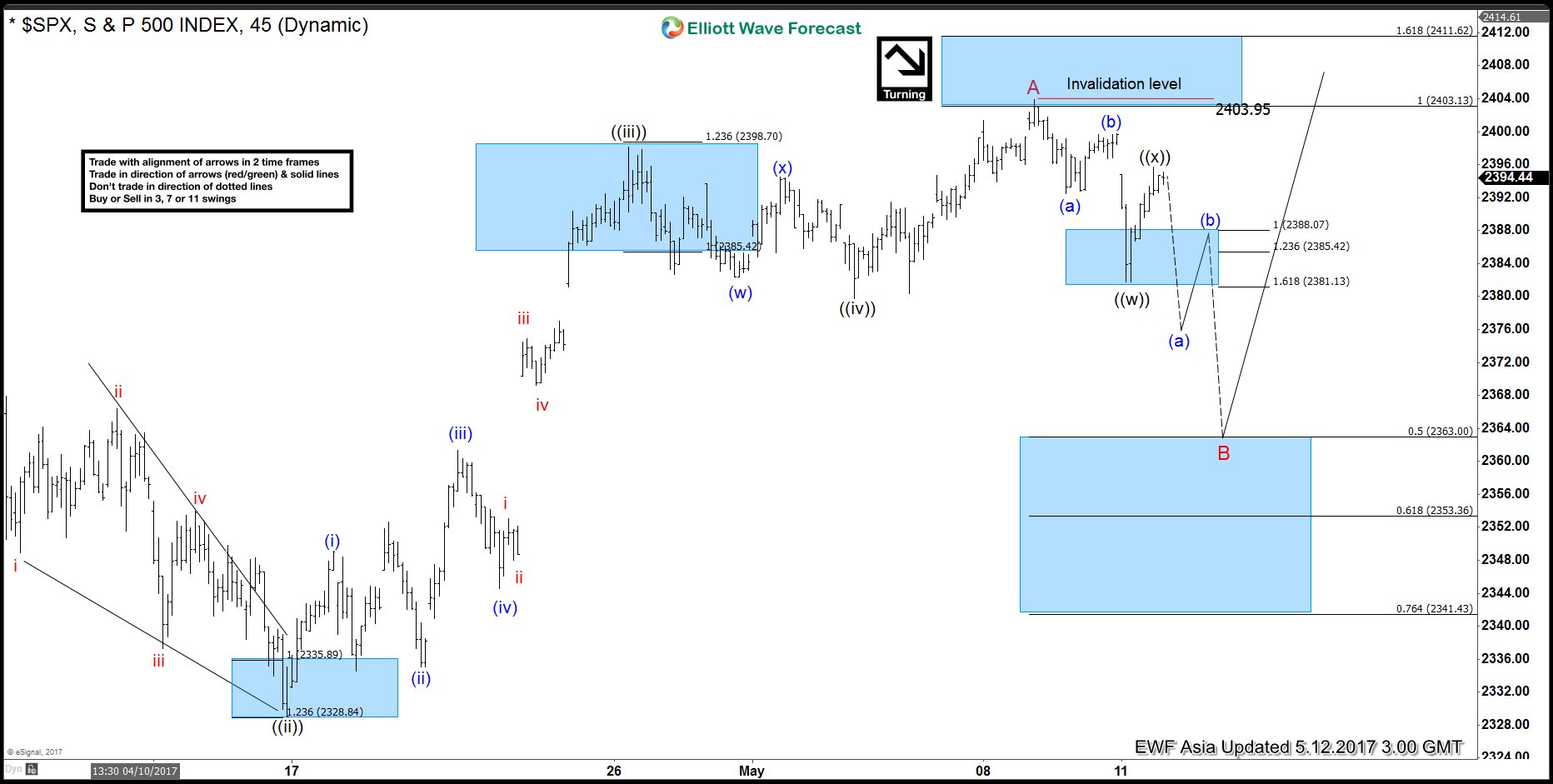

SPX Elliott Wave View: Pull back started

Read MoreShort Term Elliott Wave view in SPX suggests the rally from 3/27 low (2322.2) ended at 2403 as a leading diagonal Elliott Wave structure where Minute wave ((i)) ended at 2378.3, Minute wave ((ii)) ended at 2328.95, Minute wave ((iii)) ended at 2398.16, Minute wave ((iv)) ended at 2379.75, and Minute wave ((v)) of A ended at 2403. […]

-

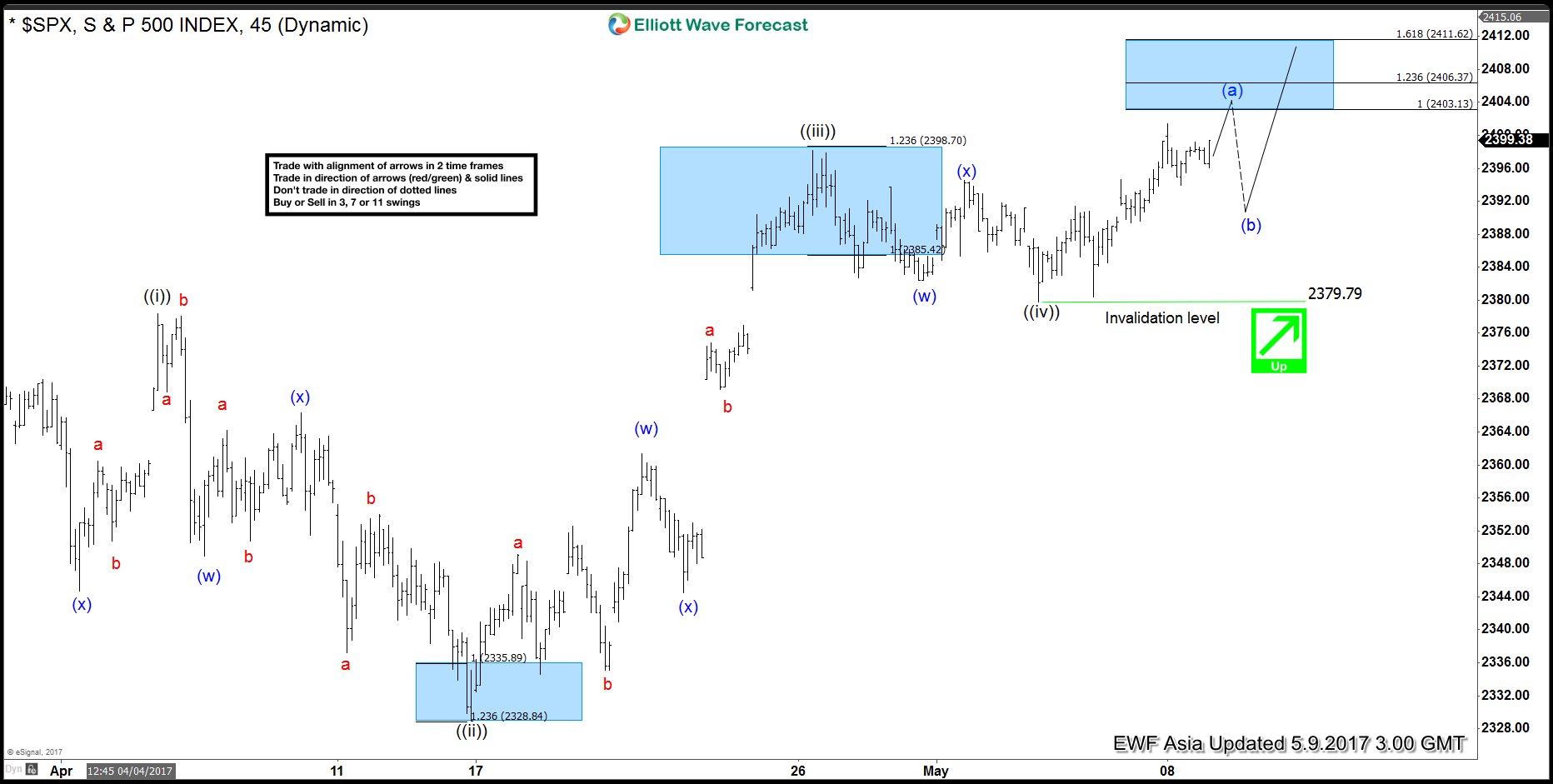

SPX Elliott Wave View: Mature Cycle

Read MoreShort Term Elliott Wave view in SPX suggests the rally from 3/27 low (2322.2) is unfolding as a leading diagonal Elliott Wave structure where Minute wave ((i)) ended at 2378.36, Minute wave ((ii)) ended at 2328.95, Minute wave ((iii)) ended at 2398.16, and Minute wave ((iv)) ended at 2379.75. The Index has broken above previous Minute wave ((iii)) and thus […]

-

Learning Flat Elliott Wave Structure

Read MoreThere are three different types of Flat Elliott Wave Structure: A. Regular Flat Elliott Wave Structure Rules: Corrective 3 waves labelled as ABC Subdivision of wave A and B is in 3 waves Subdivision of wave C is in 5 waves Wave B terminates near the start of wave A Wave C generally terminates slightly […]

-

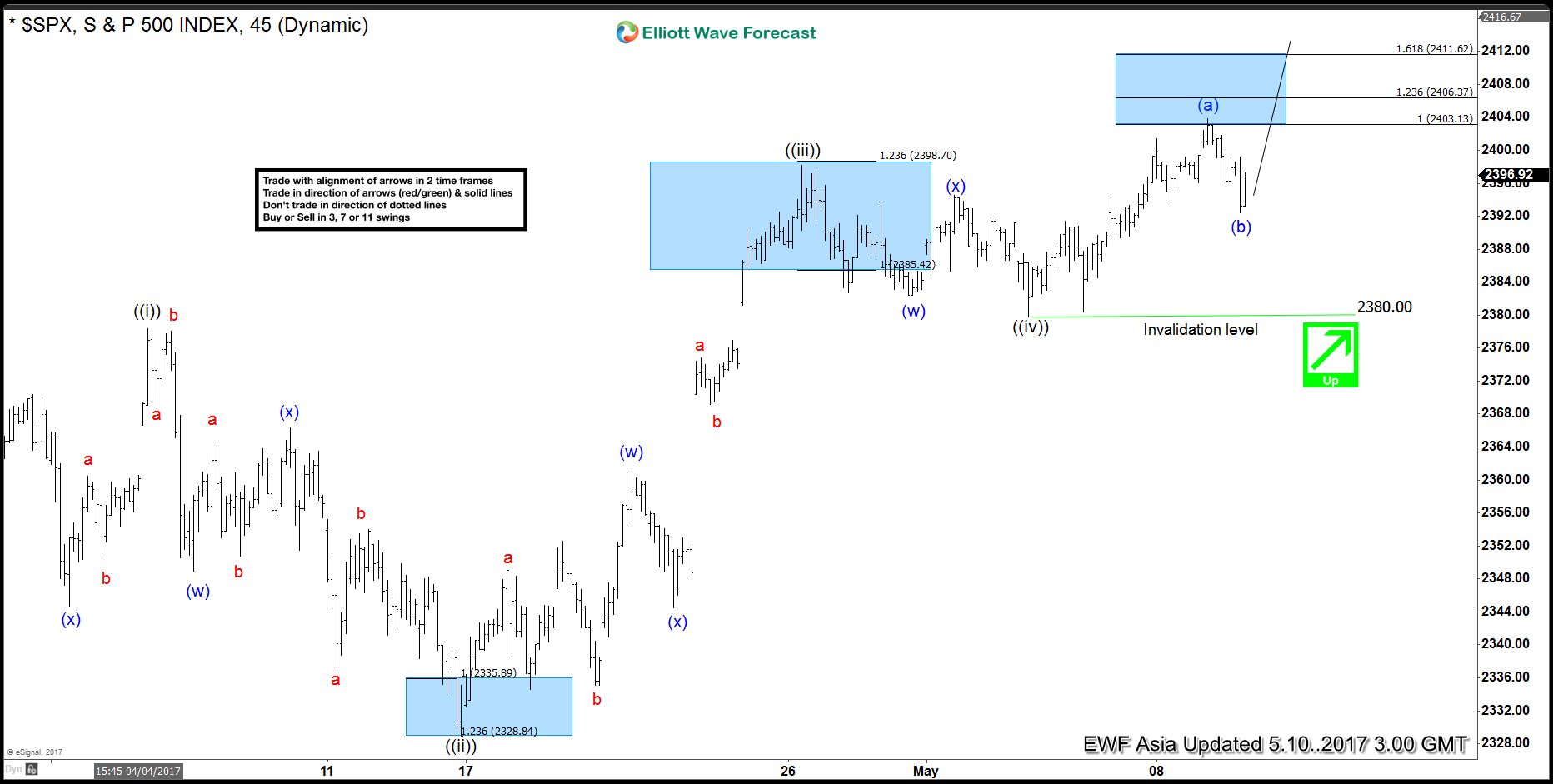

SPX Elliott Wave View: Diagonal Structure

Read MoreShort Term Elliott Wave view in SPX suggests the rally from 3/27 low (2322.2) is unfolding as a leading diagonal Elliott Wave structure where Minute wave ((i)) ended at 2378.36, Minute wave ((ii)) ended at 2328.95, Minute wave ((iii)) ended at 2398.16, and Minute wave ((iv)) ended at 2379.75. The Index has broken above previous Minute wave ((iii)) and thus […]

-

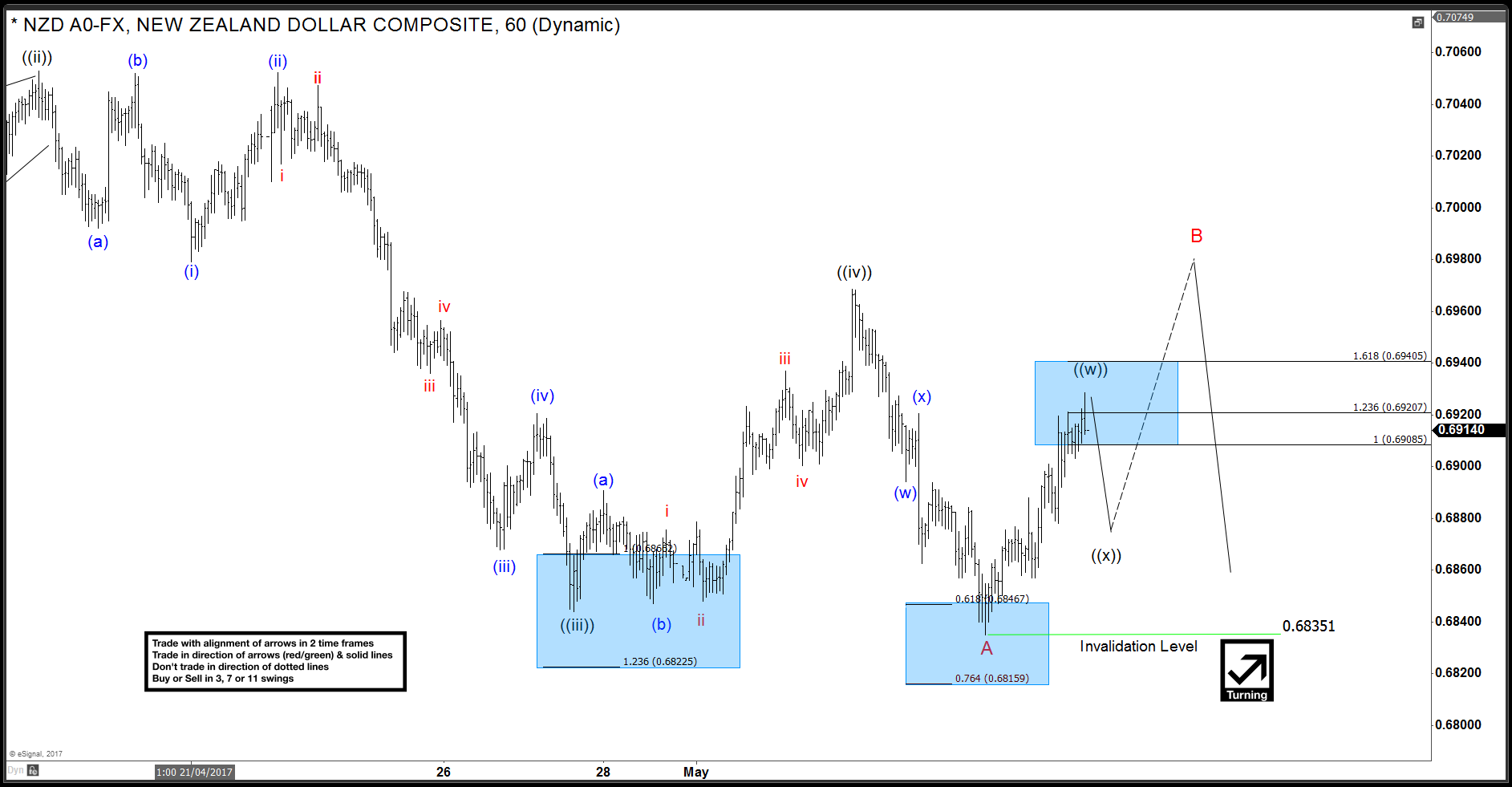

NZDUSD Elliott Wave View: Extended Correction

Read MoreRevised Elliott Wave view in NZDUSD suggests the decline from 3/21 high (0.709) is unfolding as a leading diagonal Elliott Wave structure where Minute wave ((i)) ended at 0.6905, Minute wave ((ii)) ended at 0.7053, Minute wave ((iii)) ended at 0.6844, Minute wave ((iv)) ended at 0.6968. and Minute wave ((v)) of A ended at 0.6835. Pair is […]