-

Elliott Wave Forecast: Nike ($NKE ) Rally to Fail in 7-Swing Pattern

Read MoreNike (NKE) is correcting in 7 swing pattern which is likely to fail. This article and video look at the Elliott Wave path of the stock.

-

Uranium Miners ETF ($URA): Correction Likely Over, Now Rising

Read MoreThe Global X Uranium ETF (URA) tracks a market-cap-weighted index of companies in the uranium mining and nuclear components sector. The ETF, featuring key holdings like Cameco Corp, has a market cap of approximately $3.9 billion and a dividend yield of about 6.07%. Elliott Wave Technical Analysis point to continued growth potential. $URA Elliott Wave […]

-

Elliott Wave Outlook: IBEX Poised to Surge to 6-Year High

Read MoreIBEX is about to break above the previous peak prior to the trade war. This article and video look at the Elliott Wave of the Index.

-

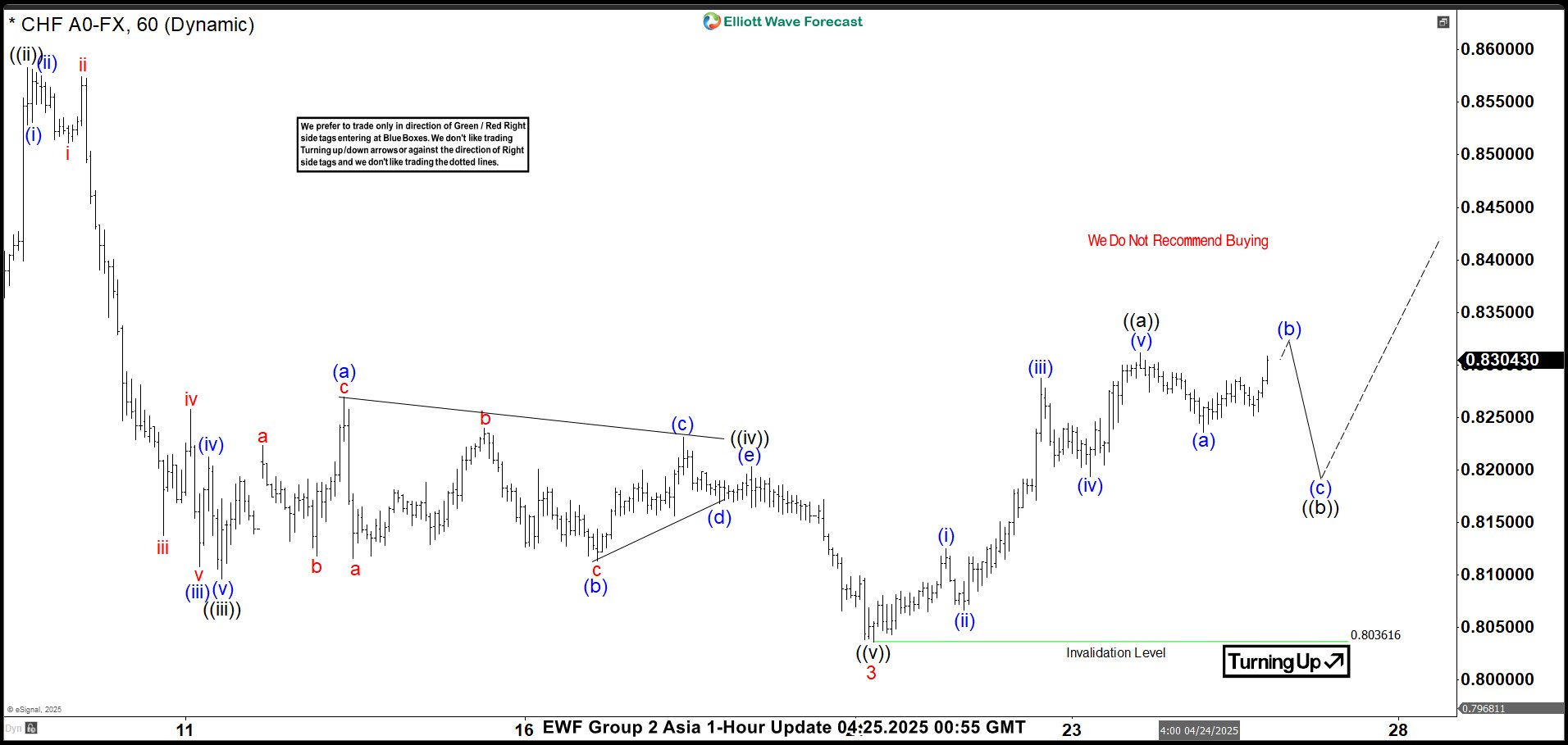

Elliott Wave View: USDCHF Zigzag Corrective Rally Expected to Fail

Read MoreUSDCHF is correcting in a zigzag pattern within a bearish market. This article and video look at the Elliott Wave path of the pair.

-

Elliott Wave: Copper (HG) Impulsive Rally Signals More Upside

Read MoreThe short-term rally in Copper (HG) from April 7, 2025 low looks impulsive, favoring upside. This article & video explore the Elliott Wave path ahead.

-

FTSE Elliott Wave Update: Short-Term 5 Swing Pattern Favors Additional Gains

Read MoreFTSE 5-swing Elliott Wave move from the 4/7/2025 low points to continued upside. This article and video break down the Elliott Wave path.