-

Elliott Wave Analysis: Is US Dollar About to Turn?

Read MoreIn this video today, we will analyze US Dollar through USDPLN (Poland Zloty). Below you can find the short term and long term outlook in US Dollar Video on US Dollar Elliottwave Analysis through USDPLN At Elliottwave-Forecast.com, we use correlation as one tool to complement our forecast. We often use USDPLN as we believe […]

-

Has Stock Market Put In Major Top?

Read MoreIn the video below, we take a look and explain the timing cycle of Hang Seng Index from Hong Kong to figure out whether stock market has put in a major top. Hang Seng Index is one of the clearest structures in the market that we can study to learn about the potential duration and […]

-

Soybean Hit 9 Year Low Due to Trade War

Read MoreEarly this week the price of Soybean futures (ZS_F) plunged to a new low in more than 9 years due to the tit-for-tat trade war between U.S. and China. Soybean Futures started to drop on Friday last week after Trump administration decided to go ahead with 25% tariff on $50 billion worth of goods from […]

-

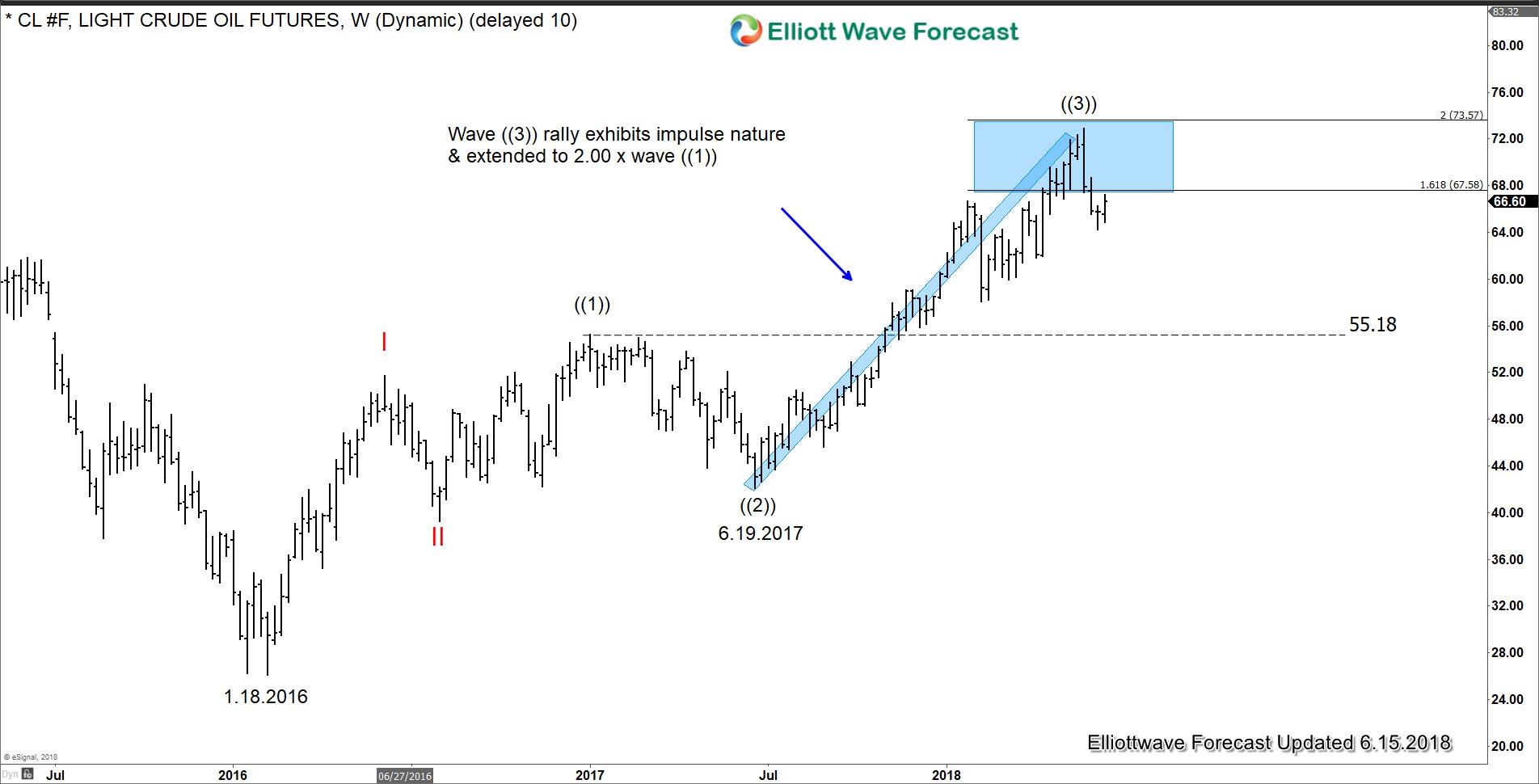

Oil Price on Holding Pattern Ahead of OPEC meeting

Read MoreThe Organization of the Petroleum Exporting Countries (OPEC) will meet in Vienna next week to discuss potential reduction or revision to the 1.8 million barrels/day production cut put in place in early 2017. After yearlong rise in oil and gasoline price, there’s a call to control the price from rising too far and too fast. […]

-

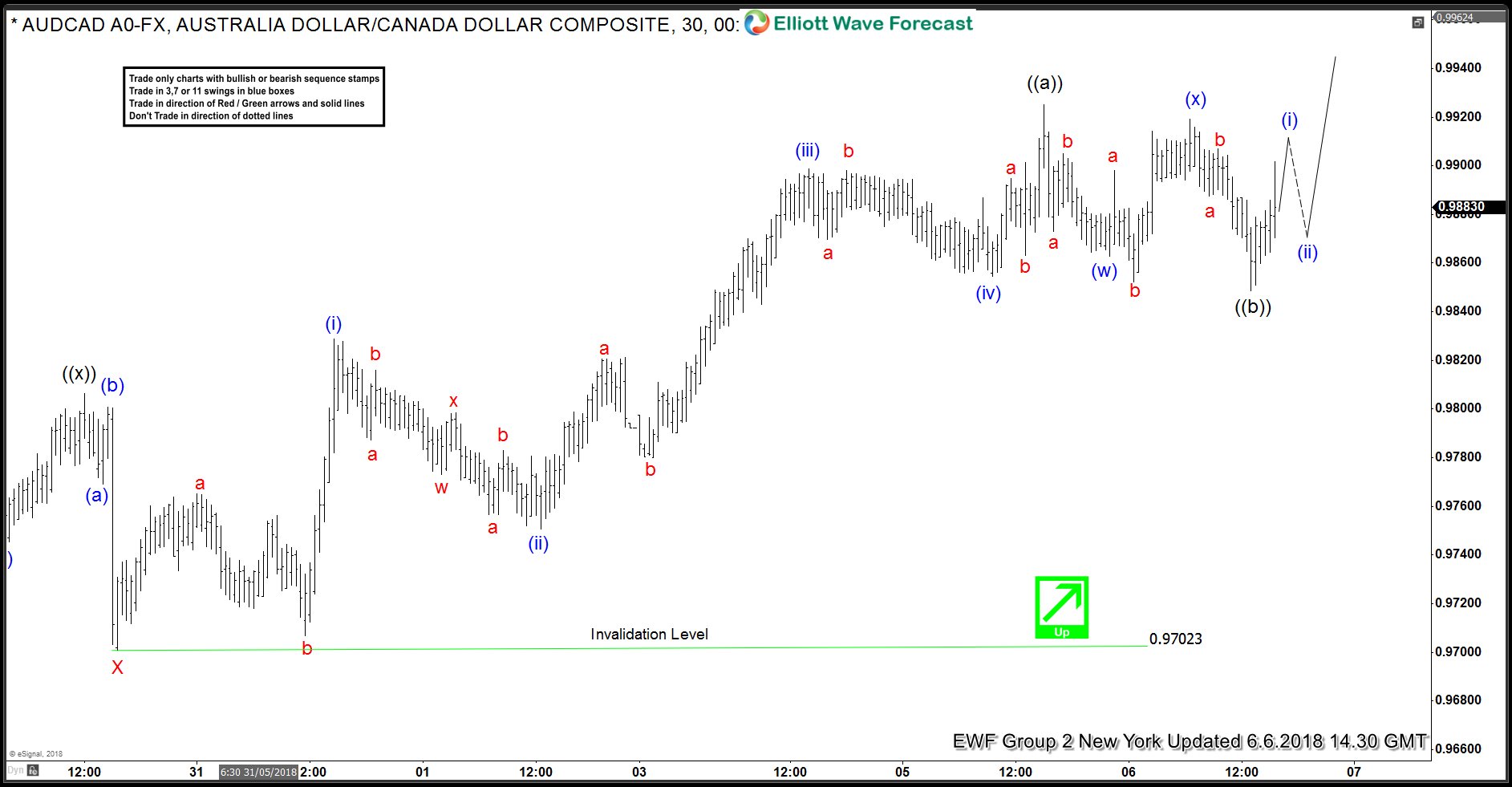

Australia Economy Beat Expectation

Read MoreAustralia Economy Posts Strong Q1 Growth Australia’s 1st quarter 2018 Gross Domestic Product is growing at 1.01%, beating the expectation of 0.9%. This is the largest increase since late 2011 and brings the year-on-year growth rate to 3.1%, up from 2.4% in the previous quarter. Chart below shows the year-on-year growth of Australia’s GDP: The […]

-

European Political Turmoil Headwind to Stock Market

Read MoreMost World Indices spend time trading sideways in 2018. There are some exceptions such as FTSE from the U.K. and Russel from the U.S. which have been able to make a new high. Several factors however could slow down the move higher in Stock Market and even make the weakest among the group to turn […]