-

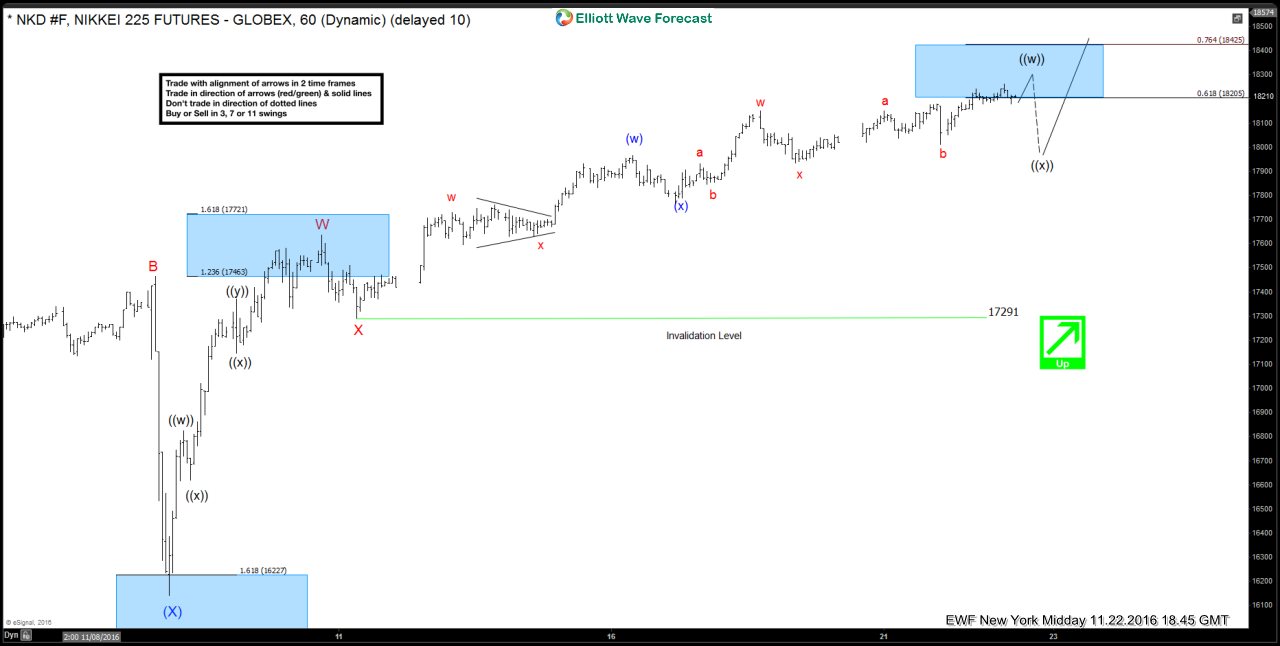

Nikkei Short-term Elliott Wave Analysis 11.23.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term focus is on 18205 – 18425 area to complete wave ((w)), then it should pullback in wave ((x)) in 3, 7, or 11 […]

-

Nikkei Short-term Elliott Wave Analysis 11.22.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term focus is on 18207 – 18427 area to complete wave ((w)), then it should pullback in wave ((x)) in 3, 7, or 11 […]

-

Nikkei Short-term Elliott Wave Analysis 11.18.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term focus is on 18207 – 18427 area to complete wave ((w)), then it should pullback in wave ((x)) in 3, 7, or 11 […]

-

AUDJPY Short-term Elliott Wave Analysis 11.16.2016

Read MoreAUDJPY Short Term Elliott wave cycles suggests that decline to 76.75 ended wave (X). Rally from there is unfolding as double three where wave W ended at 82.46 and wave X ended at 80.23. Wave (Y) is currently in progress with the internal structure as a zigzag where wave (a) is proposed complete at 82.59. Near term, expect […]

-

AUDJPY Short-term Elliott Wave Analysis 11.15.2016

Read MoreAUDJPY Short Term Elliott wave cycles suggests that decline to 76.75 ended wave (X). Rally from there is unfolding as double three where wave W ended at 82.46 and wave X ended at 80.23. Near term, AUDJPY is expected to correct the rally from 80.23 low, and correction is expected to complete at 80.9 – 81.11 area (50 – […]

-

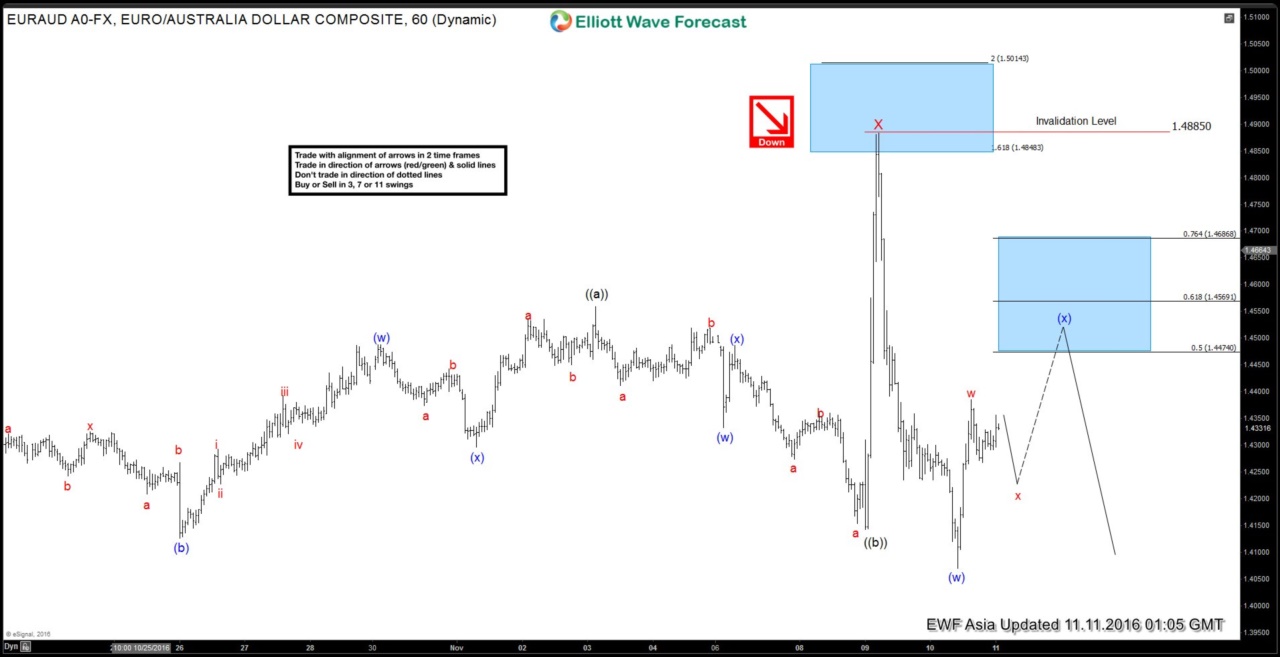

EURAUD Short-term Elliott Wave Analysis 11.11.2016

Read MoreEURAUD Short Term Elliott wave cycles suggests that decline to 1.418 ended wave W and bounce to 1.4885 ended wave X. Decline from there is unfolding as a double three where wave (w) ended at 1.407. Wave (x) bounce is in progress in 3, 7, or 11 swing to correct cycle from 11/9 peak (1.4885) before turning lower. […]