-

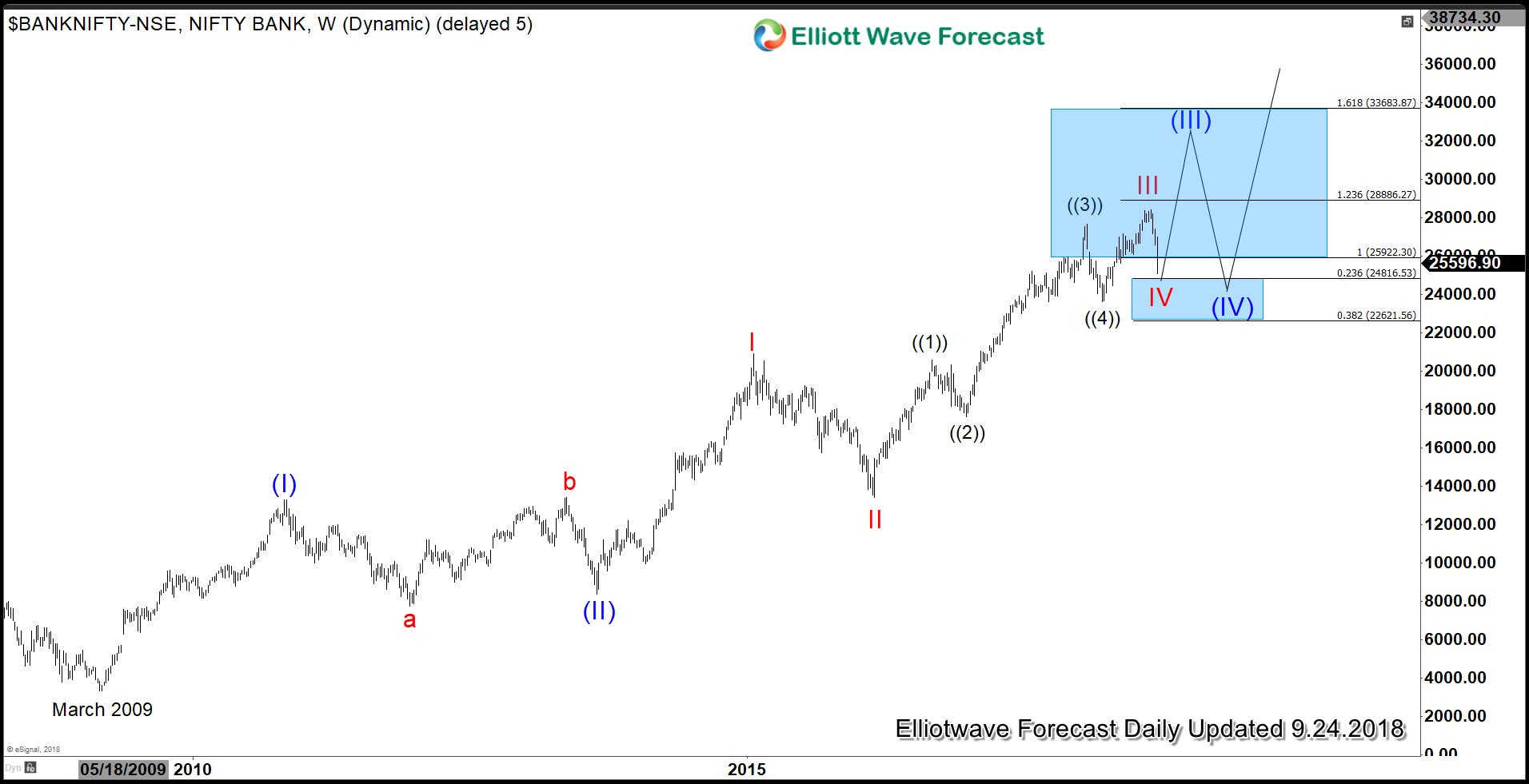

Bank Nifty: Will Trouble in Financial Sectors Drag India Stock Market?

Read MoreVolatility in India stocks spiked higher last week as panic set in the nation’s financial shares and dragging down Bank Nifty and other benchmark Index. Investors confidence remain fragile after the recent default by IL&FS (Infrastructure Leasing & Financial Services). Then last Friday, India’s central bank rejected the tenure extension of Yes Bank’s Chief Executive […]

-

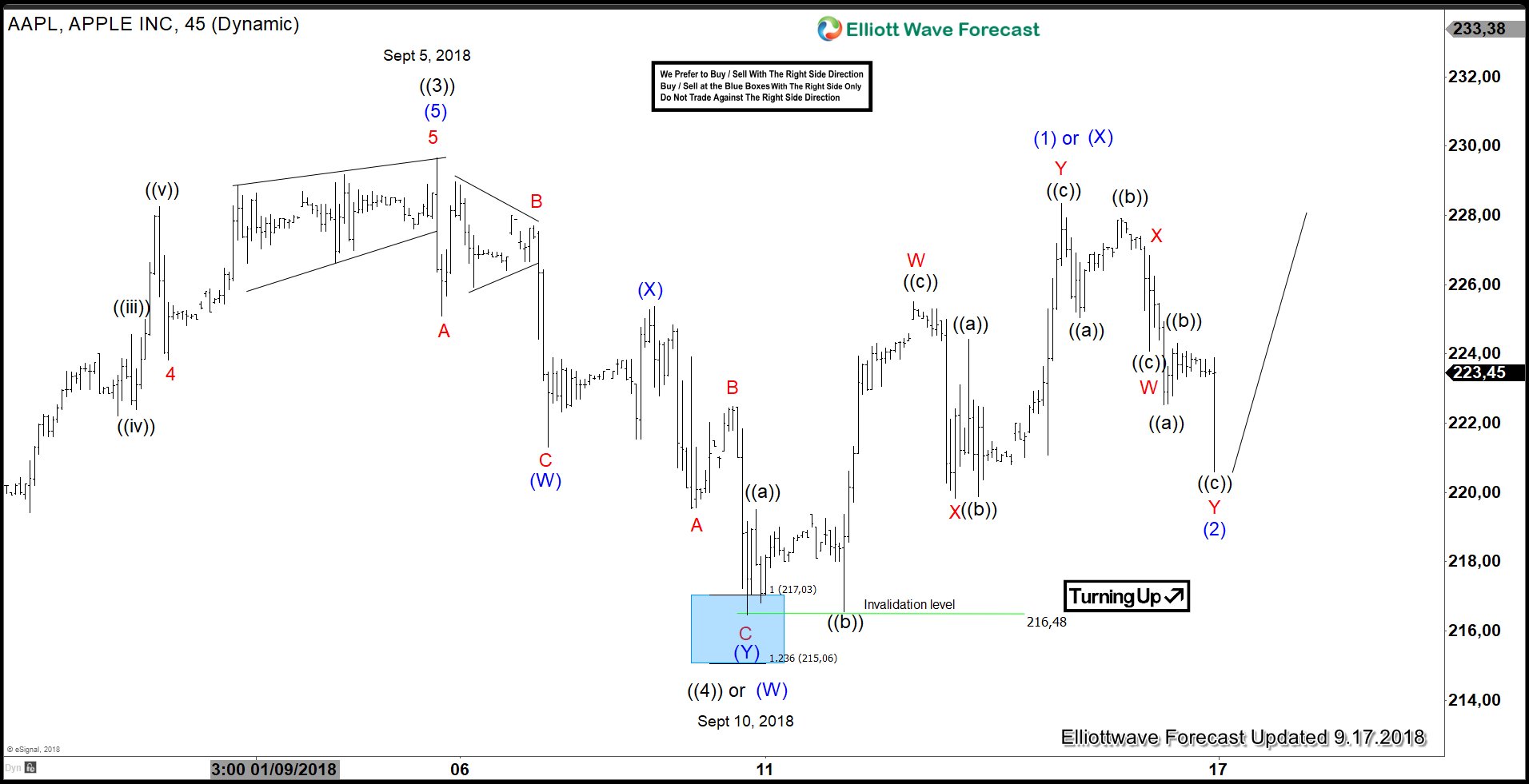

Apple (AAPL): Is the Next Trade War Decline Still a Buy?

Read MoreThe latest trade war between U.S. and China may affect U.S. companies with big operations in China, such as Apple. Saturday’s report by The Wall Street Journal suggests that President Trump has given a go ahead to his aides to implement a fresh $200 billion tariffs ahead of scheduled trade talks with China. This can […]

-

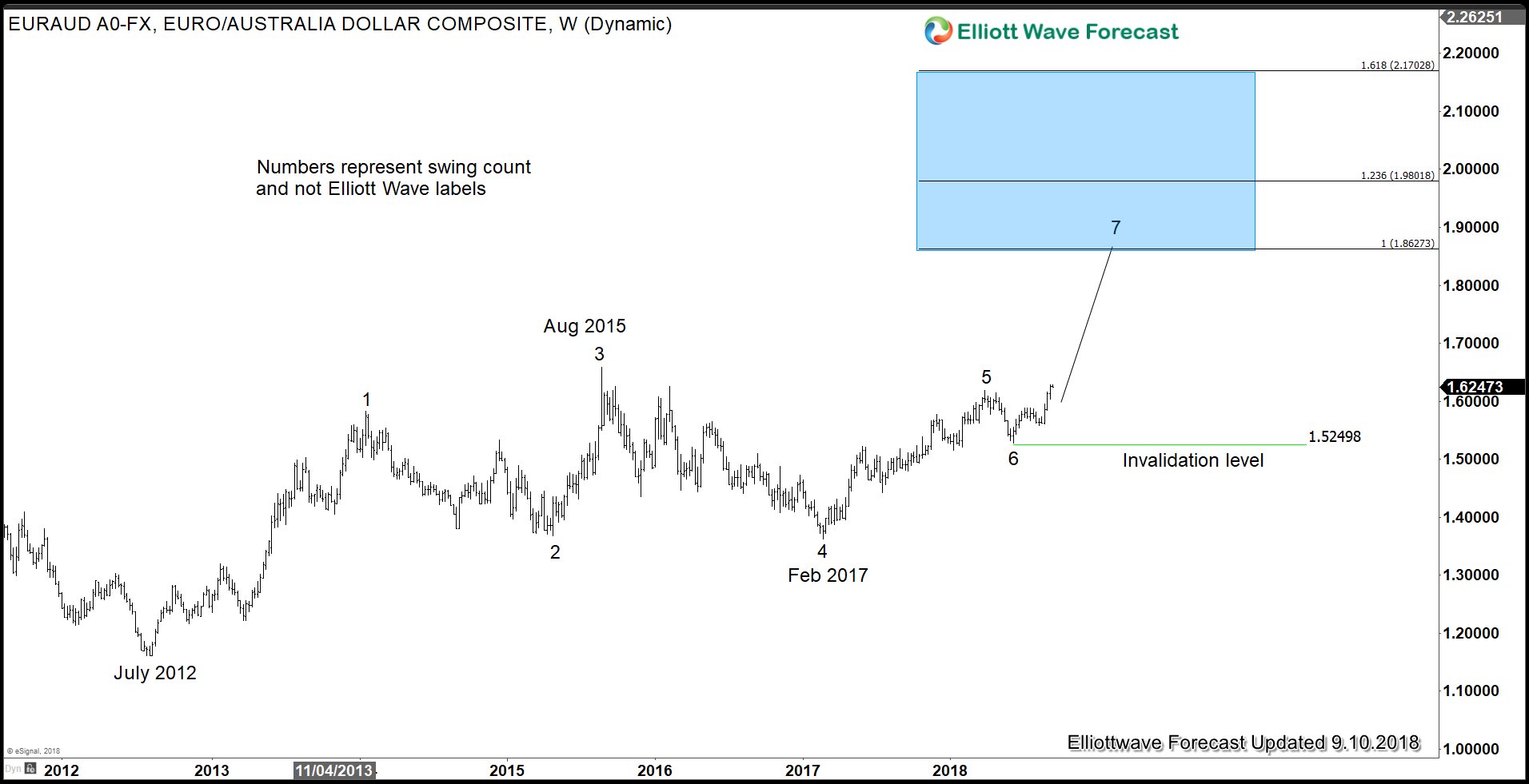

Trade War Concern May Continue to Pressure Australian Dollar

Read MoreLast Friday Australian Dollar dipped to a two-and-a-half-year low after it broke blow 71 US cents due to a rising US Dollar and escalation in US-China trade wars. The last time the Australian Dollar traded below 71 US cents was on February 2016. The currency fell out of favor after last week’s comment by President […]

-

Tesla Shares Tumbled as Senior Executives Leave

Read MoreTesla shares (TSLA) dropped sharply to as much as 10% to $252.25 in New York after the company disclosed that its chief accounting officer is resigning after less than a month into the job. The head of HR, who is currently on leave, also said she won’t be rejoining the company. This is the steepest […]

-

Market Participants Betting on Nafta Deal between US and Canada

Read MoreThe Canadian Dollar strengthened to a two month high against US Dollar earlier this week. Market participants seem to bet on possible inclusion of Canada in a new Nafta pact. The U.S. has just concluded a successful bilateral talk with Mexico on Monday. Under the new agreement, cars need to have 75% of their content […]

-

AUDUSD Elliott Wave View: Downside Pressure Remains

Read MoreElliott Wave view on AUDUSD suggests that the decline to 0.7199 ended Intermediate wave (W). Intermediate wave (X) rally appears complete at 0.7382. The internal of Intermediate wave (X) unfolded as a zigzag Elliott Wave structure. Minor wave A of (X) ended at 0.7287, Minor wave B of (X) ended at 0.7248. and Minor wave […]