-

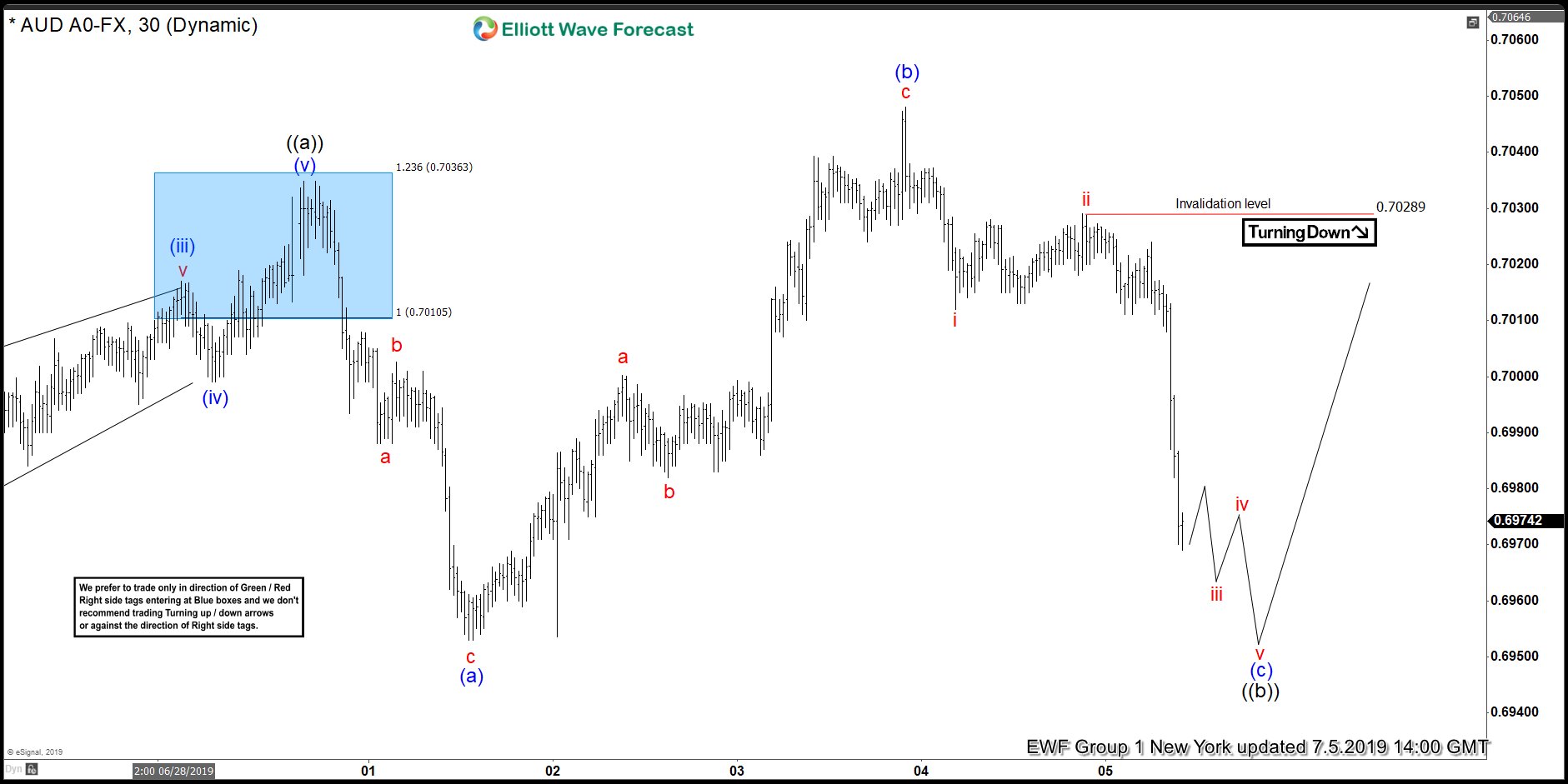

Elliott Wave View: AUDUSD Strength Should Resume

Read MoreAUDUSD is correcting the rally from June 18, 2019 low in a Flat structure. This article and video show the Elliott Wave path.

-

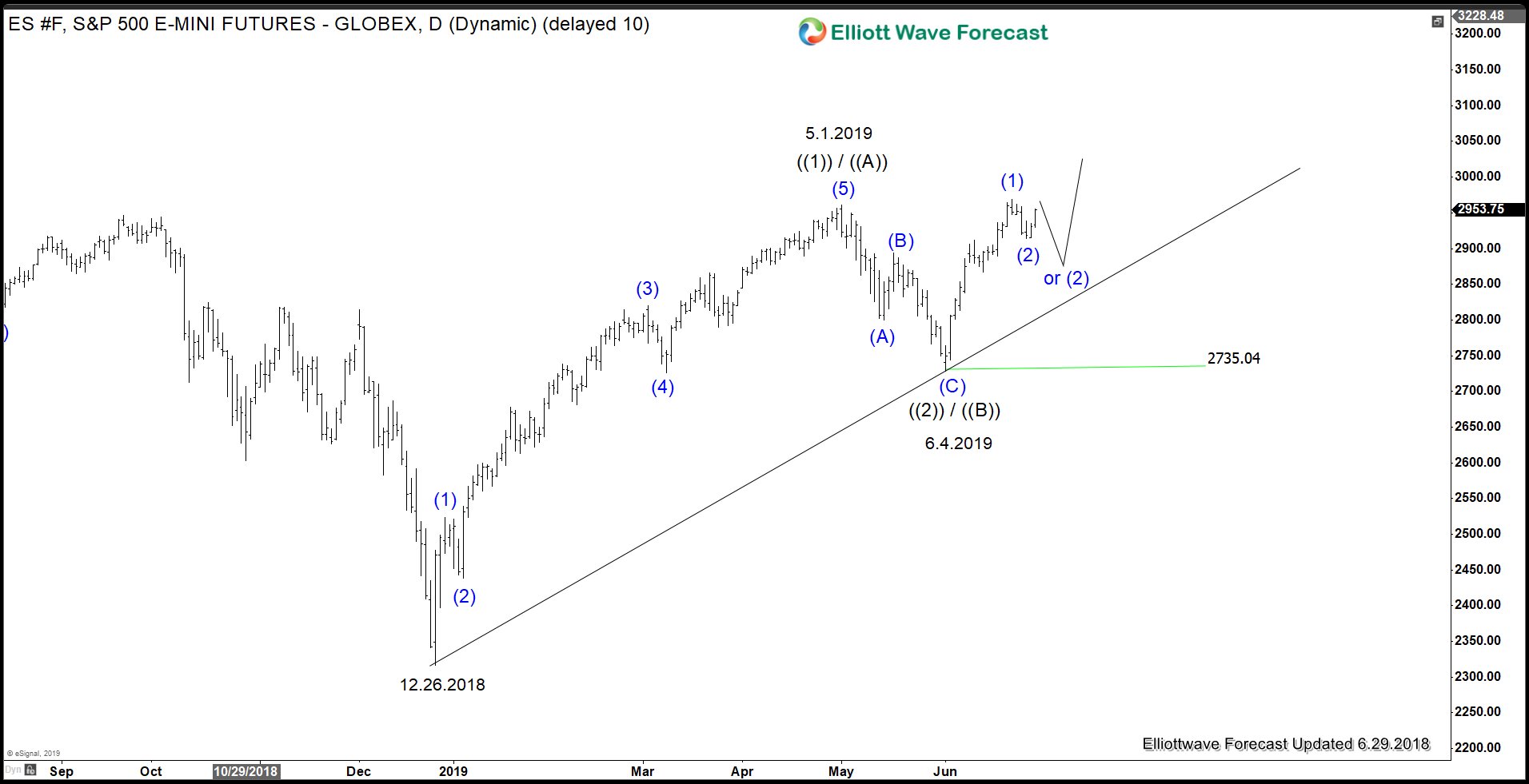

Elliott Wave View: More Upside in S&P 500 Futures (ES_F)

Read MoreS&P 500 Futures (ES_F) shows a bullish sequence from Dec 26, 2018 low favoring more upside.This article and video show the Elliott Wave path.

-

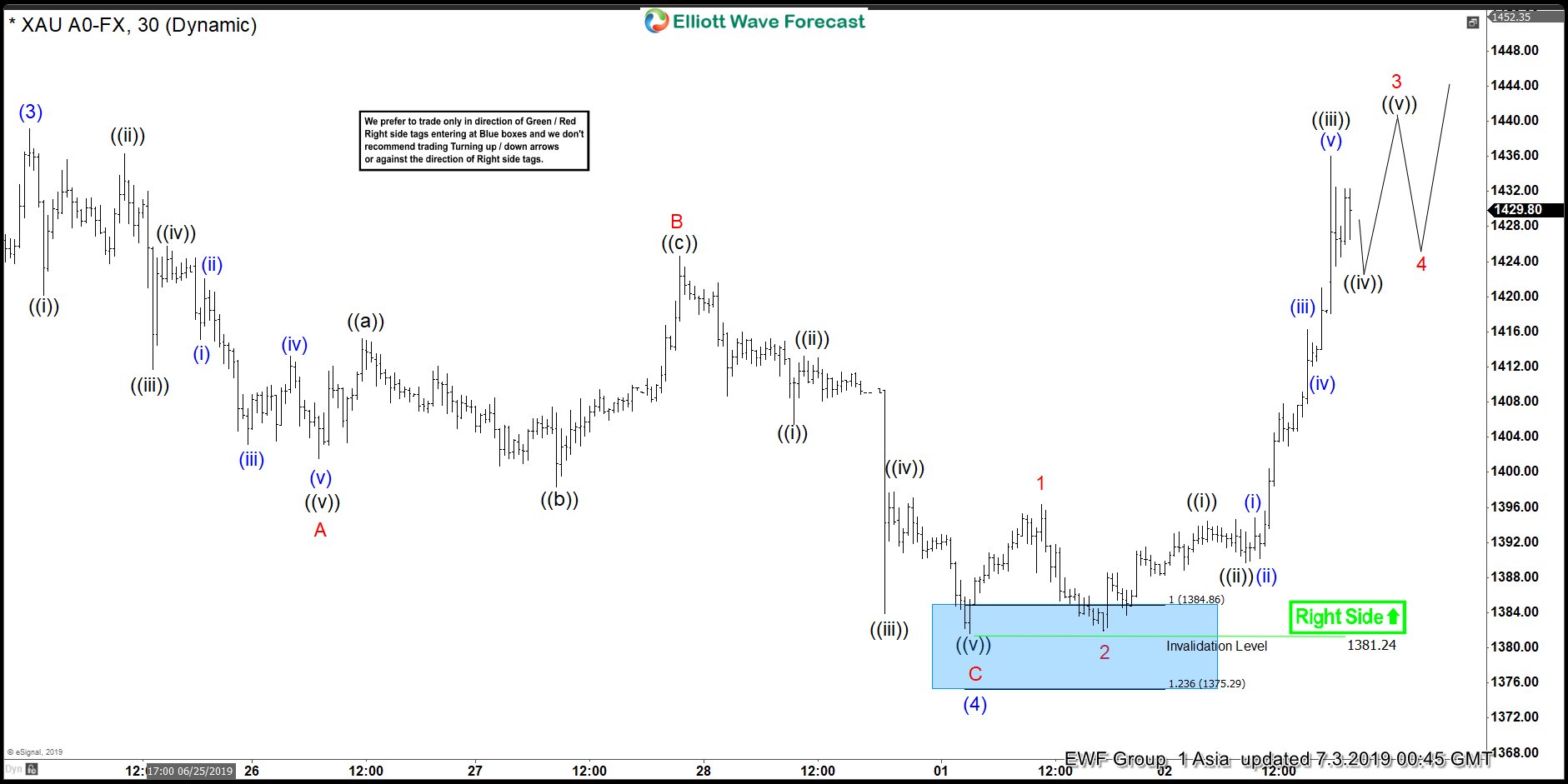

Elliott Wave View: Gold Extends Higher in Impulsive Move

Read MoreShort Term Elliott wave view in Gold suggests that the decline to $1381.42 low on July 1 ended wave (4). Above from there, the yellow metal is rallying higher as an impulse Elliott Wave structure looking for more upside within wave (5). Up from July 1 low, wave 1 ended at 1396.35 and wave 2 pullback […]

-

Elliott Wave View: AUDJPY Should Remain Supported

Read MoreAUDJPY shows a 5 waves impulsive rally from June 18 low favoring more upside. This article and video shows the Elliott Wave path.

-

G20 Temporary Truce between USA and China May Boost Market Sentiment

Read MoreThe highly anticipated meeting between the U.S. and China during G20 meeting in Japan has concluded. Both parties agree to resume the trade talks and the U.S also agreed to put on hold additional tariffs on $325 billion Chinese goods for the time being. The U.S. previously has threatened to slap 25% tariffs on all […]

-

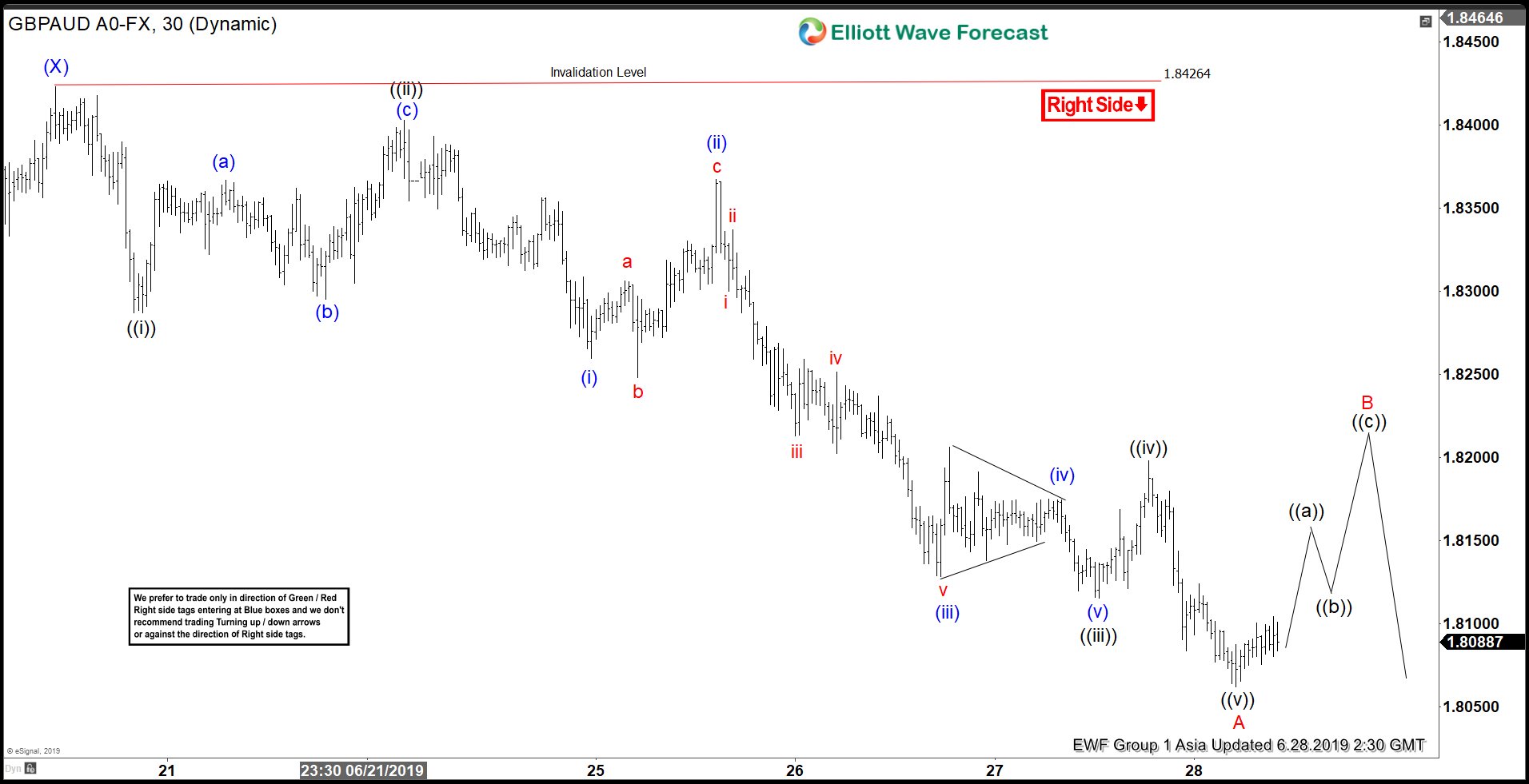

Elliott Wave View: GBPAUD Rally Should Find Sellers

Read MoreGBPAUD shows 5 swing bearish sequence from May 6 high, favoring more downside. This article and video show the Elliott Wave path.