-

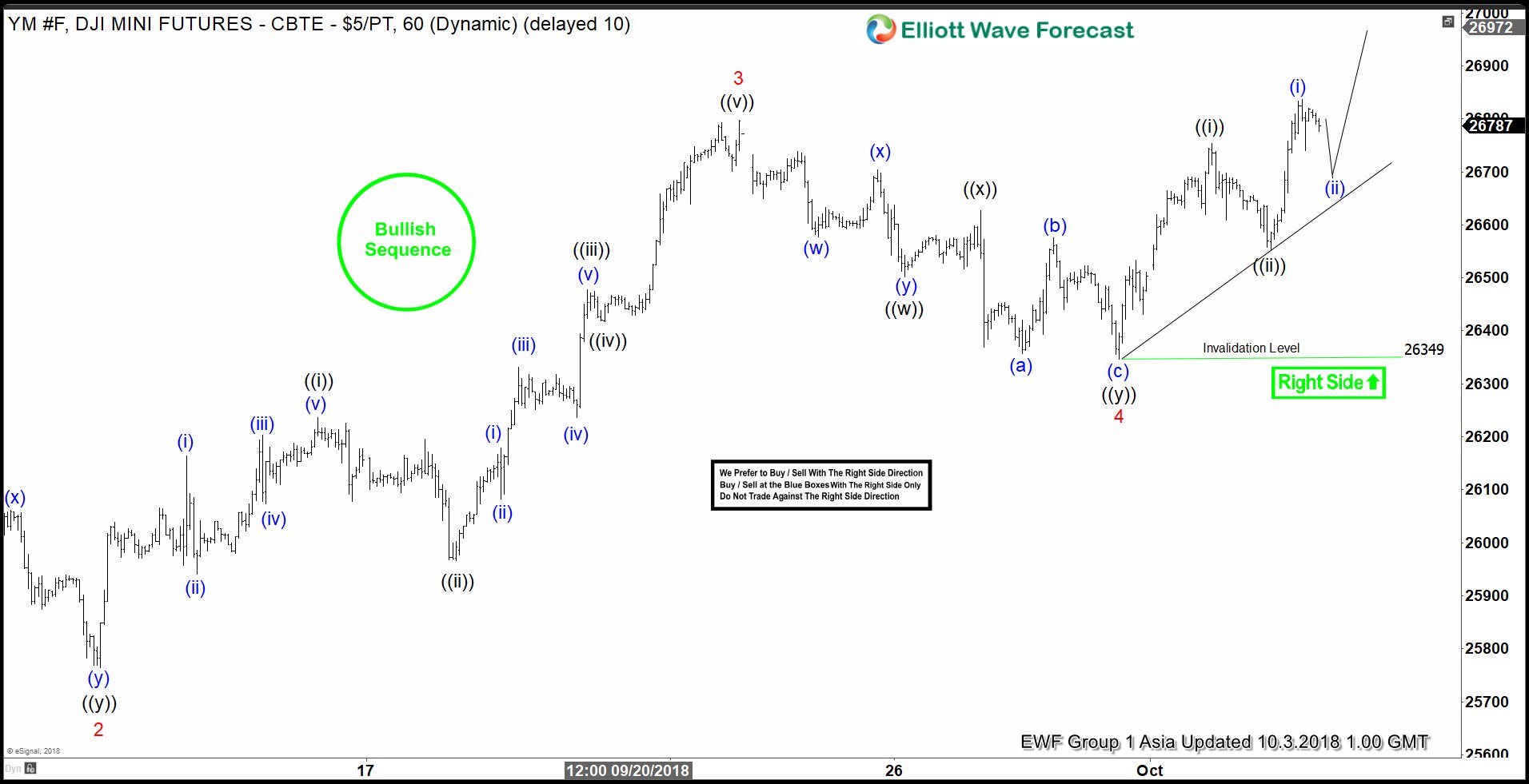

YM_F Elliott Wave: Started Nesting Next Leg Higher

Read MoreDJI Mini Futures ticker symbol: YM_F short-term Elliott wave view suggests that the index is nesting higher as impulse structure looking for more upside. The internals of lesser degree cycles is showing the sub-division of 5 waves advance in each leg higher i.e Minor wave 1, 3 & 5. While Minor wave 2 & 4 […]

-

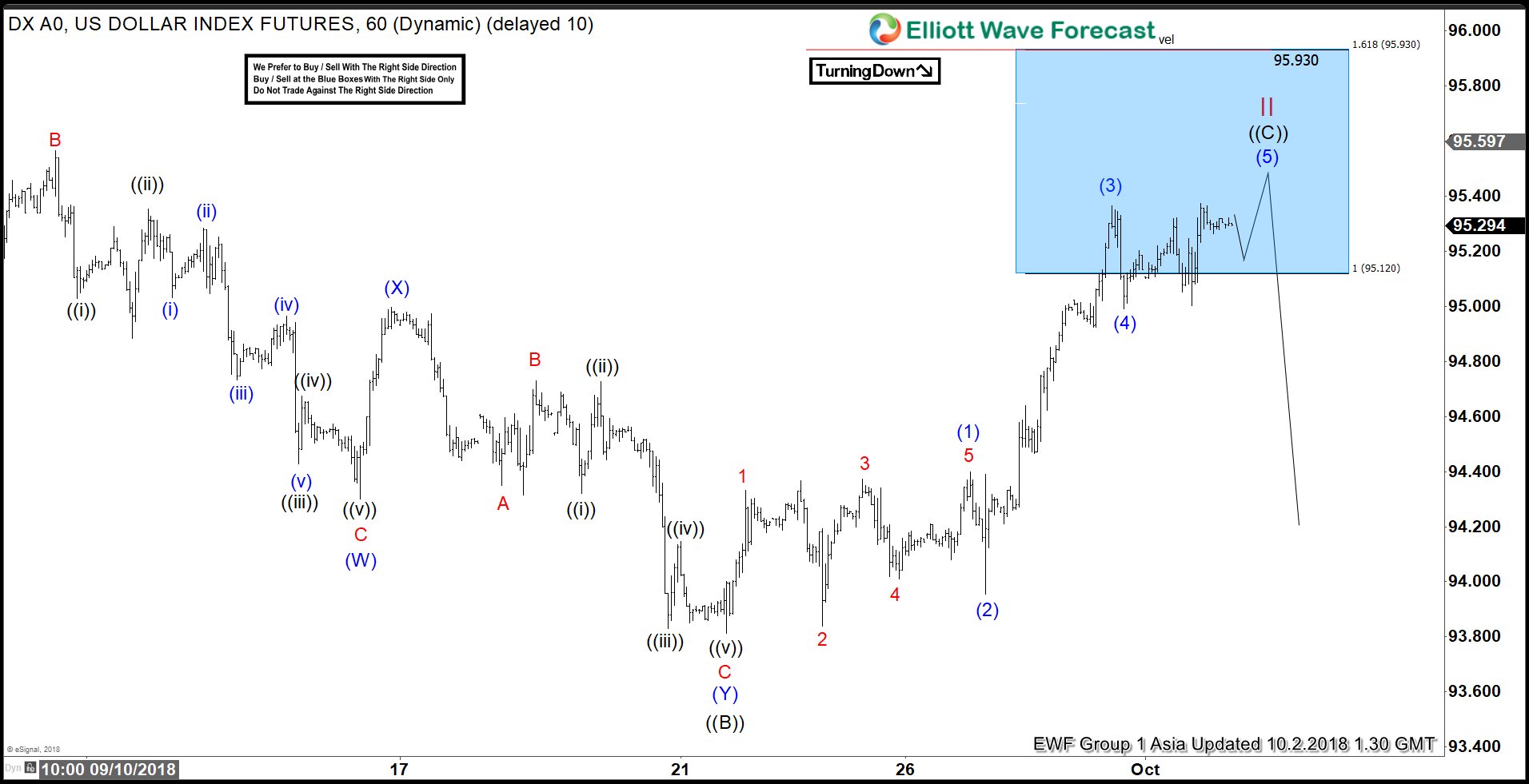

DXY Ending The Elliott Wave Flat Correction

Read MoreDXY short-term Elliott wave view suggests that the index is doing a Flat correction coming from 8/28/2018 low within cycle degree wave II. Meaning that the internal distribution of cycle from that low is showing the sub-division of 3-3-5 wave structure. Where primary wave ((A)) ended in 3 swings at 95.73 on 9/04 peak. Down […]

-

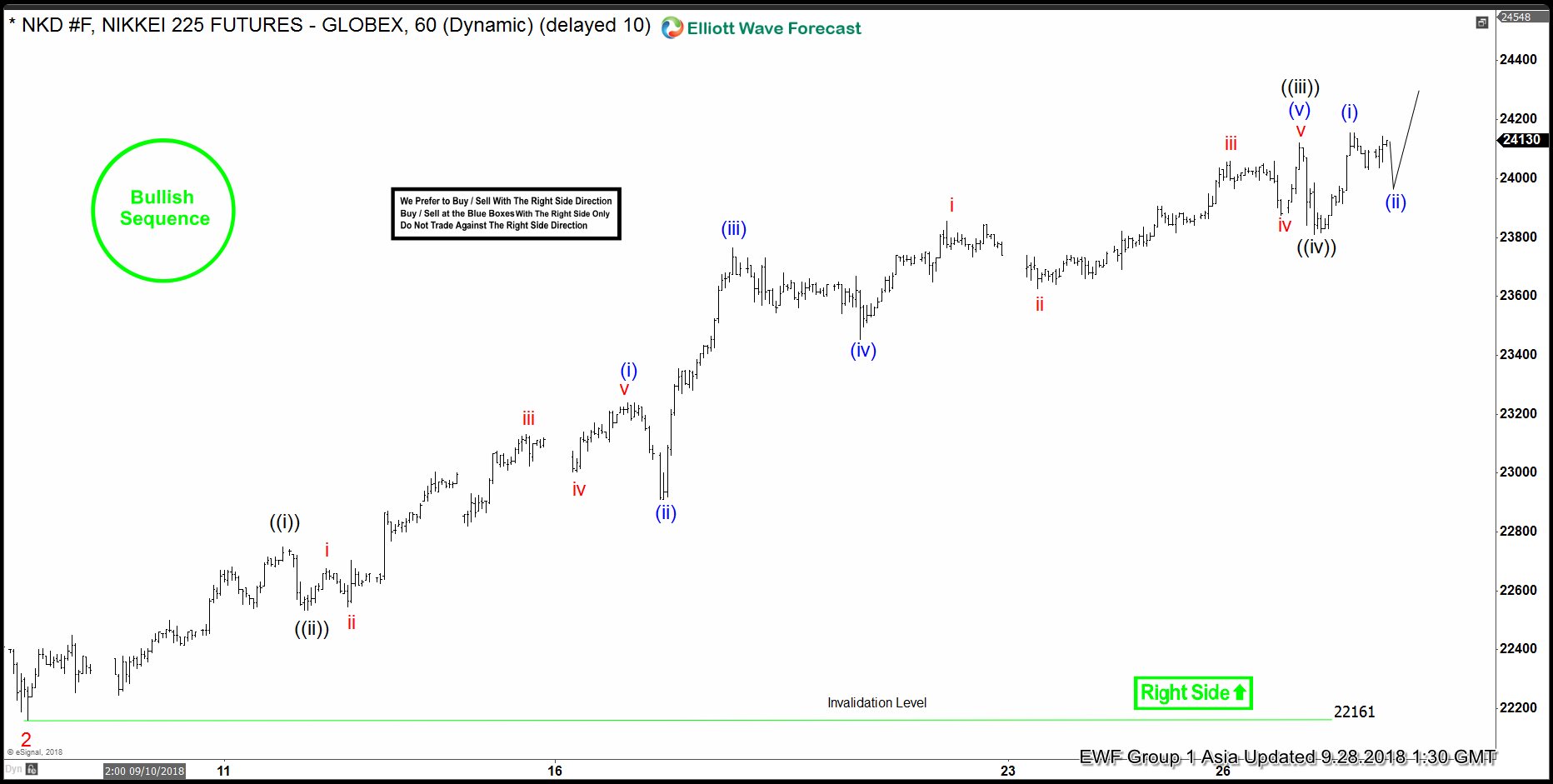

Nikkei Elliott Wave Right Side Calling Higher

Read MoreNikkei short-term Elliott wave view suggests that the decline to 22161 on 9/06/2018 low ended Minor wave 2. Above from there, Minor wave 3 remain in progress, nesting higher in an impulse structure. With lesser degree cycles showing sub-division of 5 waves structure in each leg higher i.e Minute wave ((i)), ((iii)) & ((v)) expected […]

-

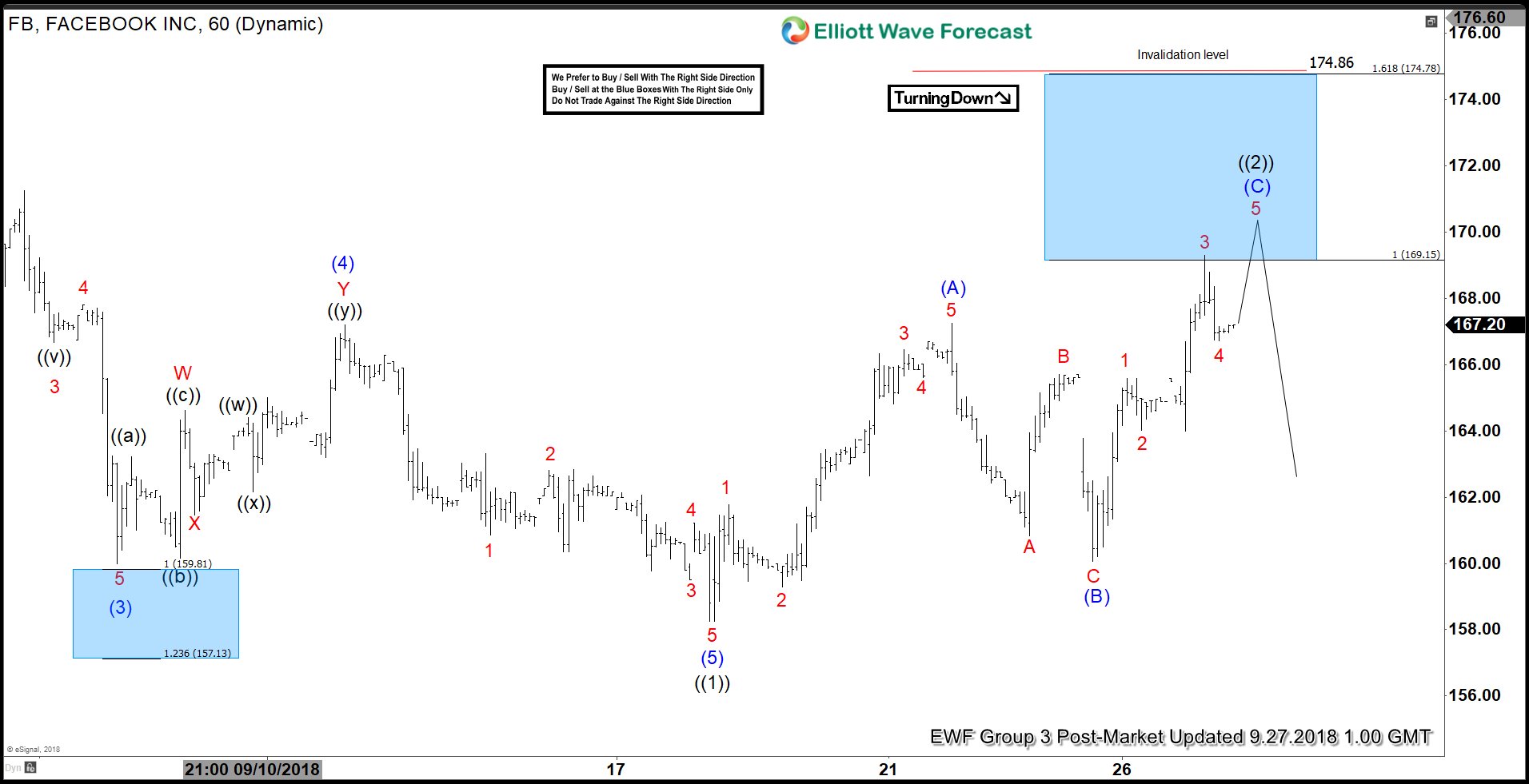

Facebook At Verge Of Rejection Again?

Read MoreFacebook ticker symbol: $FB short-term Elliott wave view suggests that the decline to $158.26 low ended the cycle from 8/07/2018 peak in primary wave ((1)). The internals of that decline unfolded in 5 waves impulse structure with lesser degree cycles showing the sub-division of 5 waves structure in it’s each leg lower i.e intermediate wave […]

-

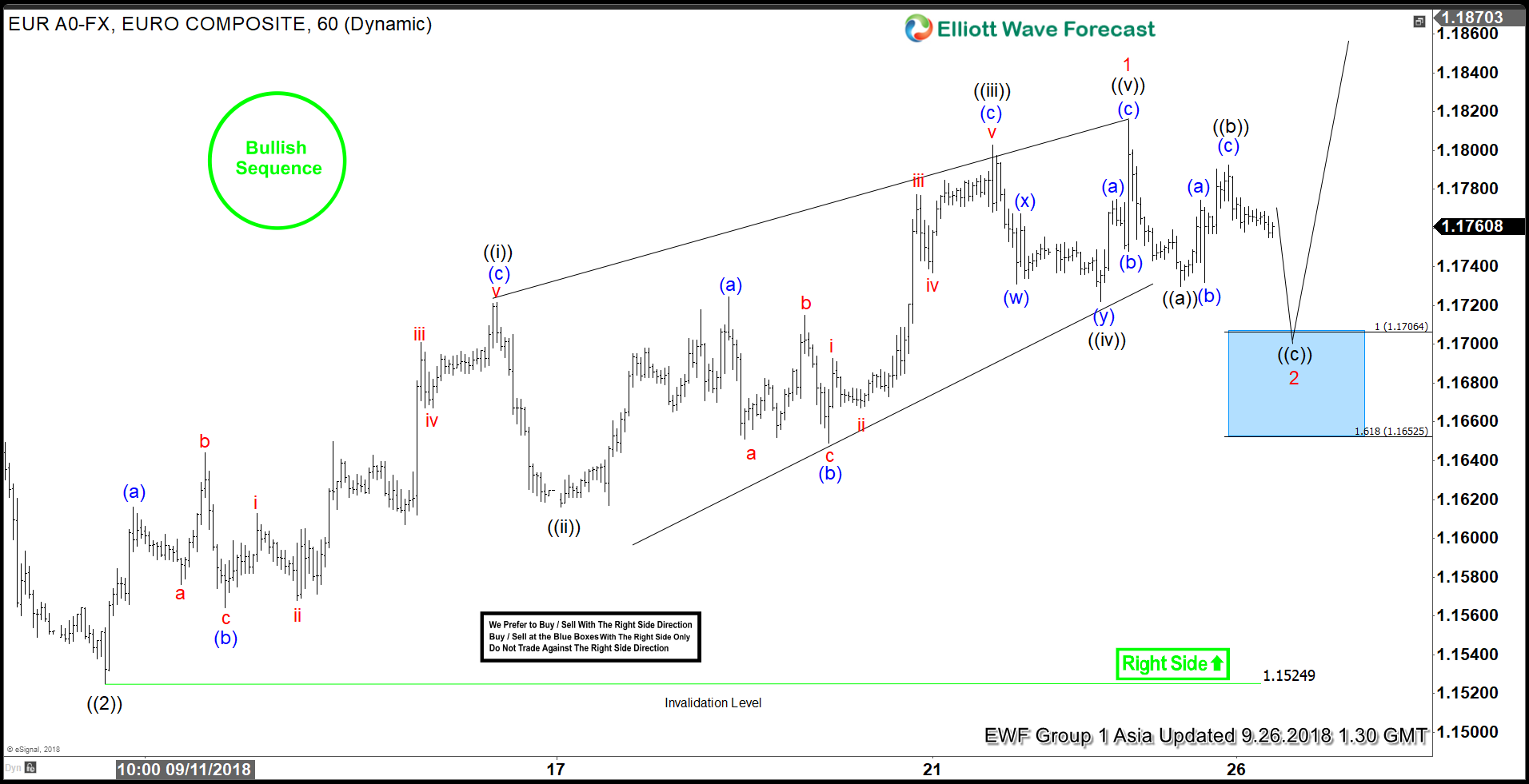

EURUSD Elliott Wave: Why Dips Should Remain Supported?

Read MoreEURUSD short-term Elliott wave view suggests that the decline to 1.1524 low ended Primary wave ((2)) pullback. Above from there, Primary wave ((3)) remain in progress as impulse structure looking for a further extension higher. It’s important to note that the pair is having bullish sequence tag & also the right side tag is calling higher. […]

-

BAC Elliott Wave View: Ready To Resume Higher?

Read MoreBAC short-term Elliott wave view suggests that the rally to $31.49 low ended Minor wave X bounce. Down from there, the decline to $30.08 low ended Minor wave Y & also completed intermediate wave (2) pullback. The internals of Minor wave Y unfolded as double three structure where Minute wave ((w)) ended at $30.62 low […]