-

Apple Nesting Higher As Elliott Wave Impulse Structure

Read MoreApple ticker symbol: $AAPL short-term Elliott wave view suggests that the decline to $215.31 low ended intermediate wave (4) pullback. Above from there, the stock is nesting higher within wave intermediate wave (5) looking for more upside extension. The internals of intermediate wave (5) is unfolding as impulse structure with the sub-division of 5 waves […]

-

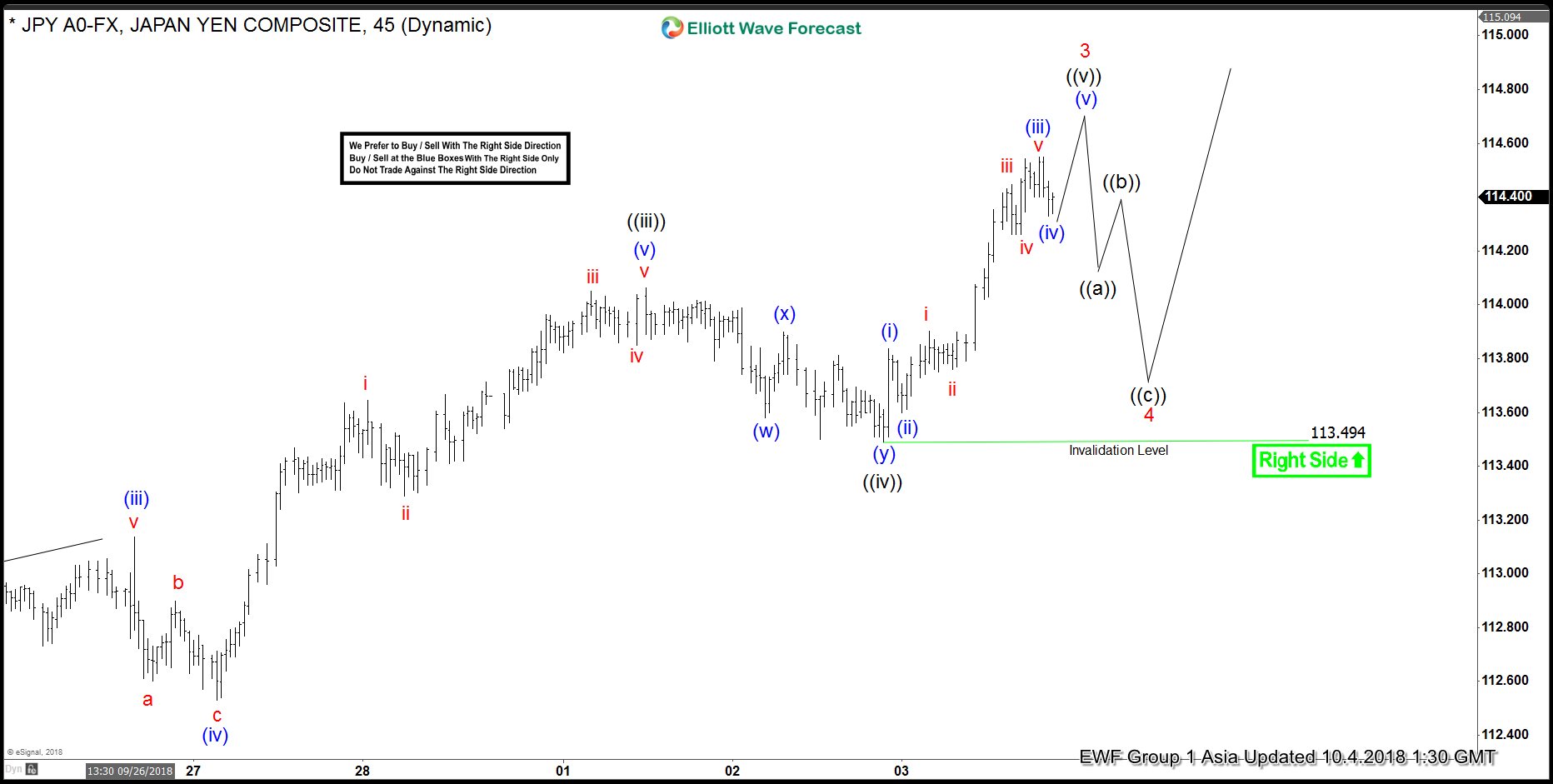

USDJPY Elliott Wave Suggest Extension Towards 118.24-120.30 Next

Read MoreUSDJPY short-term Elliott wave view suggests that the pair is nesting higher as impulse structure. Looking for an extension higher towards 118.24-120.30 100%-123.6% Fibonacci extension area from 3/23/2018 low. And until that area is reached dips are expected to remain supported in 3, 7 or 11 swings looking for upside extension. Currently, Minor wave 3 remain […]

-

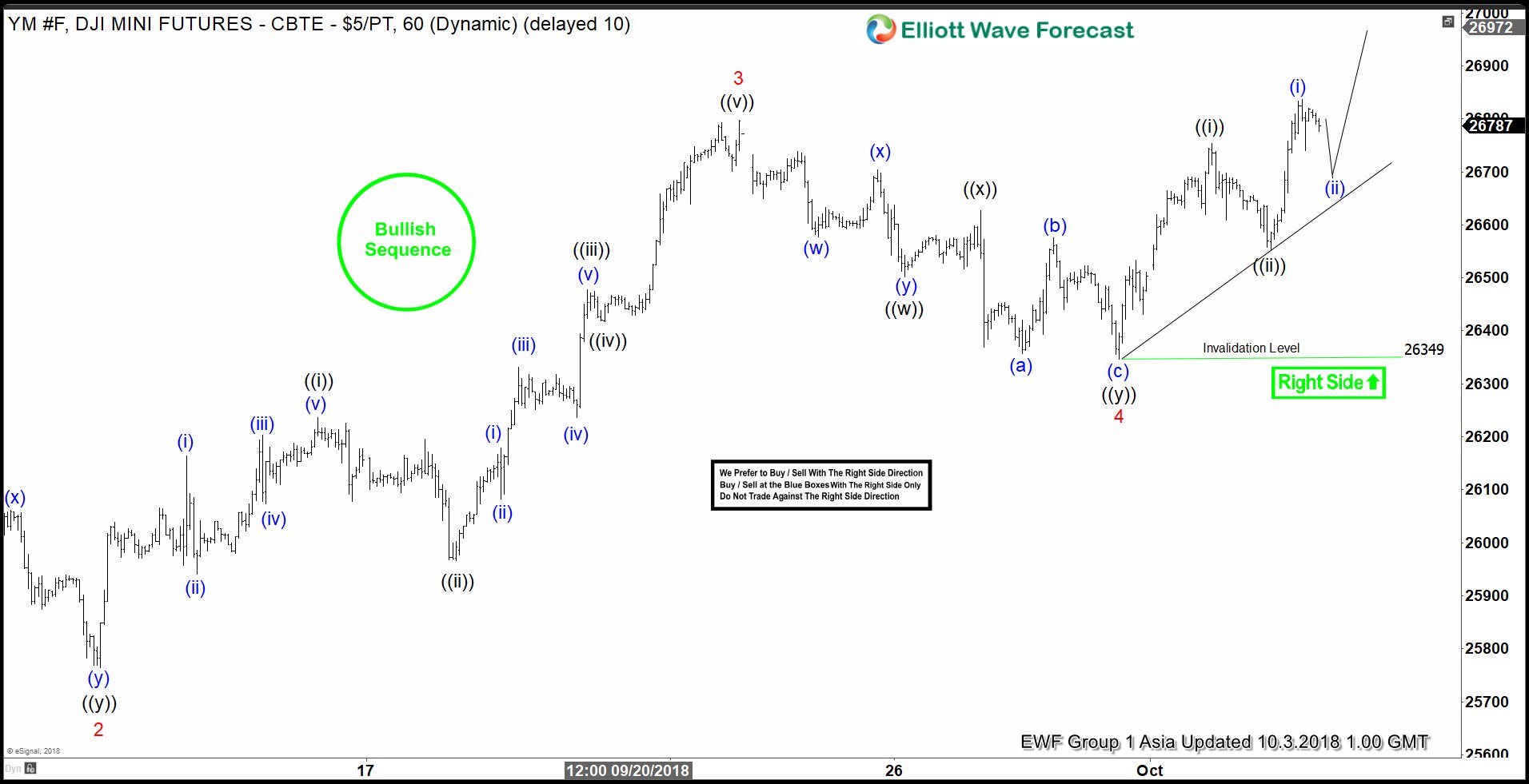

YM_F Elliott Wave: Started Nesting Next Leg Higher

Read MoreDJI Mini Futures ticker symbol: YM_F short-term Elliott wave view suggests that the index is nesting higher as impulse structure looking for more upside. The internals of lesser degree cycles is showing the sub-division of 5 waves advance in each leg higher i.e Minor wave 1, 3 & 5. While Minor wave 2 & 4 […]

-

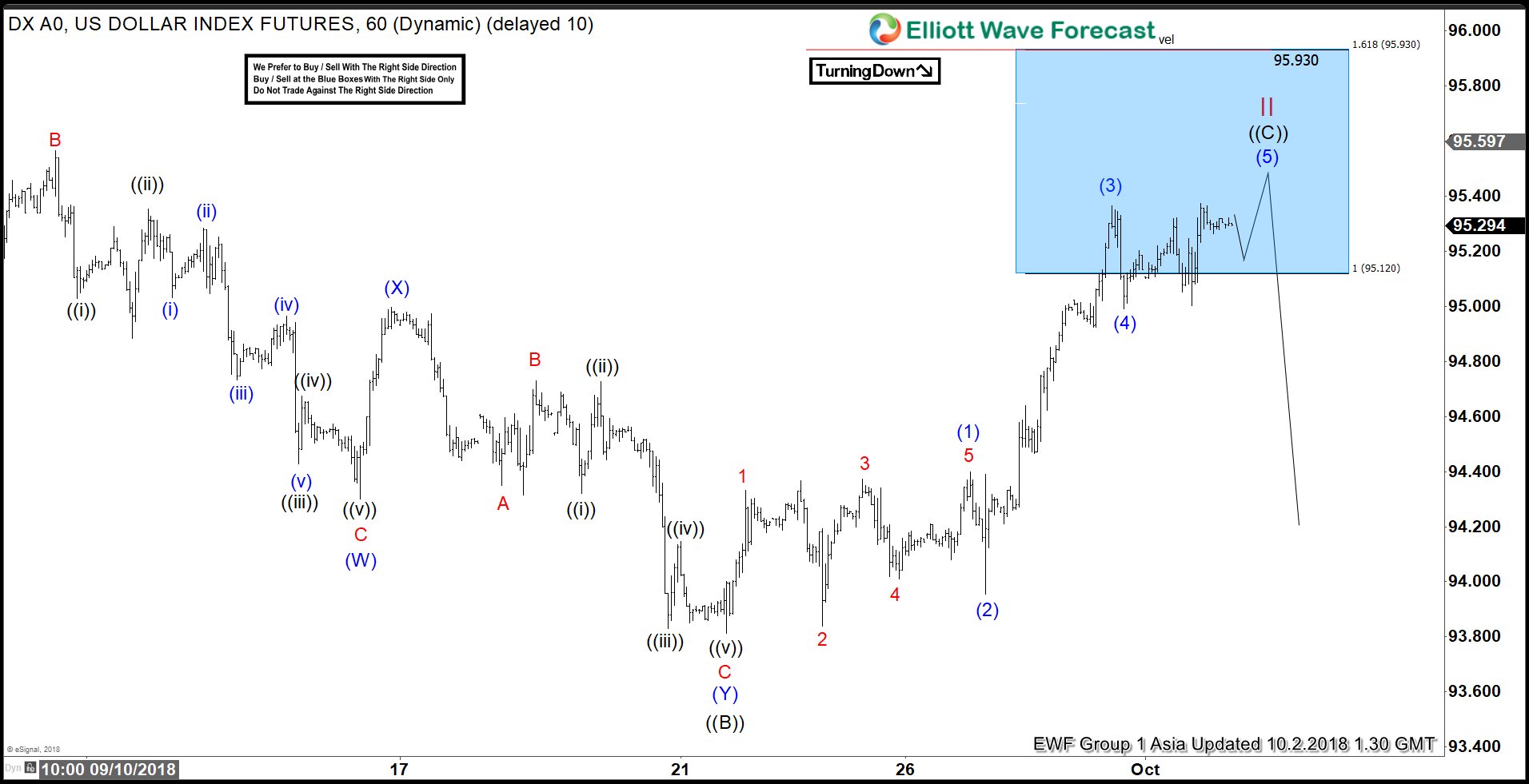

DXY Ending The Elliott Wave Flat Correction

Read MoreDXY short-term Elliott wave view suggests that the index is doing a Flat correction coming from 8/28/2018 low within cycle degree wave II. Meaning that the internal distribution of cycle from that low is showing the sub-division of 3-3-5 wave structure. Where primary wave ((A)) ended in 3 swings at 95.73 on 9/04 peak. Down […]

-

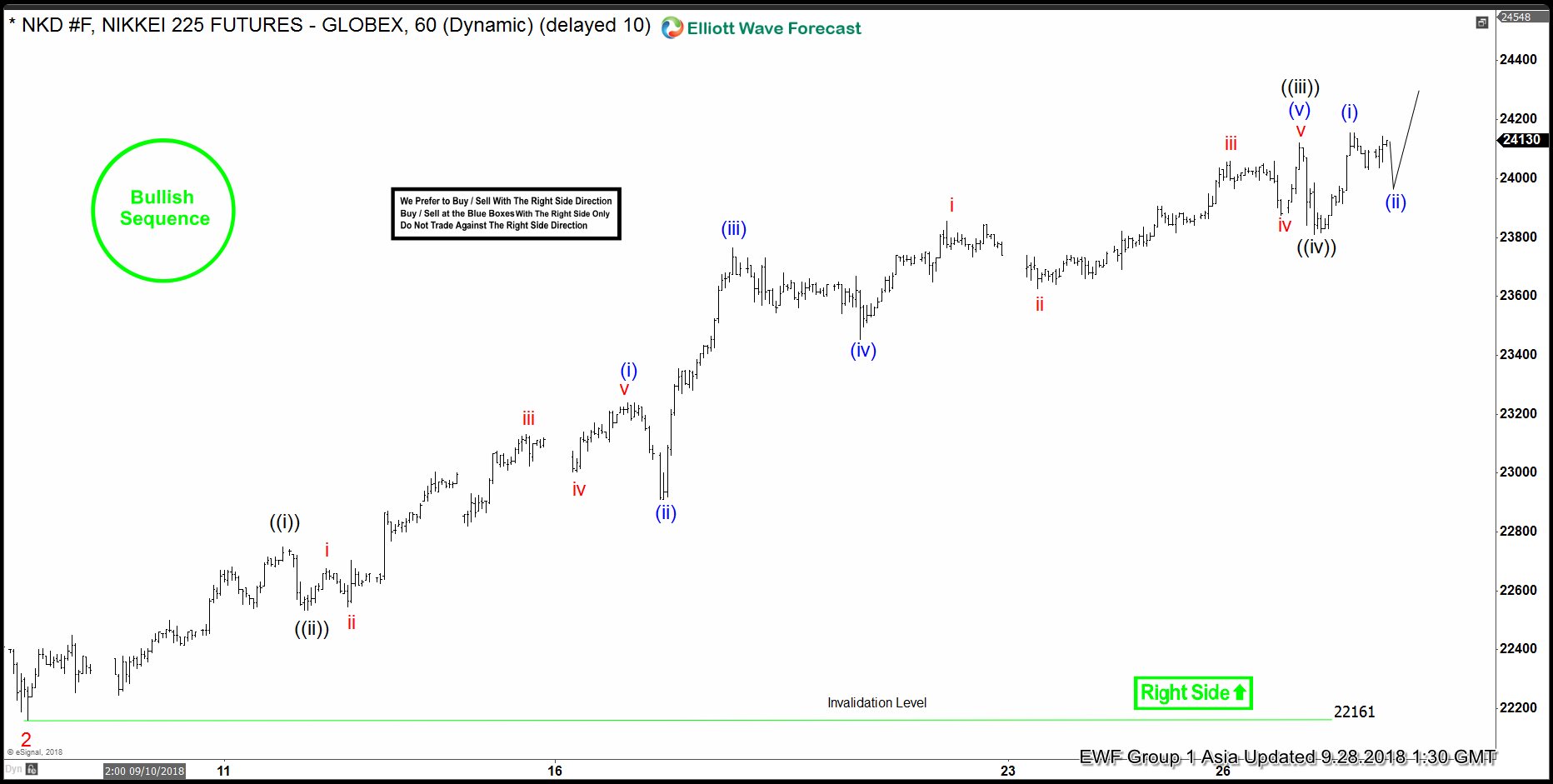

Nikkei Elliott Wave Right Side Calling Higher

Read MoreNikkei short-term Elliott wave view suggests that the decline to 22161 on 9/06/2018 low ended Minor wave 2. Above from there, Minor wave 3 remain in progress, nesting higher in an impulse structure. With lesser degree cycles showing sub-division of 5 waves structure in each leg higher i.e Minute wave ((i)), ((iii)) & ((v)) expected […]

-

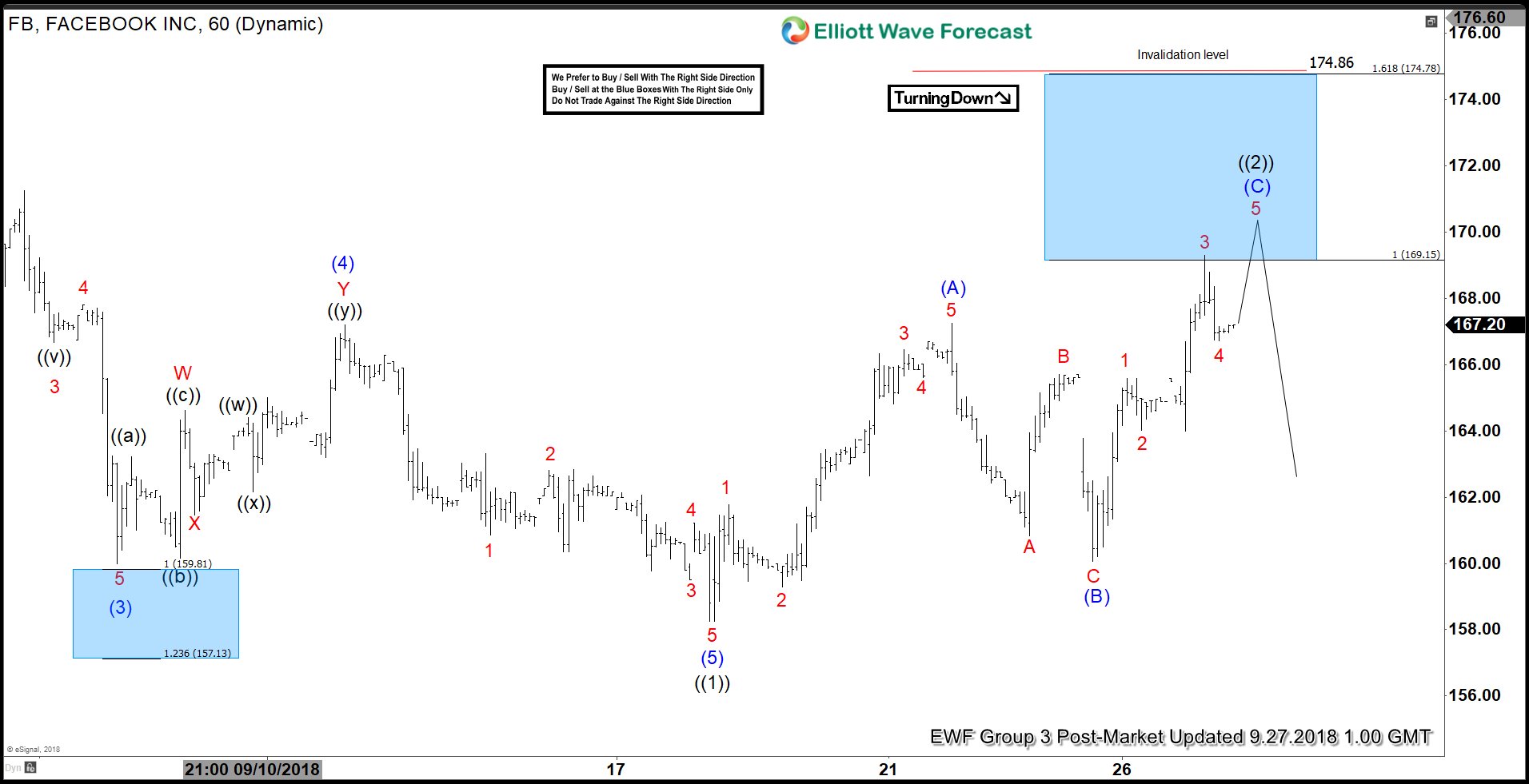

Facebook At Verge Of Rejection Again?

Read MoreFacebook ticker symbol: $FB short-term Elliott wave view suggests that the decline to $158.26 low ended the cycle from 8/07/2018 peak in primary wave ((1)). The internals of that decline unfolded in 5 waves impulse structure with lesser degree cycles showing the sub-division of 5 waves structure in it’s each leg lower i.e intermediate wave […]