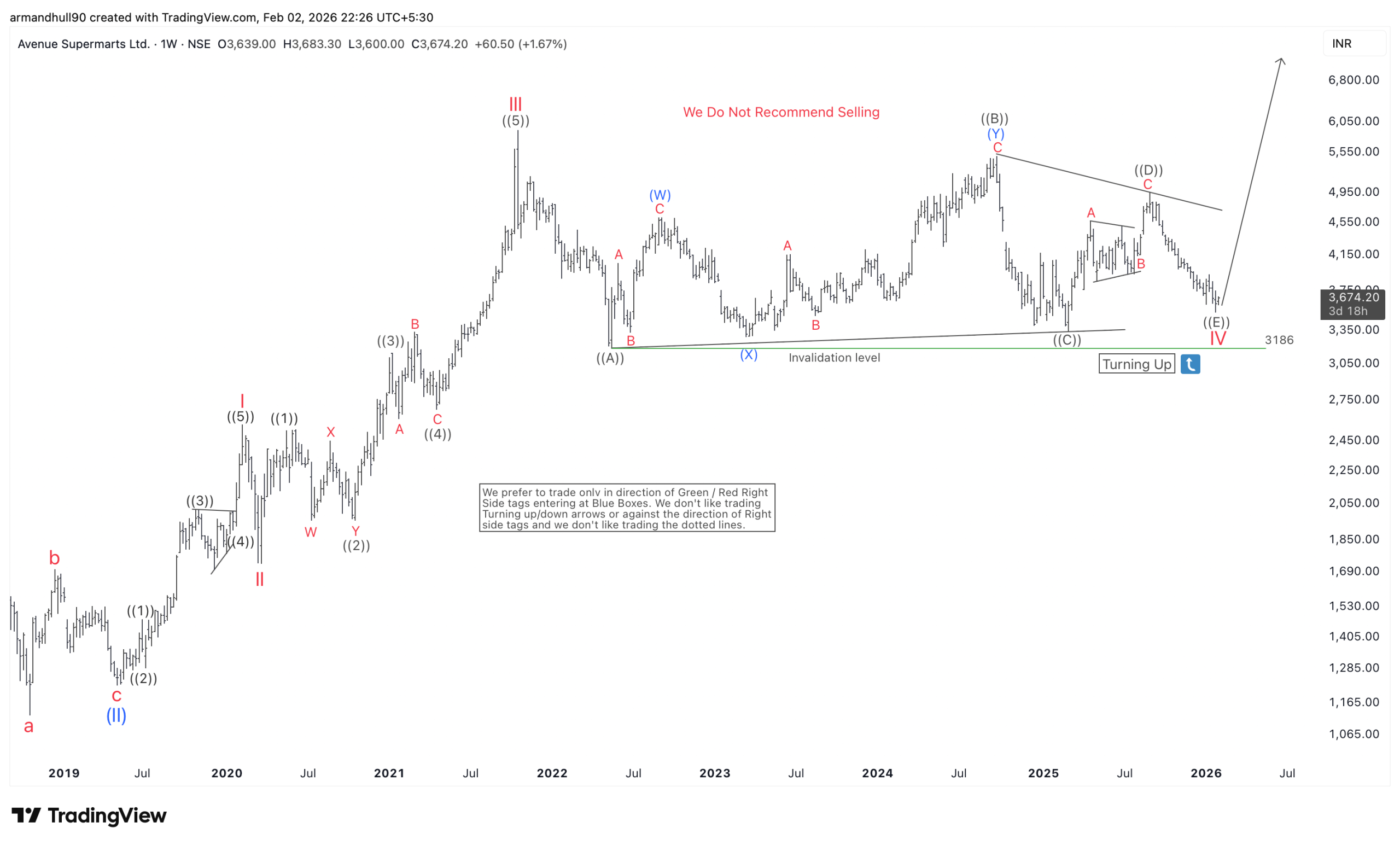

Wave IV consolidation since late 2021 appears to be maturing near key support. Elliott Wave structure favors a Wave V breakout toward the 6,600–6,800 zone

Avenue Supermarts Ltd. (DMart) is showing a strong bullish structure on the weekly chart based on Elliott Wave theory. The long-term trend turned positive after the stock formed a major bottom at blue wave (II). From this low, DMart started a new bullish cycle and completed a clear five-wave impulsive move in wave I. This was followed by a healthy correction in wave II, which set the base for the next rally.

After the wave II low, DMart delivered another strong five-wave advance in wave III. This confirmed the continuation of the long-term uptrend. Since late 2021, the stock has been moving sideways and forming a broad consolidation. This phase is marked as wave IV. The correction has been ongoing for a long time, which makes the overall setup stronger. Long consolidations often prepare the ground for the next trending move.

Within wave IV, the price action has shaped into a five-legged contracting triangle pattern. This is a common Elliott Wave structure that appears before the final wave of an impulsive cycle. The triangle reflects tight price movement and declining volatility. Such patterns usually resolve with a strong breakout.

The key support and invalidation level remains near 3,186. As long as DMart share price stays above this level, the bullish Elliott Wave count remains valid. A sustained move higher from the current range would confirm that wave V has started. If this scenario plays out, the next upside target for DMart lies near the 6,600–6,800 zone over the medium to long term.

Summary

In summary, DMart remains in a long-term bullish Elliott Wave cycle. The completion of a five-legged contracting triangle in wave IV suggests that the stock is preparing for the next impulsive leg higher. A confirmed break and hold above 3186 would strengthen the case for wave V targeting the 6631 area in the coming phase. For trend-aligned investors, the current structure favors positioning in the direction of the broader bullish trend rather than selling into consolidation.