The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave suggests Real Estate ETF ($IYR) Should Extend Higher

Read MoreHello Everyone! In this technical blog, we are going to take a look at the Elliott Wave path in Real Estate ETF ($IYR). The iShares U.S. Real Estate ETF seeks to track the investment results of the $DJUSRE index. The index is composed of U.S. equities in the real estate sector. It provides exposure to U.S. […]

-

Webinar Recording: Commodities – What Is Next?

Read MoreWe conducted a Free webinar on Friday, 13th January 2023 titled Commodities – What Is Next? in which in the beginning we explained various Elliott wave structures like Impulse and a nest and extensions. We also explained the cycles and market correlation (first and second dimensions) and then we looked across the market and explained US […]

-

$NLST: How Strong is Bearish Pressure on Netlist?

Read MoreNetlist Inc. is a designer and manufacturer of high-performance SSDs, modular memory subsystems and legacy memory products. Netlist holds a portfolio of patents in the areas of server memory, hybrid memory, storage class memory, rank multiplication and load reduction. The products are sold to enterprise and appliance customers, system builders and cloud and datacenter customers. […]

-

Twitter: Good Timing For The Buyer, Bad Timing For The Sellers

Read MoreTwitter (TWTR) has been in the news later when the board agreed to sell the company to Elon Musk for $54.20 per share, around 44 billion dollars. The deal has not been completed, and it is pending to the best of our knowledge. We, at Elliottwave-Forecast looked at the symbol’s technical side and the future […]

-

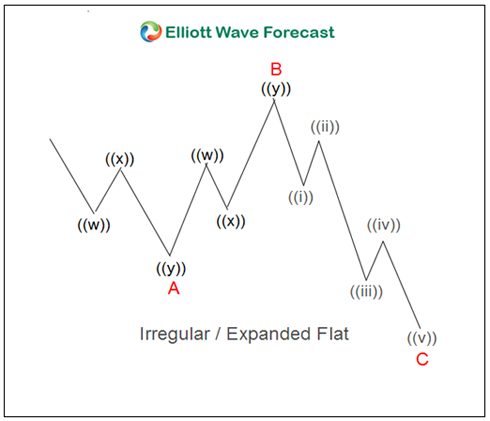

$SPX: The Expanded Flat, Which Tricked Buyers Last Month

Read MoreThe Expanded Flat is one of trickiest structures in the Elliott Wave Theory. The structure comes with a strong reaction after new highs are made. But the idea is that the reaction comes in five waves, which confuse wavers. As a result, wavers often get trapped by the structure. When Mr. Elliott developed the theory […]

-

Webinar Recording: Indices Future Advance – Series of wave 4,5 or a Super Rally

Read MoreWe conducted a Free webinar on Friday, 18th March 2022 titled Indices Future Advance – Series of wave 4,5 or a Super Rally in which we explained looked at the history of $SPX and debated the starting point of $SPX and talked about the most likely Elliott wave counts based on what year we use […]