-

Webinar Recording – Indices Super Rally or Crash?

Read MoreWe conducted a Free webinar on Friday, 8th October 2021 titled Indices Supper Rally or Crash? in which we talked about Elliott wave structures in various Indices to arrive at the conclusion whether Indices will be going into a Crash or a Super Rally? We explained two paths in $SPY and then looked at Elliott […]

-

LUV (Southwest Airlines) shows a nice Elliott wave structure

Read MoreLUV (Soutwest Airlines) shows a very constructive price action since the all-time lows. We can see a very nice impulse or five waves into the peak in 2017. The Elliott Wave Theory’s main message is that the trend advances in five waves and then a pullback in three waves. The following chart is a representation […]

-

Royal Gold ( RGLD) : The stock might show the path for Gold

Read MoreRoyal Gold is an ETF with a higher degree correlation with Gold and might show a path for an expected move higher in Gold into the $2700.00 area. The Symbol shows five swings or waves since the all-time lows, which is a bullish structure. In the Elliott wave Theory, every time five waves or swings […]

-

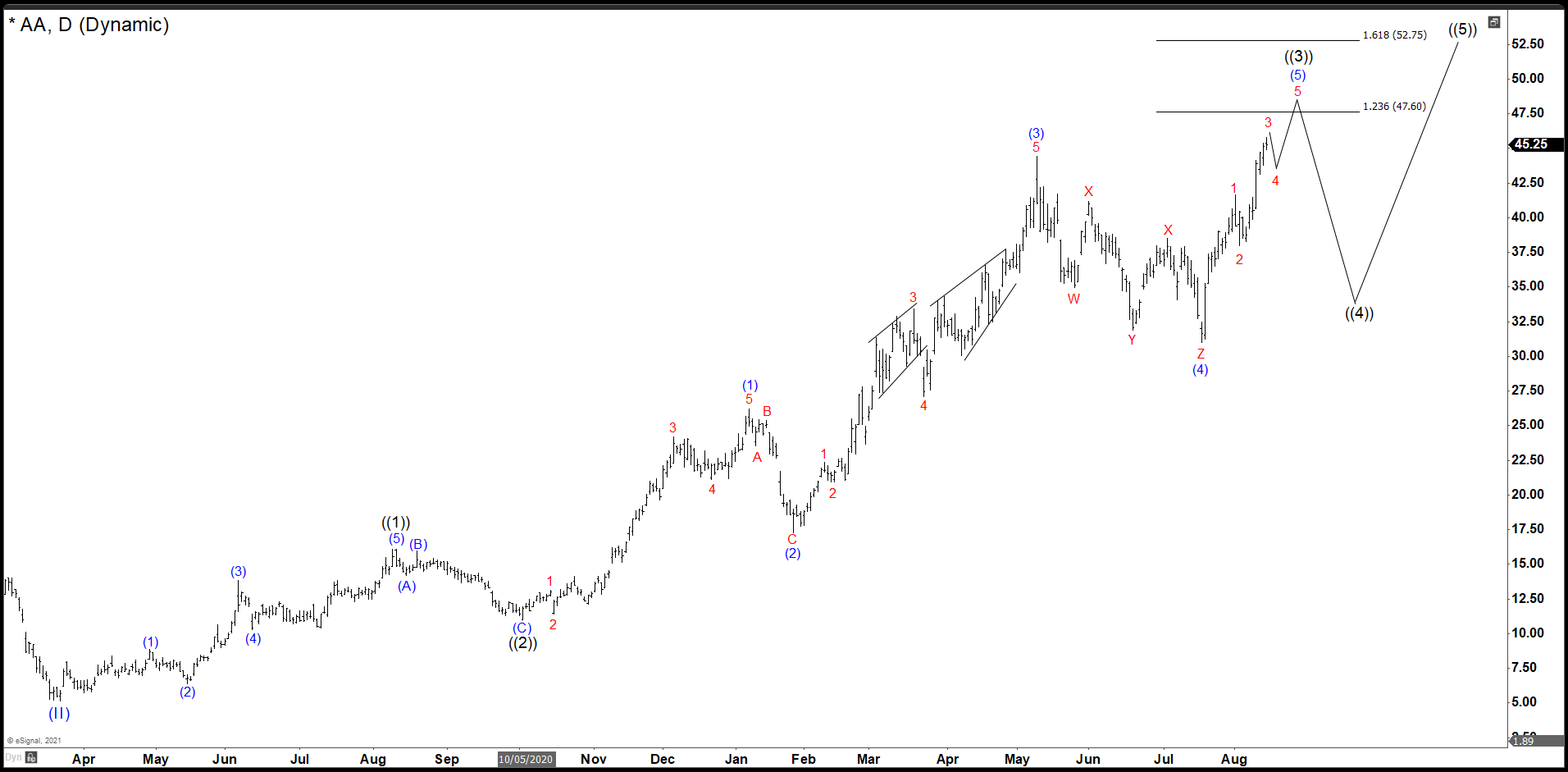

Alcoa Did A Triple Correction And Rally. Impulse Almost Done!

Read MoreSince March 2020 crash, Alcoa (AA) has risen in share value around 800% and with the high prices of the Aluminum it must continue rising its value. Besides, AA has built an incomplete impulse and it needs to keep the rally to develop the whole structure. We are considering a target above $47.00 dollars in […]

-

Is it Time for a COKE or Wait for It to become Ice Cold!

Read MoreTemperatures Soaring – Is it time for a Coca Cola drink? In today’s article, we will look at the difference between COKE and KO tickers and determine whether it’s the right time to consume Coca Cola (COKE) or should we leave it in the refrigerator for now and wait for it to become Ice cold? […]

-

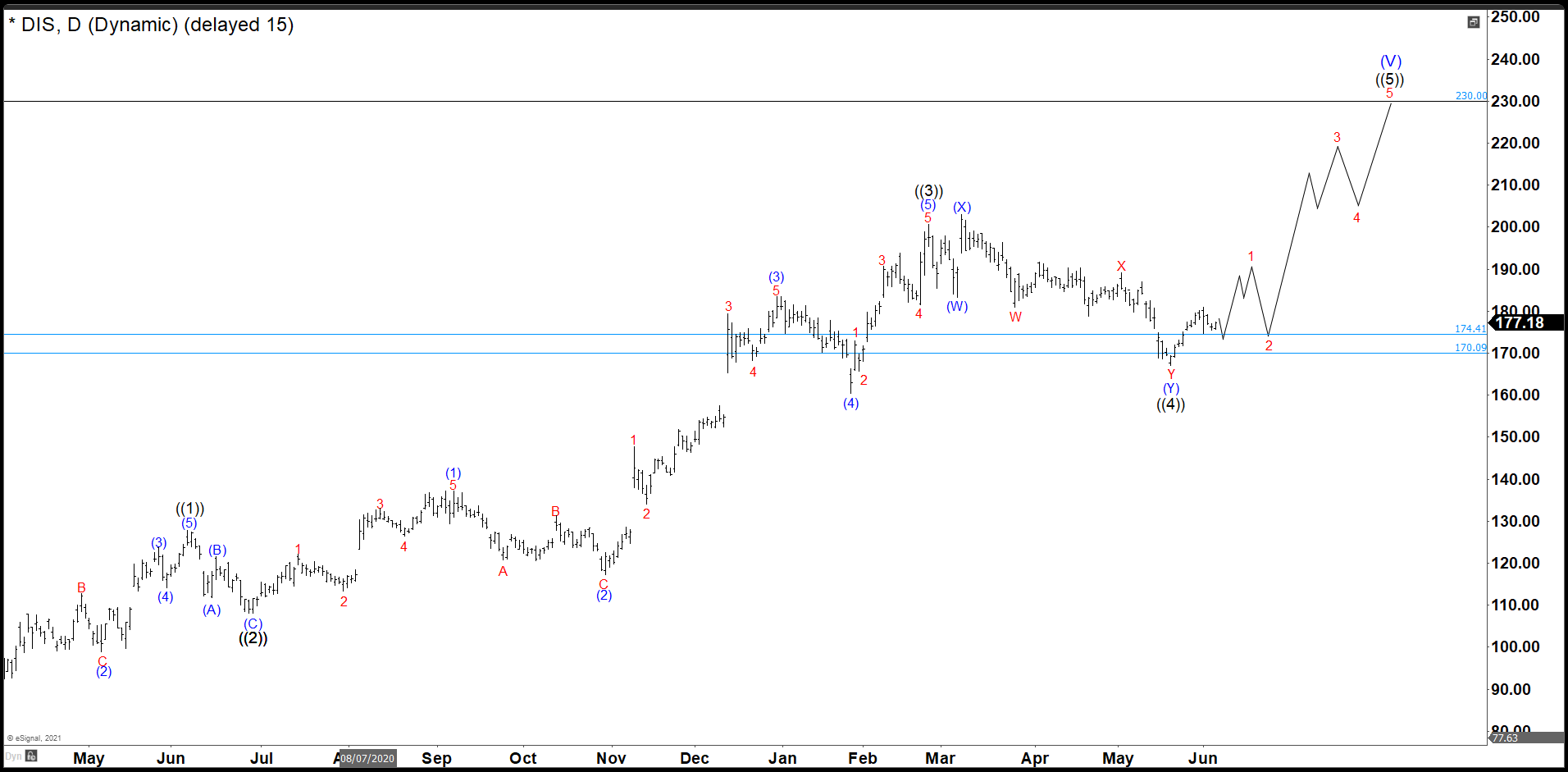

Disney Still Needs One More Swing To Complete An Impulse. Why $230 Target?

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]