Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

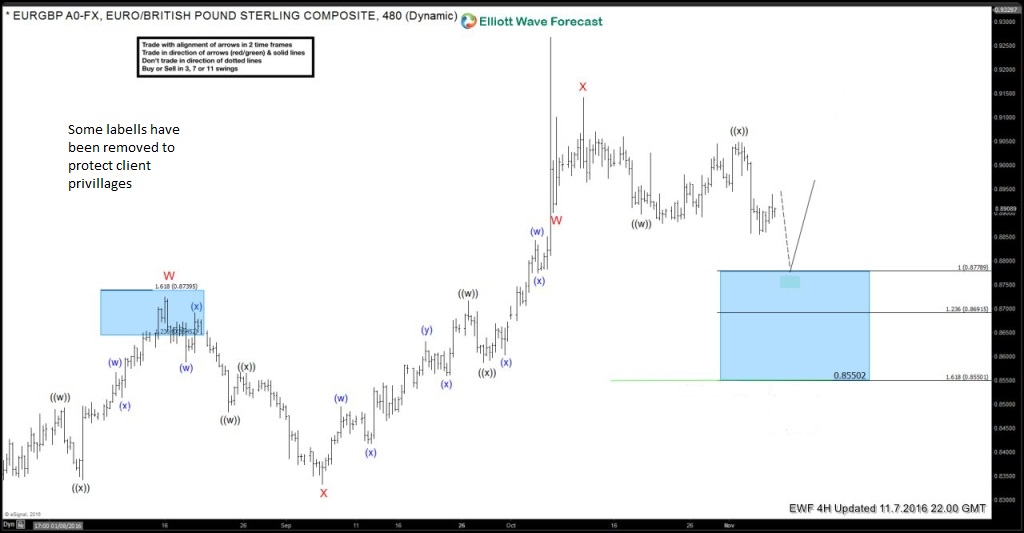

EURGBP forecasting the decline into the Election day

Read MoreIn this technical blog we are going to take a quick look at the $EURGBP 4 hour chart dated: 7th of November 2016. Pair since the October 7th peak (0.9224) was showing lower lows & lower highs, also was missing the extreme from the peak favored another push lower in the pair to happens to […]

-

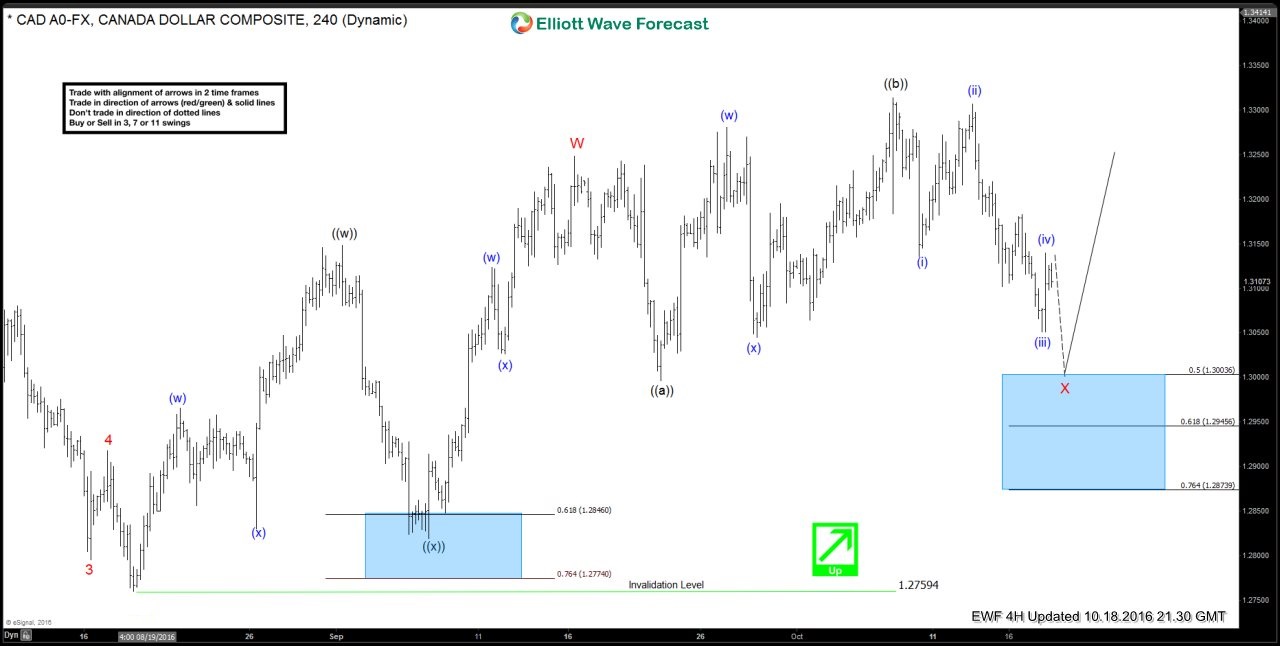

USDCAD: Buying the dips based on incomplete Elliott wave sequence

Read MoreIn this technical blog we are going to take a look at USDCAD October 18th 2016, 4 hour chart. In which pair was showing incomplete Elliott wave bullish sequence from May 3rd 2016 lows (1.2460) showing higher highs & higher lows. Hence, the strategy was to buy the dips in sequence of 3, 7 or […]

-

$EURAUD forecasting the path & selling the rallies

Read MoreOn August 10th $EURAUD broke the previous low from April 21st @1.4425 , making the bearish cycle from the Febrtary peak still alive. Our Elliott Wave analysis suggested for at least another big swing lower below 1.44037 low, so we recommend our members to avoid buying the pair and keep selling the rallies against the […]

-

NZDCAD Elliott Wave Trade Setup 10.13.2016

Read MoreNZDCAD is showing a 5 swing sequence from 8/24 (0.8246) low and more upside is favored. Near term, pair is correcting cycle from 4/27 (0.86) low in 3, 7, or 11 swing before turning higher again. We plan to buy the pullback in 3, 7, or 11 swing for another extension higher. Entry: 0.912 (updated Oct 23) Stop loss: […]

-

$GBPAUD Elliott Waves: Forecasting The Decline

Read MoreHello fellow traders, the video below is short capture from the London Live Analysis session held on 10/04 by EWF Senior Analyst Daud Bhatti. Back then, Daud presented Elliott Wave count of $GPBAUD, suggesting further decline due to a fact the pair was showing incomplete bearish swings sequences in the cycle from the September peak. […]

-

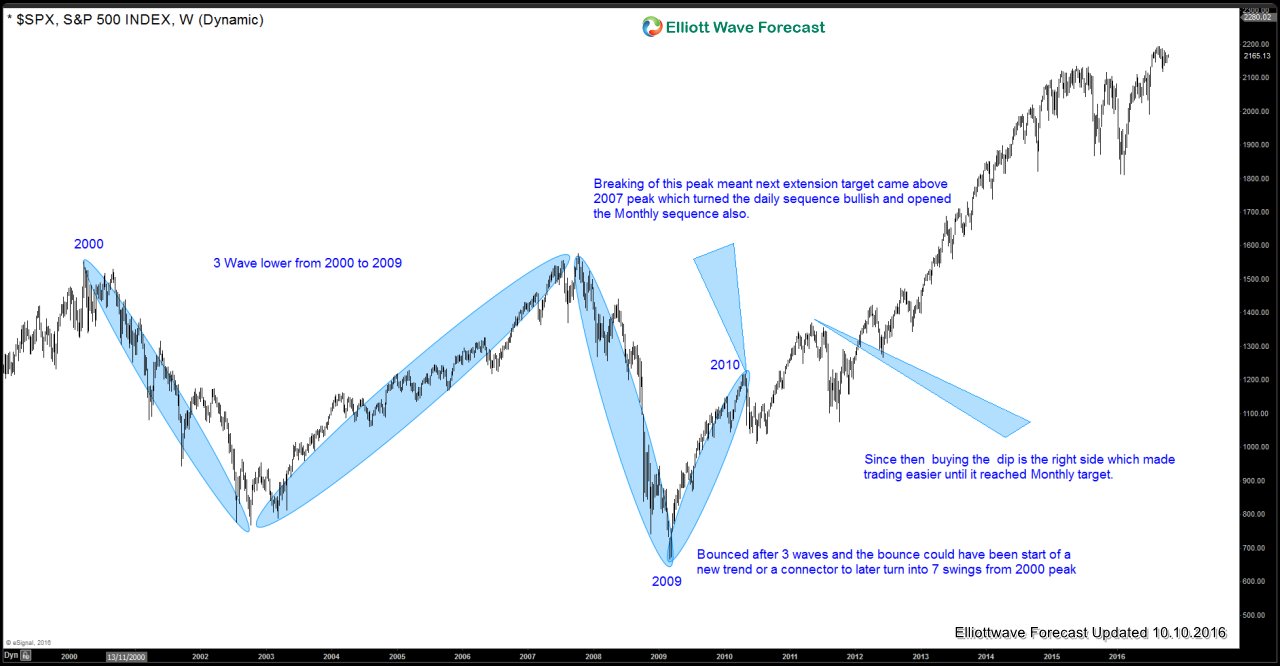

The Art of Trading

Read MoreThe Art of trading: Using Elliott wave as a compass Many years have passed since the creation of markets, trading and since the introduction of the Elliott wave Theory. The Reality is that for years traders have been trying the best way to get money out of the Market, which sometimes is easier than others. Trading, […]