The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Starbucks (SBUX) Ending Correction and Turning Bullish

Read MoreStarbucks Corporation (NASDAQ: SBUX) began the new year slightly below its long-term plan as revenue only improved by 7% and earnings per share rose 11%. The company continues to target earnings growth of between 15% and 20% each year through 2021 with its aggressive expansion plan, which aims to add 12,000 new locations over the next five […]

-

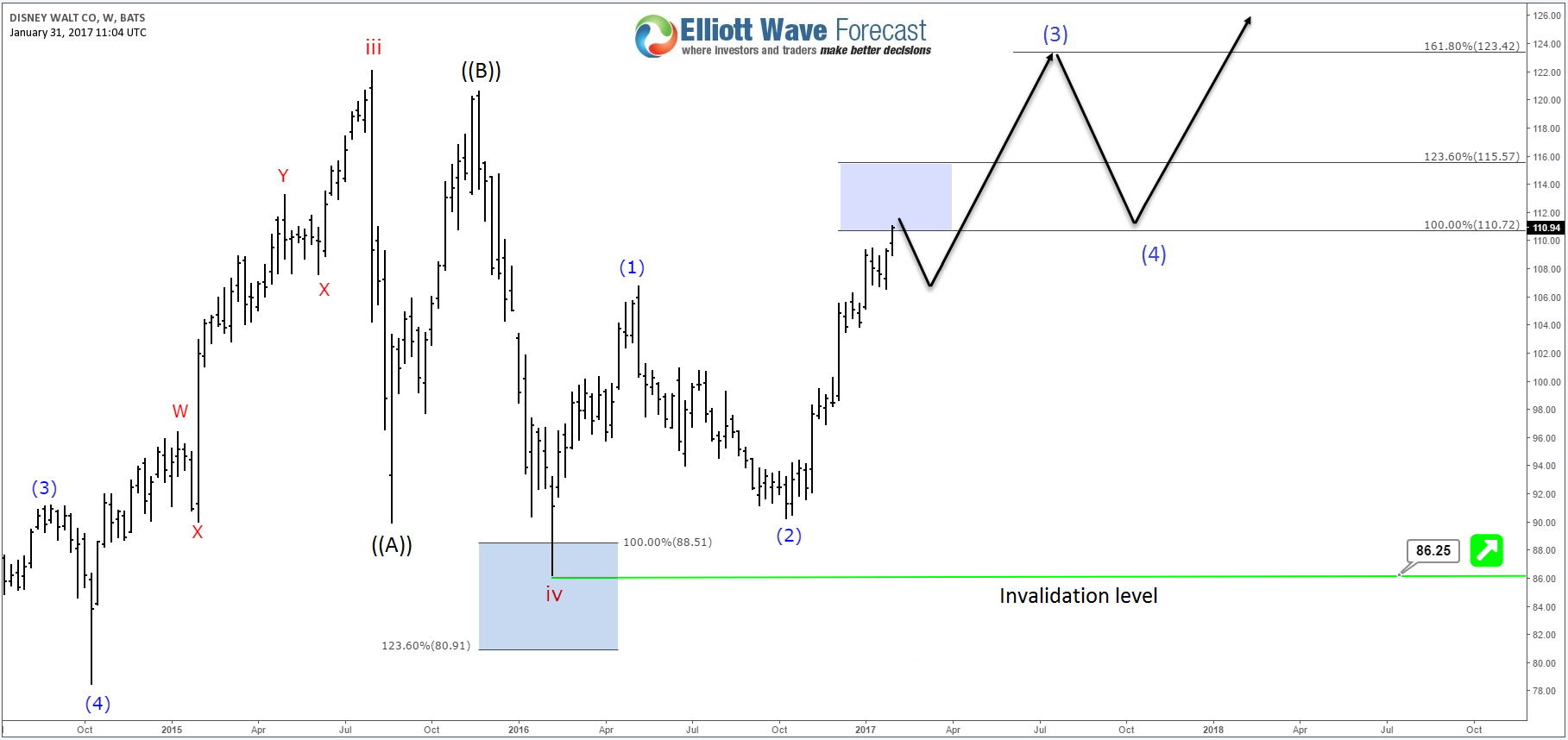

Can Disney shares break to new all time highs ?

Read MoreWalt Disney Company (NYSE: DIS) is one of the strongest players in the entertainment industry on a global scale and it rewarded its investors by a +255% return over the recent decade , more than twice the S&P 500’s 95% total return. The company wrapped up its sixth consecutive year of record-high sales and profits with revenue […]

-

ASX All Ordinary ( $XAO) showing incomplete pattern

Read MoreIn this Technical blog we are going to take a quick look at ASX (XAO) All ordinary from Australia is correcting the cycle from November 9,2016 lows. Where as the structure from January 09,2016 peak suggesting the index has broken below the January 23 low (5661), as shown below the 4 hour chart of ASX from […]

-

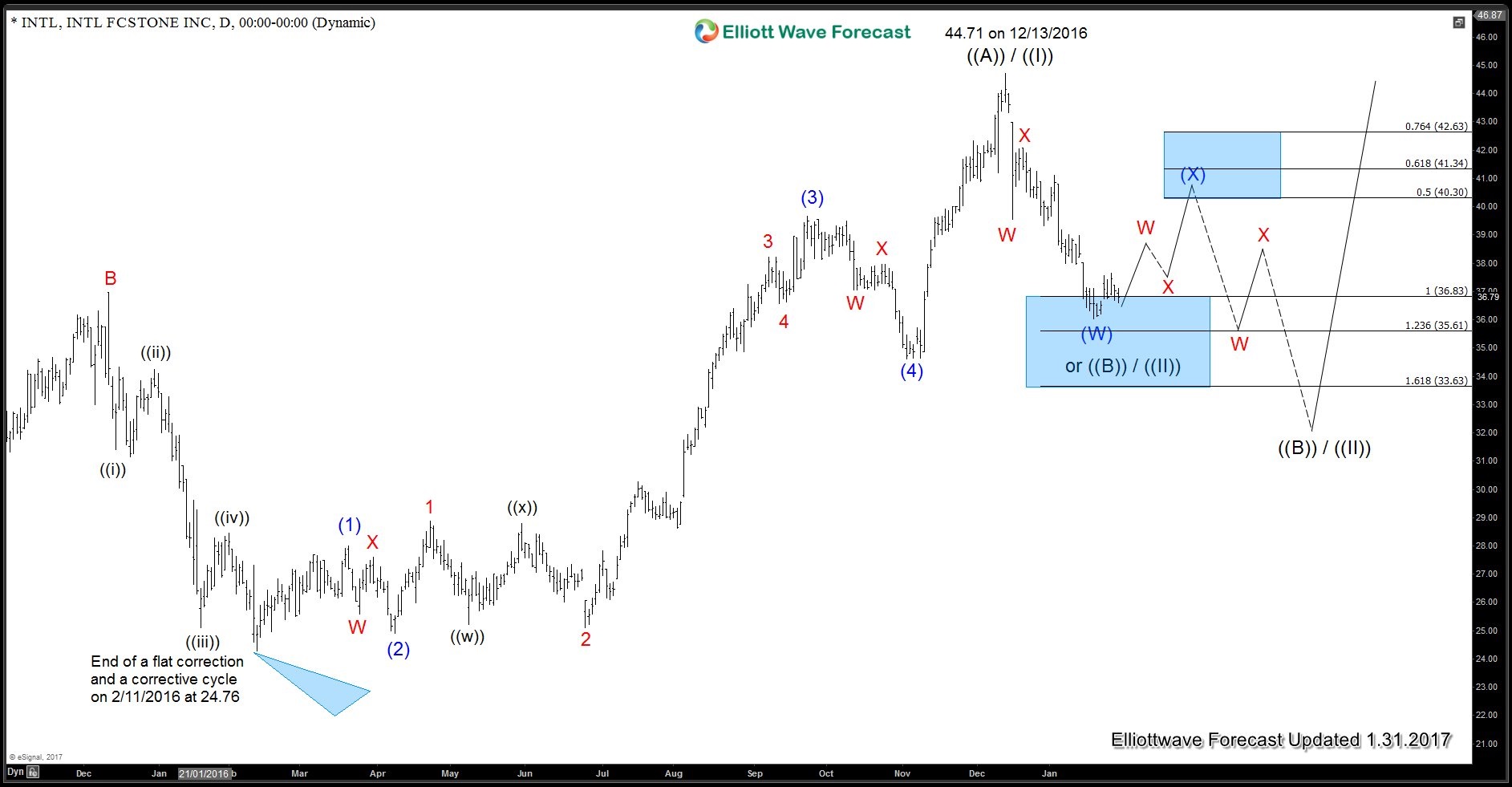

$INTL INTL Fcstone Inc Daily Elliott Wave Analysis

Read MoreThis is a daily Elliott Wave analysis of the aforementioned company. Firstly I will mention some of the company’s past history and merger. INTL Fcstone Inc is a Fortune 500 financial services industry firm listed on the Nasdaq exchange. The company has offices worldwide and is headquartered in New York City, NY in the United […]

-

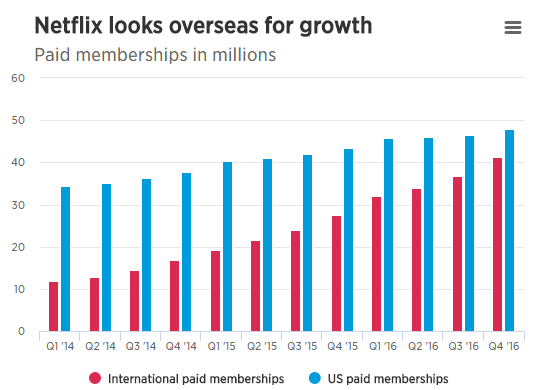

Do you need to worry about Netflix 5 waves move ?

Read MoreNetflix (NFLX) is an American multinational entertainment company that specializes in streaming media , film and television production , as well as online distribution and DVD by mail. Last week , the company posted its biggest-ever quarterly subscriber growth with 7.05 million new subscribers beating its own expectations of 5.2 million . As we can see in the chart below that Netflix international […]

-

DAX Intra-day Analysis: Wave 3 in progress

Read MoreDAX extend the rally today and broke to a new high above blue (3). Index has reached 2.618 – 3.236 extension area where black wave ((iii)) can complete and we can see a pull back in black wave ((iv)) followed by more upside towards 11866 – 11951 area to complete red wave 3. We can […]