The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

CROX Reacted Higher From Blue Box Area & Favors Upside

Read MoreCrocs Inc., (CROX) designs, manufactures, markets & distributes casual lifestyle footwear & accessories for men, women & children worldwide. The company sells its products in approximately 85 countries through wholesalers, retail stores, e-commerce sites & third-party marketplaces. It is based in Colorado, US, comes under Consumer Cyclical sector & trades as “CROX” ticker at Nasdaq. […]

-

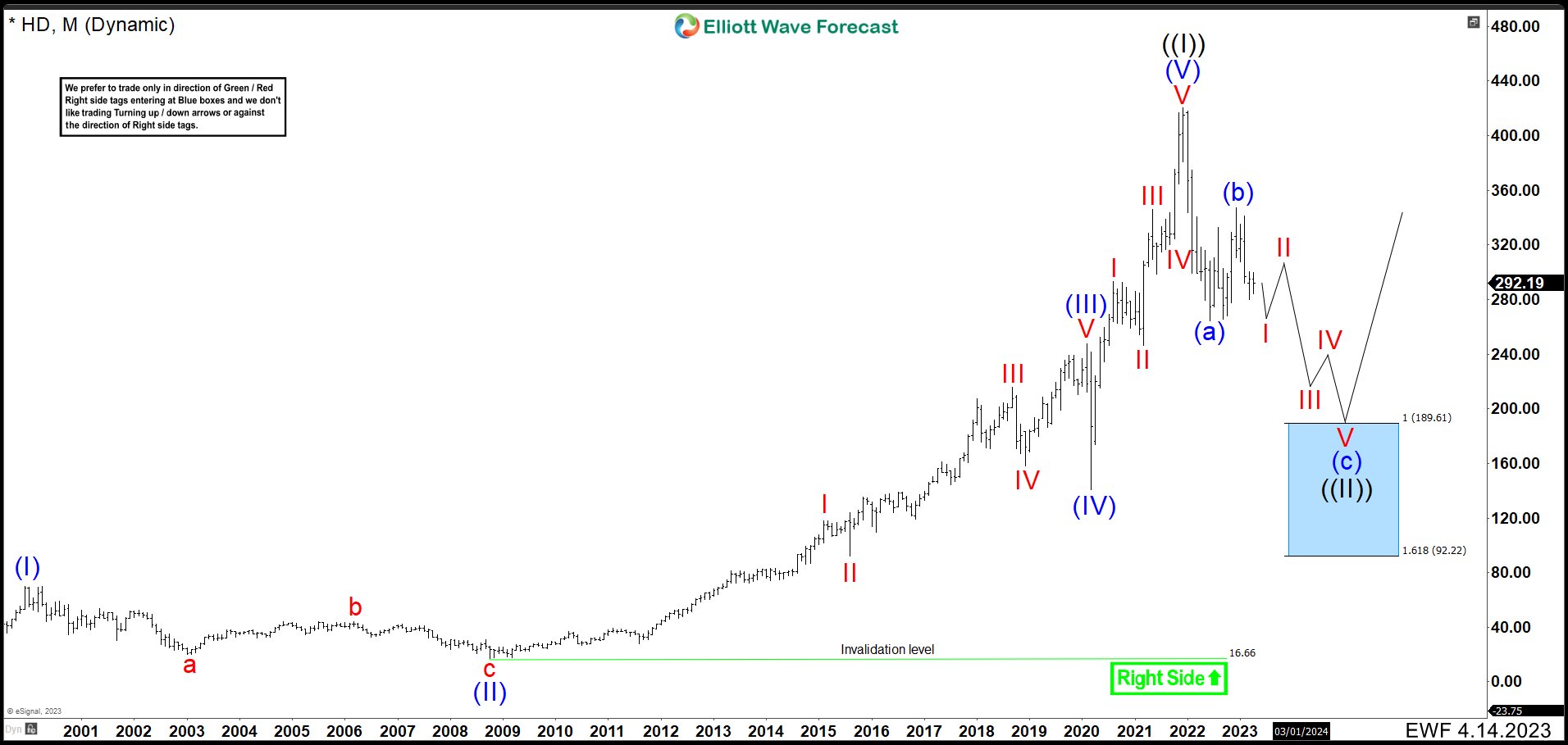

Home Depot (HD) Is Correcting The Cycle Since The Company’s Inception

Read MoreHome Depot (HD), is an American multinational home improvement retail corporation that sells tools, construction products, appliances, and services, including fuel and transportation rentals. Home Depot is the largest home improvement retailer in the United States. The shares of the Home Depot HD company have entered a very interesting stage. After reaching all-time highs in […]

-

10 Best Cyclical Stocks for Inflation

Read MoreWhat are Cyclical Stocks? Cyclical stocks are securities that are heavily affected by the economic cycles of the overall economy. These securities rise and fall in line with the general economic cycle and are affected by macroeconomic changes in the overall economy. These stocks usually belong to companies producing discretionary products like luxury clothing, furniture, […]

-

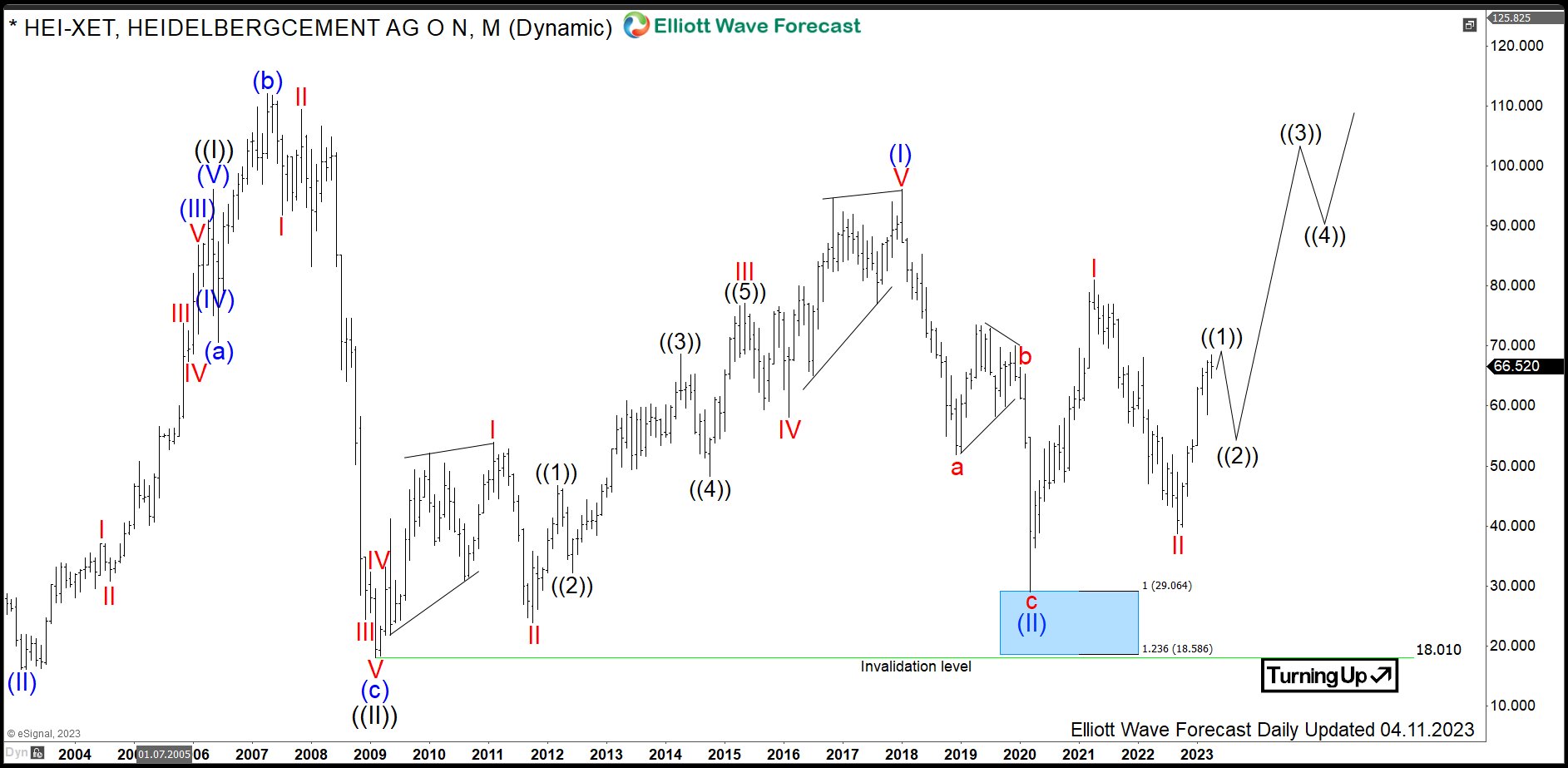

$HEI : German HeidelbergCement Reacting from Daily Buying Area

Read MoreHeidelbergCement is a German multinational building materials company. Today, it is the largest producer of construction aggregates in the world. It is number 2 in production of cement and number 3 worldwide in ready mixed concrete. Founded in 1874 and headquartered in Heidelberg, Germany, HeidelbergCement is a part of DAX40 index. One can trade it […]

-

Best Income Stocks to Buy in 2024

Read MoreWhat are Income Stocks? Income stocks are financial securities that pay regular dividends to investors. They are purchased to generate a steady stream of dividend flows and the dividends are predictable. Main Characteristics of Income Stocks: Some of the most common characteristics of income stocks are: Low Price Volatility This means that there are no […]

-

TSLA (TESLA) Favors Further Downside

Read MoreTSLA Showing impulse Elliott Wave sequence as ((1)) higher started from 1/06/2023 low, which ended at $217.82 high on 2/16/2023. Below $217.82 high, it favors pullback in 7 or 11 swings correction in ((2)) against January low before upside resumes. It placed (W) of ((2)) at $163.91 low & (X) connector at $208 high on […]