The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$OR: Cosmetics Manufacturer L’Oréal Remains Supported

Read MoreL’Oréal S.A. is the world largest cosmetics and beauty company. Headquartered in Clichy, France, the field of activities concentrates on skin care, hair color, perfume, make-up, hair care, sun protection etc. L’Oréal is a part of Euro Stoxx 50 (SX5E) and CAC40 indices. Investors can trade it under the ticker $OR at Euronext Paris. In […]

-

Nasdaq (NQ) Buyers Can Appear Soon According to Elliott Wave

Read MoreShort Term Elliott Wave in Nasdaq (NQ) suggests the Index is cycle from 3.13.2023 low ended in wave ((1)) at 13349.37 as the 1 hour chart below shows. Wave ((ii)) pullback is currently in progress to correct cycle from 3.13.2023 low. Internal subdivision of wave ((ii)) is unfolding as a double three Elliott Wave structure. […]

-

Coca-Cola Stock KO Price Surge Creates Bullish Sequence

Read MoreCoca-Cola (NYSE: KO), a leading beverage company, recently reported better-than-expected earnings and revenue for the quarter. The strong financial results, demonstrate the company’s resilience in the face of challenging economic conditions and highlight its ability to adapt to changing market dynamics. It leads to increased investor confidence and a surge in the company’s stock price. As […]

-

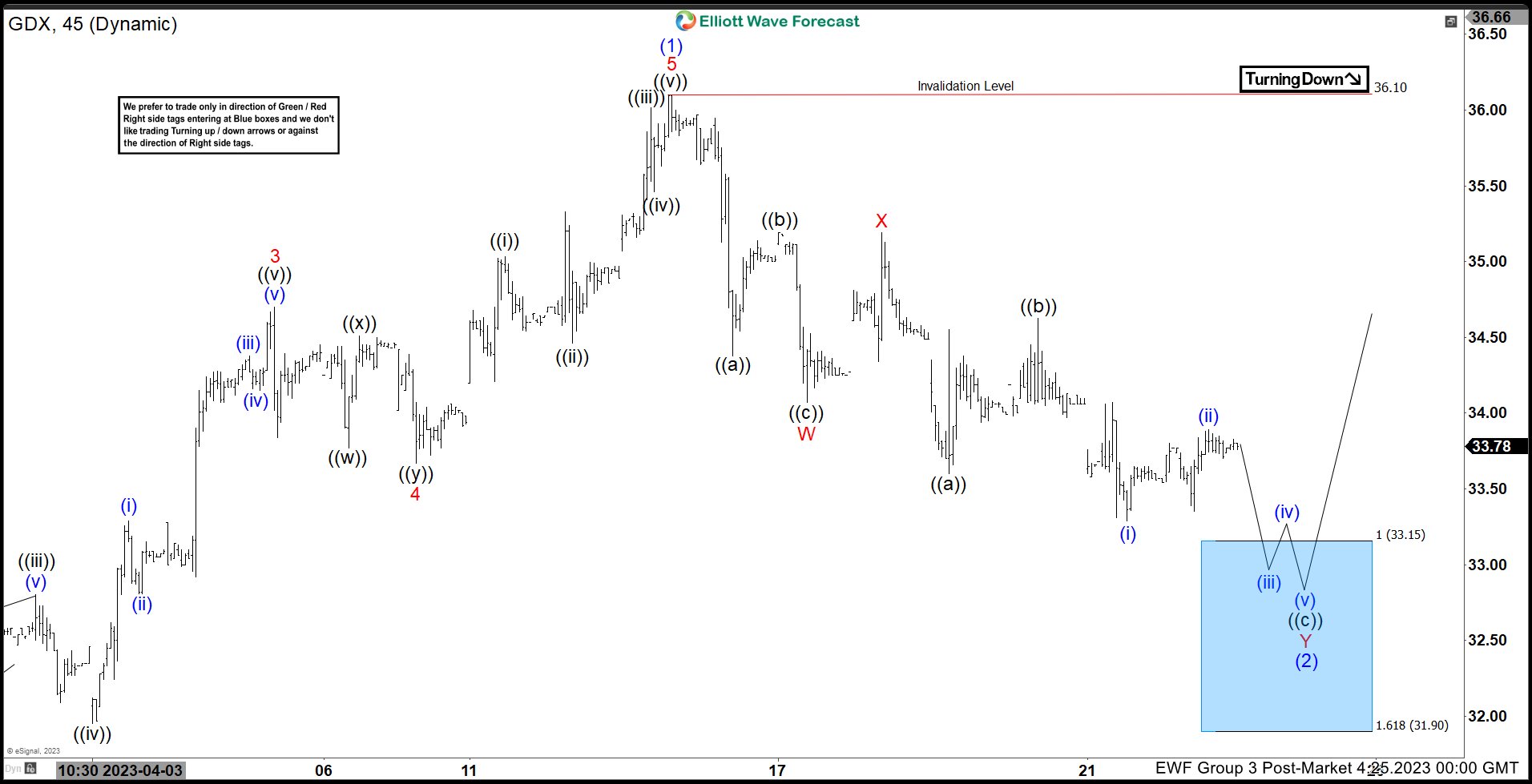

Elliott Wave Expects Gold Miners ETF (GDX) Buyers Should Appear Soon

Read MoreGold Miners ETF (GDX) shows a bullish sequence from 9.26.2022 low favoring further upside. The 100% – 161.8% Fibonacci extension target from 9.26.2022 low comes at 38.3 – 45.7 area. Rally from there is unfolding as a nest where wave ((1)) ended at 33.34 and wave ((2)) pullback ended at 26.64. Wave ((3)) is in […]

-

Bank of America ($BAC) Reacts Lower from Blue Box Area.

Read MoreHello Traders. In today’s article, we will look at the past performance of 4 Hour Elliott Wave chart of Bank of America ($BAC). The decline from 2.07.2023 peak unfolded as 5 swings and made a lower low on 3.24.2023 which created a bearish sequence in the 4H timeframe. Therefore, we knew that the structure in […]

-

Newmont Mining (NEM) Starts a New Bullish Cycle

Read MoreNewmont Mining (ticker: NEM) is the world’s largest gold mining company, based in Greenwood Village, Colorado, United States. The stock may have formed a significant low at 37.57 on November 2022 and started a new bullish cycle. This article looks at the Elliott Wave Outlook for the stock. Newmont Monthly Elliott Wave Chart Monthly Elliott […]