The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

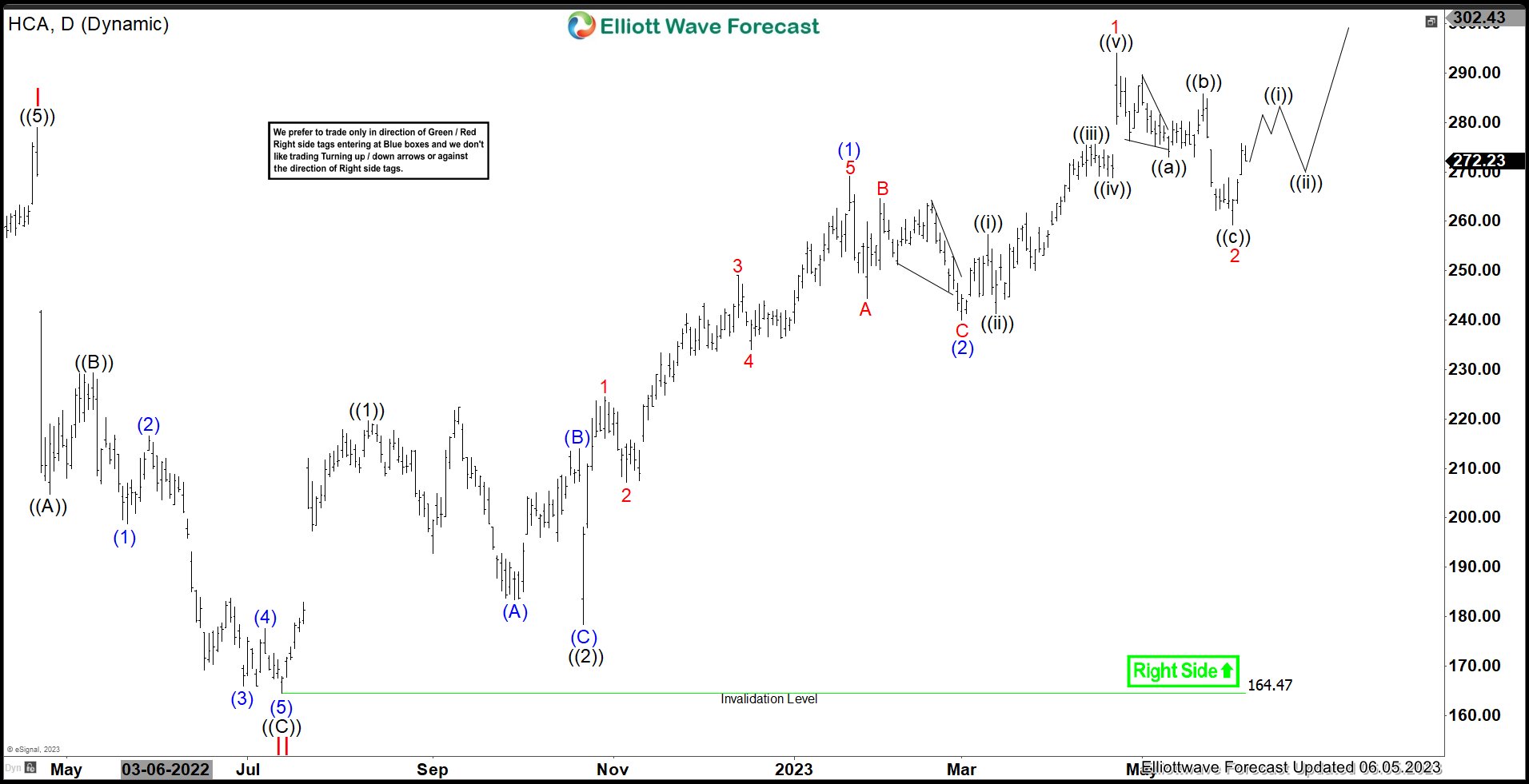

HCA Healthcare (HCA) Favors Higher In Bullish Sequence & Remain Supported

Read MoreHCA Healthcare, Inc., (HCA) provides health care services company in the United States. The company operates general & acute care hospitals that offers medical & surgical services, including inpatient care, intensive care, cardiac care, diagnostic & emergency services & outpatient services. It is based in Tennessee, comes under Healthcare (XLV) sector & trades as “HCA” […]

-

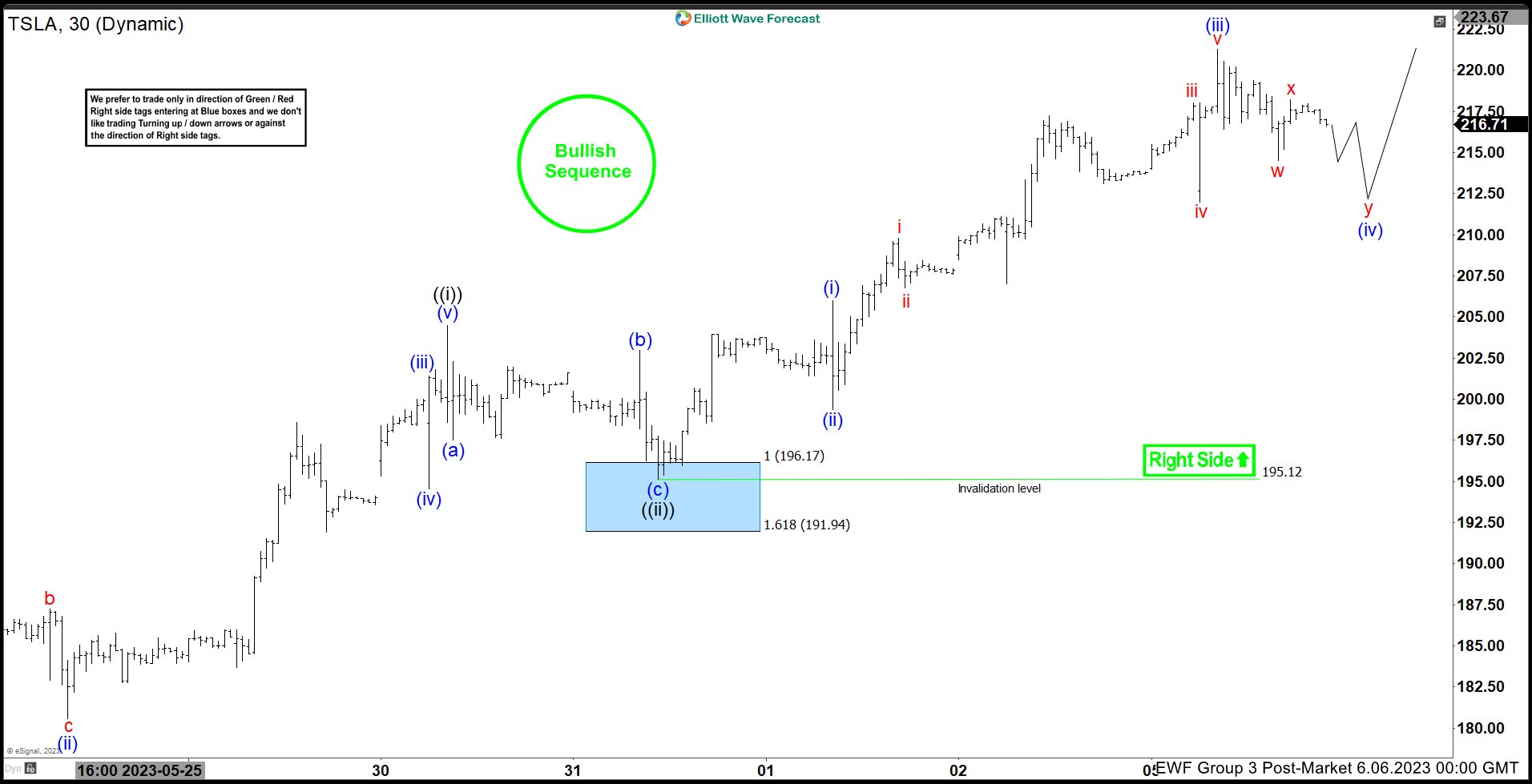

Tesla (TSLA) Elliott Wave Bullish Sequence Suggests Further Rally

Read MoreTesla (TSLA) shows bullish sequence from 5.24.2023 low favoring more upside. This article and video look at the Elliott Wave path.

-

Microsoft Corp. ($MSFT) Reacts Higher From The Blue Box Area.

Read MoreGood Day Traders and Investors. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Microsoft Corp. ($MSFT) The rally from 5.24.2023 low unfolded as a 5 wave impulse with an incomplete bullish sequence from 4.25.2023 low. So, we advised members to buy the pullback in 3 […]

-

Chevron (CVX) Flat Correction In Progress

Read MoreChevron Corporation (ticker: CVX), commonly known as Chevron, is one of the world’s largest multinational energy corporations. The company operates in all aspects of the oil, natural gas, and geothermal energy industries. This includes exploration, production, refining, marketing, and transportation. The stock is bullish in larger degree. However, in shorter cycle, it is still correcting […]

-

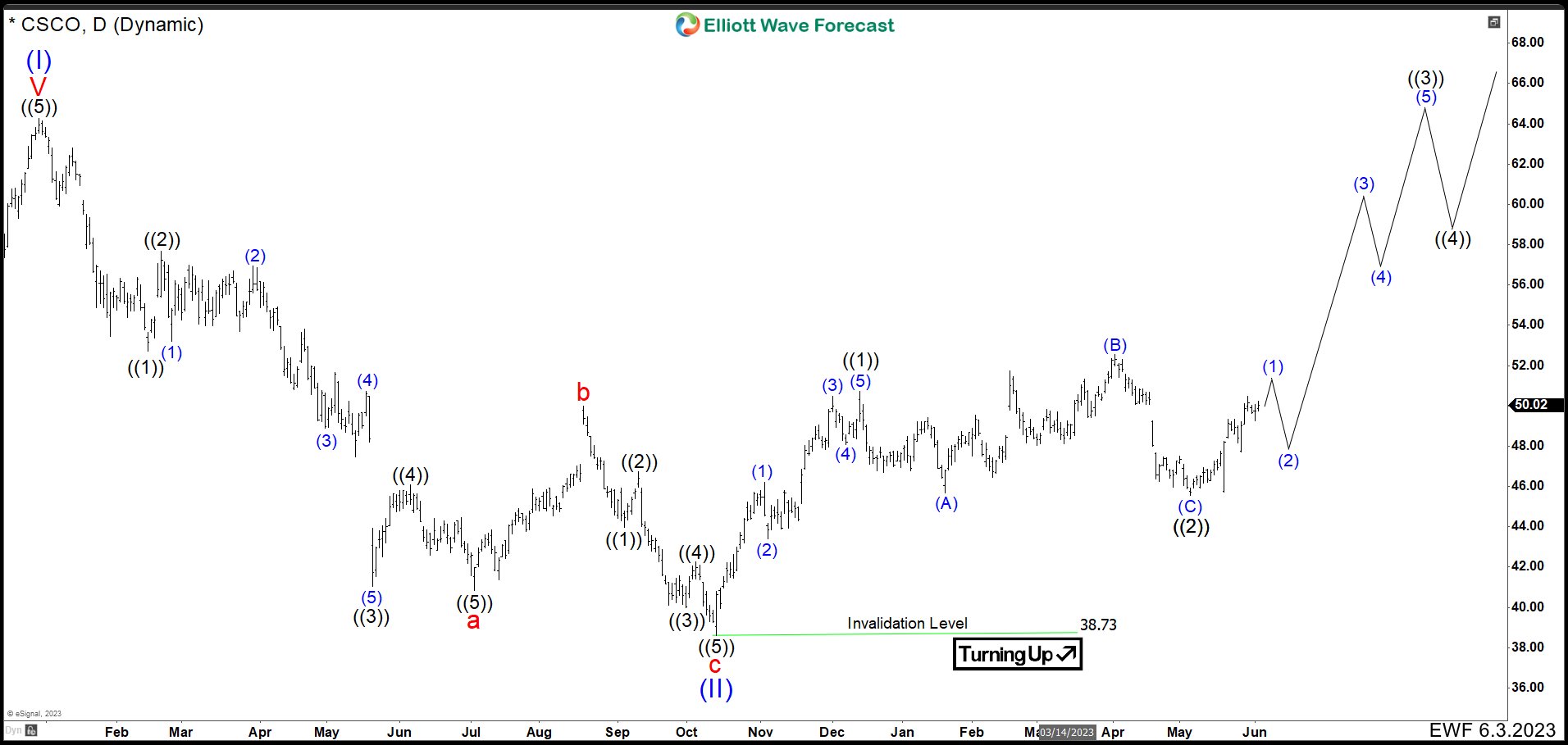

Cisco (CSCO) Ended A Correction And It Should Resume To The Upside

Read MoreCisco Systems, Inc., commonly known as Cisco (CSCO), is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products. CSCO Daily Chart February 2023 At the end of 2021, Cisco finished an impulsive structure at 64.33 which we called wave (I). From this high, CSCO has been down […]

-

Nikkei (NKD) Looking to Complete Wave 5 of Elliott Wave Impulse

Read MoreNikkei (NKD) rallying in wave 5 of an impulsive structure. This article and video look at the Elliott Wave path of the pair.