The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Coinbase (COIN) Structure Shows Losses To Come In Cryptocurrencies

Read MoreCoinbase Global, Inc., branded Coinbase (COIN), is an American company that operates a cryptocurrency exchange platform. Coinbase is a distributed company; all employees operate via remote work and the company lacks a physical headquarters. It is the largest cryptocurrency exchange in the United States by trading volume. COIN Daily Chart March 2023 Last March, we were calling a triple correction structure […]

-

Procter & Gamble (NYSE: PG) Next Investment Opportunity

Read MoreProcter & Gamble (NYSE: PG) continues to capture investor attention following our previous video blog that illuminated a promising bullish trajectory for the company. Building upon those insights, this article delves deeper into PG’s mid-term prospects. By examining two Elliott Wave potential scenarios that could shape its near future, we aim to offer readers a […]

-

Apple (AAPL) 3 Waves Corrective Rally in Progress

Read MoreApple (AAPL) is correcting cycle from 7.20.2023 high as a zigzag. This article and video look at the Elliott Wave path of the stock.

-

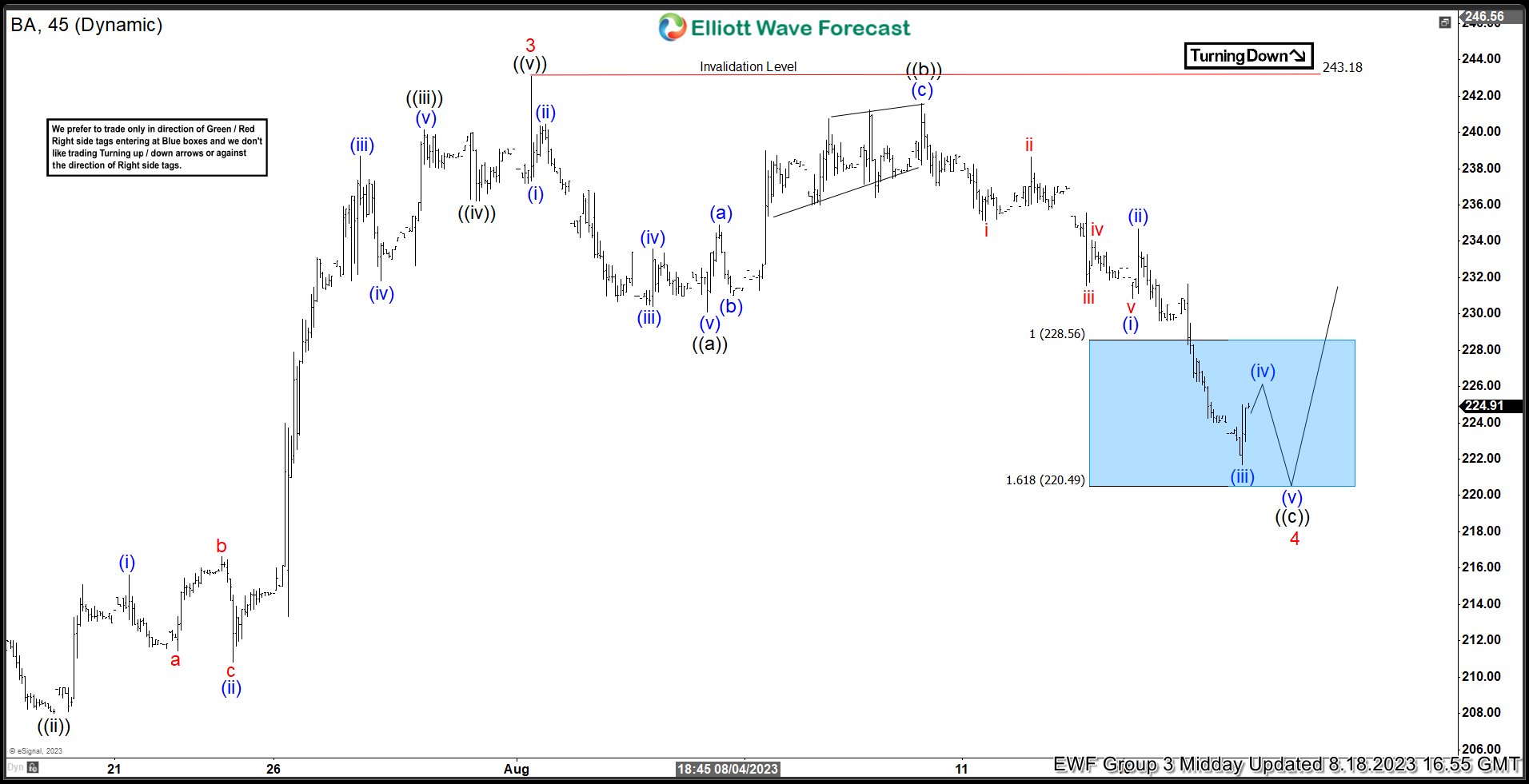

Boeing Blue Box Should Offer Minimum Reaction Higher

Read MoreIn this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of Boeing ticker symbol: BA. In which, the rally from 15 March 2023 low unfolded as an impulse structure. And showed a higher high sequence favored more upside extension to take place. Therefore, we advised members not to […]

-

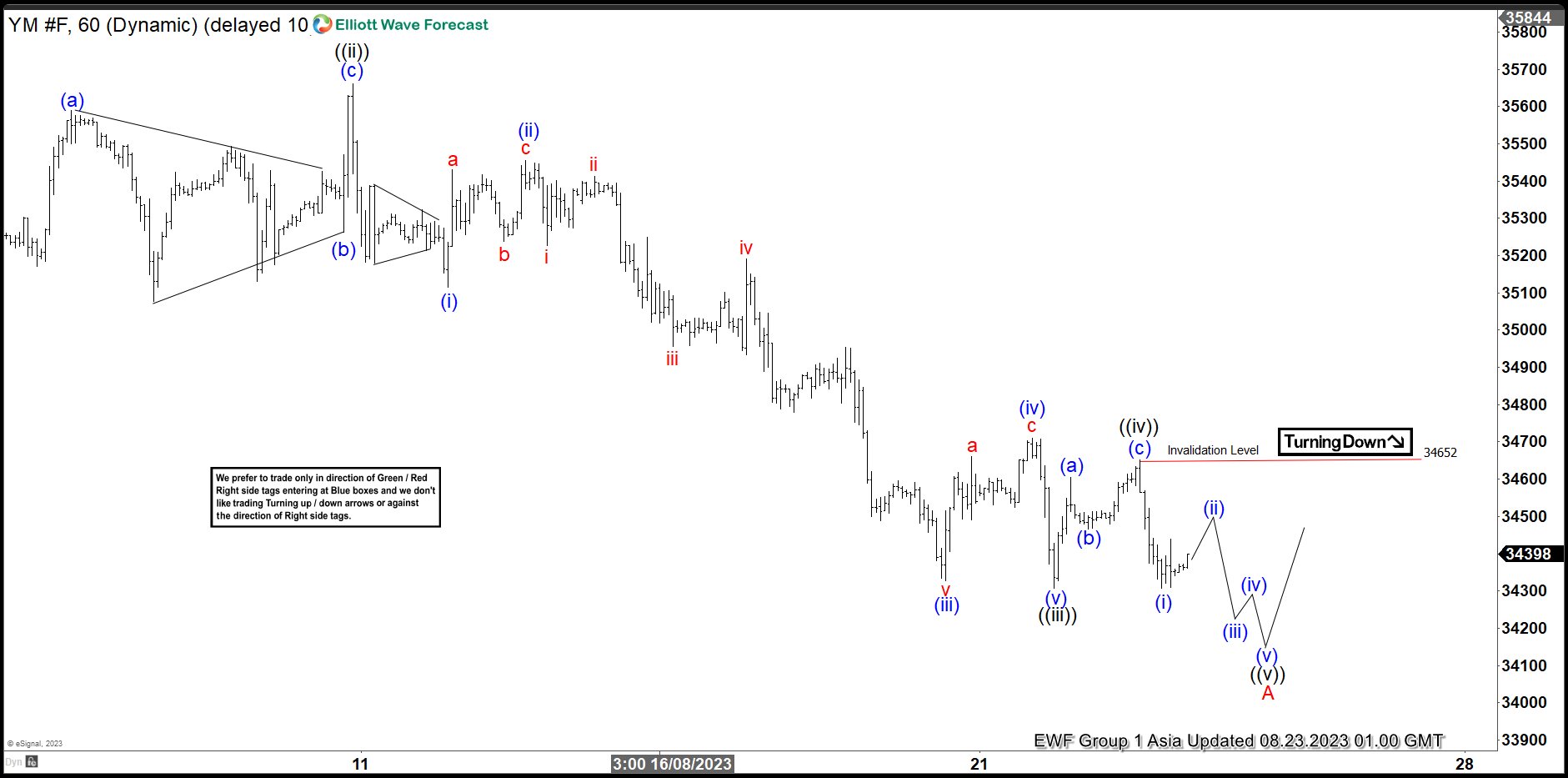

Dow Futures (YM_F) Looking for Corrective Rally Soon

Read MoreShort Term Elliott Wave view in Dow Futures (YM_F) suggests that cycle from 7.27.2023 high is mature and about to complete soon as 5 waves impulse. Down from 7.27.2023 high, wave ((i)) ended at 35076 and rally in wave ((ii)) ended at 35660. Index extended lower in wave ((iii)) as another impulse in lesser degree. […]

-

FTSE and Hangseng Should Act As a Floor for the Indices

Read MoreIndices sold off last week, while some Indices reached extreme Fibonacci extension areas from the highs in 3 or 7 swings, it remains to be seen whether correction in the Indices is over or will extend. Today, we will take a look at Elliott wave sequences in two Stock Markets like FTSE from UK and […]