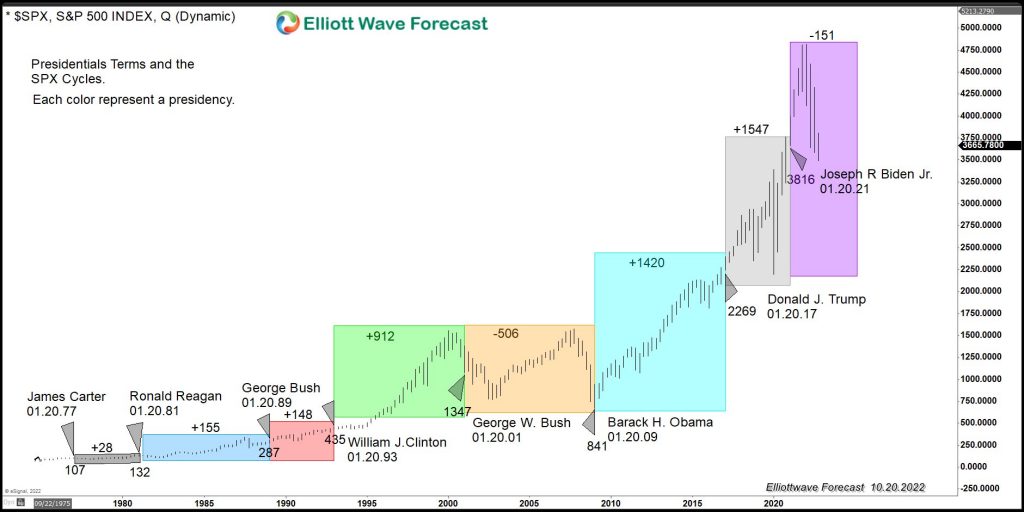

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

Twilio ($TWLO) Pulling Back In Wave II

Read MoreThe last time I took a look at this company was back in August of 2020, nearly 1.5 years ago. (this article can be viewed here). Before I get into the charts, lets take a look at what Twilio does: “Twilio is in the cloud communications business and has had an extremely impressive rally since […]

-

Elliott Wave View: WIT (WIPRO) Should Favor Flat Correction Lower

Read MoreWipro Limited (WIT) operates as Information technology, Consulting & Business process services company globally. It operates through three main segments, IT Services, IT Products & India State Run Enterprise Services. The company is based in Bengaluru, India (ADR stock) & trades under $WIT ticker at NYSE. It comes under Technology sector as Information Technology services […]

-

Elliott Wave View: NWSA Should Favor Double Correction Lower

Read MoreNews Corporation (NWSA) is a Media & Information Services company focuses on creating & distributing content worldwide. It operates in different segments like Digital estate services, subscription-based video services, Dow Jones services, book publishing, news media & others. It trades under NWSA ticker at Nasdaq & comes under Communication services sector. Since 2013 in daily, […]

-

Top Best Blue-Chip Stocks to Buy in 2024

Read MoreWhat are Blue Chip Stocks? High-quality companies which hold the leading positions within their industry are blue-chip stocks. They are the most well-known names on the stock markets. These companies are usually having years of operational history. And they are recognized and accepted by investors and shareholders as successful investments. What makes a Blue-Chip Company […]

-

Best Gaming Stocks to Invest in 2024

Read MoreThe gaming industry is on the rise since 2020. New gaming platforms are continuously developing around the globe. Moreover, the video gaming industry is highly affected by the choice and taste of gamers. Therefore, understanding audience preference is the key to investment success in this sector. Examples of successful online games are Dota 2 […]

-

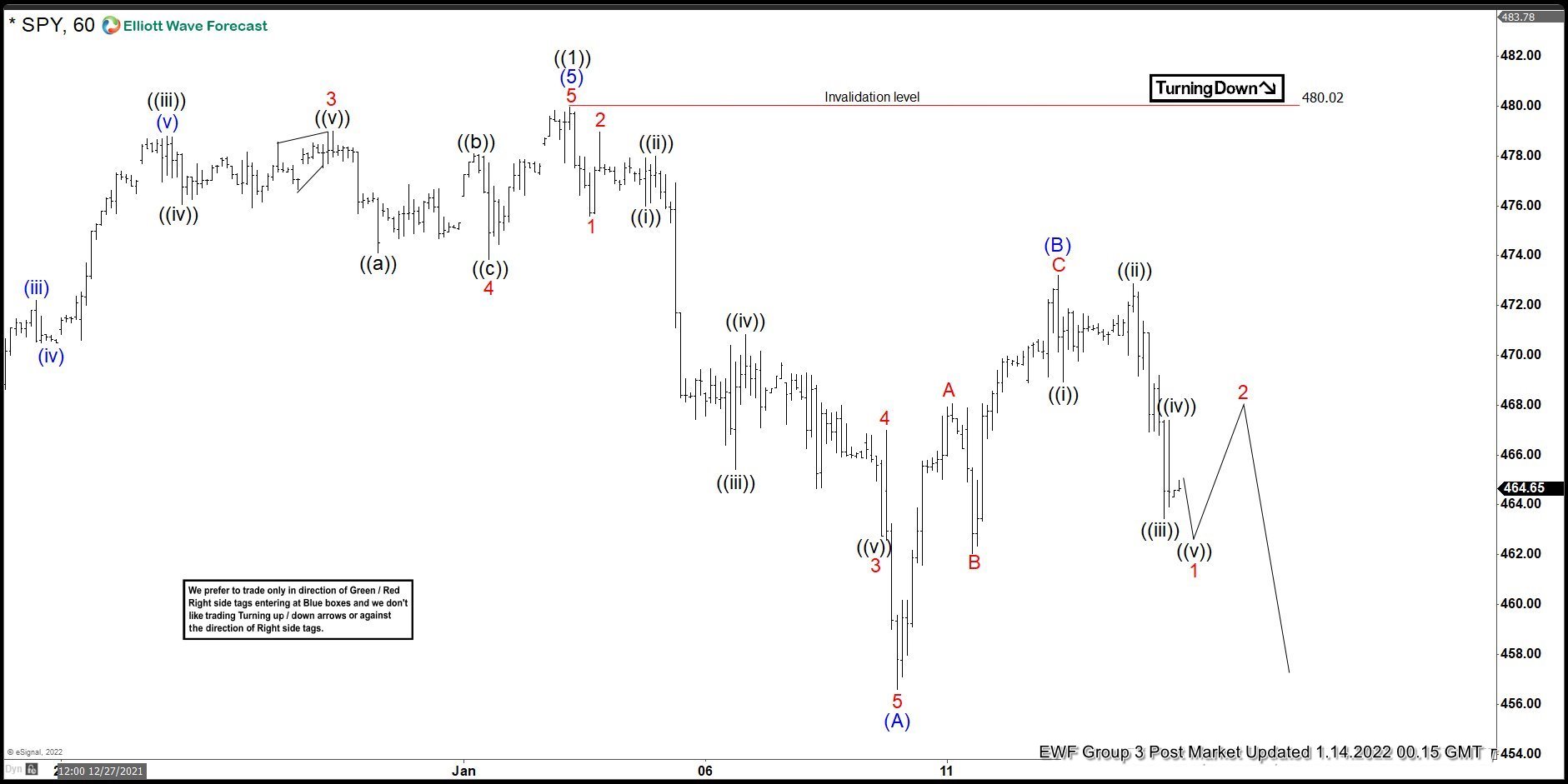

Elliott Wave View: SPDR S&P 500 ETF (SPY) Looking for More Downside

Read MoreSPDR S&P 500 ETF (SPY) is looking for further downside as a zigzag. This article and video look at the Elliott Wave path of the ETF.