In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

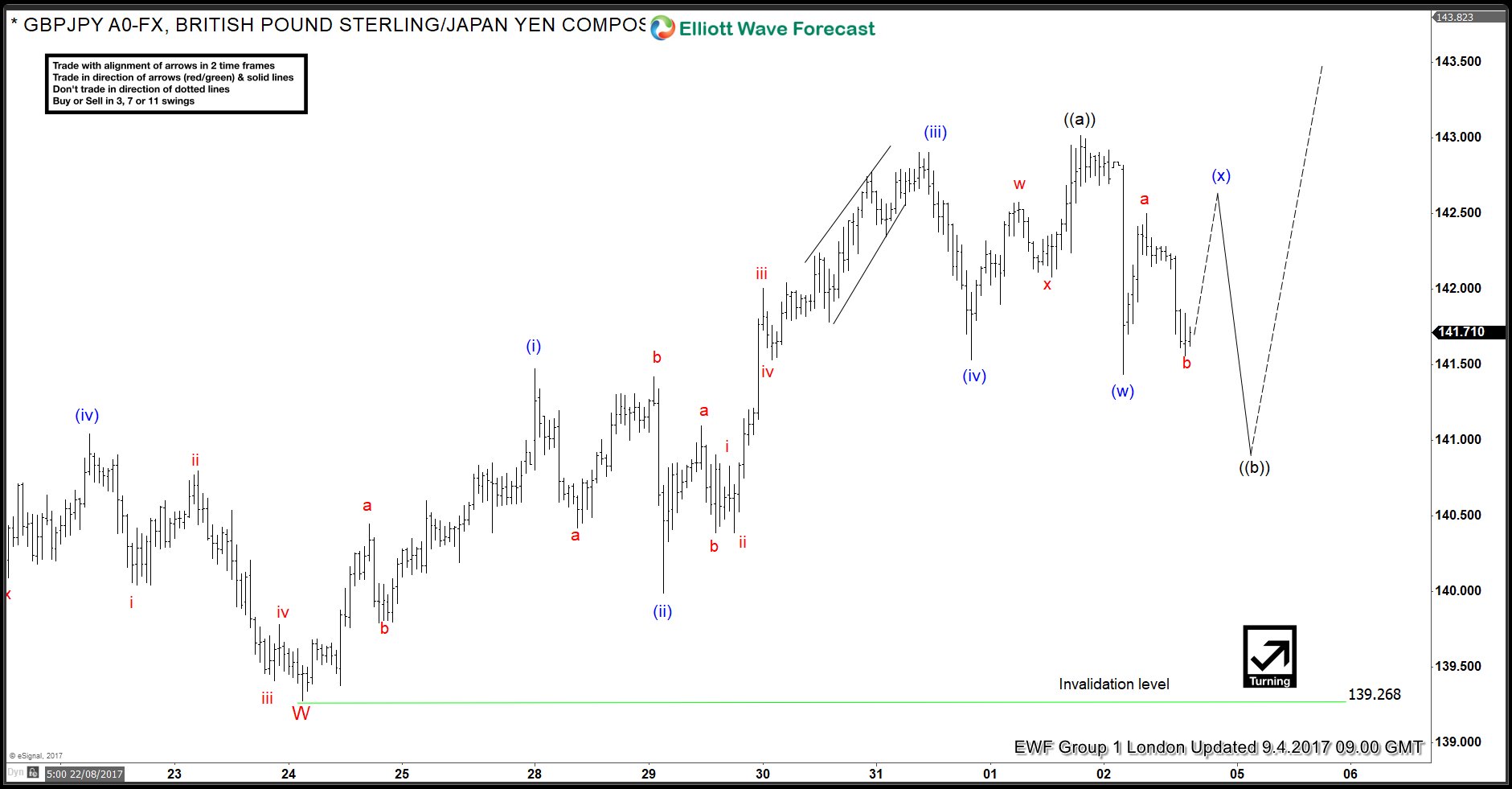

GBPJPY Elliott Wave View: 9.4.2017

Read MoreGBPJPY Short Term Elliott Wave suggests that the decline to 8/23 low at 139.26 ended Minor wave W. Up from there, the rally is unfolding as an Diagonal structure . Which we are viewing as part of Minute wave ((a)) of an Elliott wave zigzag structure. Where Minutte wave (i) ended at 141.40 and Minutte wave (ii) ended at 139.99 […]

-

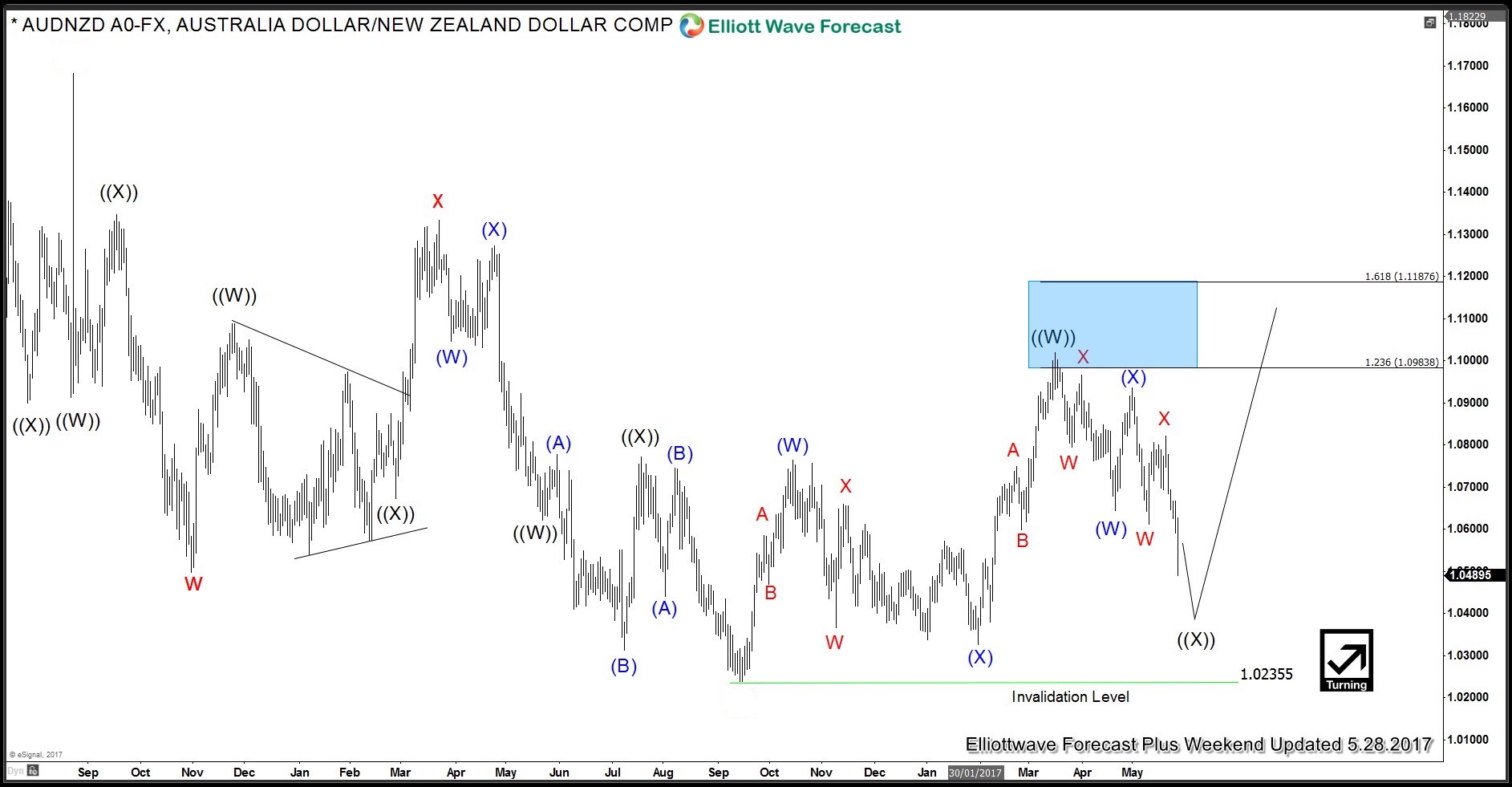

AUDNZD Live Trade reaches target for 455 pips profit

Read MoreIn May 17th Live Trading Room, we issued a trading idea for AUDNZD . The trade was to buy AUDNZD at 1.0565 and the entry was filled on May 25th. Below is the trading journal we presented to members on May 17th Live Trading Room We subsequently put a limit target of 1.102 and the pair […]

-

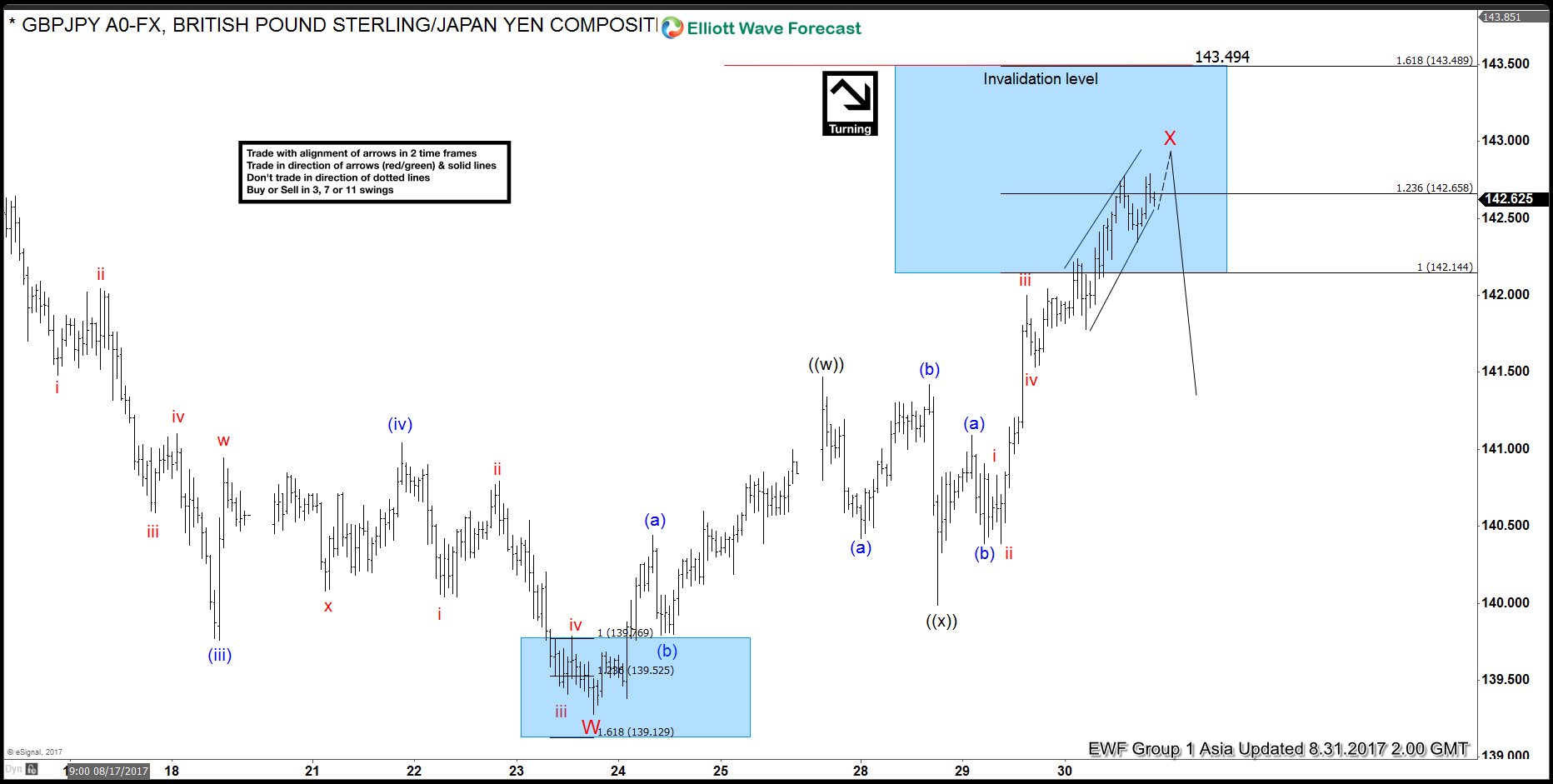

GBPJPY Elliott Wave View: Ending correction

Read MoreGBPJPY Short Term Elliott Wave suggests that the decline to 8/23 low at 139.27 ended Minor wave W. Minor wave X bounce is currently unfolding as a double three Elliott Wave Structure. Minute wave ((w)) of X ended at 141.47, Minute wave ((x)) of X ended at 139.98, and Minute wave ((y)) of X is subdivided into a […]

-

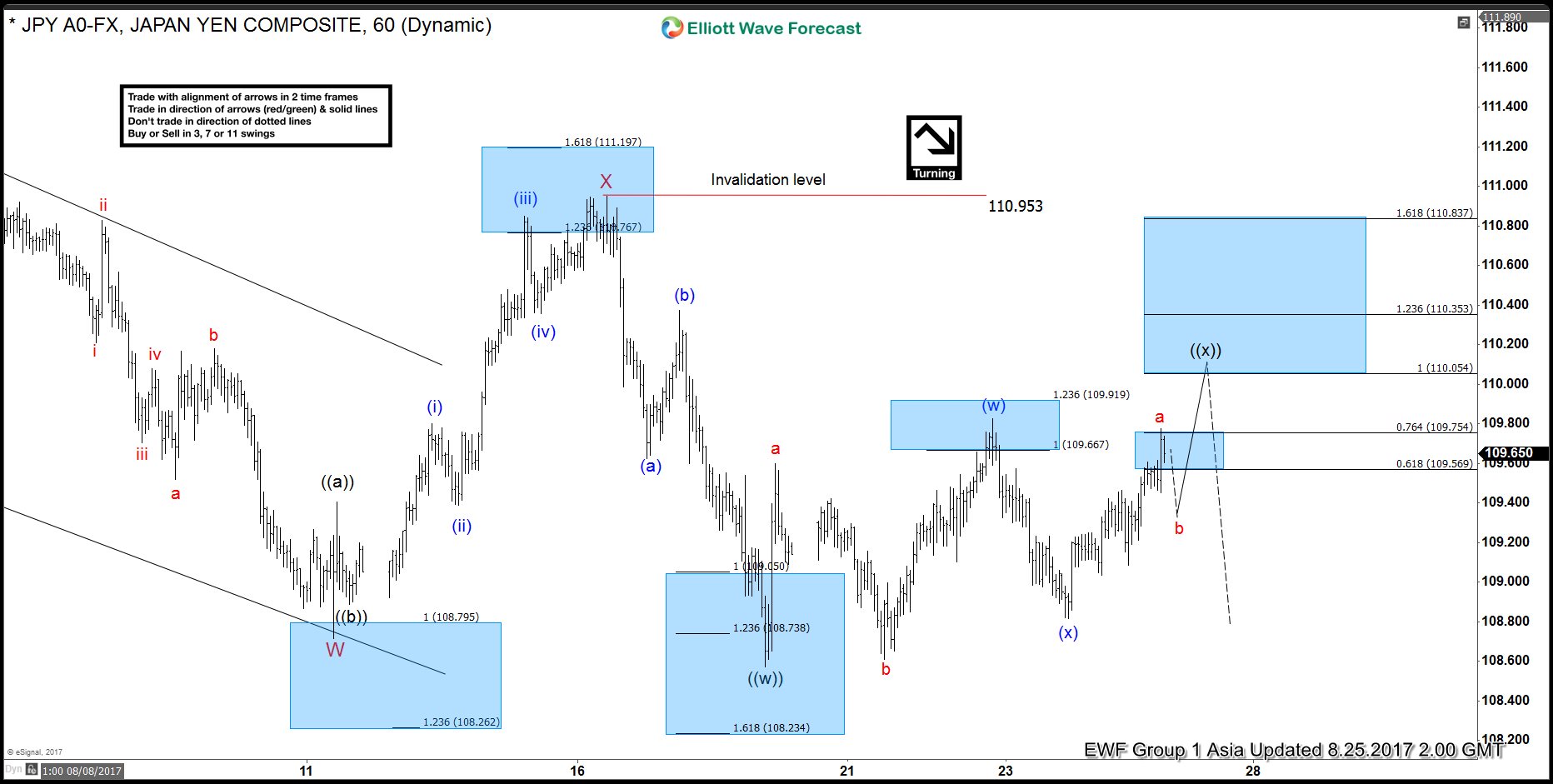

USDJPY Elliott Wave view: Double Correction

Read MoreShort term USDJPY Elliott wave view suggests the decline from 7/11 peak is unfolding as a double three Elliott wave structure. Decline to 108.71 low ended Minor wave W and Minor wave X bounce ended at 110.95 peak. Subdivision of Minor wave Y is unfolding as another double three structure of a lesser degree. Minute wave ((w)) […]

-

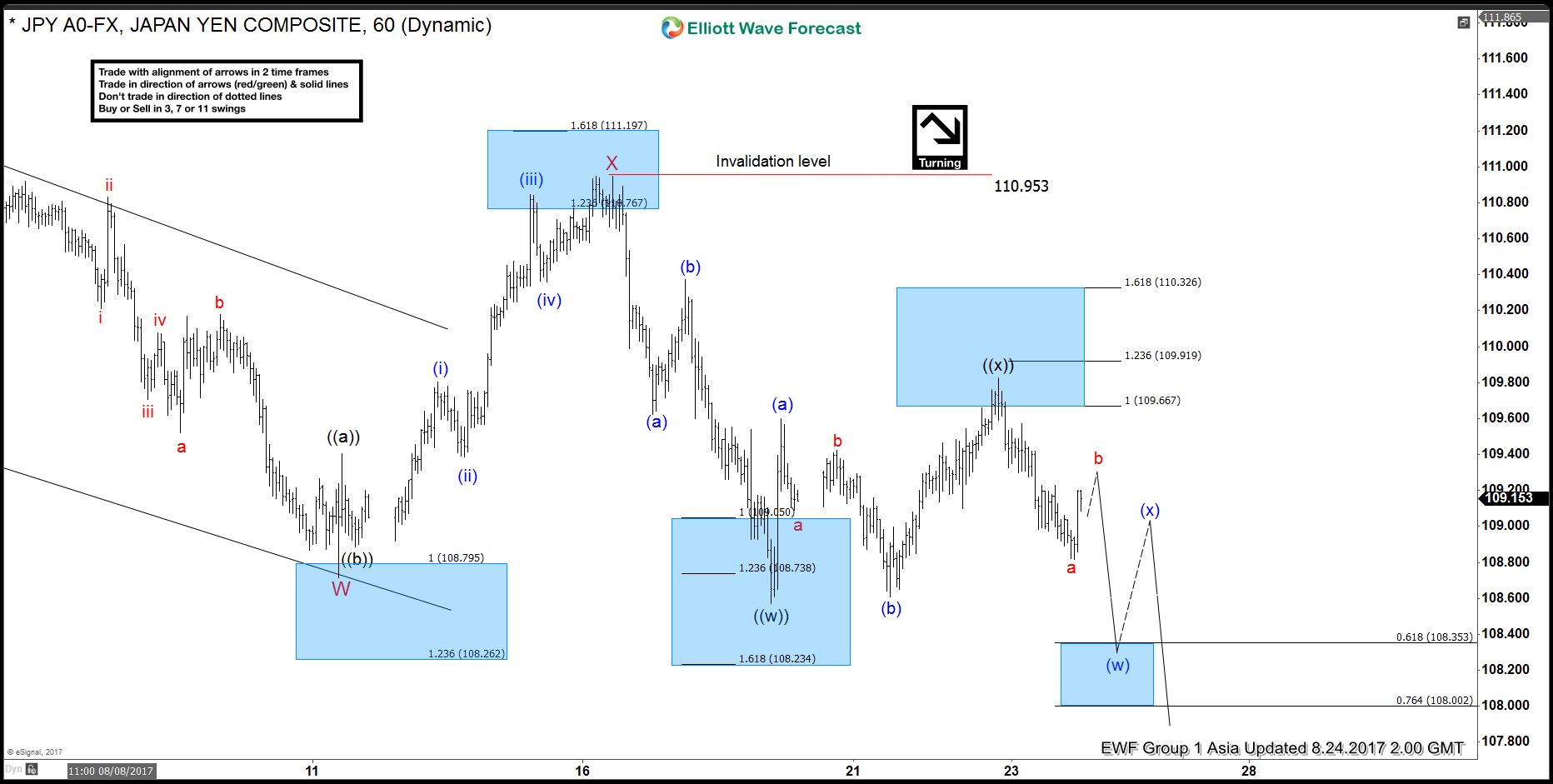

USDJPY Elliott Wave view: Resuming lower

Read MoreShort term USDJPY Elliott wave view suggest the decline from 7/11 peak is unfolding as a double three Elliott wave structure. Decline to 108.71 low ended Minor wave W and Minor wave X bounce ended at 110.95 peak. Subdivision of Minor wave Y is unfolding as a Zigzag structure. Minute wave ((w)) of ((Y) ended at 108.59 low […]

-

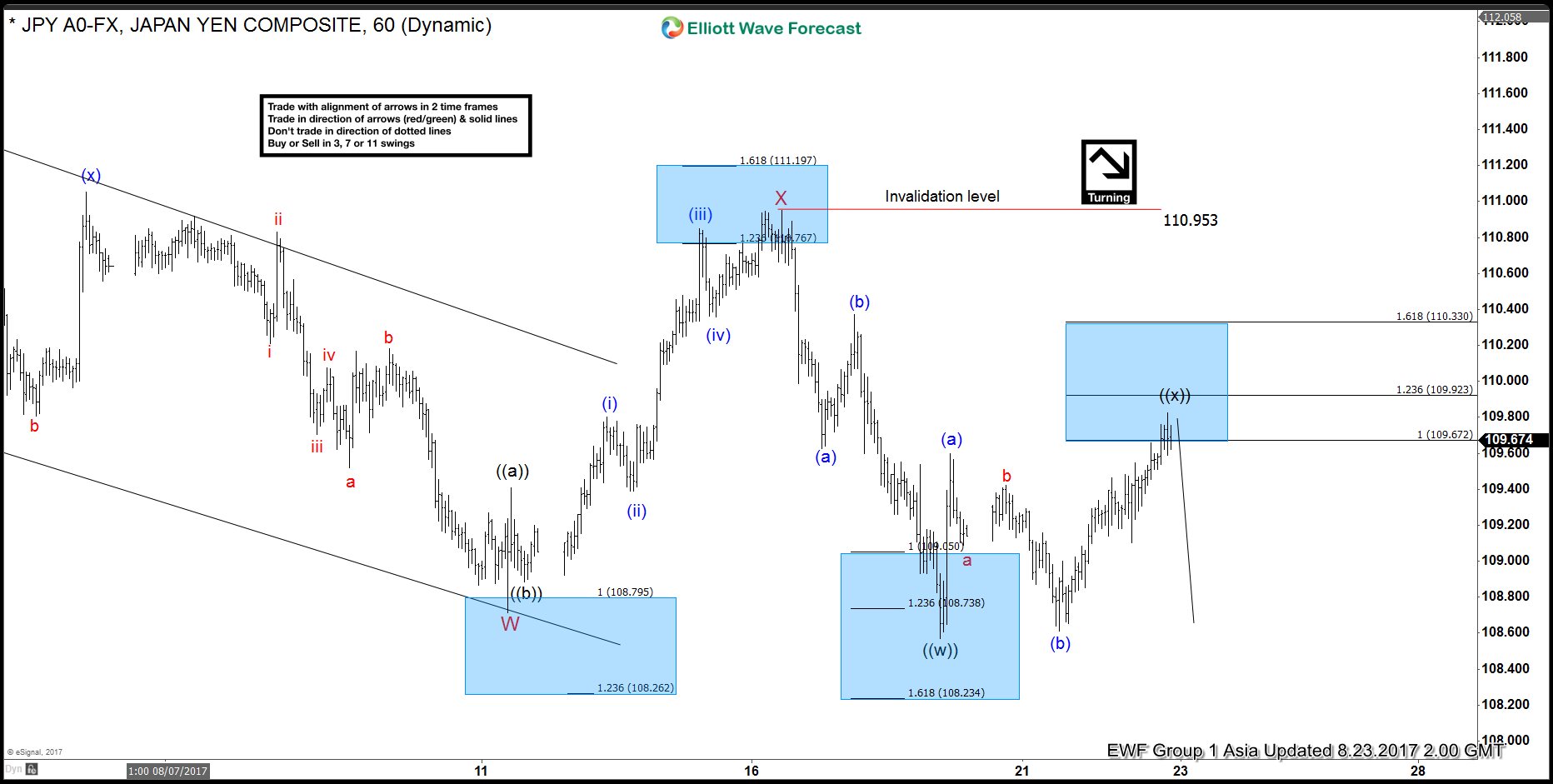

USDJPY Elliott Wave View: Turning Lower

Read MoreShort term USDJPY Elliott wave view suggest that the decline from 7/11 peak is unfolding as a double three Elliott wave structure. Decline to 108.71 low ended Minor wave W and Minor wave X bounce ended at 110.95 peak. Subdivision of Minor wave Y is unfolding as a Zigzag structure. Minute wave ((w)) of ((Y) ended at 108.59 […]