Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

FTSE : Elliott Wave (Long) Setup hits targets

Read MoreFrom the begining of November our Elliott Wave analysis for FTSE suggested rally from 6452.48- 6424.00 zone toward 6693.47 area. Now, after two weeks of trading, FTSE has reached our target. Index gave us the rally that we forecasted and presented in Elliott Wave Setup Video from the 3th November. You can watch the video here : […]

-

What to look for in Corrections of any Elliott Wave Cycle

Read MoreThe point of this article is to help a trader get in position to profit from the expected market move thus the following is related to what to look for and how to trade it without fear or emotion. The first thing that is needed to be known is which direction higher or lower the […]

-

Elliott Wave Principle: Now and Then

Read MoreElliott Wave Principle Now and Then The Elliott Wave Principle is a form of technical analysis that is used by some traders to analyze cycles in financial markets and based on that forecast the future path by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered […]

-

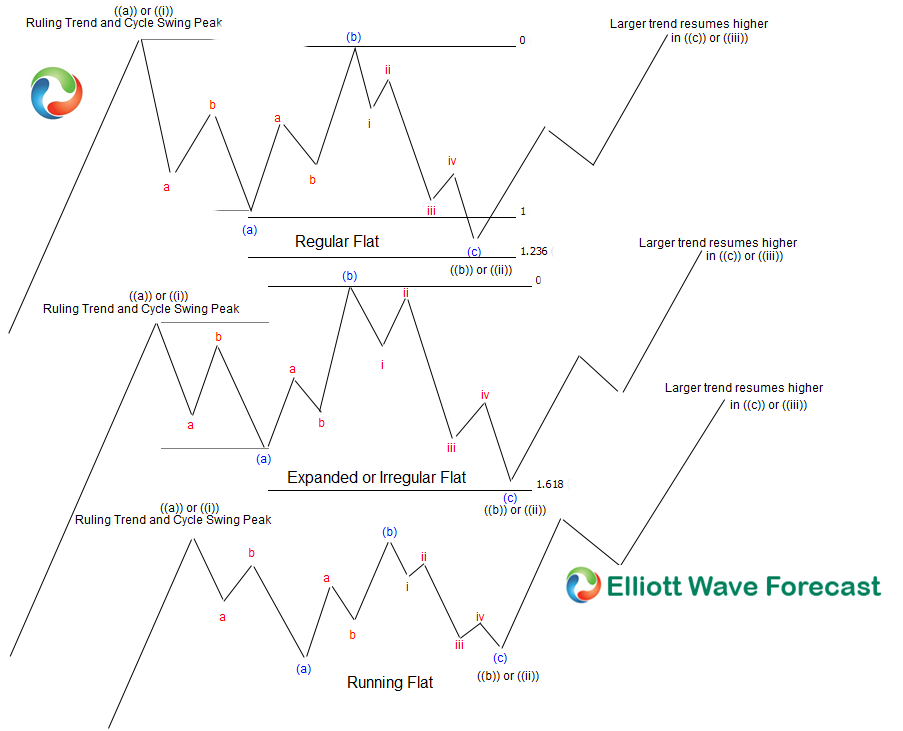

Understanding the Three Types of Elliott Wave Flat Corrections

Read MoreThe Essential Structure of Wave Flats Flat corrections represent crucial 3-3-5 pullback patterns in Elliott Wave theory. These formations differ from zigzags by moving sideways before trend continuation. Three distinct types exist, each with unique characteristics. 1. Regular Flat Correction Pattern While we primarily show bullish examples here, it’s important to note that the same […]

-

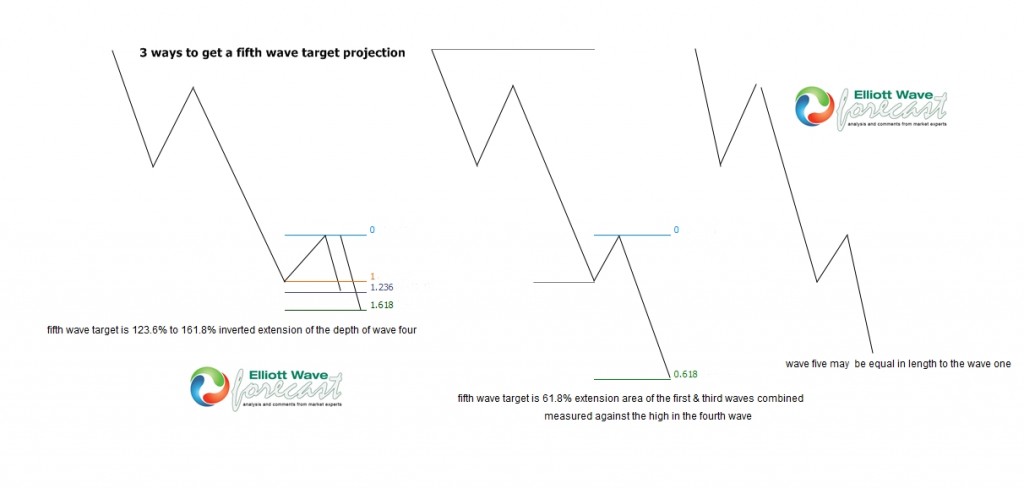

Fifth Wave Trading: Elliott Wave Target Strategies That Work

Read MoreUnderstanding Fifth Wave Projections In both bullish and bearish markets—whether the Elliott Wave trend is up or down, or the cycle and degree of the wave is bullish or bearish, you can determine fifth-wave targets in three ways, regardless of the trend’s degree. However, this list is not definitive, nor is it ranked in any […]

-

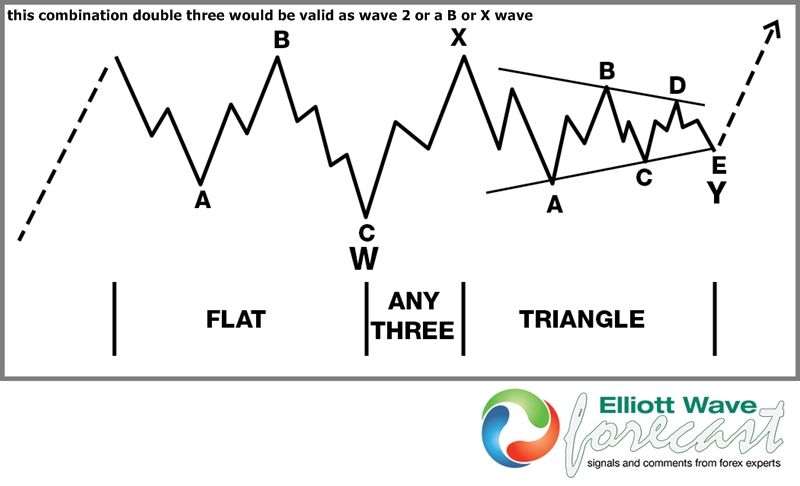

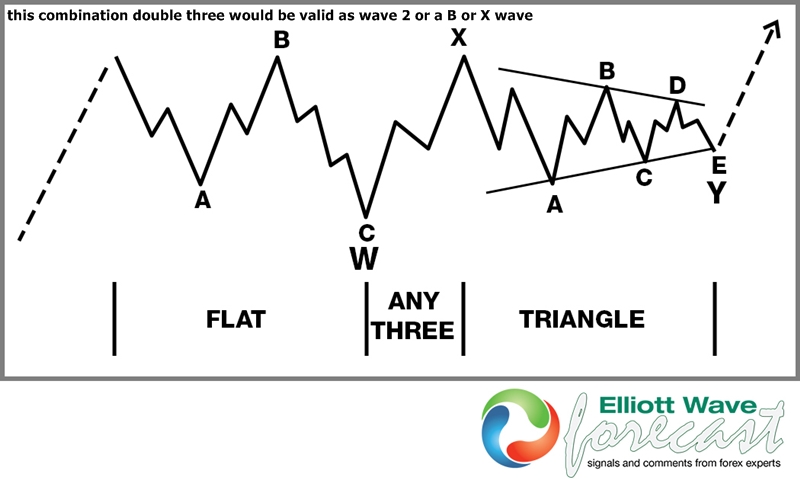

How to Trade Wave 2 or B Wave Corrections in any Elliott Wave Cycle or Degree

Read MoreThe point of this article is to help a trader get in position to profit from the expected market move thus the following is related to what to look for and how to trade it without fear or emotion. The first thing that is needed to be known is which direction higher or lower the […]