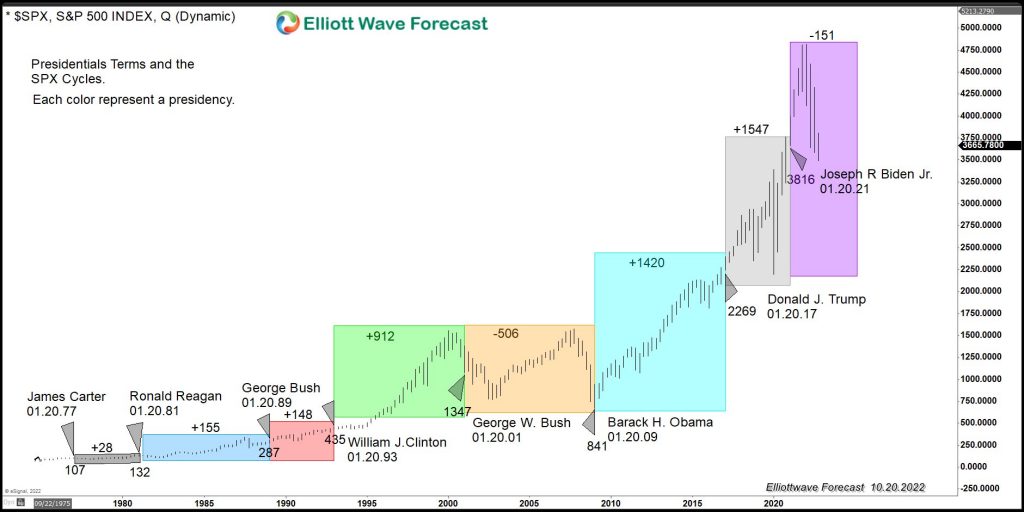

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

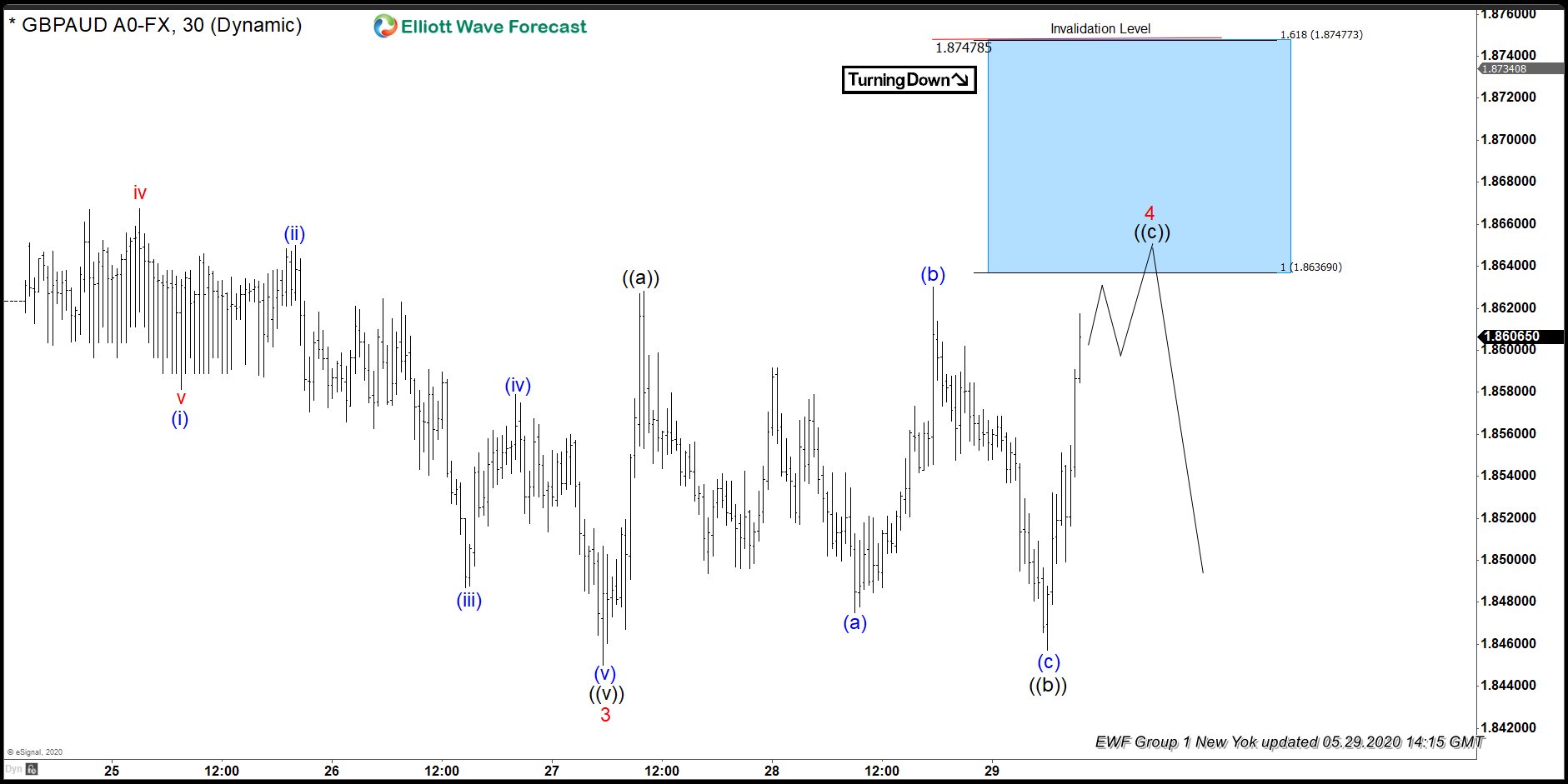

GBPAUD: Saw Sellers At The Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of GBPAUD, In which our members took advantage of the blue box areas.

-

Elliott Wave View: Further Downside in GBPAUD

Read MoreGBPAUD shows an impulsive Elliott Wave structure from 5.4.2020 high and has scope to see more downside. This article & video look at the Elliott Wave path.

-

Fortinet Inc (NASDAQ: FTNT) Bullish Sequence Supporting the Stock

Read MoreFortinet Inc (NASDAQ: FTNT) ended it’s initial bullish cycle from 2009 low after it rallied within an impulsive 5 waves advance which reached a pea at $121.8 peak on February of this year. The multinational corporation gained a total of %1330 during this 11 Years rally putting it on the list of one of the fastest growing stocks […]

-

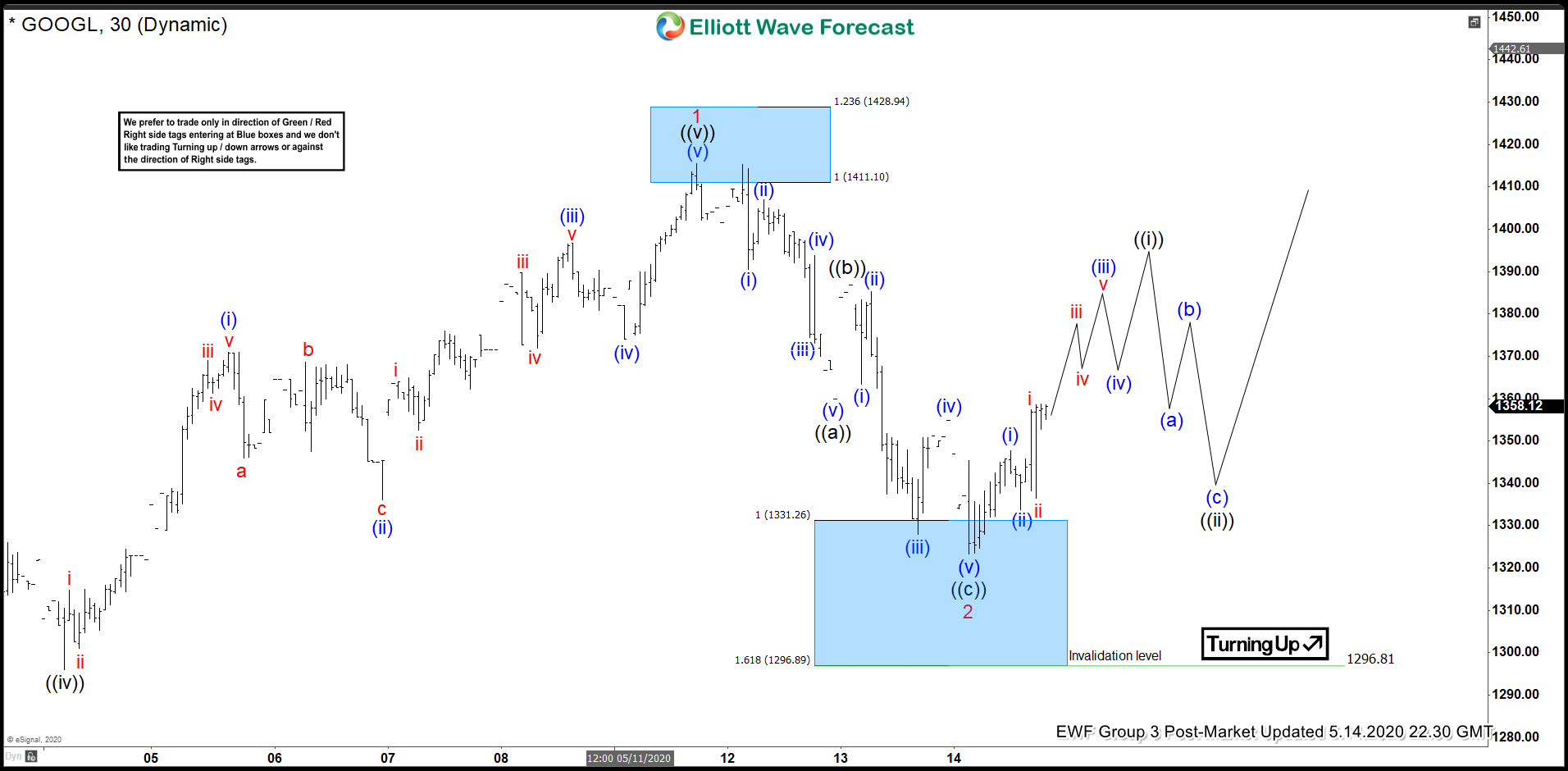

GOOGLE (GOOGL) Elliott Wave Forecasting The Path

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of GOOGL, published in members area of the website. The stock is trading within the cycle from the March 1009.6 low. Proposed cycle can be still in progress as impulsive structure. In further text we’re going to explain Elliott […]