-

Google ( GOOGL ) Found Buyers At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOOGL, published in members area of the website. As our members know, Google is trading within the cycle from the March 1009.6 low. Proposed cycle is unfolding as 5 waves structure, when its last leg […]

-

NFLX Ended 5 Waves Up In From The 290.47 Low

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NETFLIX (NFLX) stock, published in members area of the website. As our members know, NETFLIX made New All-time high recently. The price has been showing impulsive structure in the cycle from the 290.47 low. Consequently […]

-

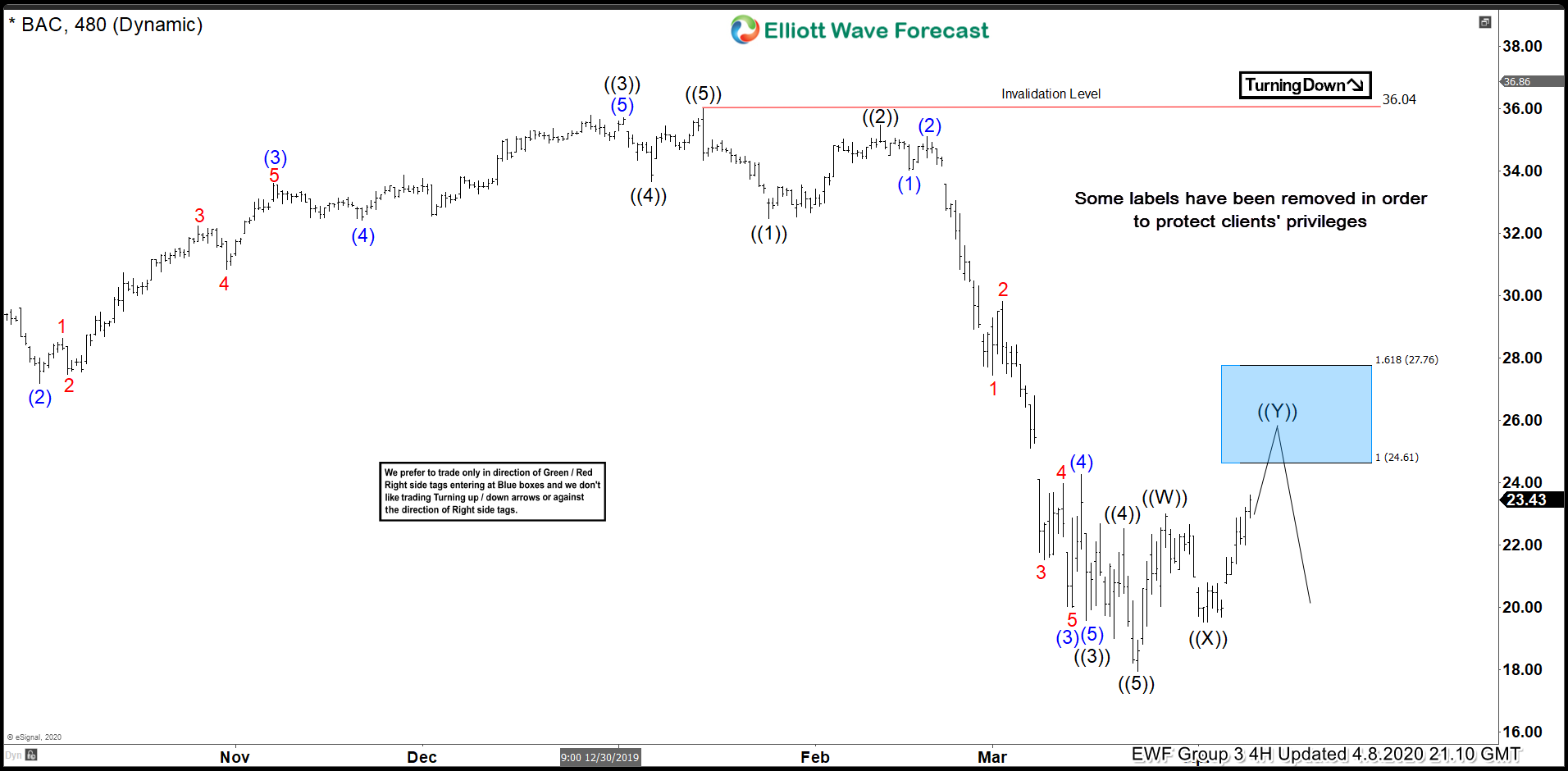

BAC Forecasting The Decline From The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the charts of Bank Of America (BAC) published in members area of the website. As our members know BAC made 5 waves down from the 36.04 peak ( 01/15). Proposed January cycle completed on March 23th date and the Stock made recovery. BAC […]

-

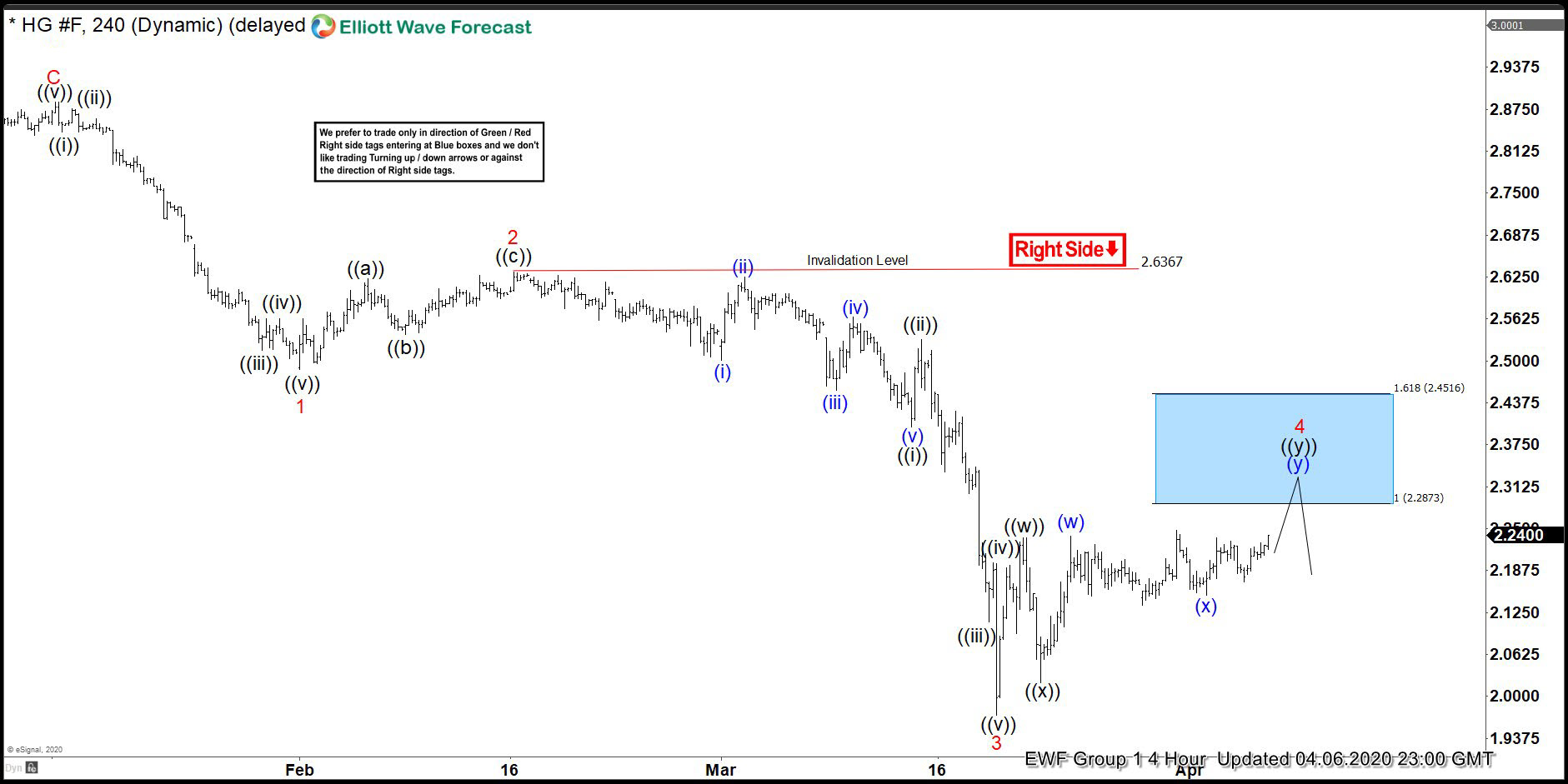

COPPER ( $HG_F ) Forecasting The Decline From The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of COPPER ( $HG_F ) published in members area of the website. As our members know, COPPER has given us recovery against the January 16th peak that unfolded as Elliott Wave Double Three Pattern. We advised clients to […]

-

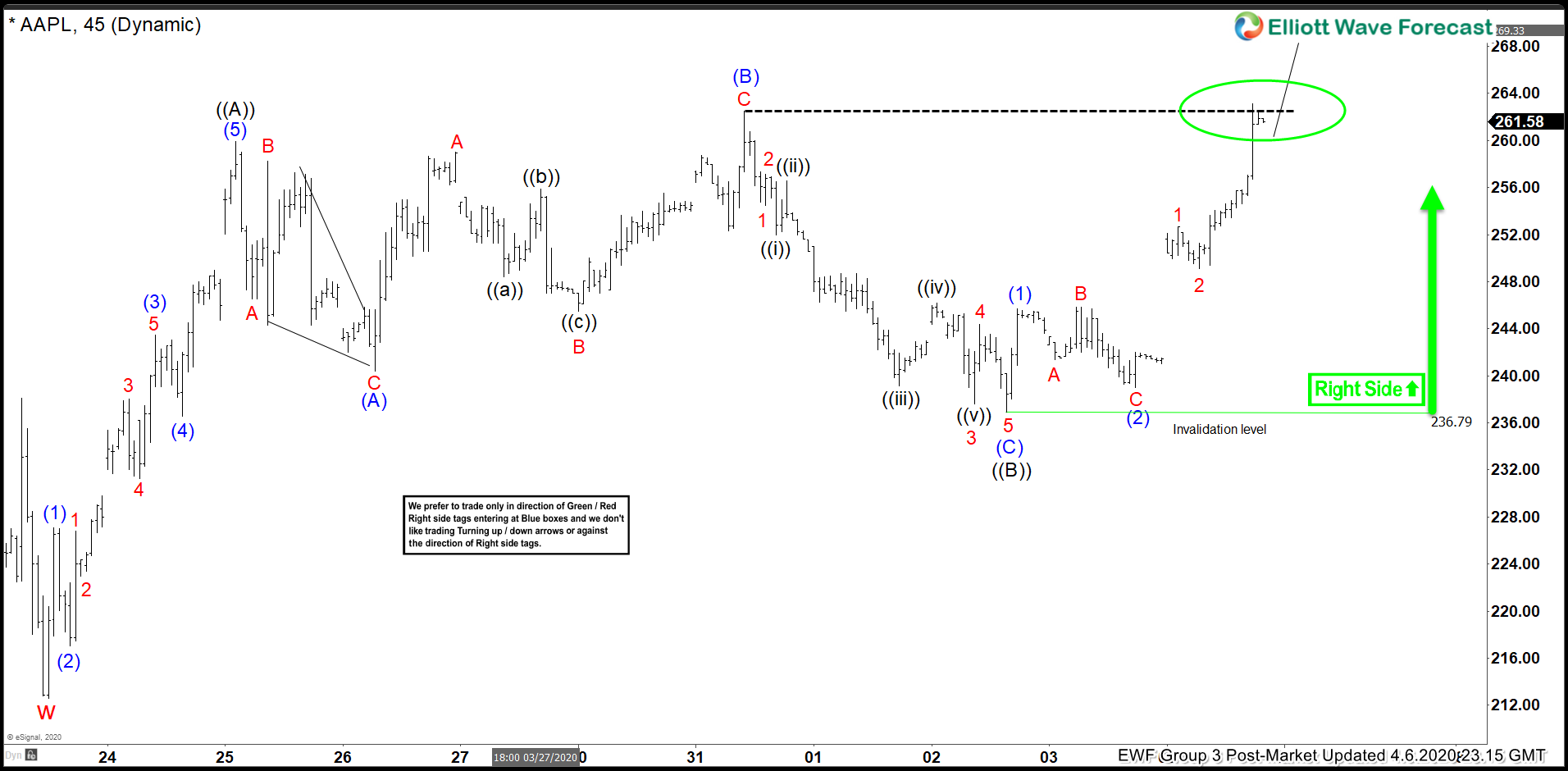

Apple ( $AAPL) Elliott Wave: Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Apple stock, published in members area of the website. As our members know, Apple has been showing incomplete Higher- High Sequences in the cycle from the March 23rd low, calling for further rally. Consequently we […]

-

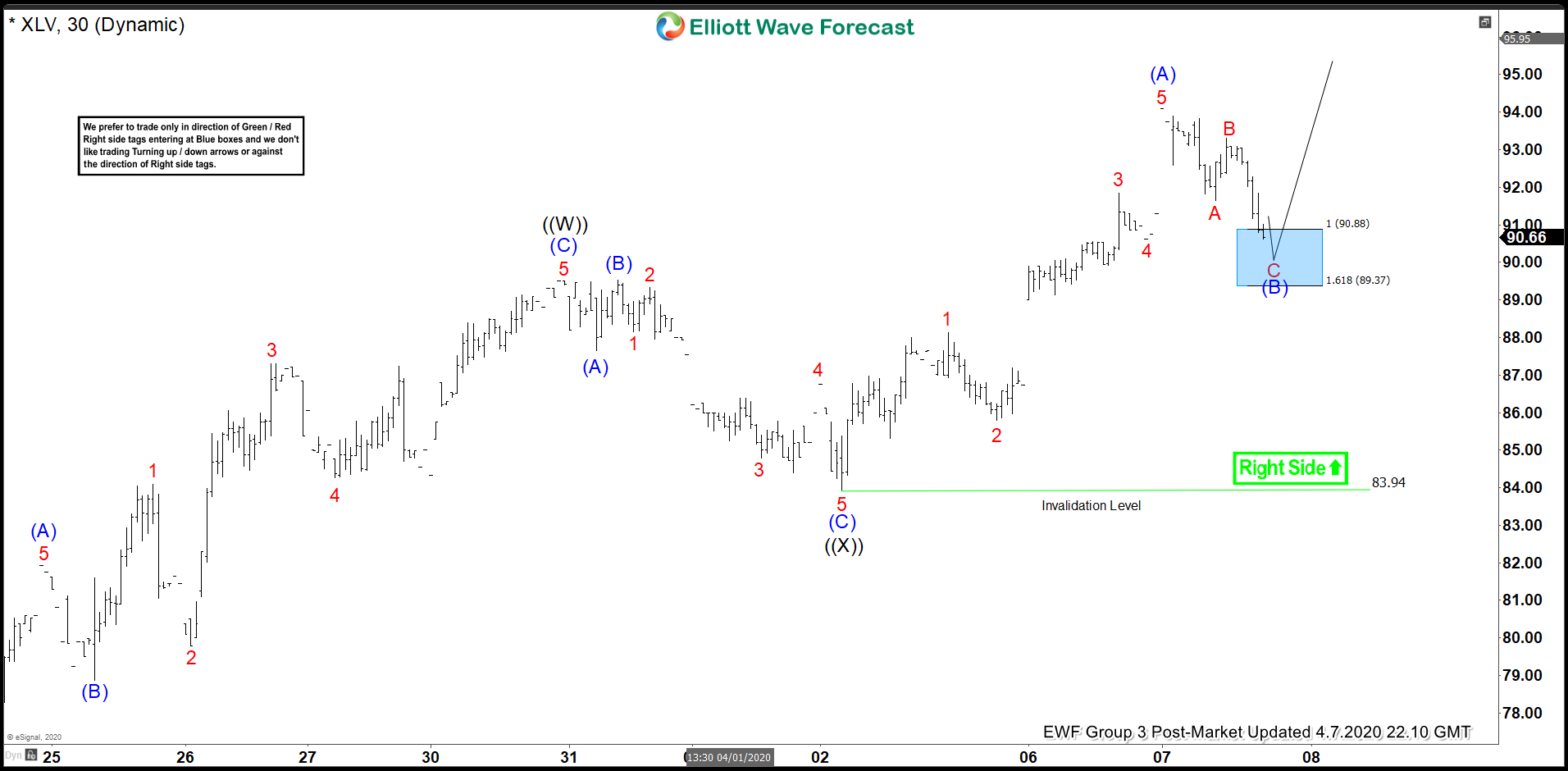

XLV Forecasting The Rally & Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. XLV is another instrument that we have been trading lately . In this technical blog we’re going to take a quick look at the Elliott Wave charts of XLV, published in members area of the website. As our members know, XLV is correcting the cycle from the January 22nd peak (105.09) . […]