-

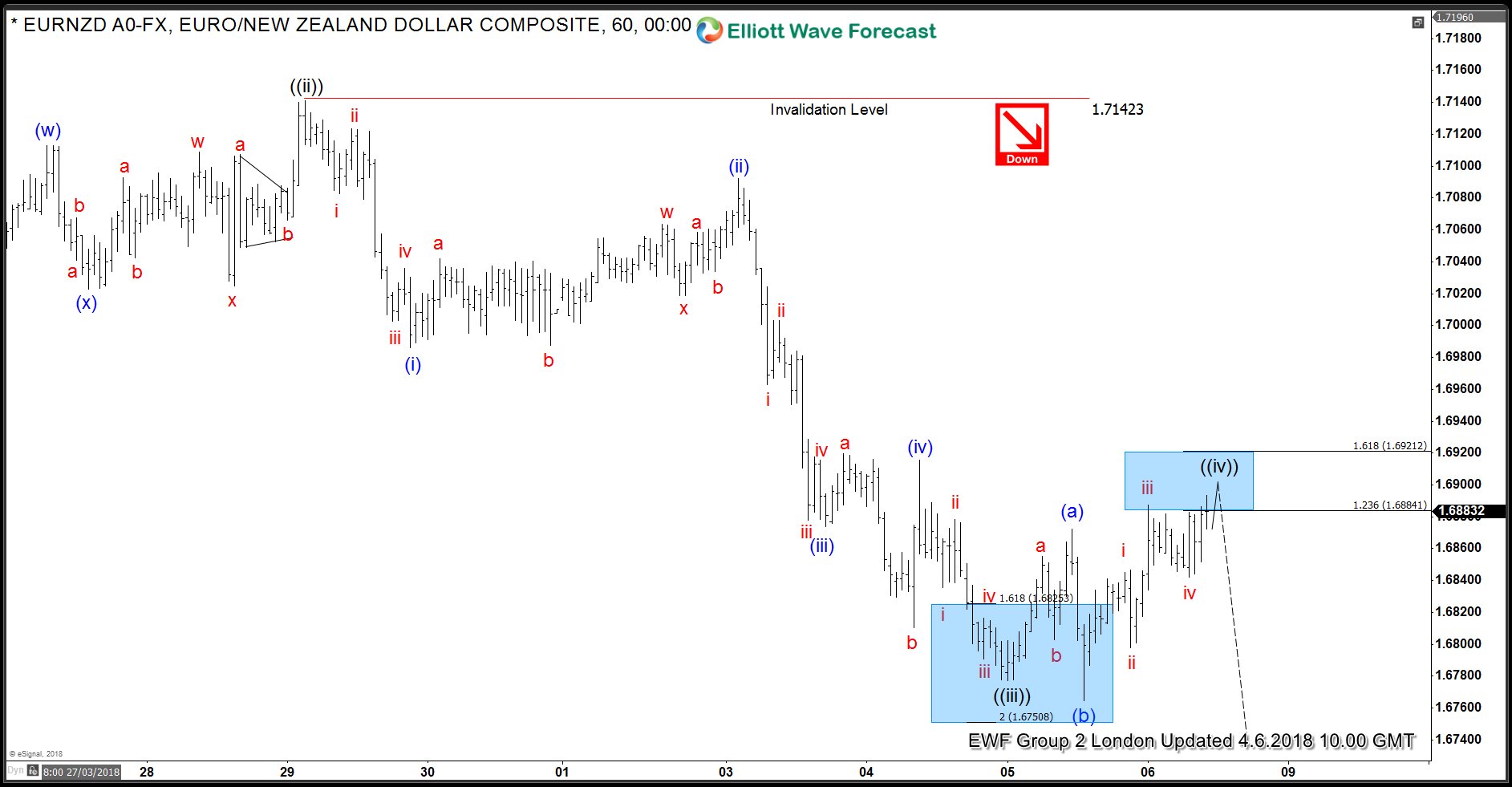

EURNZD Forecasting The Decline after Elliott Wave Flat

Read MoreHello Fellow Traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURNZD published in members area of the website. We’re going to explain the forecast and Elliott Wave Pattern. Before we take a look at the real market expample of Expanded Flat, let’s explain it in […]

-

NASDAQ Elliott Wave : Bearish Sequence Called The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NASDAQ published in members area of the website. As our members know, NQ #F have had incomplete sequences in the 4H cycle , according to Sequence Report. Consequently, we advised clients to keep on selling […]

-

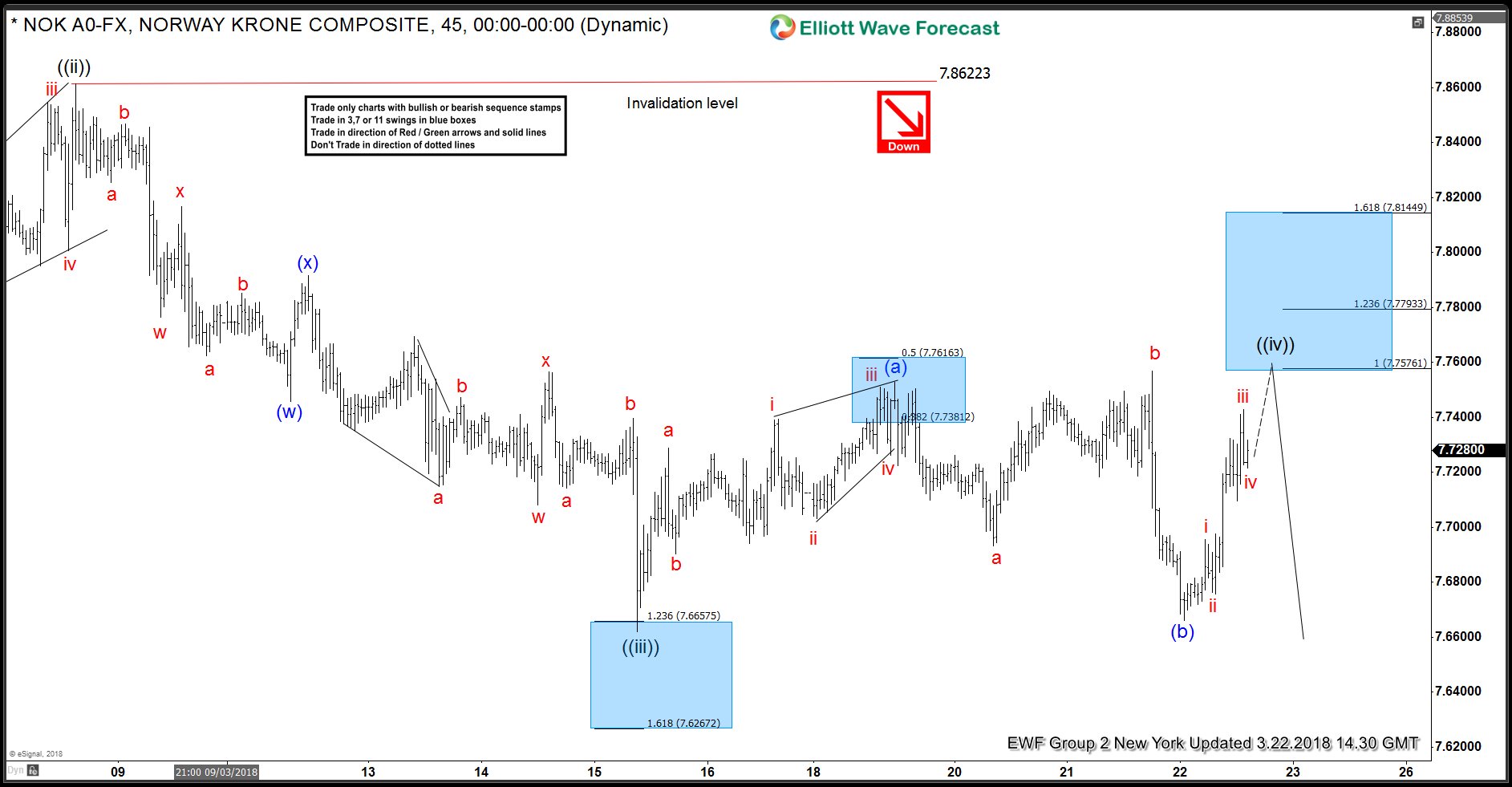

USDNOK Elliott Wave: Calling Extension Lower After The Bounce

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of USDNOK published in members area of the website. In further text we’re going to explain the short term Elliott Wave view. As our members know, the pair has incomplete bearish sequences in 4 Hour […]

-

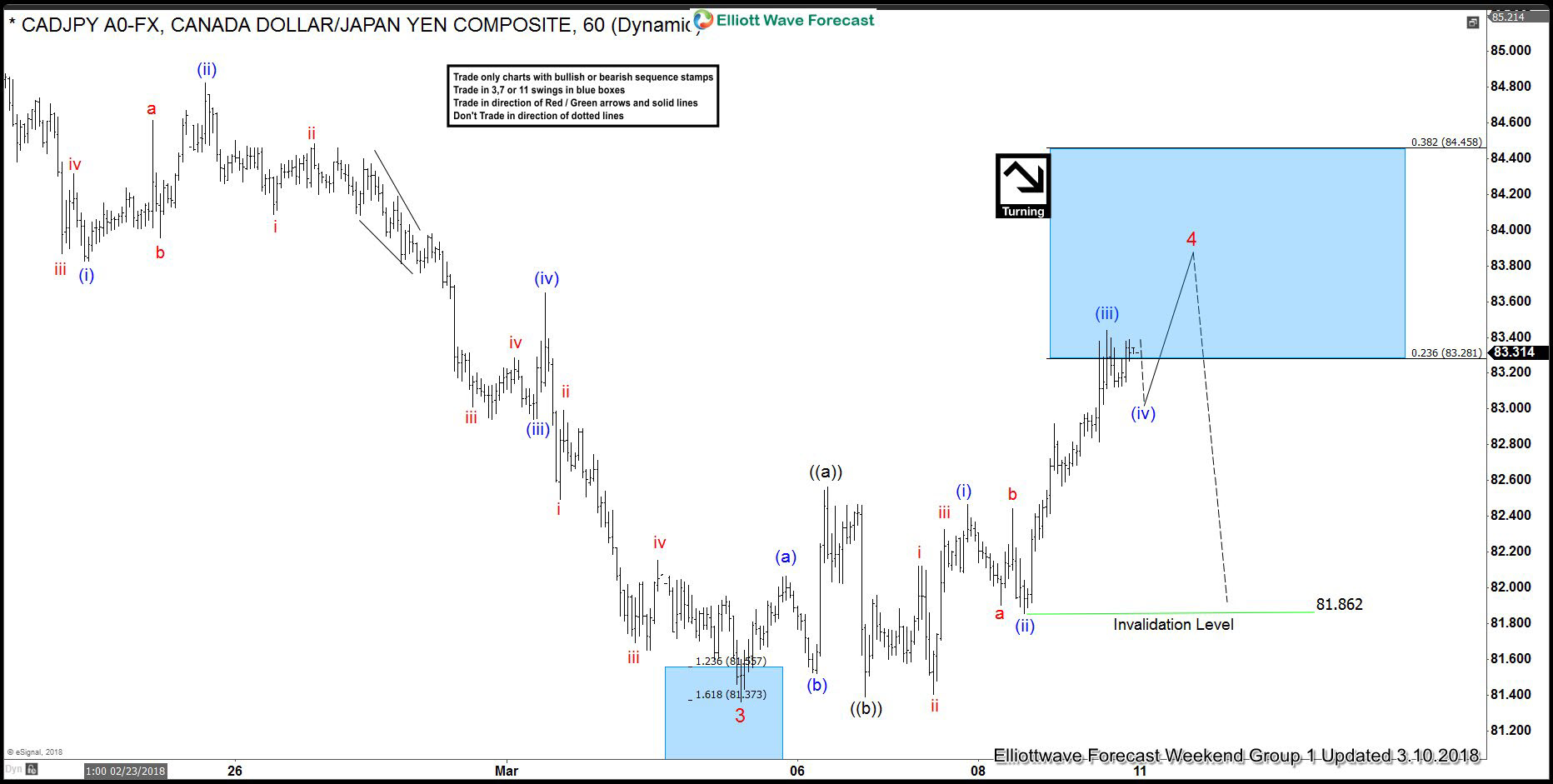

CADJPY Forecasting Decline After Elliott Wave Flat

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of CADJPY published in members area of the website. In further text we’re going to explain the short term Elliott Wave view. As our members know, we have been syaing saying that the pair has reached […]

-

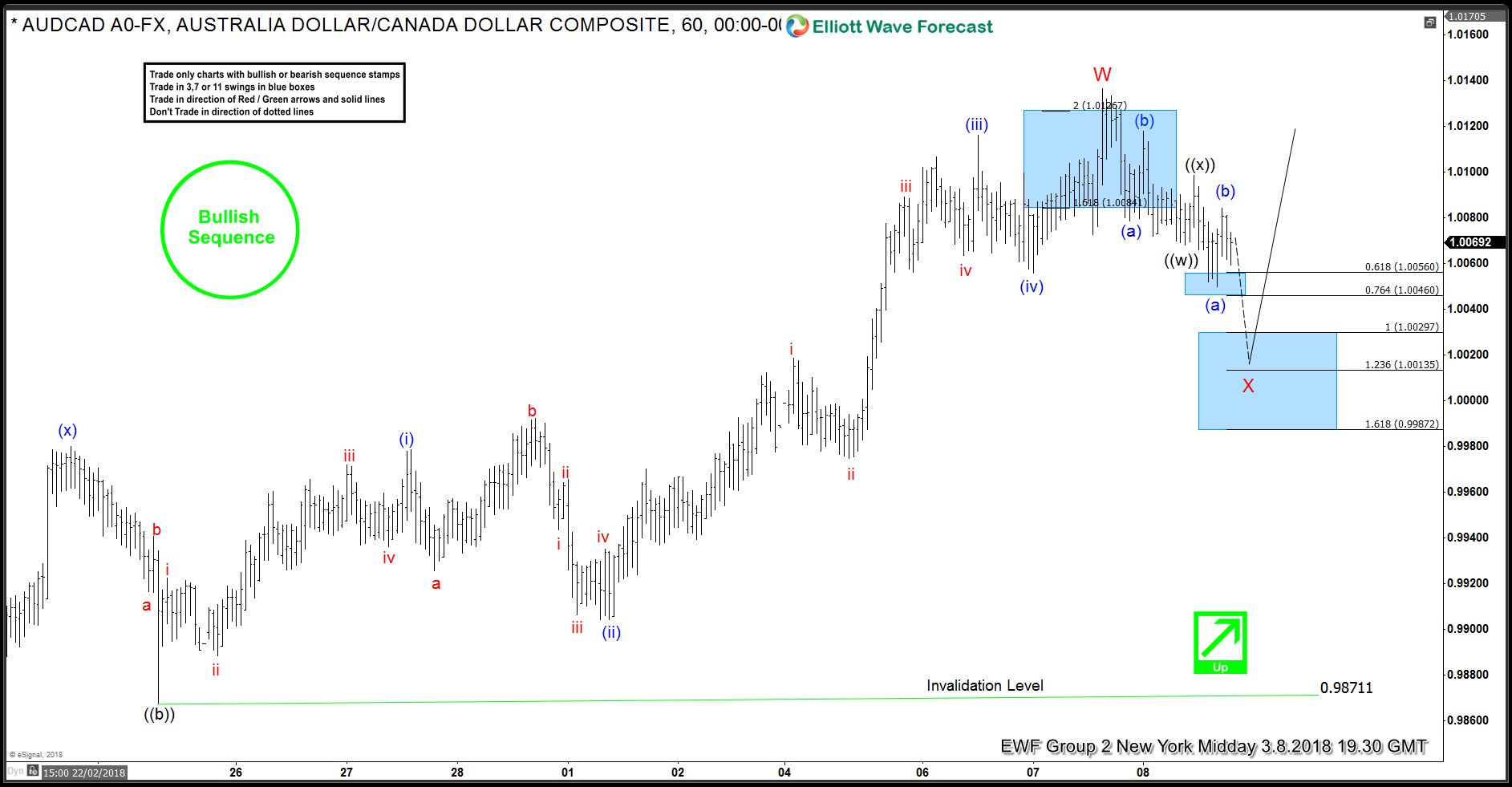

AUDCAD: Why We Were Bullish

Read MoreHello fellow traders. Another pair we have traded lately is AUDCAD. As our members know, AUDCAD is having incomplete bullish sequences in the 1 Hour cycle and suggesting further rally. Due to incomplete structure the pair is targeting 1.0212+ area according to Sequence Report. Consequently, we advised clients to avoid selling the pair and keep […]

-

GBPCAD: Forecasting the rally after Flat

Read MoreHello fellow traders. In this technical blog we’re going to take a look at the past Elliott Wave charts of GBPCAD published in members area of the website. As our members know, GBPCAD have had incomplete bullish sequences in the 1 Hour cycle, suggesting further rally. Consequently, we advised clients to avoid selling the pair […]