-

EURGBP Opened Further Extension Down in 7th Swing

Read MoreHello fellow traders. Another instrument that we have been trading lately is EURGBP . In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURGBP , published in members area of the website. As our members know, EURGBP has incomplete bearish sequences in the cycle from the 08/28 […]

-

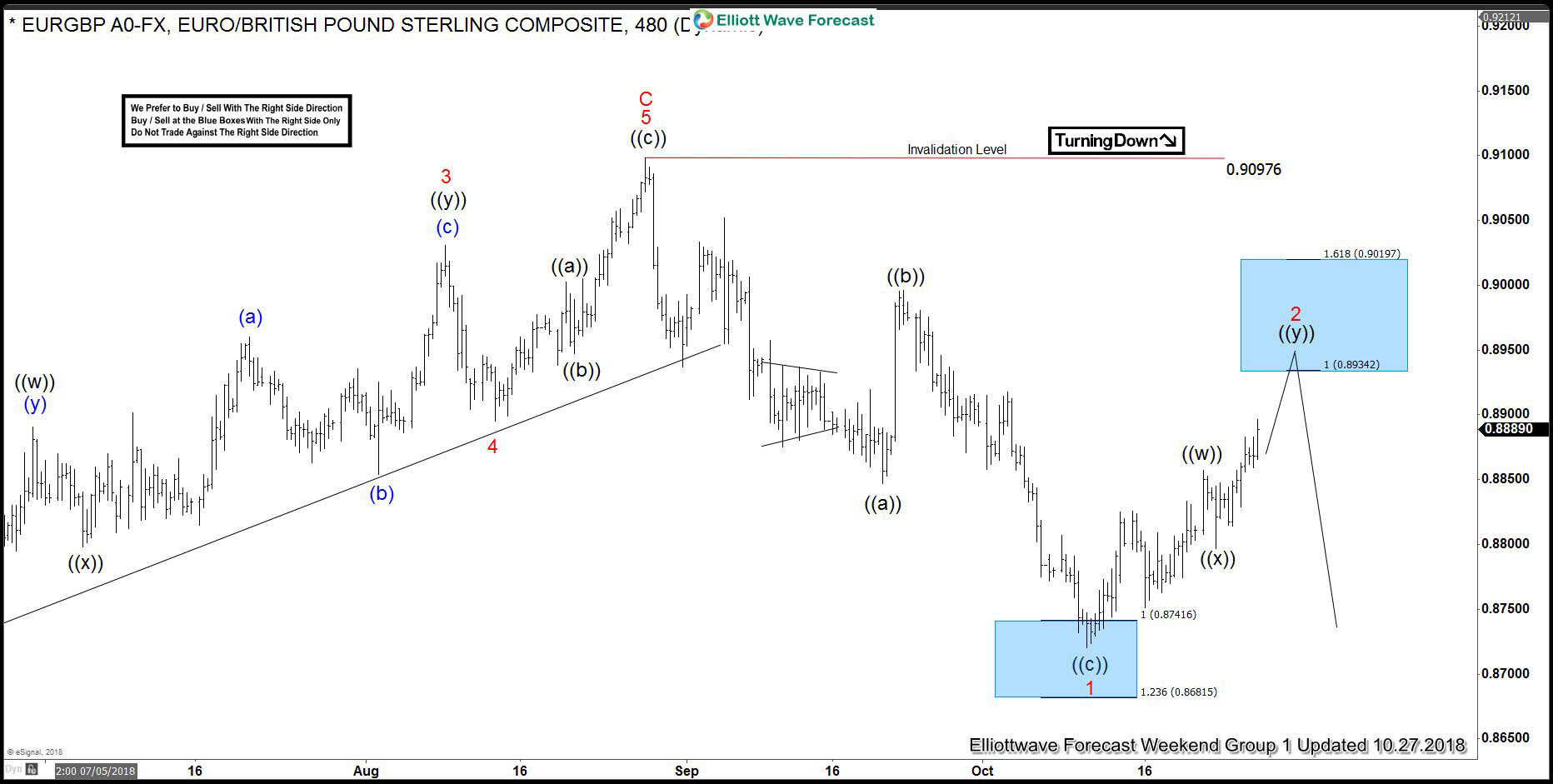

EURGBP Found Sellers After Double Three Pattern

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of EURGBP published in members area of the website. We’ll explain the Forecast and the Price Structure. As our members know EURGBP has ended April 2018 cycle at the 0.90976 peak. We were calling for pottential turn lower […]

-

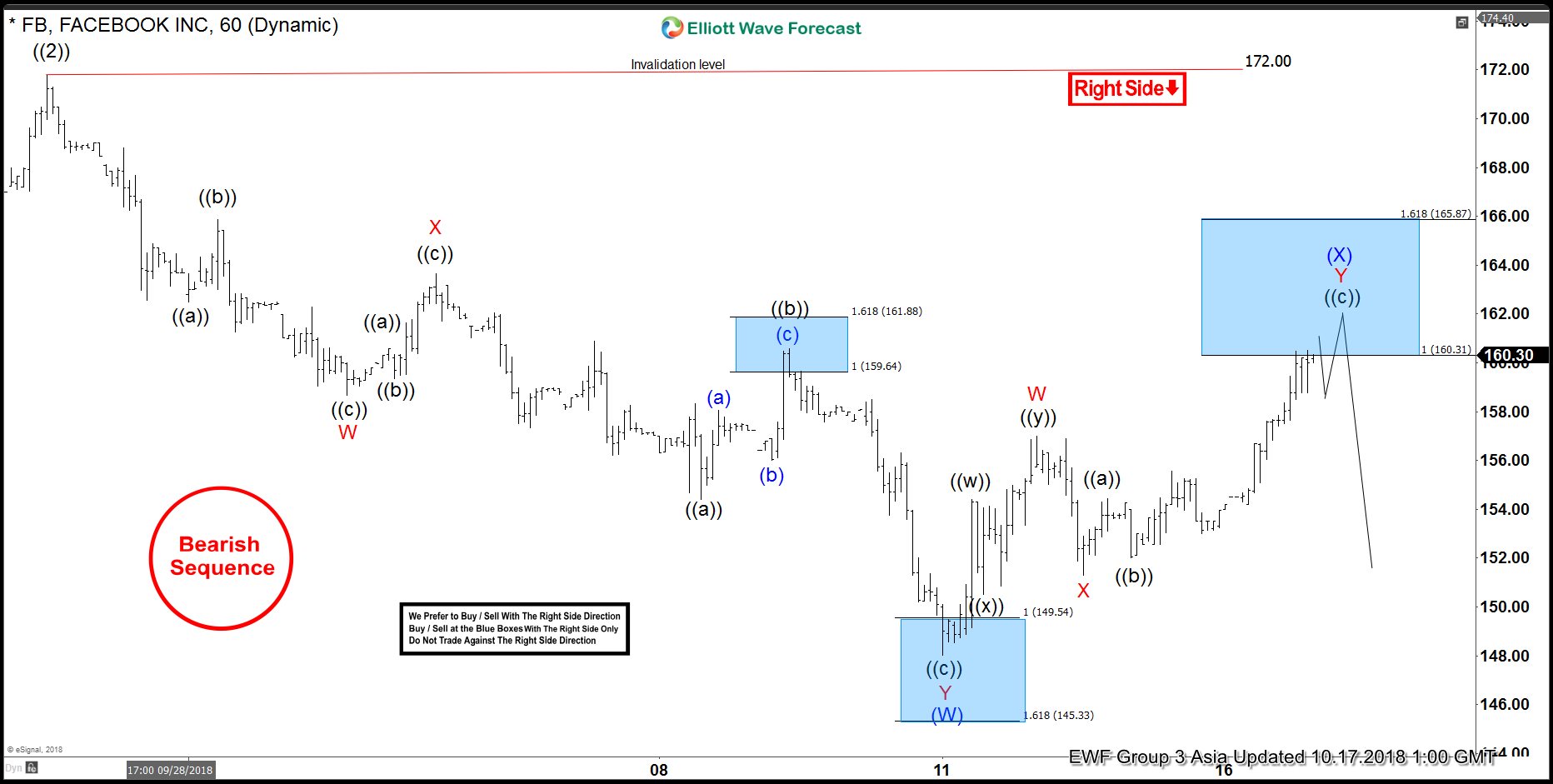

Facebook Forecasting The Decline & Selling The Rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of Facebook. As our members know, early in October, Facebook has incomplete sequences in the cycle from the July 2018 peak. The Stock was still missing another swing down to complete proposed pattern. Consequently , we expected Facebook […]

-

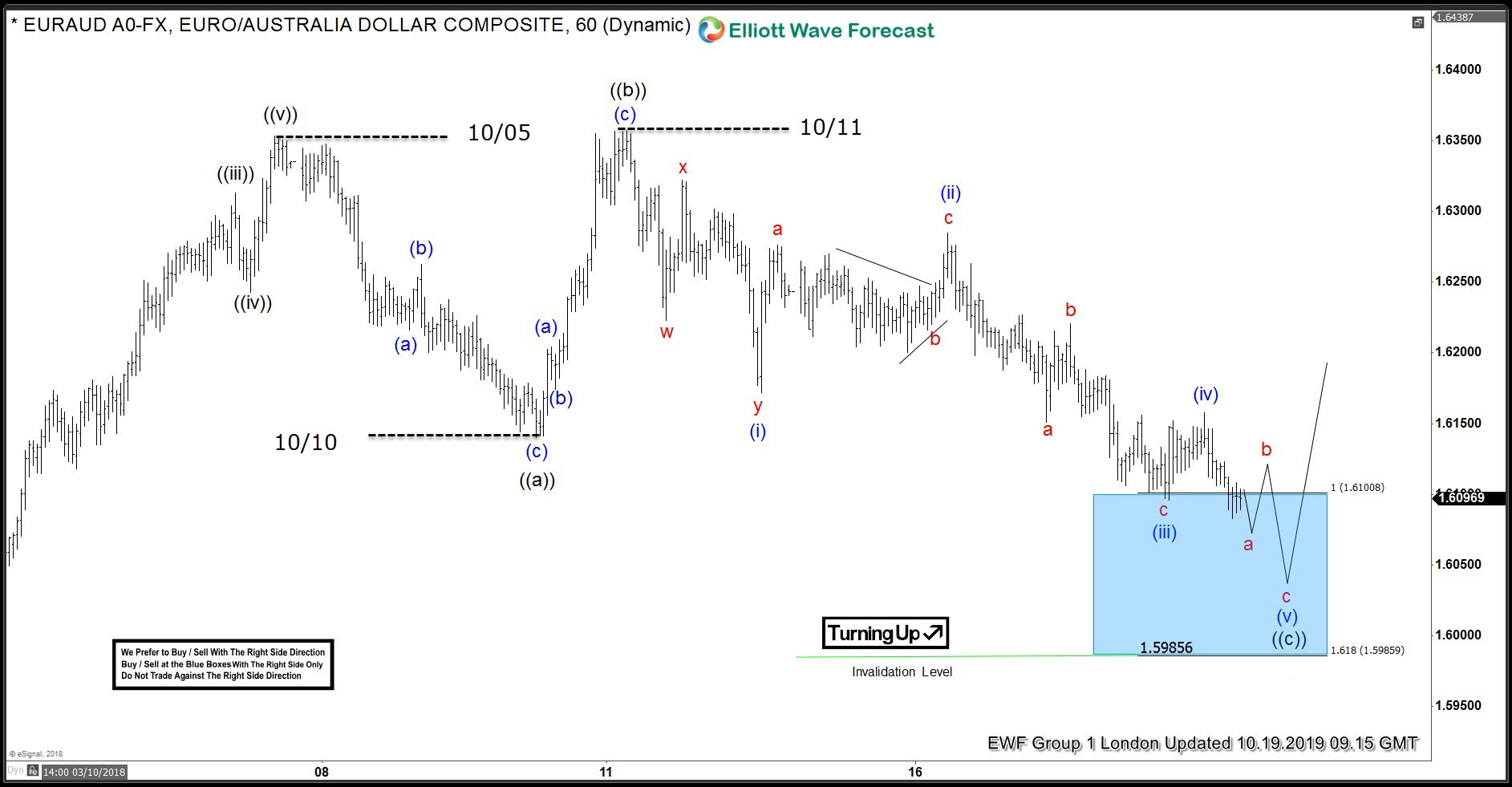

EURAUD Found Buyers After Elliott Wave Flat Pattern

Read MoreHello fellow traders. In this technical blog we’re going to talk about EURAUD forex pair. As our members know, EURAUD has incomplete bullish sequences in February Cycle. Break of March 28th peak has made cycle from the Februay 2017 (1.3593) low incomplete to the upside. The pair is now bullish against the 1.5569 low. Consequently, […]

-

AUDUSD: Bearish Sequence Called The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDUSD published in members area of the website. As our members know, AUDUSD has incomplete bearish sequences in the cycle from the January 2018 peak. Price structure suggests that the pair is targeting 0.6938 area as […]

-

$SPX Forecasting The Rally & Buying The Dips

Read MoreHello fellow Traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $SPXpublished in members area of the website. Another trading opportunity we have had lately is long trade in $SPX. As our members and followers already know, the right side in $SPX is long side. Recently […]