-

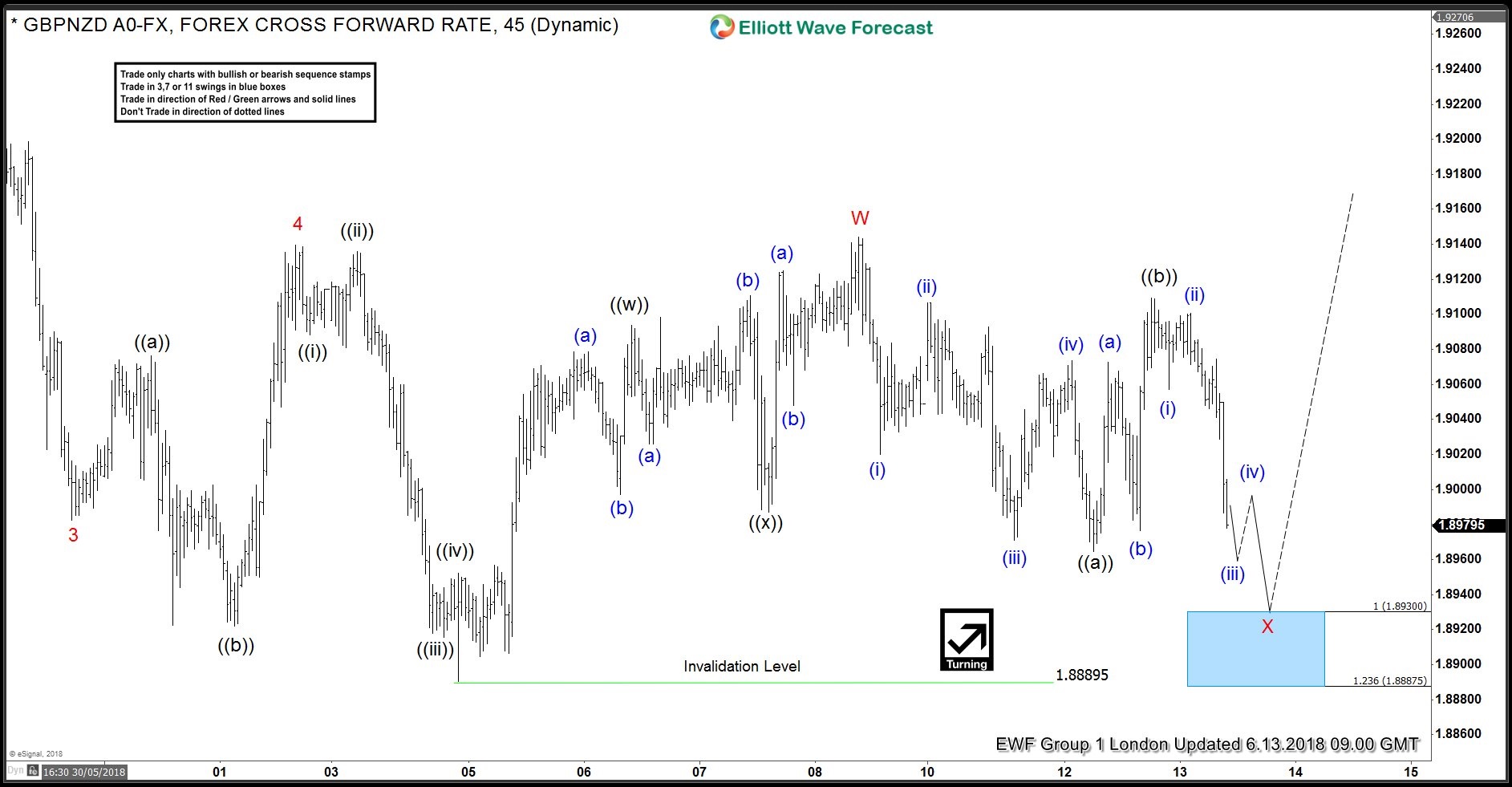

GBPNZD Forecasting the Rally after ZIGZAG

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPNZD published in members area of the website. As our members know, we have been calling for the recovery in the pair since the cycle from the April peak ended at 1.8889 low. In further text we’re […]

-

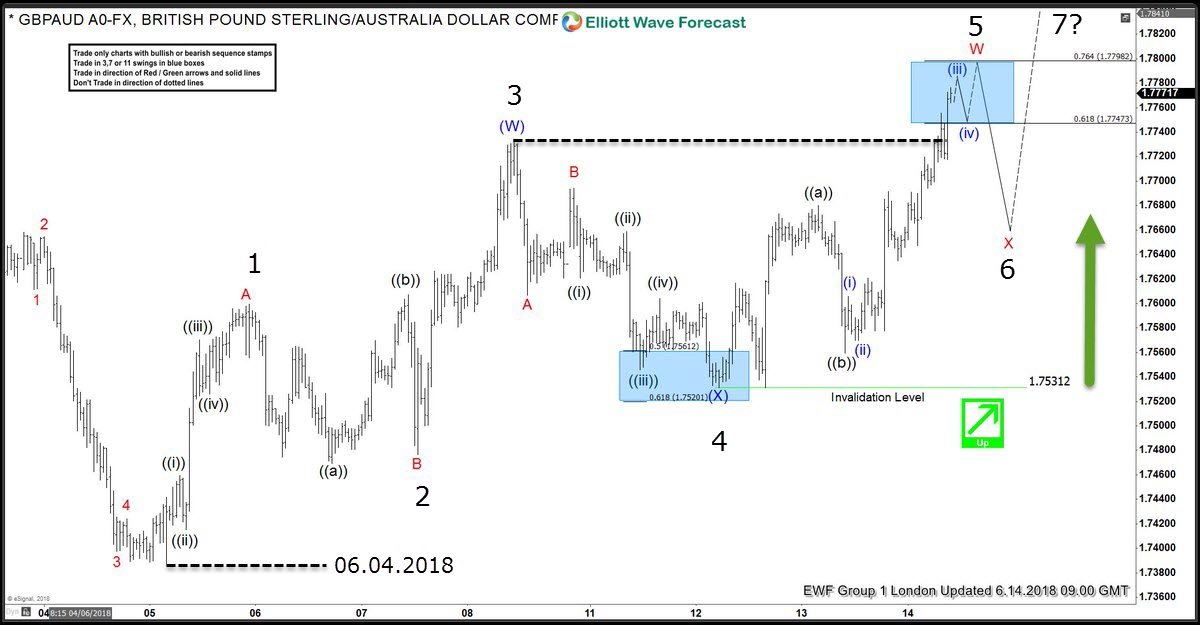

GBPAUD Incomplete Sequences Calling The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPAUD published in members area of the website. As our members know GBPAUD has been showing incomplete bullish sequence: 5 swing in the short term cycle from the June 4th low. These types of […]

-

RUSSELL Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is RUSSELL Futures. In this technical blog we’re going to take a quick look at the Elliott Wave charts of RUSSELL published in members area of the website. In further text we’re going to explain the forecast and trading setup. As our members know, RUSSELL […]

-

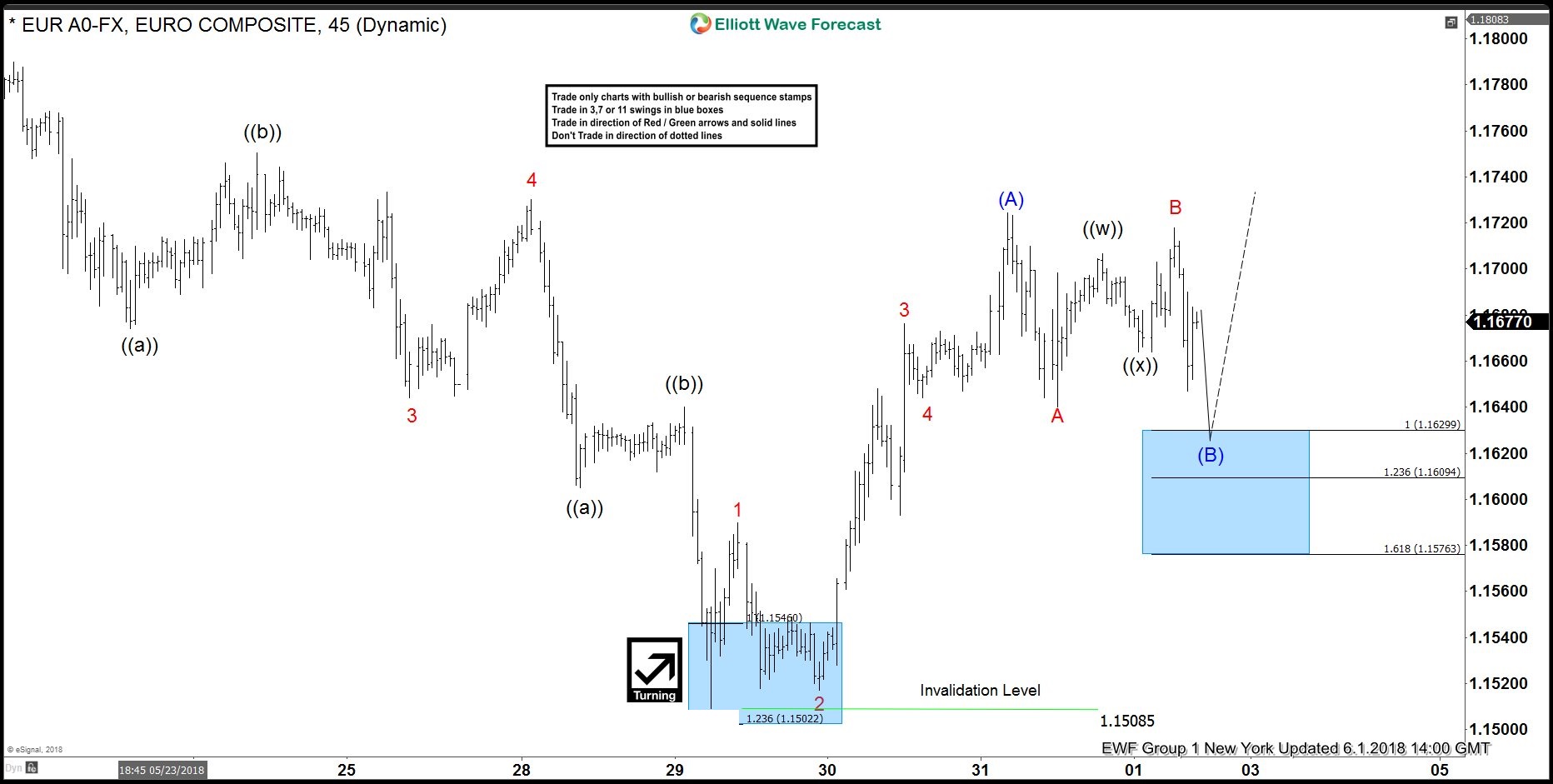

EURUSD Forecasting The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of EURUSD published in members area of the website. As our members know February cycle has ended at 1.15085 low and now we’re getting larger recovery in the pair. In further text we’re going to […]

-

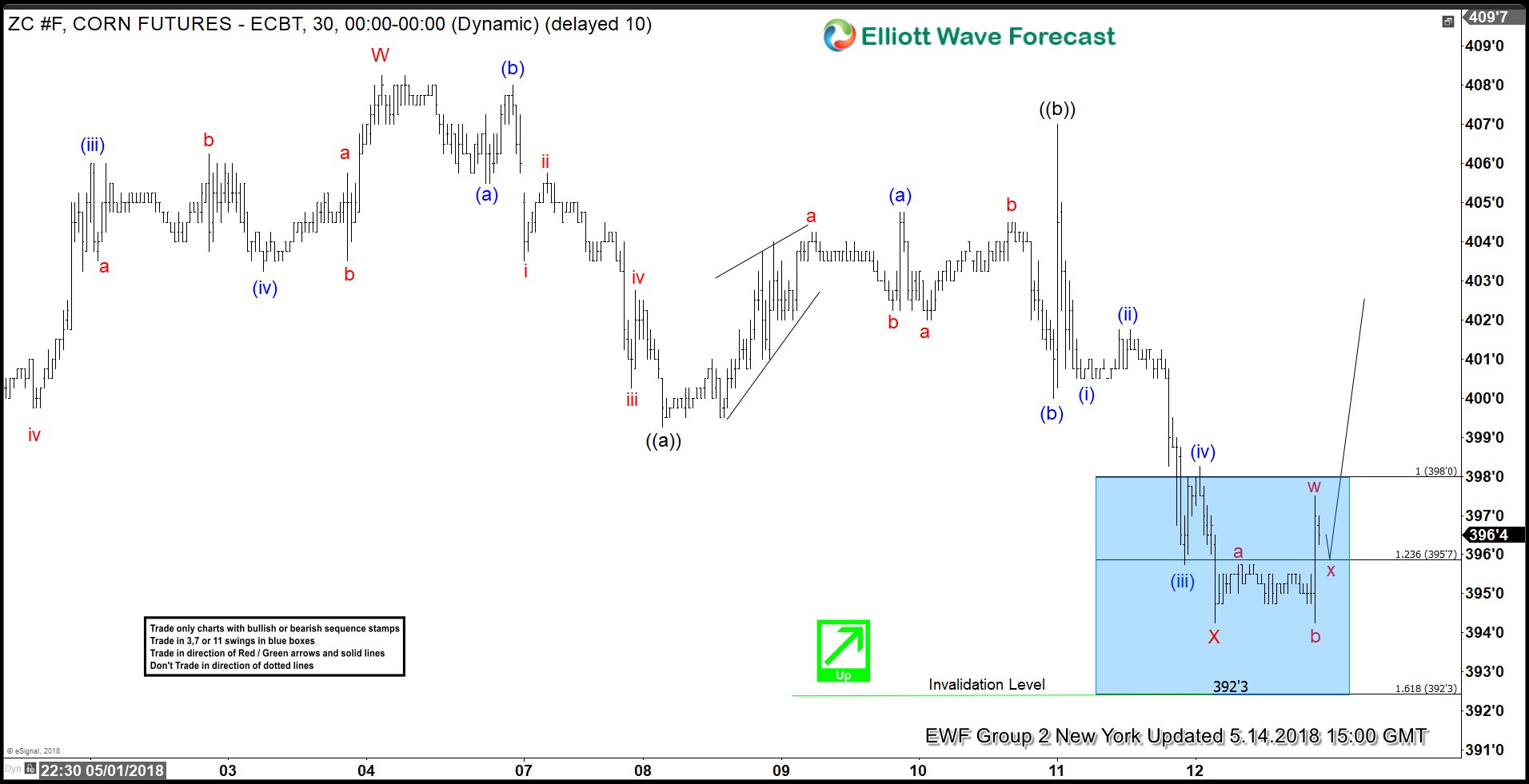

CORN (ZC #F) Futures Forecasting the Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is Corn Futures. In this technical blog we’re going to take a quick look at the Elliott Wave charts of ZC #F published in members area of the website. In further text we’re going to explain the forecast and trading setup. As our members know, […]

-

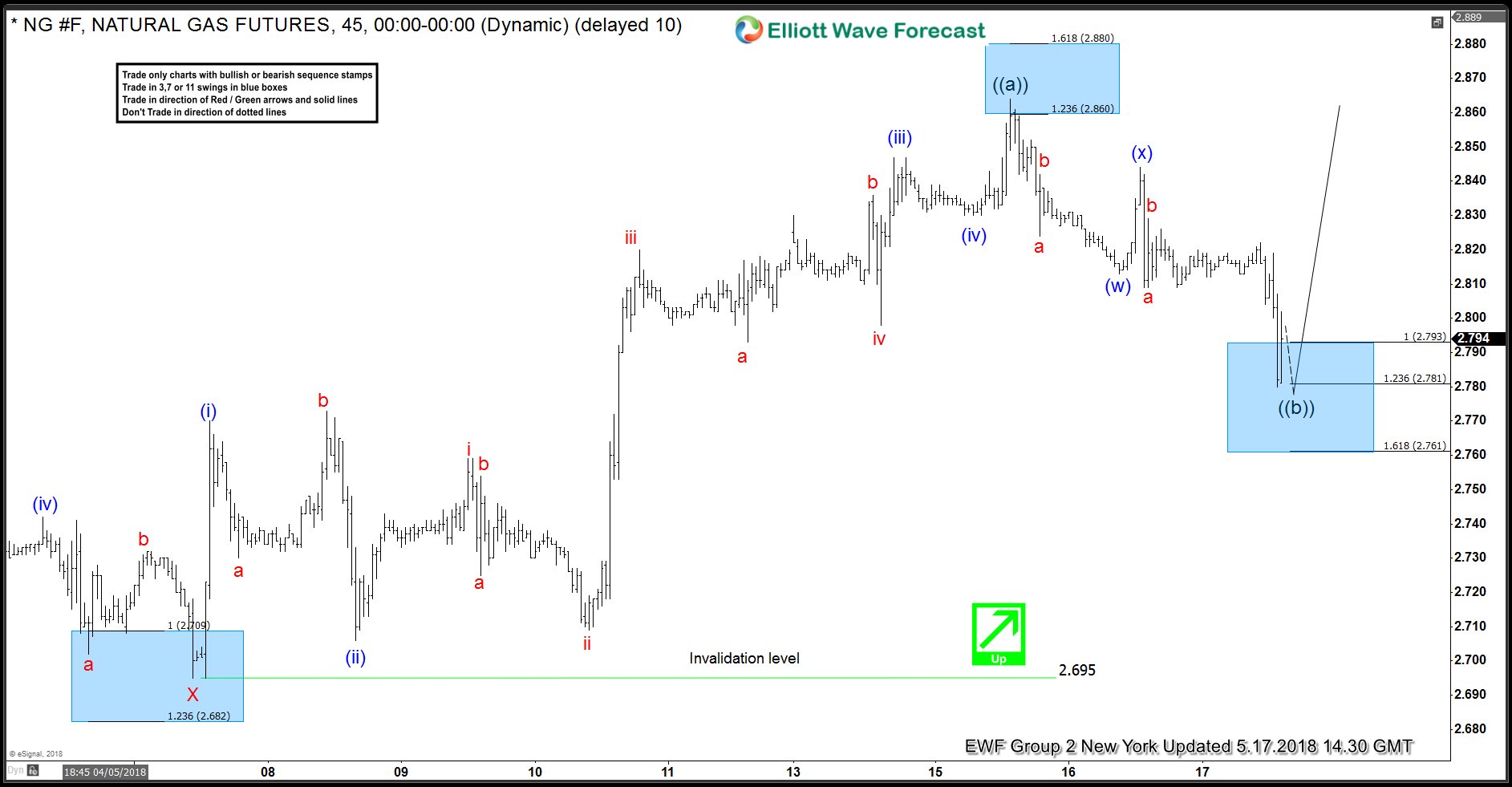

Natural Gas ( NG #F) Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is Natural Gas (NG #F). In this technical blog we’re going to take a quick look at the past Elliott Wave charts of NG #F published in members area of the website. In further text we’re going to explain the forecast and trading setup. Natural […]