-

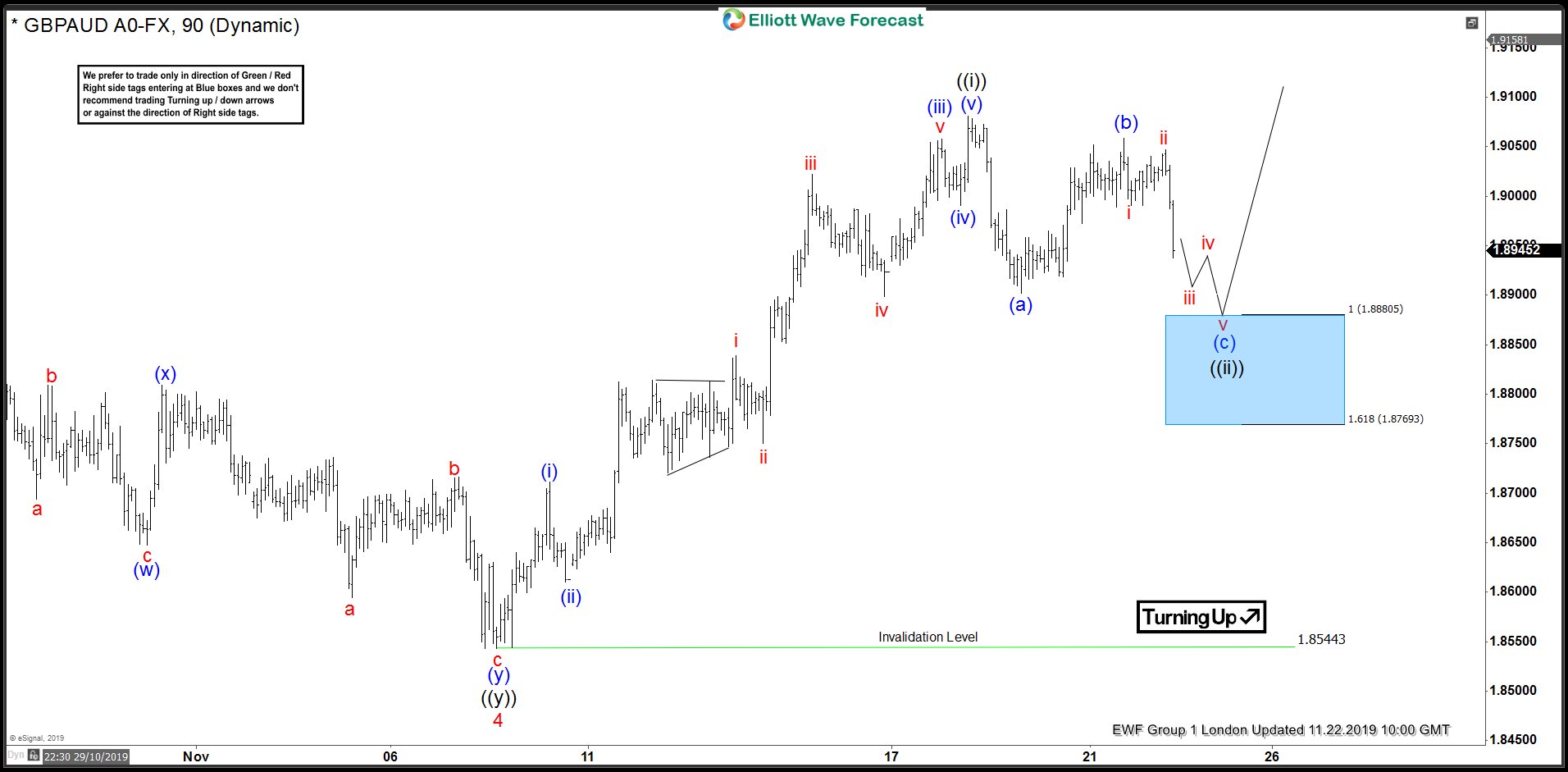

GBPAUD Calling The Rally From The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPAUD published in members area of the Elliottwave-Forecast . As our members know, GBPAUD is showing incomplete sequences in the cycle from the December 2018 low. We’ve been calling for further extension higher toward 1.923 […]

-

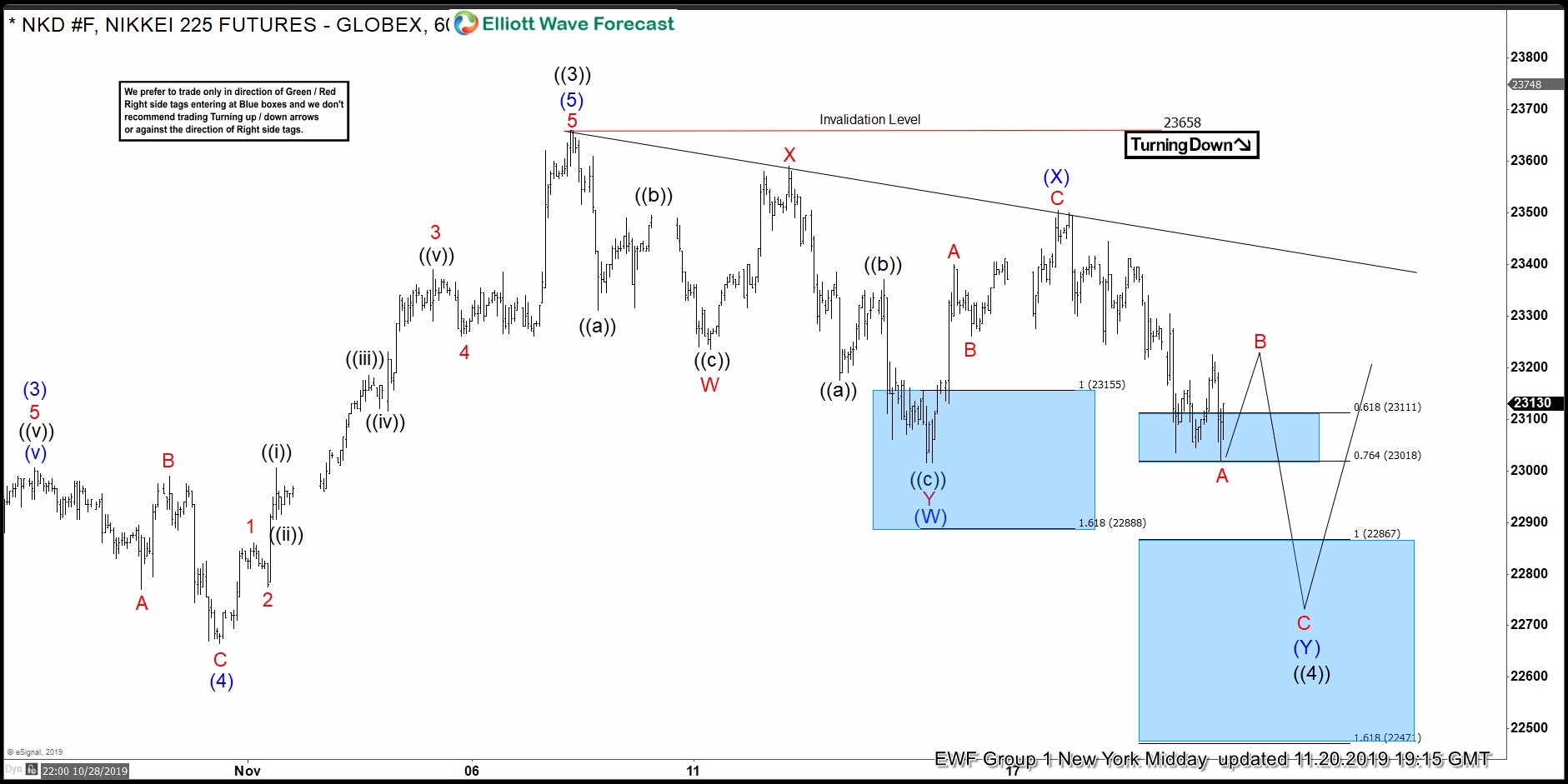

$NIKKEI Forecasting The Rally From The Blue Box

Read MoreHello fellow traders. NIKKEI has been very technical recently. The Futures was keep finding buyers at the Equal legs- Blue Box areas. We’re going to take a quick look at the Elliott Wave charts of NIKKEI published in the membership area of the elliottwave-forecast . NIKKEI ended cycle from the 22427 low as 5 waves […]

-

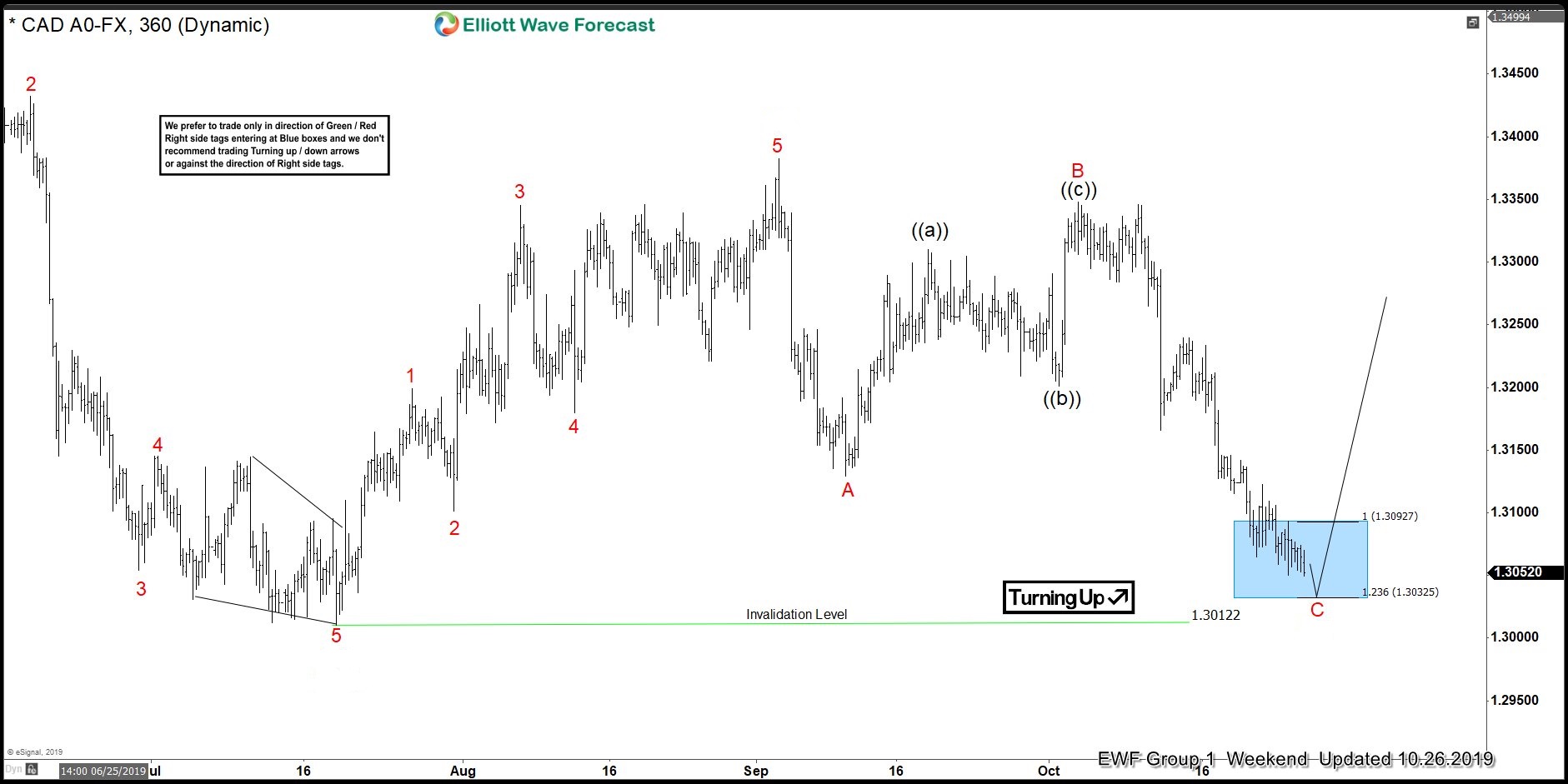

USDCAD Forecasting The Rally From The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of USDCAD published in members area of the elliottwave-forecast . As our members know, USDCAD ended cycle from the 1.30122 low as 5 waves structure. We got 3 waves pull back , when the price reached Equal Legs – […]

-

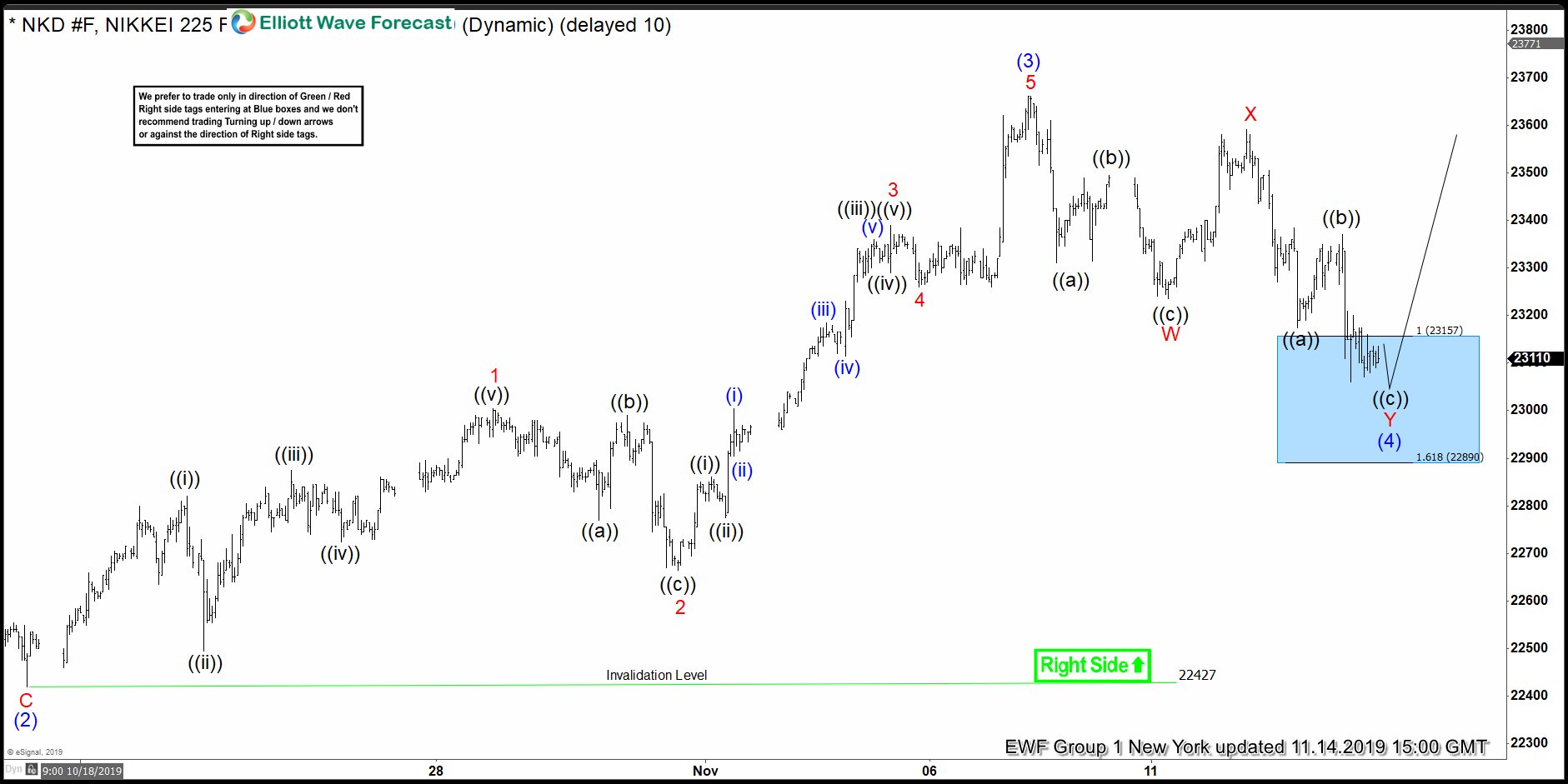

NIKKEI ( $NKD_F ) Made Bounce From The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI published in the membership area of the elliottwave-forecast . As our members know, NIKKEI ended cycle from the 22427 low as 5 waves structure. We got 3 waves pull back , when the price reached Equal Legs […]

-

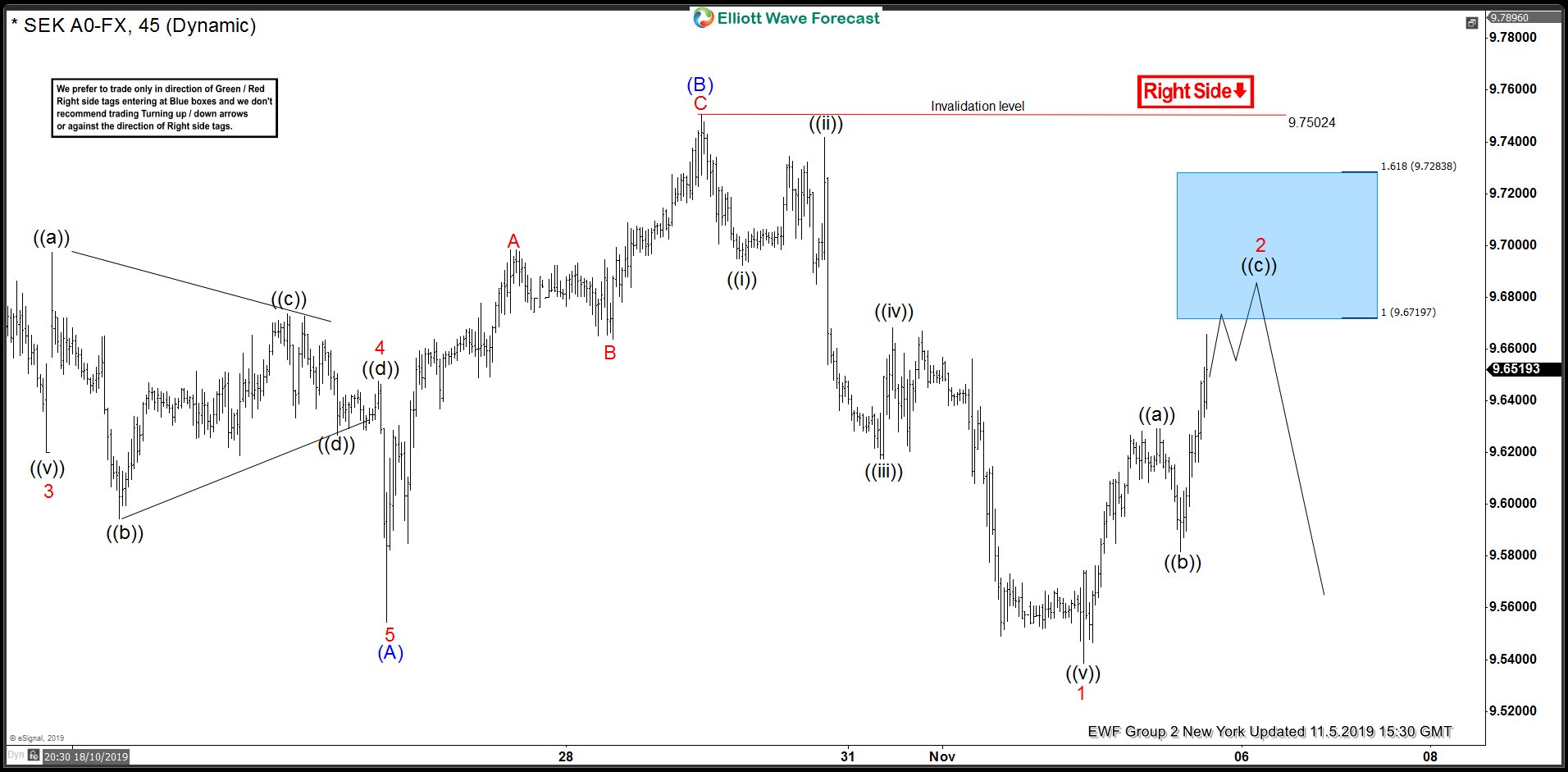

USDSEK Found Sellers At The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of USDSEK , published in members area of the website. As our members know, USDSEK has incomplete bearish sequences in the cycle from the 9.9632 (October 9th) peak. Consequently, we advised members to avoid buying the pair and keep […]

-

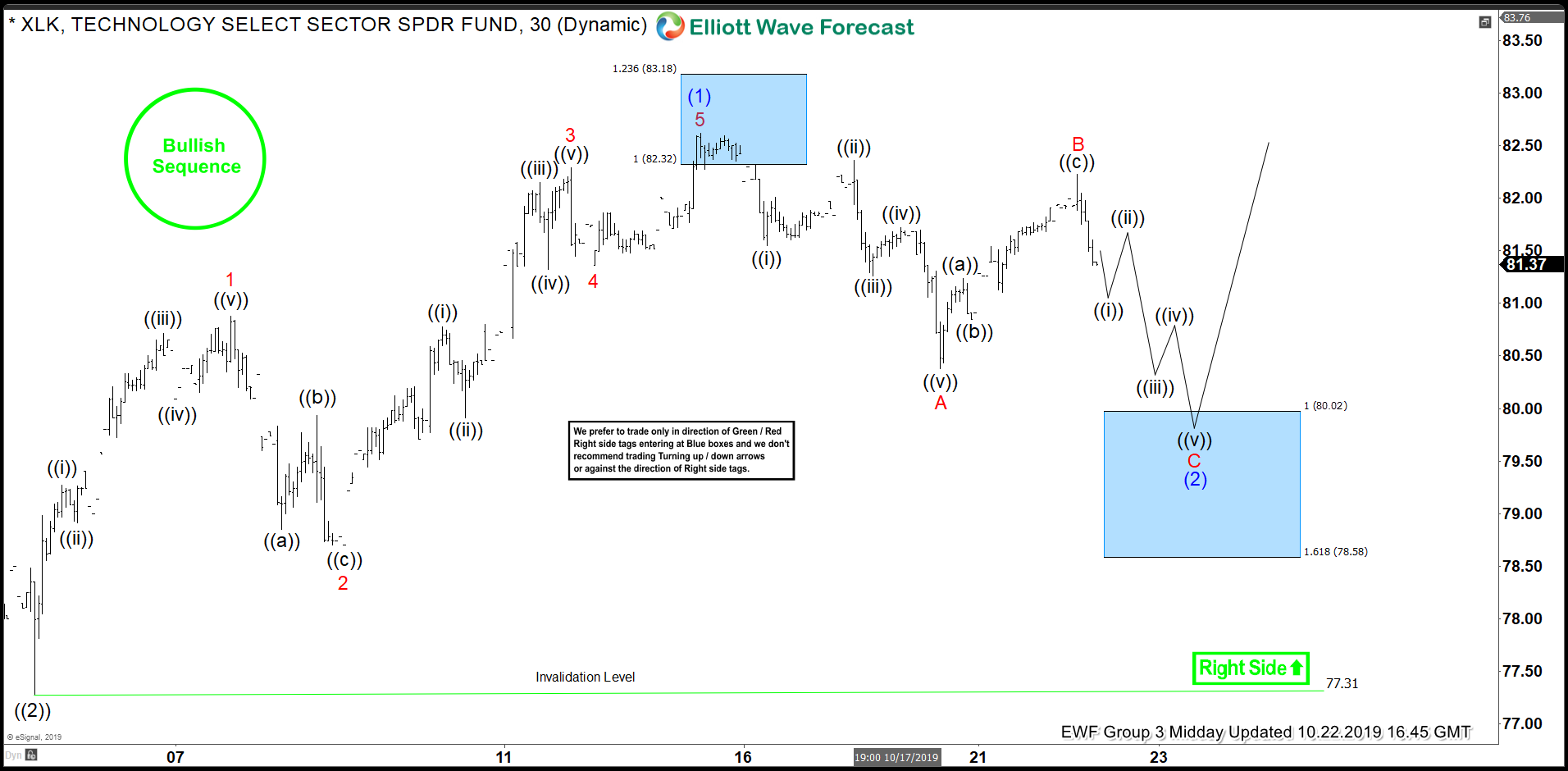

XLK Forecasting The Path & Buying The Dips In The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of XLK – Technology Select Sector , published at elliottwave-forecast. As our members know XLK has been showing incomplete bullish sequences in the cycle from the August 5th low. Break of the September 12th peak made […]