-

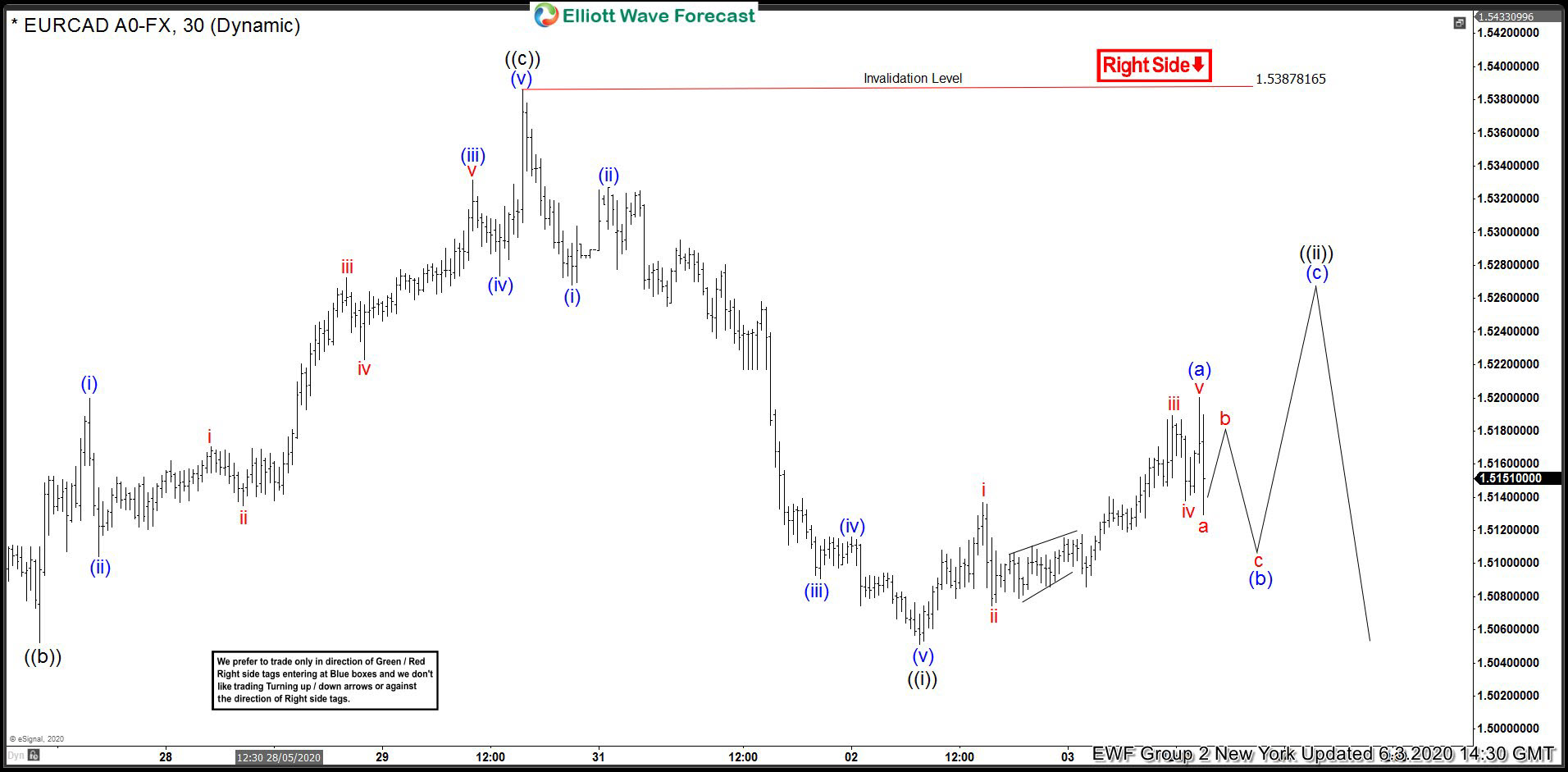

EURCAD Forecasting The Decline After Elliott Wave Zig Zag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURCAD. As our members know, recently the pair gave us 3 waves bounce against the 1.53878 peak. Recovery unfolded as Elliott Wave Zig Zag pattern (a)(b)(c). Once the price reached equal legs (a)-(b) we knew […]

-

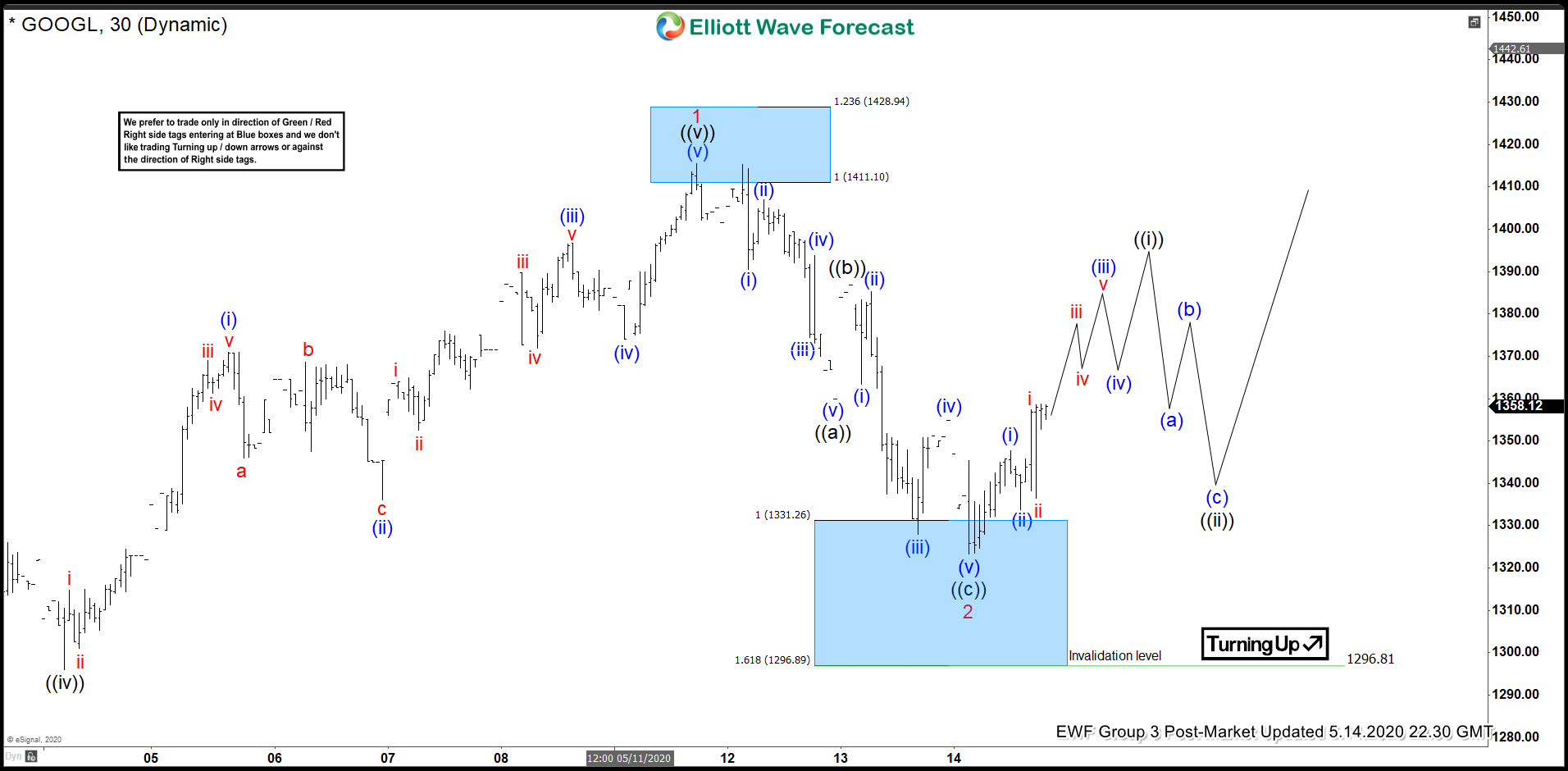

GOOGLE (GOOGL) Elliott Wave Forecasting The Path

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of GOOGL, published in members area of the website. The stock is trading within the cycle from the March 1009.6 low. Proposed cycle can be still in progress as impulsive structure. In further text we’re going to explain Elliott […]

-

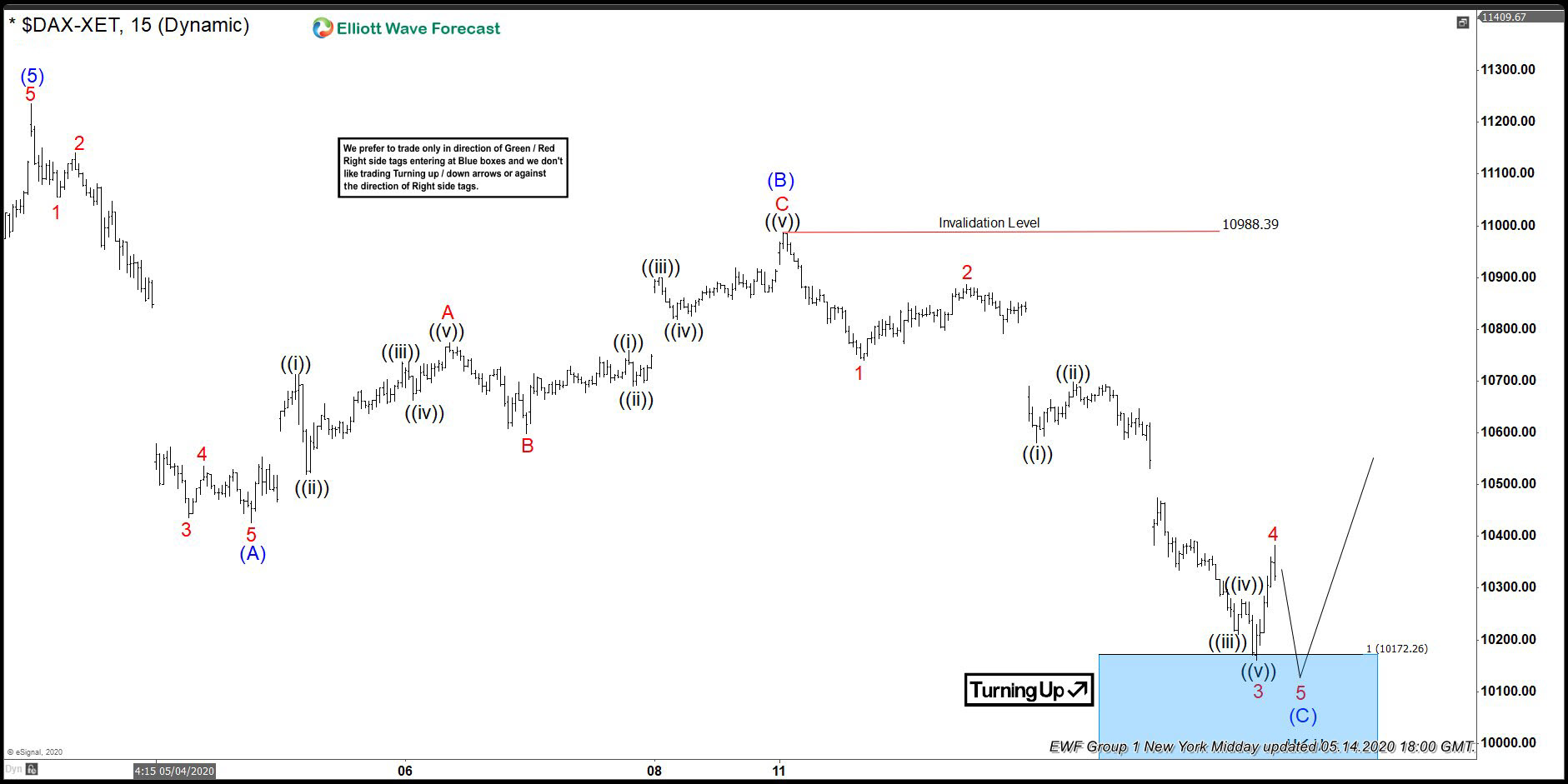

DAX Elliott Wave Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of DAX . As our members know DAX has recently given us pull back against the March 8239.5 low that has unfolded as Elliott Wave Zig Zag Pattern. We were calling cycle from the March low […]

-

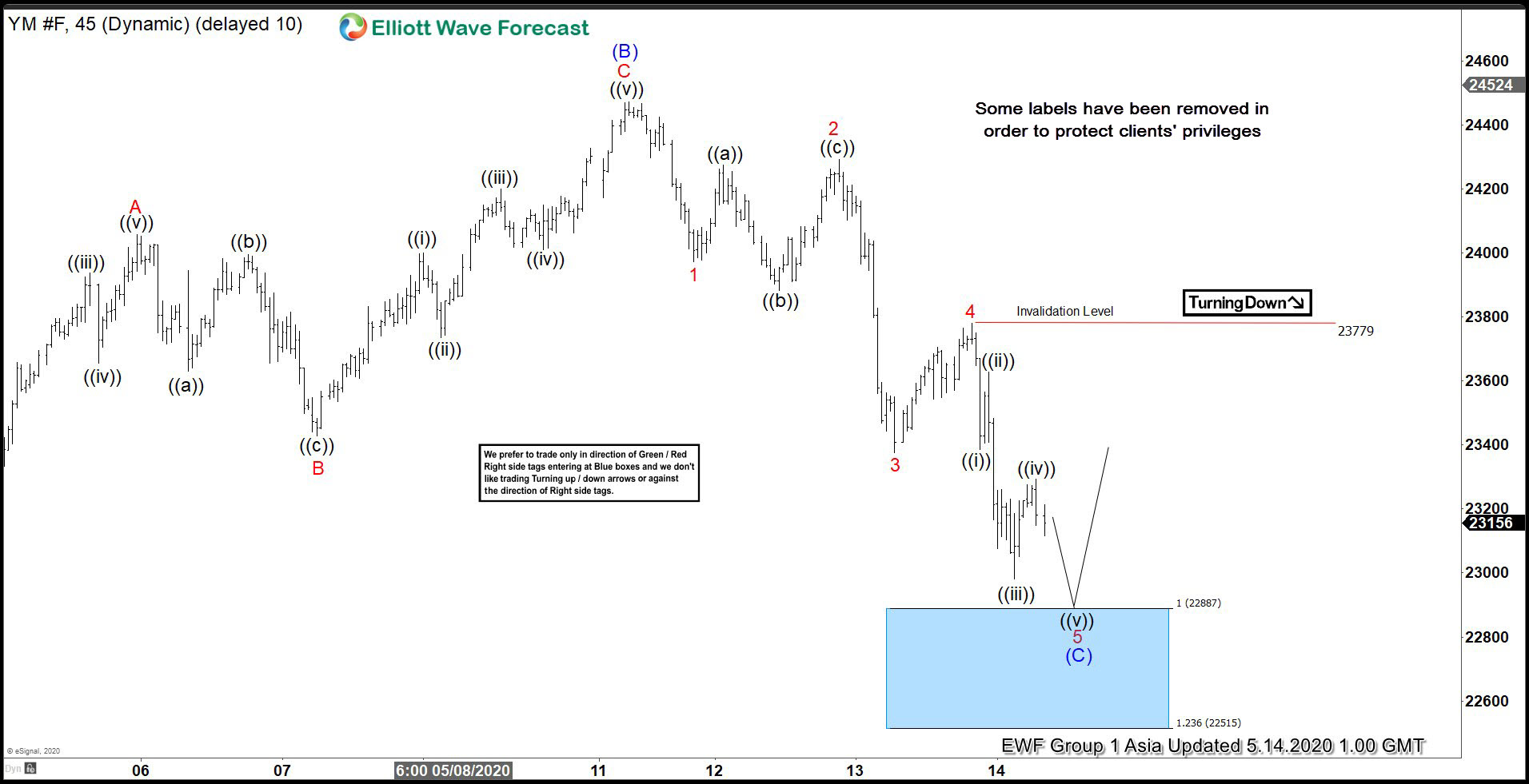

INDU ( $YM_F ) Found Buyers After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of INDU. As our members know INDU has recently given us pull back against the March 18058 low. Pull back unfolded as Elliott Wave Zig Zag Pattern. We expected buyers to show at the Blue Box […]

-

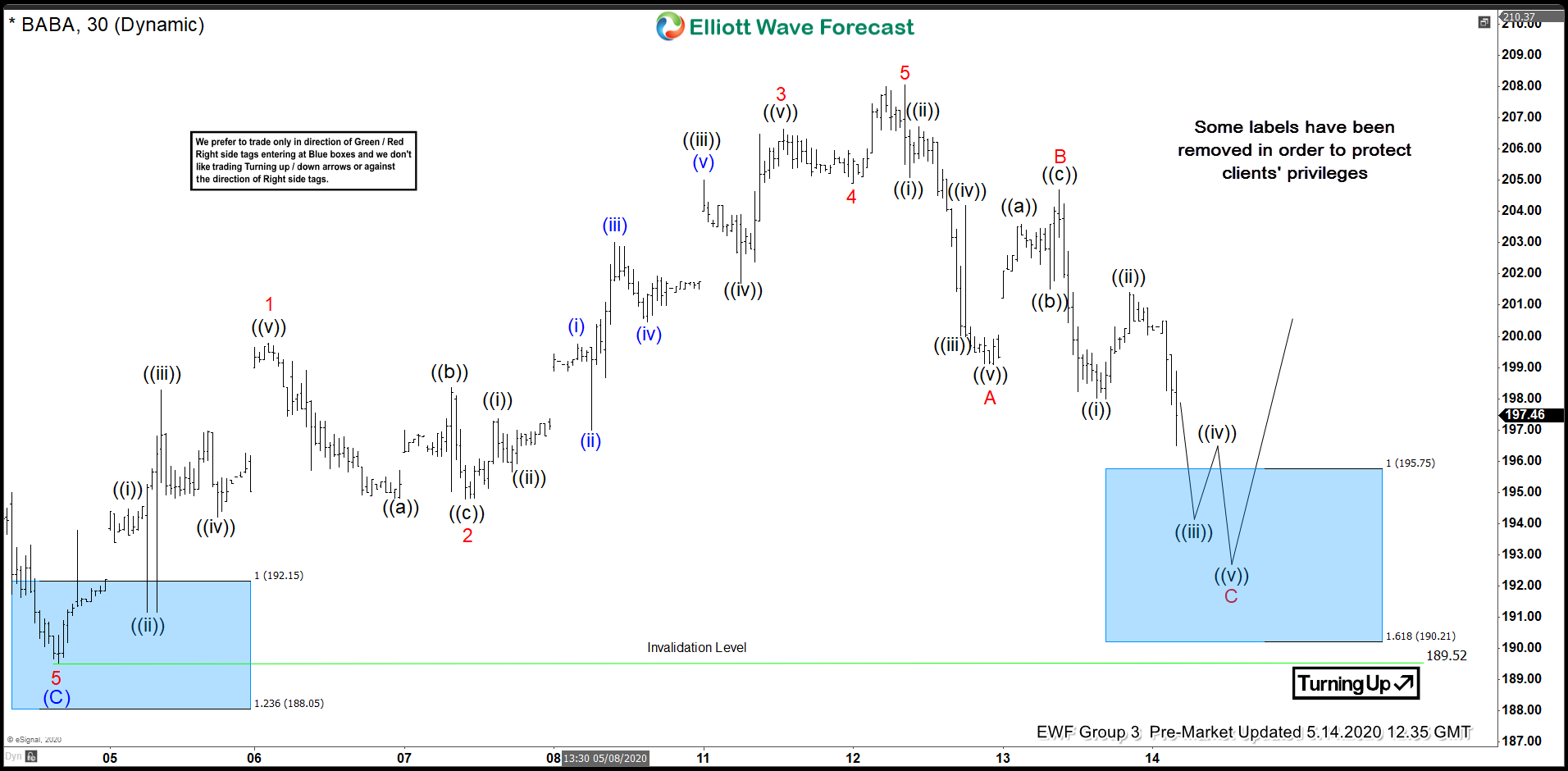

BABA Found Buyers After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of BABA stock, published in members area of the website. As our members know, BABA has been reacting nicely from blue box areas. Recently the stock found buyers, after completing Elliott Wave Zig Zag Pattern. In […]

-

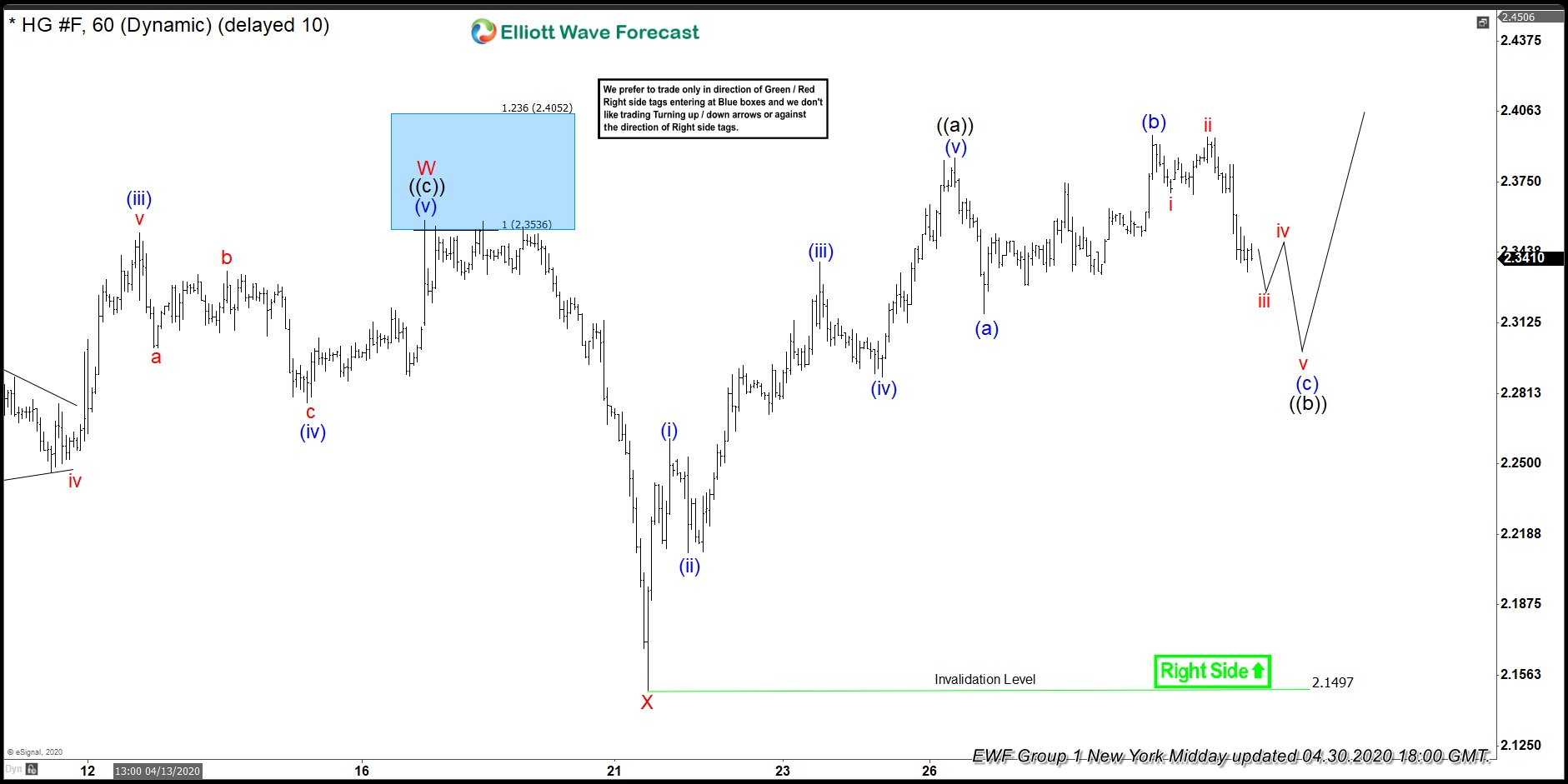

Copper ( $HG_F ) Forecasting The Rally After Elliott Wave Flat

Read MoreHello fellow traders. In this technical blog we’re going to talk about Copper. As our members know, Copper has incomplete bullish sequences in the cycle from the March 19th low. Break of 04/16 peak made cycle from the March (1.9715) low incomplete to the upside. The commodity is now bullish against the 2.1475 low. Consequently, […]