-

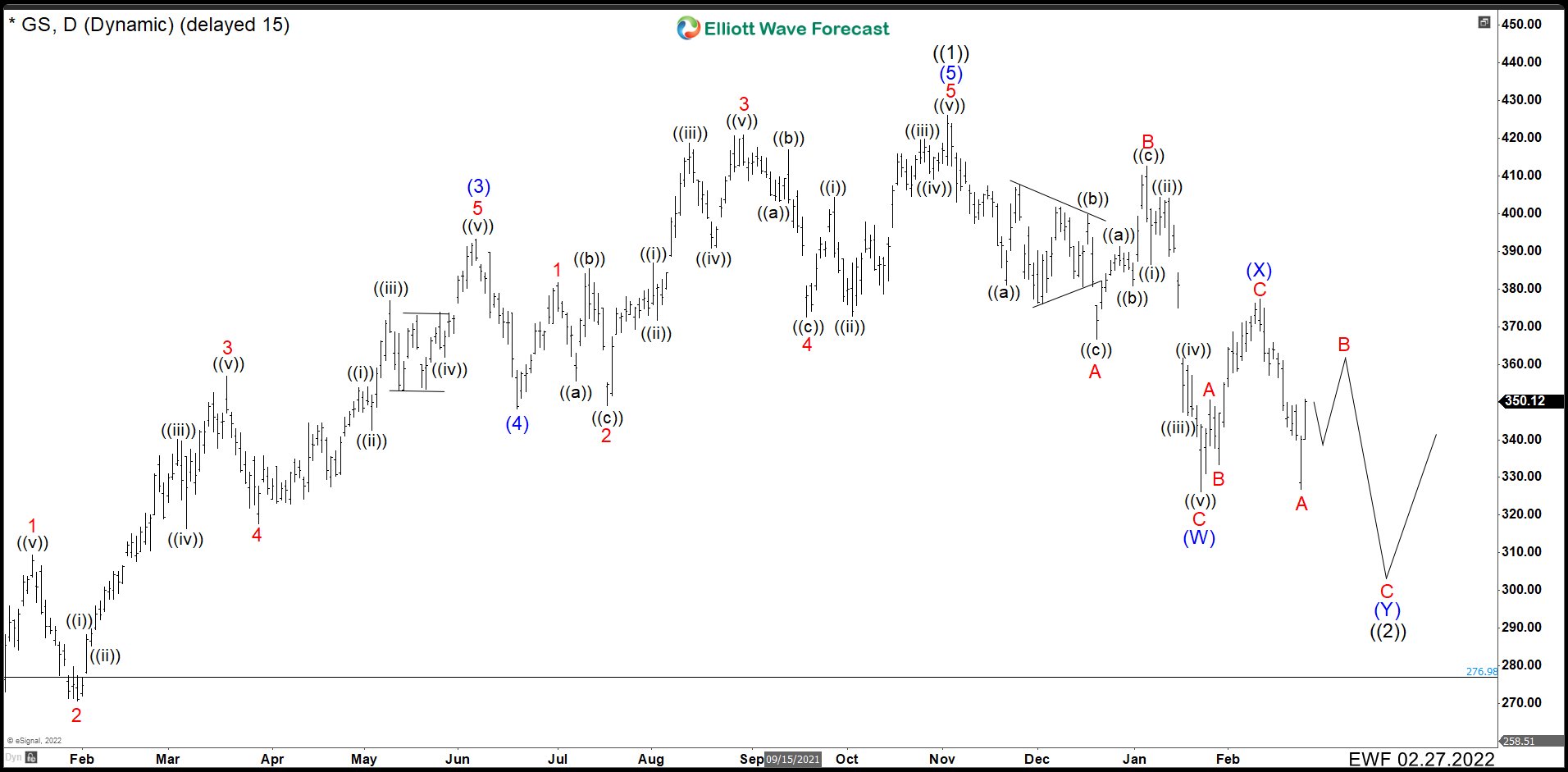

Is It Possible Goldman Sachs (GS) Keeps Falling?

Read MoreThe Goldman Sachs Group, Inc. (GS) is an American multinational investment bank and financial services company headquartered in New York City. It offers services in investment management, securities, asset management, prime brokerage, and securities underwriting. GS OCTOBER 2021 DAILY CHART Last October, we were looking to complete an impulse from March 2020 low. The first wave of impulse that we called wave (1) ended at 225.24 dollars. […]

-

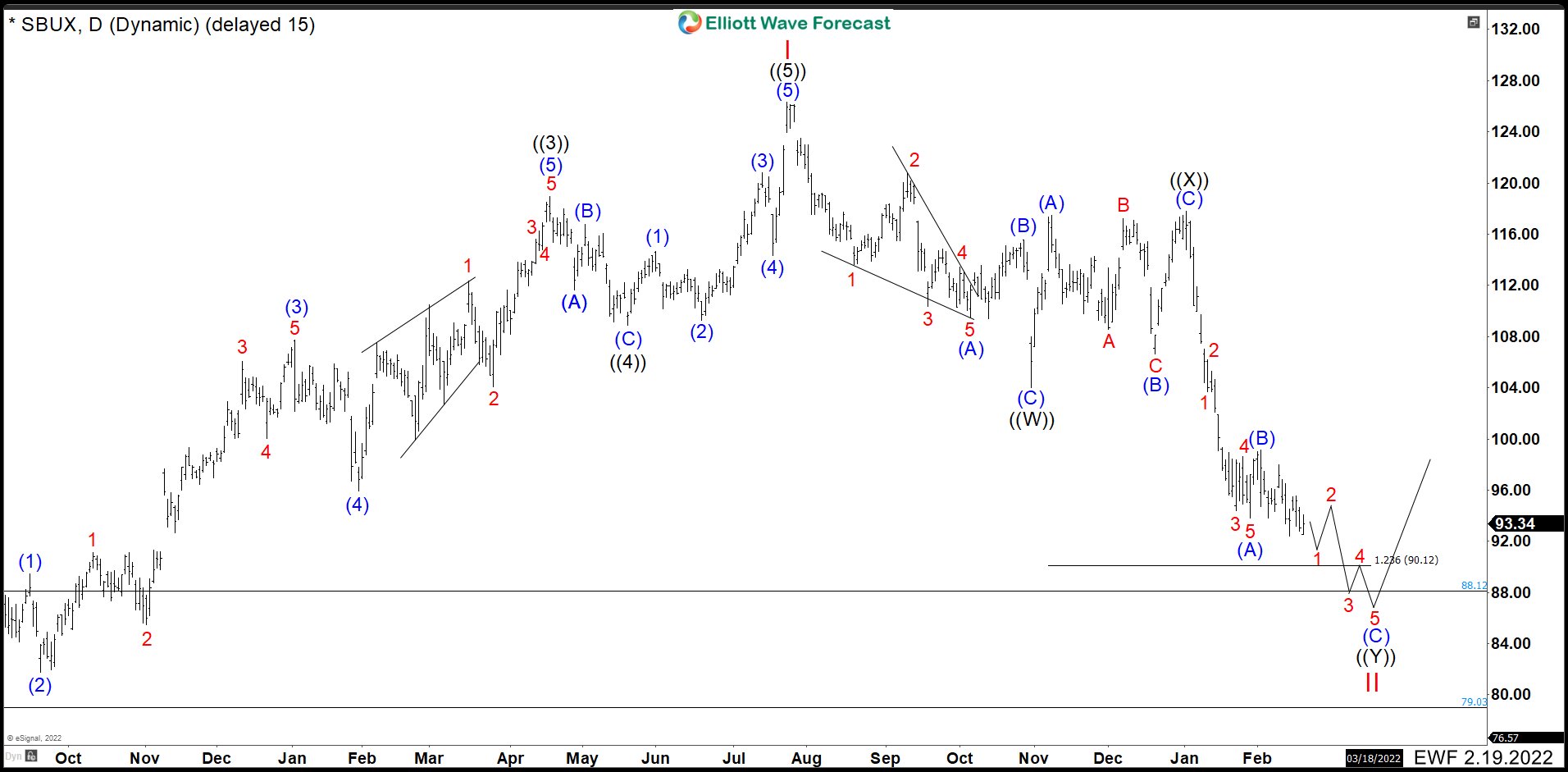

Starbucks (SBUX) Is Looking For Support And Buyers Will Appear

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. Starbucks (SBUX) Daily Chart Starbucks (SBUX) […]

-

How We Saw CrowdStrike (CRWD) and What To Expect In Coming Months

Read MoreCrowdStrike Holdings, Inc. (CRWD) is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services. CrowdStrike (CRWD) July 2021 Daily Chart On July 22nd, we analyzed CRWD showing an structure suggesting that a very important market cycle was near to end; that is, the whole cycle from its foundation in 2011. […]

-

Elliott Wave View: S&P500 (SPX) 5 Waves Rally Favors the Bulls

Read MoreSPX is looking to complete a 5 waves impulse from January 25 low which favors the bulls. This article and video look at the Elliott Wave path.

-

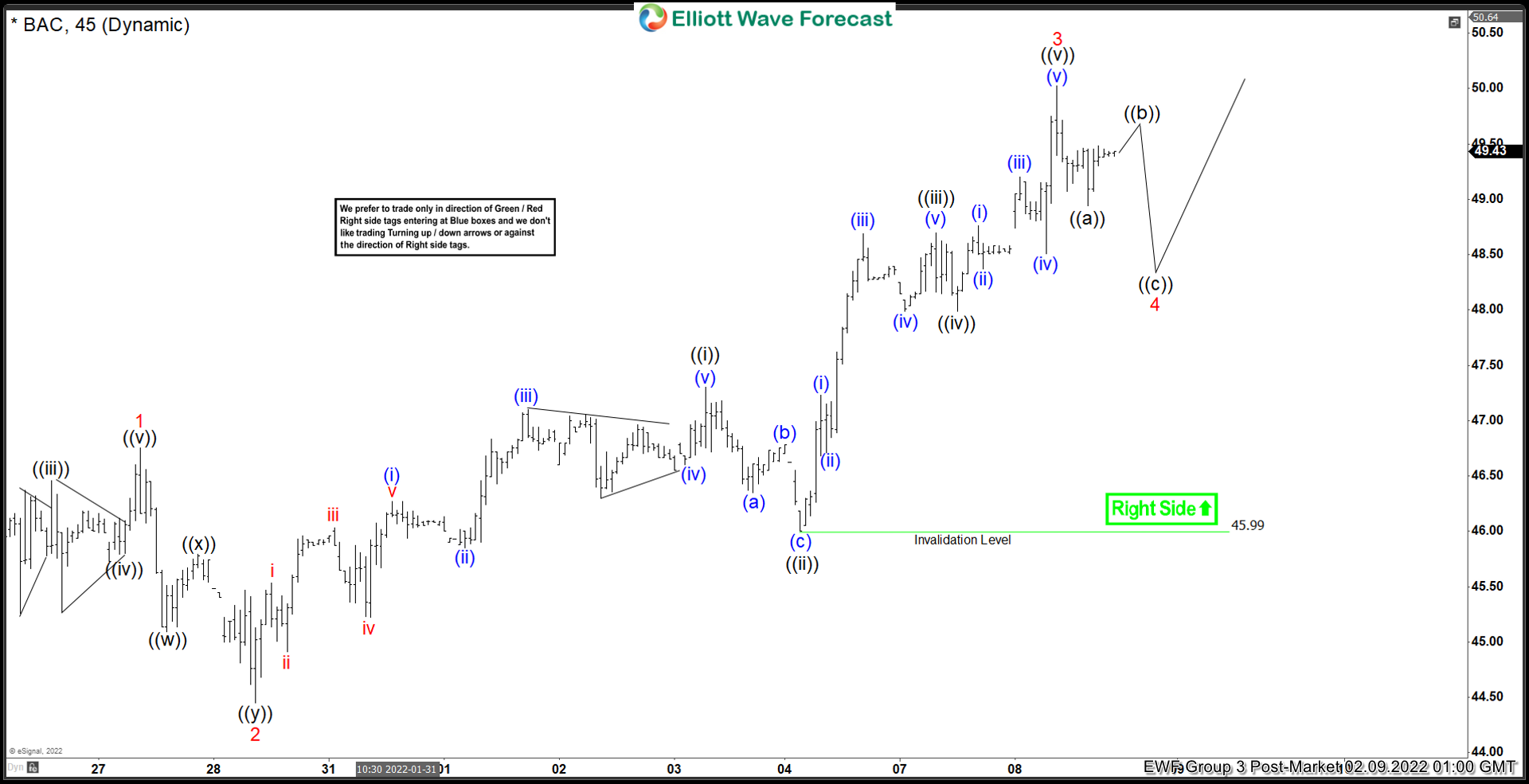

Elliott Wave View: Bank of America (BAC) Looking to Extend Higher

Read MoreBAC is looking to complete an impulse move from January 24, 2022 low looking for more upside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Oil (CL) Wave 5 Near Complete

Read MoreOil (CL) is looking to complete an impulse move from January 24, 2022 low. This article and video look at the Elliott Wave path.