-

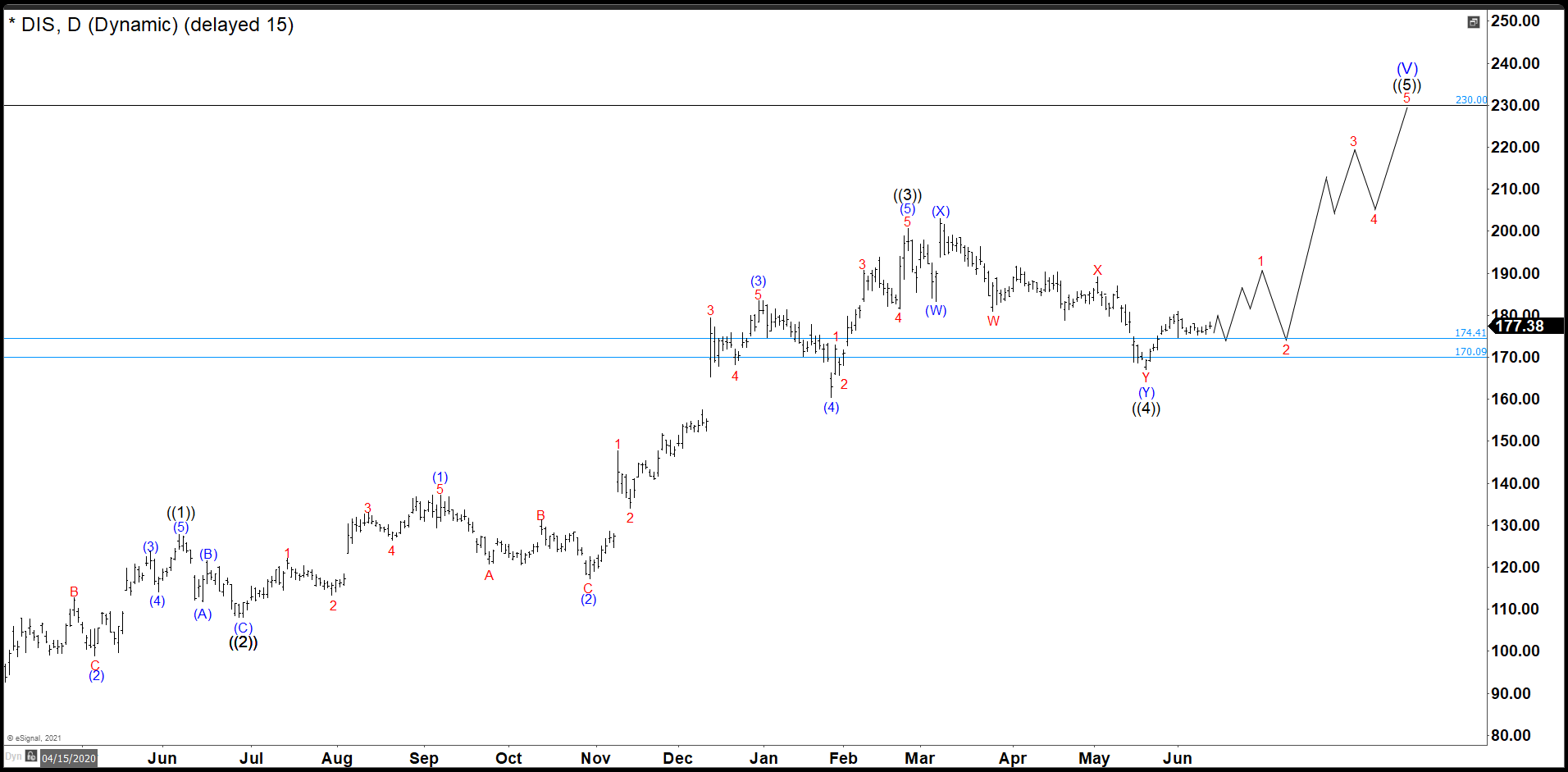

Disney Seems To Have Ended The Wave ((4)) Pullback

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]

-

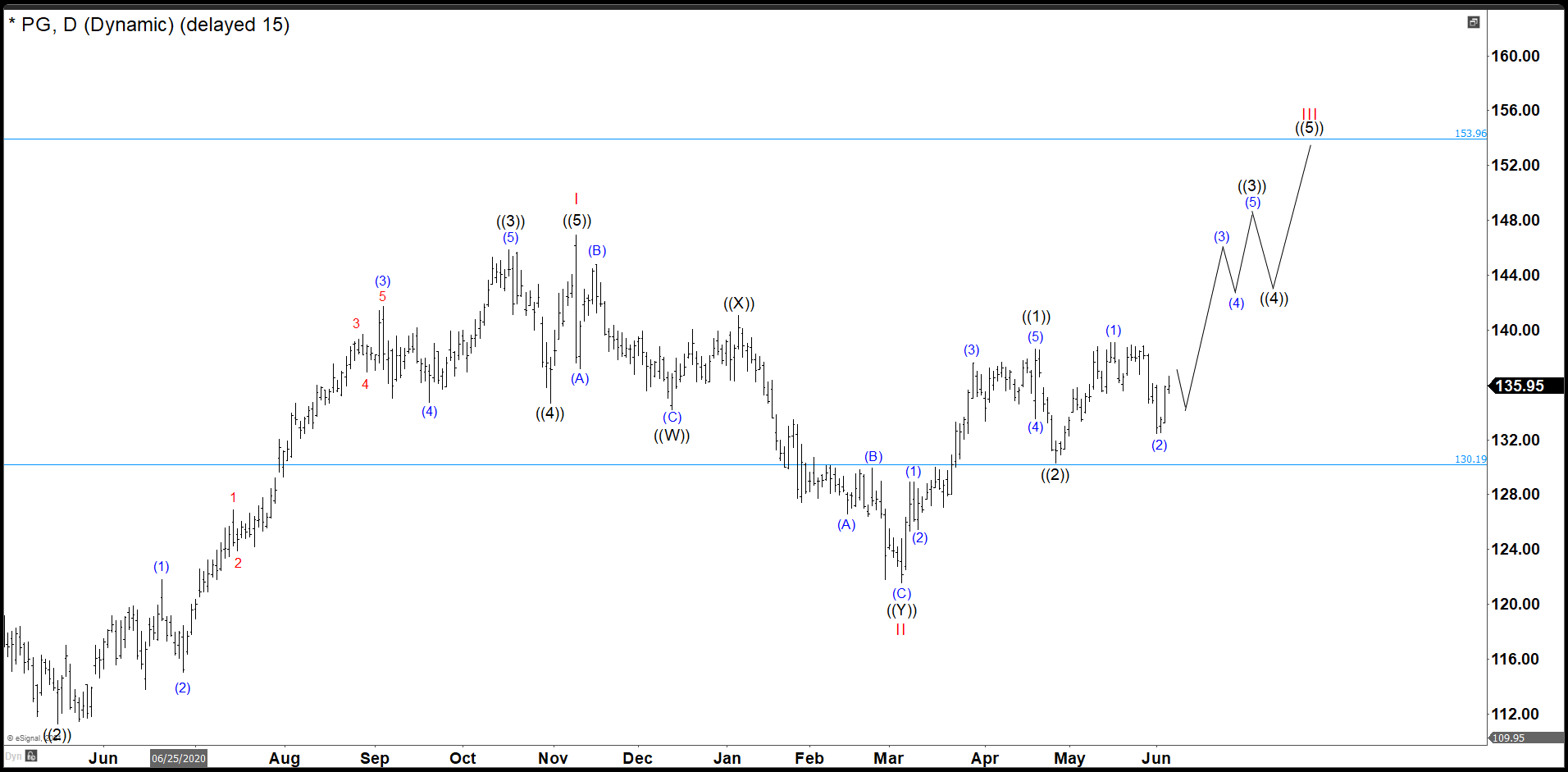

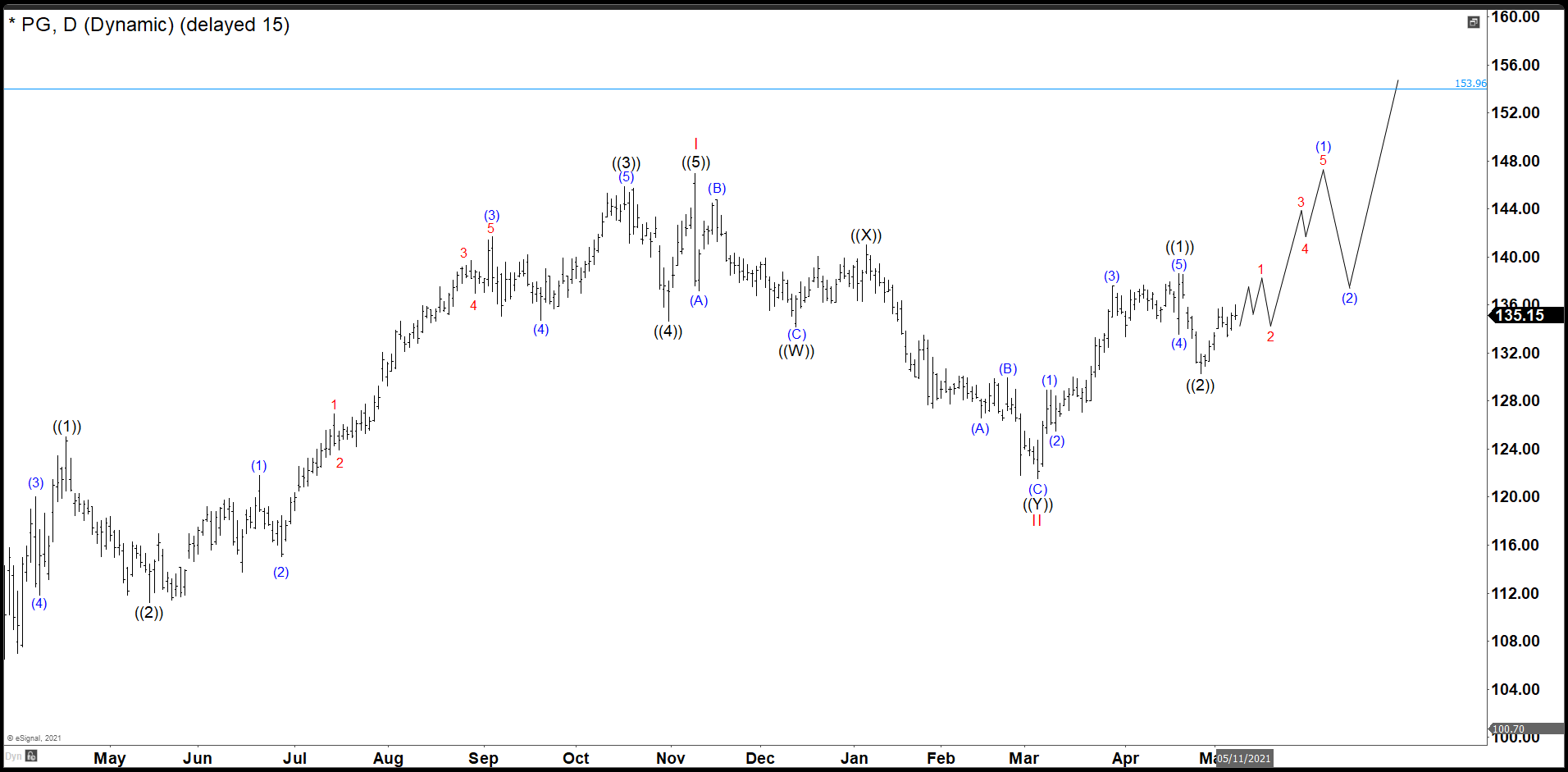

P&G Is Still On Track In Wave ((3)) Pullback Was Deep

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and P&G was no exception. P&G did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from wave II with a first target to $154.00 next $167.50 and […]

-

Berkshire Hathaway Inc. Followed The Path Entering in a Ranging Zone

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Berkshire Hathaway was no exception. BRK.B did not only recover the lost, but It also reached historic highs. Now, it is building an impulse from March 2020 lows with a target to $318 – $342 area. Target measured from […]

-

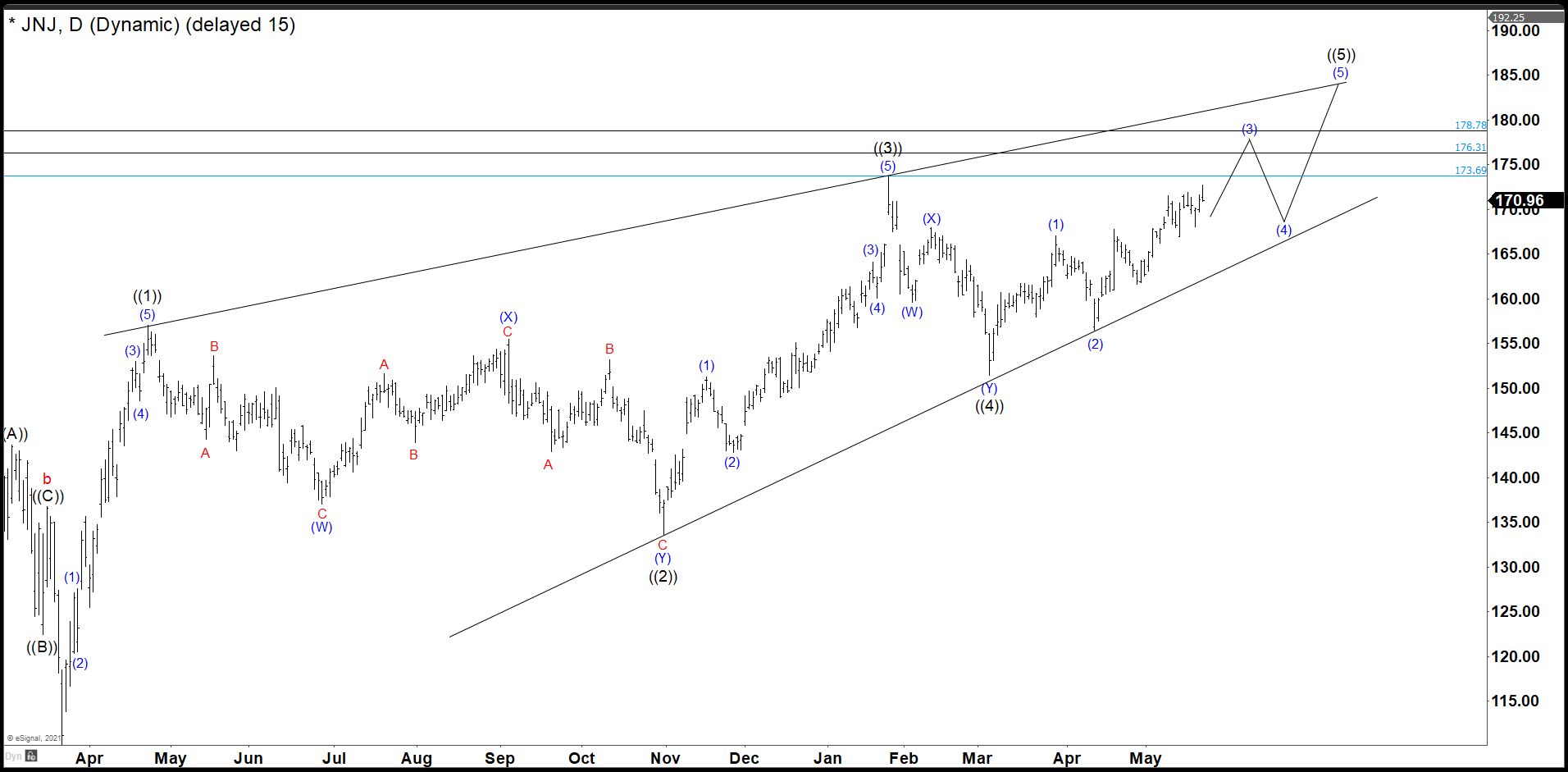

JNJ Is Still Pushing Higher Looking to End Wave (3).

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and JNJ was no exception. Johnson & Johnson did not only recover the lost, but It also reached historic highs. Now, we are going to try to build a wedge from the March 2020 lows with a target above $176. […]

-

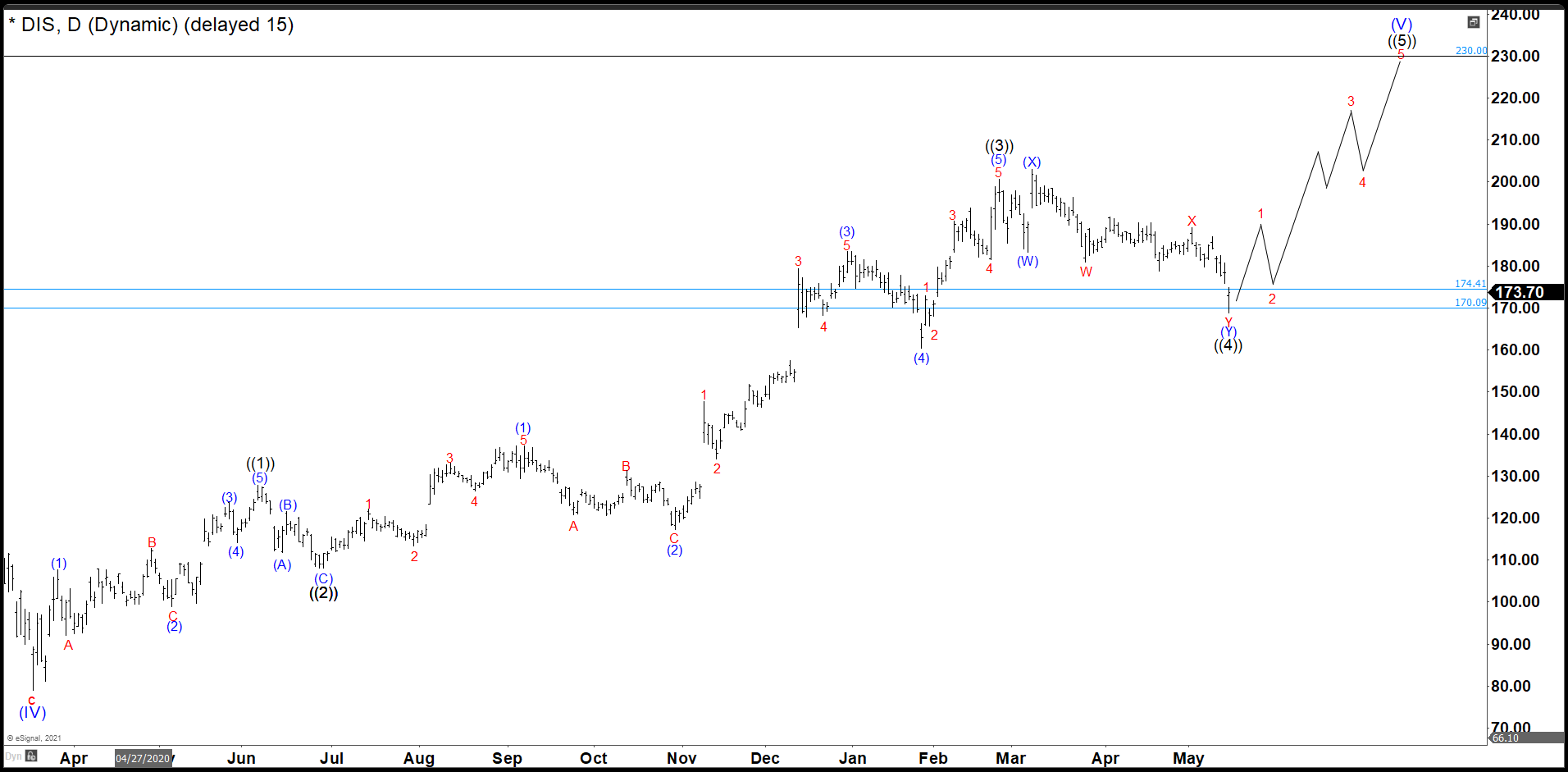

Disney Reached Our Wave ((4)) Target And It Should Continue Higher

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]

-

P&G Should Keep Moving Higher After A Pause For A Correction

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and P&G was no exception. P&G did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from wave II with a first target to $154.00 next $167.50 and […]