-

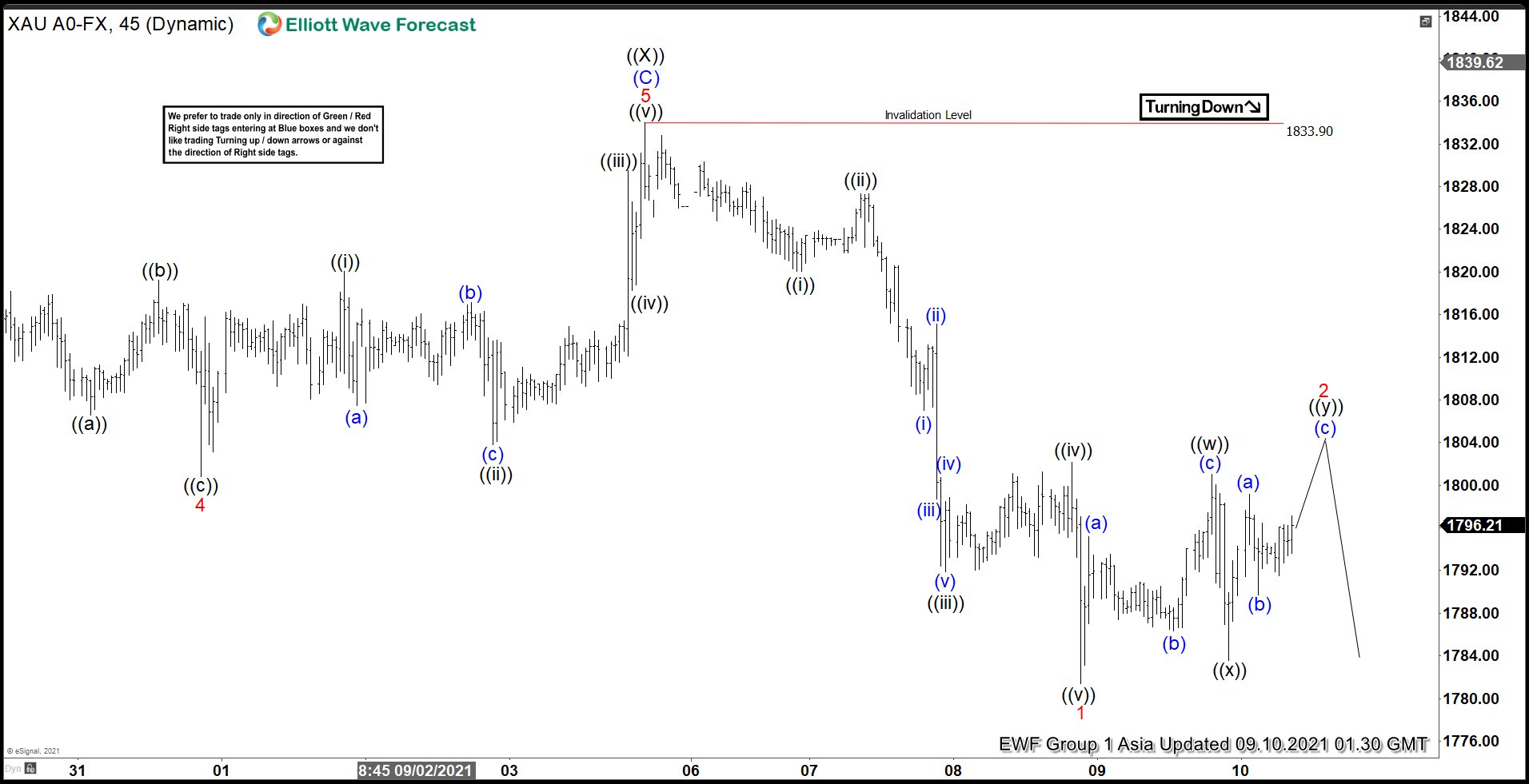

Elliott Wave View: Gold Rally Can Fail for More Downside

Read MoreGold decline from Sept 3 high looks impulsive and can see further downside. This article and video look at the Elliottwave path.

-

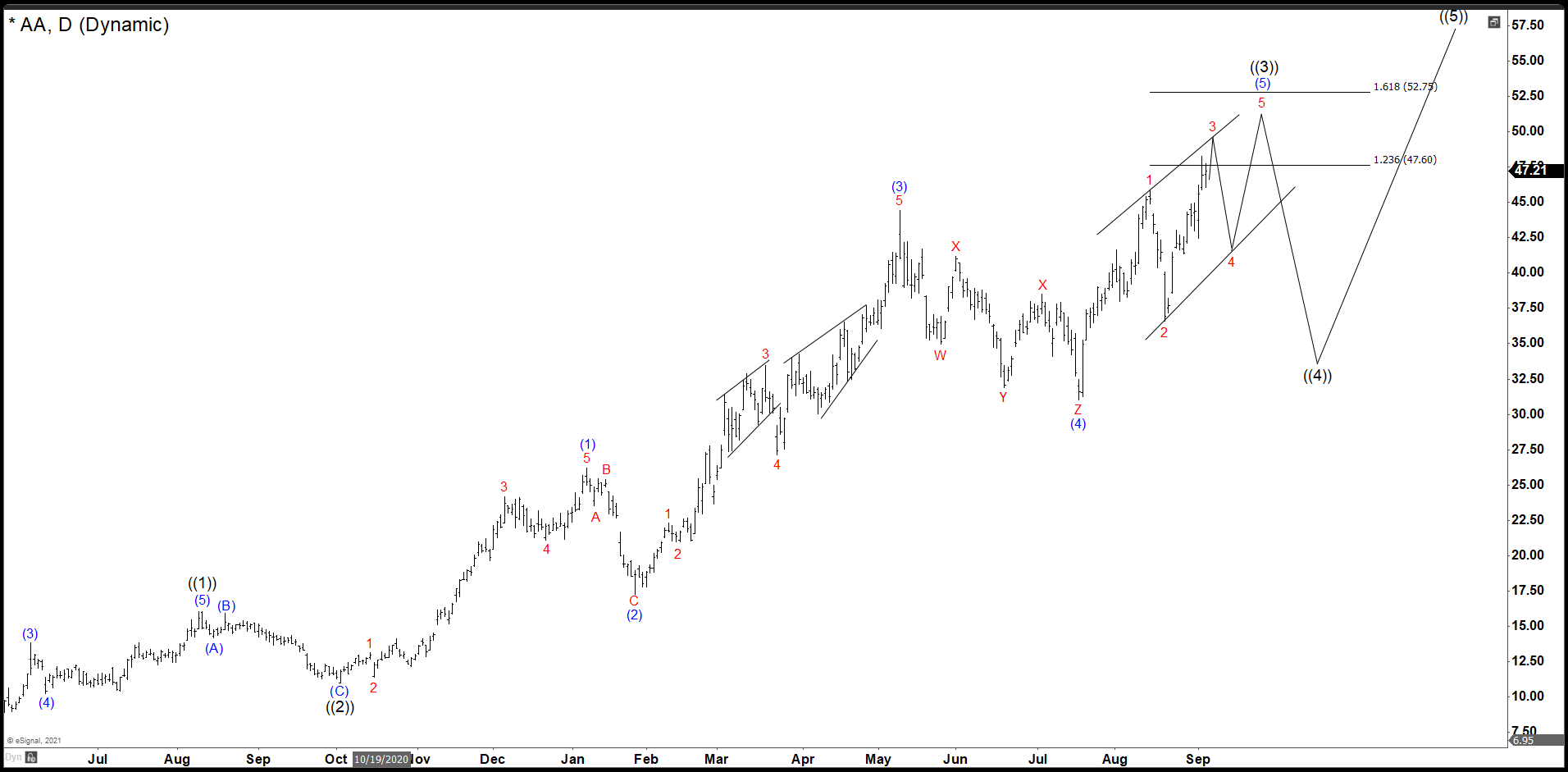

Alcoa Hit Our Minimum Target. Possible Ending Diagonal In Progress

Read MoreSince March 2020 crash, Alcoa (AA) has risen in share value around 800% and with the high prices of the Aluminum it must continue rising its value. Besides, AA has built an incomplete impulse and it needs to keep the rally to develop the whole structure. We are considering a target above $47.00 dollars in […]

-

P&G Is Developing An Impulse To Complete Wave ((3)) of III

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and P&G was no exception. P&G did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from wave II with a first target to $154.00 next $167.50 and […]

-

Berkshire Hathaway Is Developing Wave (5) To Complete Wave ((3))

Read MoreAll stocks tried to recover what they lost and Berkshire Hathaway was not exception since the crash of March 2020. BRK.B did not only recover the lost, but It also reached historic highs. Now, it is building an impulse from March 2020 lows and we are going to follow to determinate the best area to […]

-

JNJ Achieved Our Minimum Target Level Give Us A 14.04% Return

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and JNJ was no exception. Johnson & Johnson did not only recover the lost, but it also reached historic highs. In those days, we were looking as a first entry in 155.33 – 156.93 area to reach a target above […]

-

Elliott Wave View: USDCAD Looking for More Upside

Read MoreUSDCAD is looking to extend higher to continue the rally from June 1, 2021 low. This article and video look at the Elliott Wave path.