-

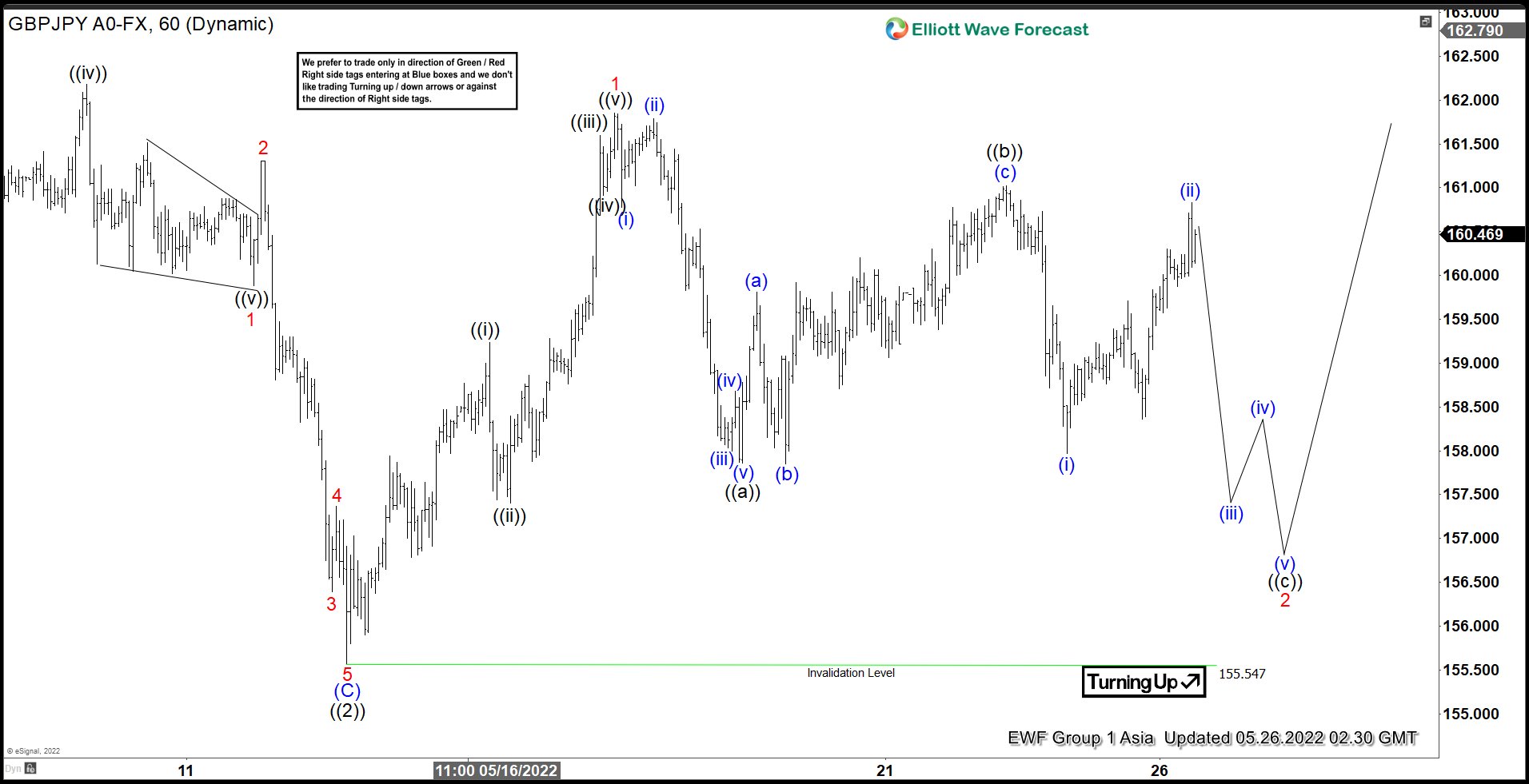

Elliott Wave View: GBPJPY Looking for the Next Leg Higher

Read MoreGBPJPY is looking to end correction and do the next leg higher. This article and video look at the Elliott Wave path for the pair.

-

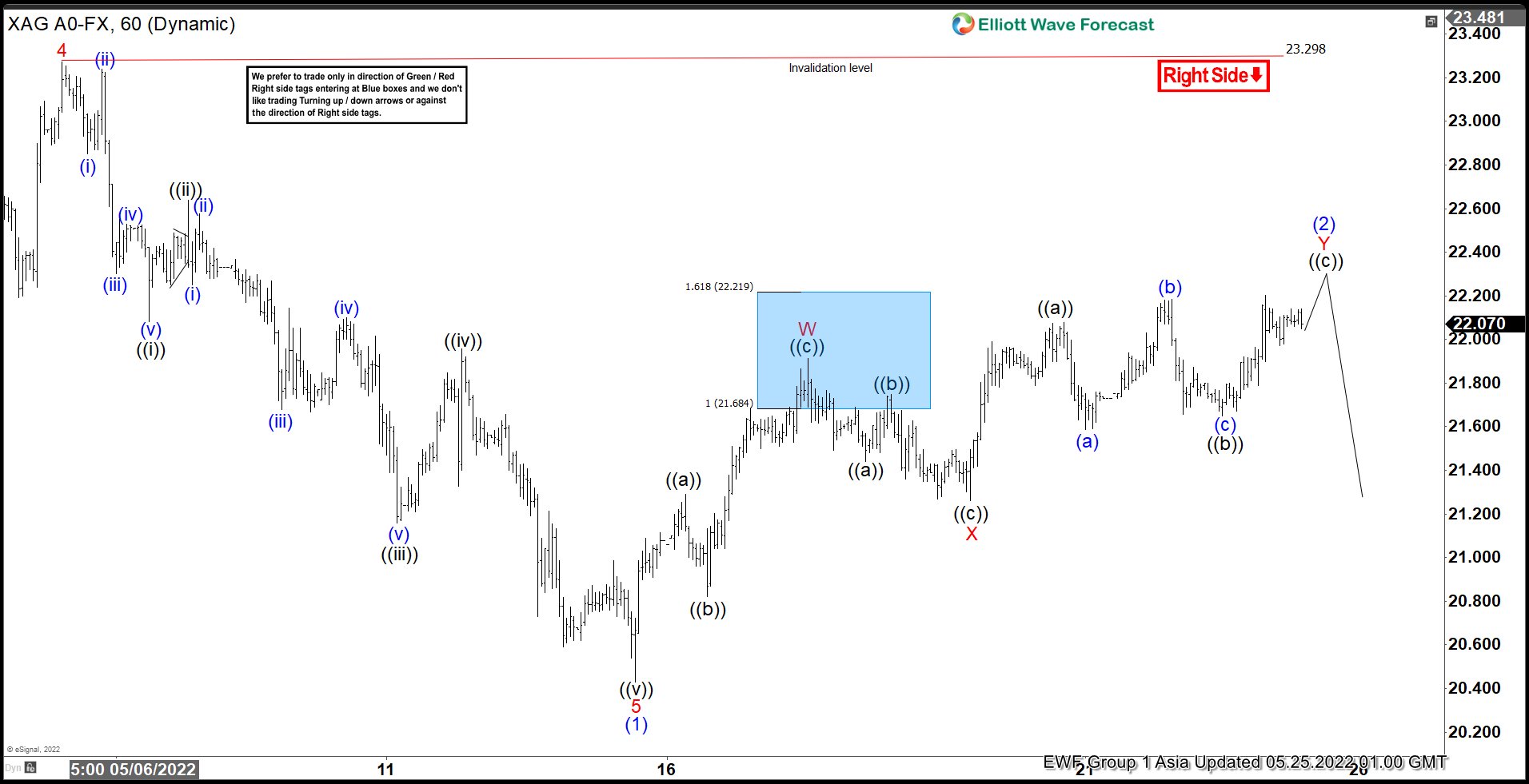

Elliott Wave View: Rally in Silver May End Soon

Read MoreSilver is looking to do a 7 swing rally before the metal turns lower. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Copper Looking to Turn Lower Soon

Read MoreCopper is doing corrective rally as a double three Elliott Wave structure. This article and video look at the short term Elliott Wave path.

-

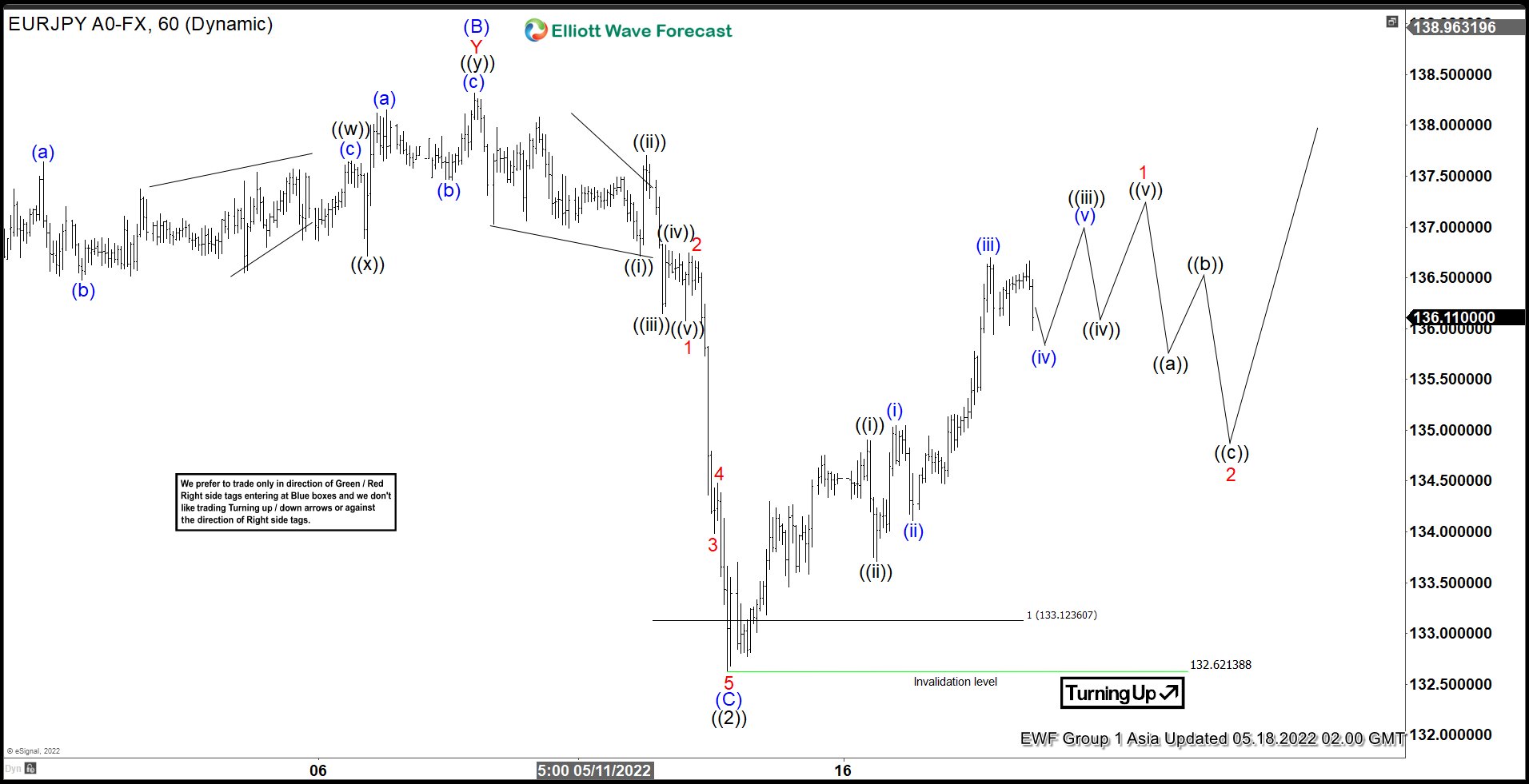

Elliott Wave View: EURJPY Rallying from Support Area

Read MoreShort Term View in EURJPY suggests cycle from 04.21.2022 peak is completed as a 3 waves zig zag Elliott Wave Structure. Down from April 21 peak, wave (A) ended at 134.75 and rally in wave (B) ended at 138.32. Pair then resumes lower in wave (C) with internal subdivision as an impulse in lesser degree. […]

-

Will Cryptos Crash Continue? COIN Could Have The Answer

Read MoreCoinbase Global, Inc., branded Coinbase (COIN), is an American company that operates a cryptocurrency exchange platform. Coinbase is a distributed company; all employees operate via remote work and the company lacks a physical headquarters. It is the largest cryptocurrency exchange in the United States by trading volume. The company was founded in 2012 by Brian Armstrong and Fred Ehrsam. COIN Daily Chart March 2022 Last […]

-

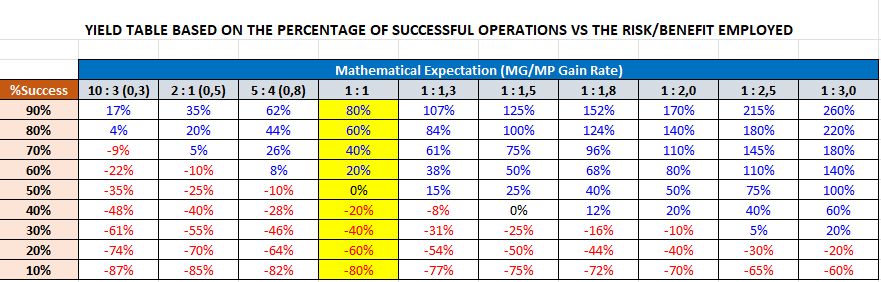

Master Risk-Reward Ratios: The Smart Trader’s Money Management Rule

Read MoreUnderstanding Risk-Reward Fundamentals Capital management is the most important thing when you invest or operate in the stock market. Within management systems there is much talk of Risk-Reward relation. How much are you willing to lose to win a certain margin. For example, I am willing to lose 0.50% of my capital to earn 2.00%, […]