-

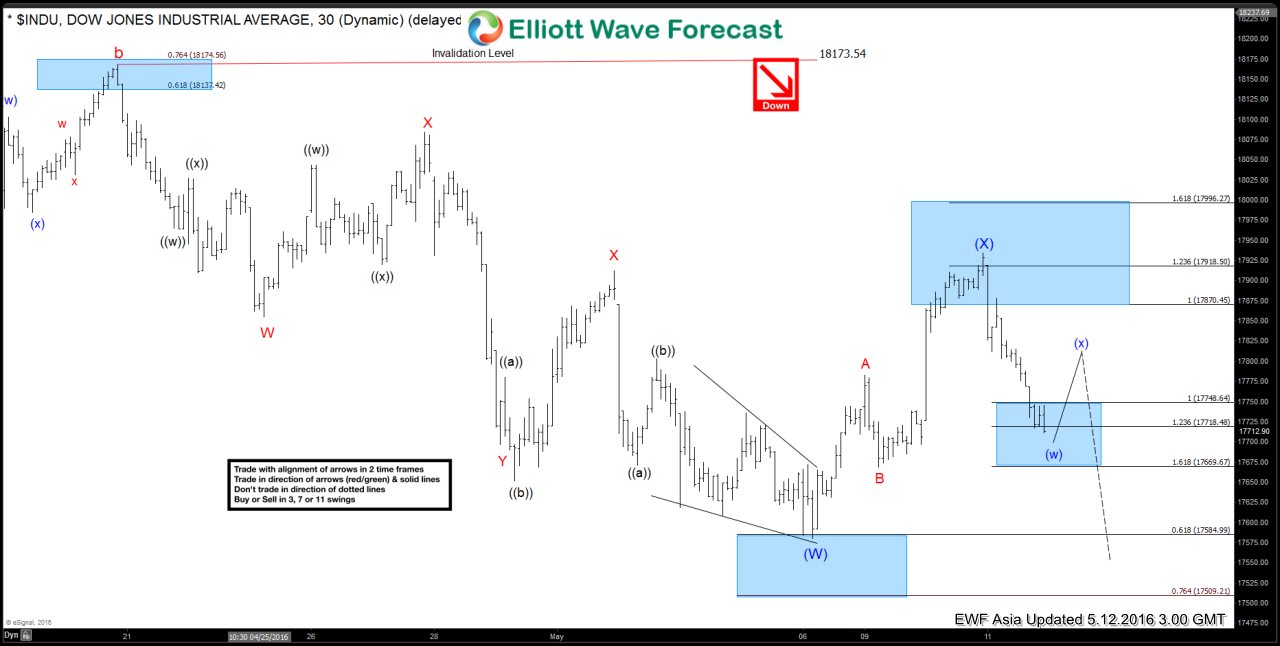

Dow Jones $INDU Short-term Elliott Wave Analysis 5.12.2016

Read MoreShort term Elliottwave structure suggests wave “b” is proposed over at 18173.54. Decline from there is unfolding as a double three structure where wave (W) ended at 17580.38 and wave (X) bounce ended at 17934.61. Near term, while wave (x) bounce stays below 17934.61, and more importantly as far as pivot at 18173.54 stays intact, expect the Index […]

-

Dow Jones $INDU Short-term Elliott Wave Analysis 5.11.2016

Read MoreShort term Elliottwave structure suggests wave “b” is proposed over at 18173.54. Decline from there is unfolding in a zigzag where wave (A) ended at 17580.38 as 5 waves diagonal. Wave (B) bounce is in progress to correct decline from 18173.54. Wave (B) bounce has enough swing and extension to call it completed although a marginal high still can’t […]

-

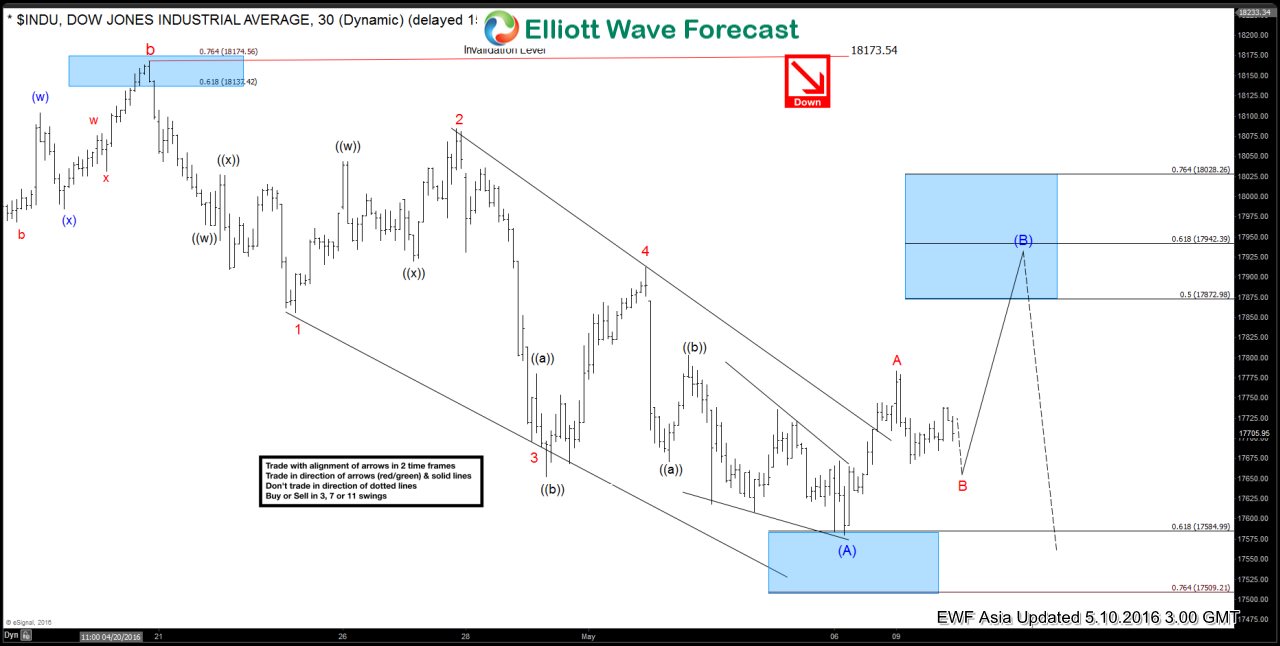

Dow Jones $INDU Short-term Elliott Wave Analysis 5.10.2016

Read MoreShort term Elliottwave structure suggests wave “b” is proposed over at 18173.54. Decline from there is unfolding in a zigzag where wave (A) ended at 17580.38 as 5 waves diagonal. Near term, while wave B pullback stays above 17580.38, Index has scope to do another leg higher in wave C of (B) towards 17872.98 – 18028.26 […]

-

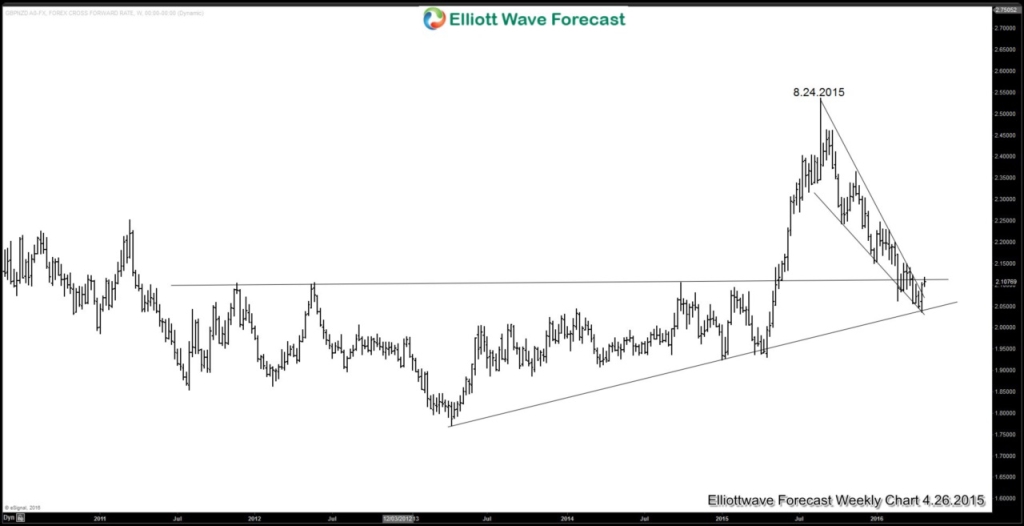

Elliottwaves calling for at least 3 waves pullback in GBPUSD

Read MoreBelow is a short clip from our New York Live Session on April 29 where our Senior Analyst Daud Bhatti explains why we like to sell GBPUSD from 1.4687 – 1.4848 area for at least 3 waves pullback. $GBPUSD made the high at 1.477 and turned lower as expected. We do two live sessions a day […]

-

Sugar $SB_F Short-term Elliott Wave Analysis 5.6.2016

Read MoreShort term Elliottwave structure suggests that decline to 13.99 ended wave X. Rally from there is unfolding as a zigzag where wave (a) ended at 15.71, wave (b) ended at 15.01, and wave (c) of ((w)) ended at 16.87. Wave ((x)) pullback is in progress to correct the rally from 13.99 with a possible target of 14.82 […]

-

New Zealand Dollar Outlook in Q2 2016

Read MoreIn the last Monetary Policy Statement (MPS) in March, Reserve Bank of New Zealand (RBNZ) is not happy with the currency’s continued appreciation. They cited the New Zealand Dollar trade-weighted exchange rate is more than 4% higher than projected in December. In subsequent meeting in April 28, RBNZ decided to stay put with the OCR (Official Cash Rate) but RBNZ Governor Graeme […]